While Andean Precious Metals Corp. (APM:TSX; ANPMF:OTCQX) has lower than expected second-quarter production results, the company is still a Buy, according to an Atrium Research note.

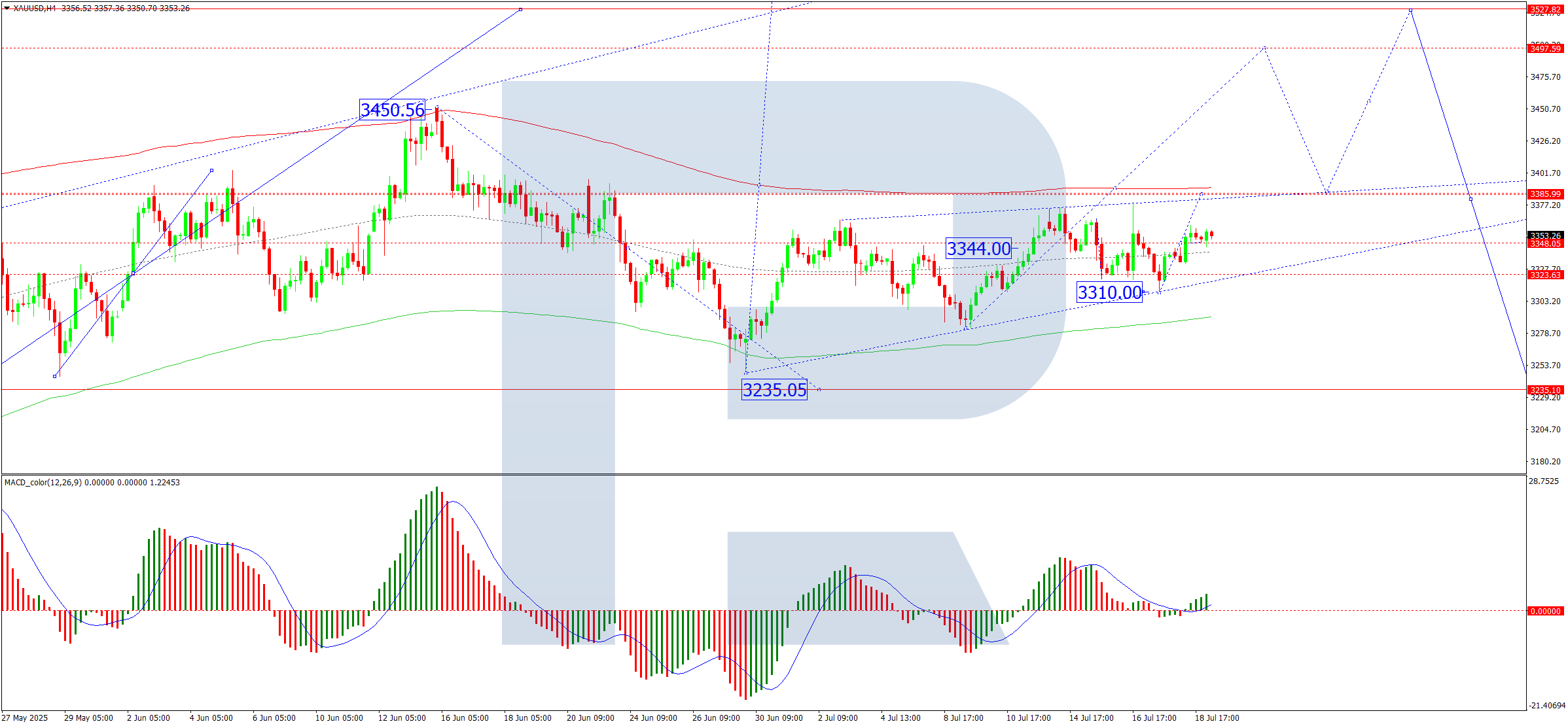

On July 18, 2025, Atrium Research analysts Ben Pirie and Nicholas Cortellucci maintained a Buy rating on Andean Precious Metals Corp. (APM:TSX; ANPMF:OTCQX) while raising the target price to CA$4.50 from CA$3.50, representing 29% upside from the current share price of CA$3.50.

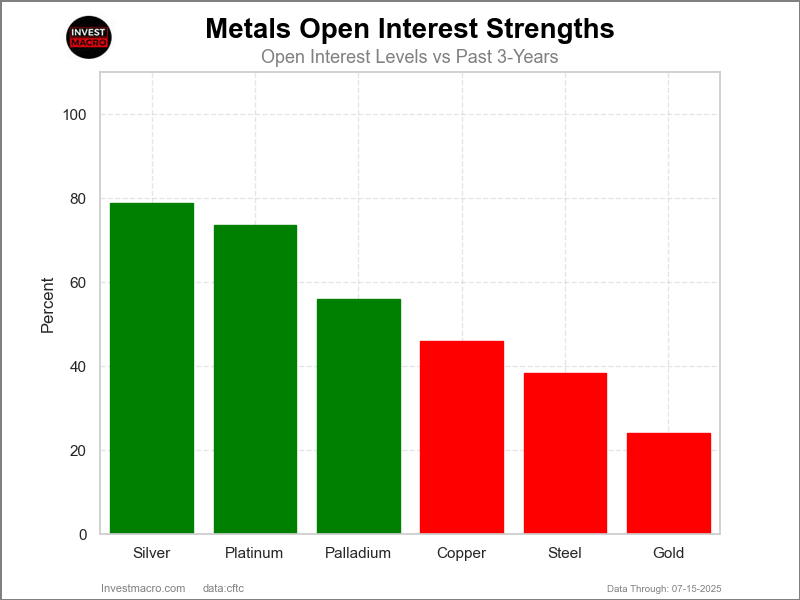

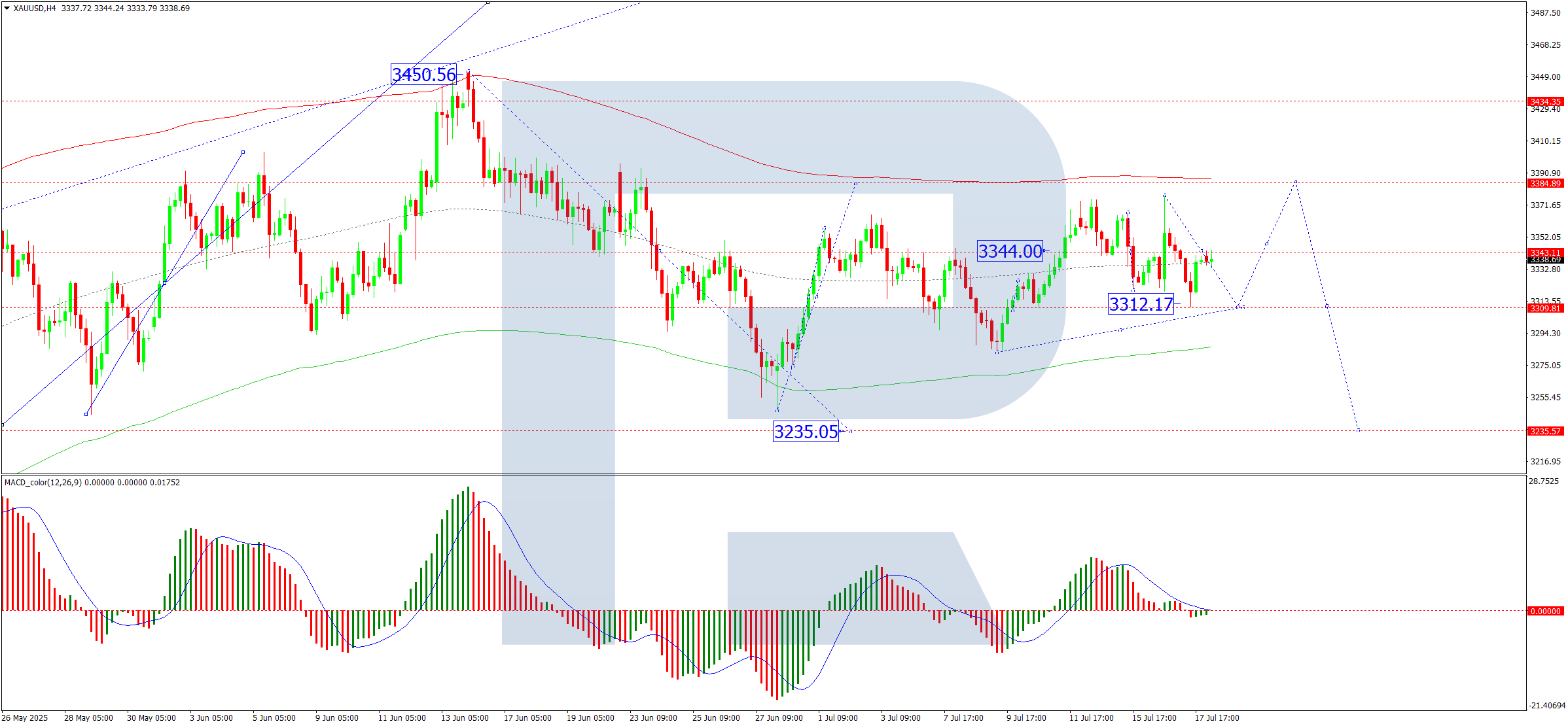

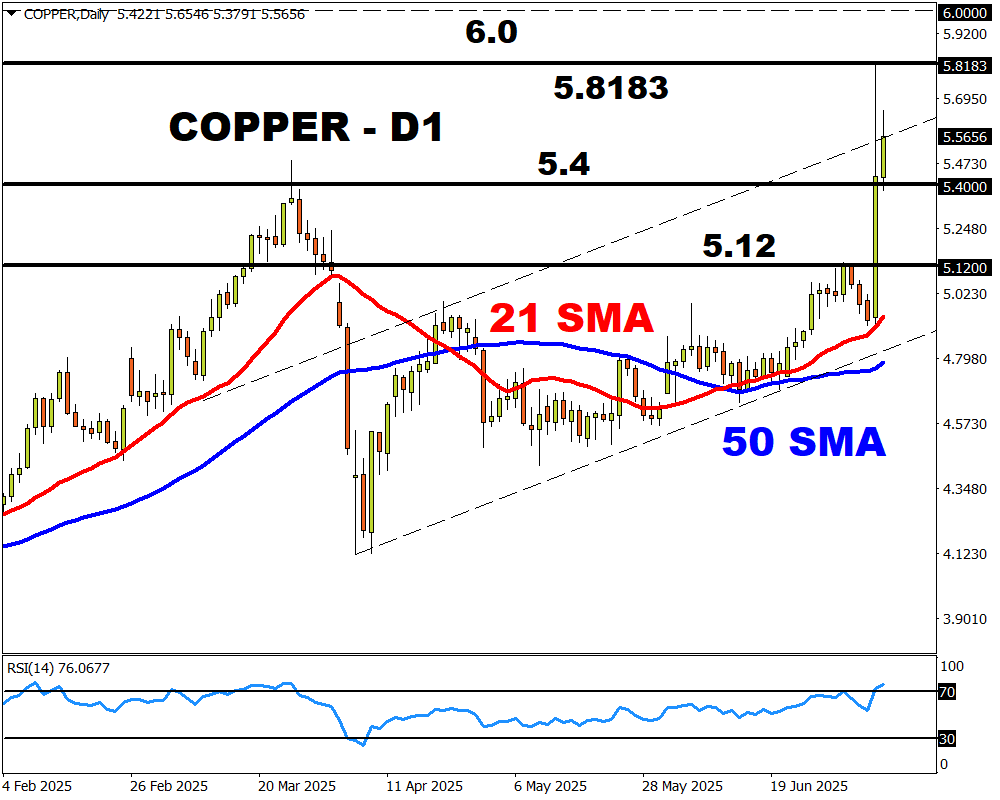

The analysts cited rising gold and silver prices, multiple expansions across the sector, and strong operational momentum despite slightly weaker-than-expected second-quarter production results.

Andean Precious Metals Inc. reported second quarter 2025 operational results producing 24.3 thousand ounces of gold equivalent between its Golden Queen and San Bartolome assets, which was softer than analyst estimates primarily due to seasonality factors. The company sold 23.0 thousand ounces of gold equivalent during the quarter, declining year-over-year due to a shift production cadence.

Golden Queen production came in at 12.2 thousand ounces of gold equivalent, down 28% year-over-year, compared to Atrium’s estimate of 14.4 thousand ounces. This consisted of 11.2 thousand ounces of gold and 89 thousand ounces of silver, with 11.8 thousand ounces of gold equivalent sold, including 10.9 thousand ounces of gold and 87 thousand ounces of silver.

San Bartolome production totaled 12.1 thousand ounces of gold equivalent, declining 9% year-over-year compared to the analyst estimate of 12.2 thousand ounces. This comprised 0.7 thousand ounces of gold and 1.0 million ounces of silver, with 11.2 thousand ounces of gold equivalent sold, including 0.5 thousand ounces of gold and 1.0 million ounces of silver.

Seasonal Production Profile and Guidance

Management reiterated that 60% of annual production will be mined in the second half of the year and confirmed the company remains on track for the top end of guidance.

Pirie and Cortellucci noted they “have now adjusted our model to better reflect the seasonality at San Bart” following the variance between their estimates and reported results due to the 40% first half, 60% second half production split.

Updated Financial Projections and Commodity Assumptions

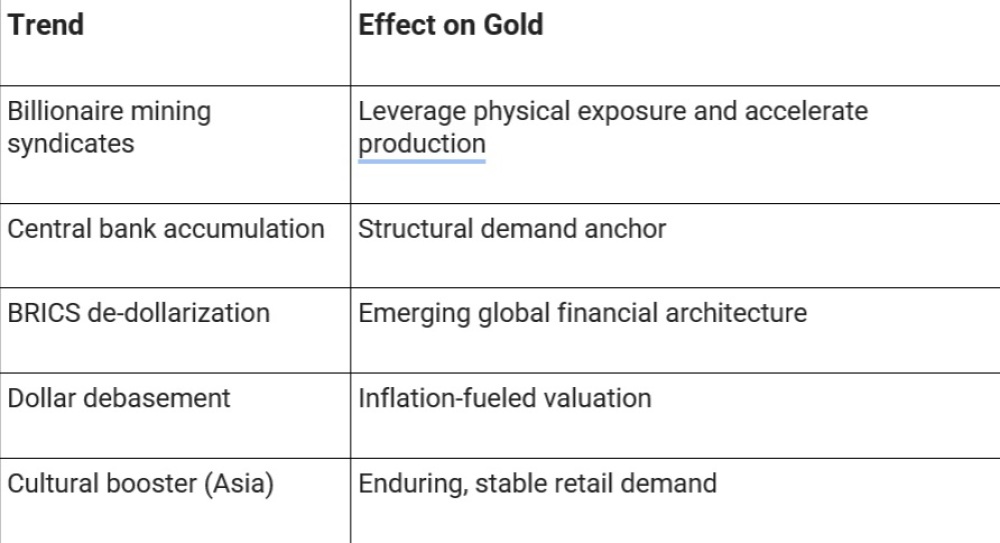

The analysts updated their commodity price assumptions to US$2,700 per ounce for gold and US$31 per ounce for silver, increased from previous assumptions of US$2,400 per ounce and US$30 per ounce, respectively, though remaining “conservatively below spot prices.”

The revised assumptions result in forecasted adjusted EBITDA of $98 million for 2025, with the company trading at 3.7x 2025 estimated EBITDA.

For second quarter financials scheduled for release on August 12, 2025, after market close, the analysts expect sales of US$64.7 million (down 7% year-over-year), adjusted EBITDA of US$17.0 million, representing a 26% margin, and operating cash flow of US$13.0 million or 20% of revenue.

Valuation Methodology and Target Price Increase

The analysts increased their target multiple from 6.0x to 6.5x for 2025 estimated operating cash flow due to “multiple expansion across gold and silver producers” and strong operational results. The CA$4.50 target price equates to 5x 2025 estimated EBITDA, 8x 2025 estimated earnings, and an 8% free cash flow yield.

Andean Precious Metals stock has risen 130% since the analysts’ initiation of coverage, driven by higher gold and silver prices and operational execution. The company exhibits a 1.3x beta to silver and a 2.4x beta to gold, “offering investors strong exposure to rising metal prices.”

Financial Position and Strategic Advantages

The company maintains a strong balance sheet with US$101 million in cash and US$70 million in debt, providing flexibility for growth through acquisitions and capital returns via share buybacks. Andean Precious Metals has demonstrated a track record of successful acquisitions, including Golden Queen and San Bartolome properties.

The company benefits from aligned management with CEO Alberto Morales bringing over 30 years of merger and acquisition and finance experience, while owning 53% of shares, and Eric Sprott holding 15%, creating strong alignment with shareholders.

Near-Term Catalysts and Outlook

Key catalysts include ongoing operational improvements, exploration results, new contracts, and debt paydown or refinancing expected in the fourth quarter 2025. The analysts emphasized that APM “remains set up to generate large cash flow in the quarter, growing into H2” based on the seasonal production profile and current commodity price environment.

The company’s conference call is scheduled for August 13, 2025, at 9:00 AM Eastern Time to discuss second quarter financial results and provide operational updates.

Important Disclosures:

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Atrium Research, Andean Precious Metals, July 18, 2025

Analyst Certification Each authoring analyst of Atrium Research on this report certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analyst’s personal, independent and objective views about any and all of the designated securities discussed (ii) no part of the authoring analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the research, (iii) to the best of the authoring analyst’s knowledge, she/he is not in receipt of material non-public information about the issuer, (iv) the analyst does not own common shares, options, or warrants in the company under coverage, and (v) the analysts adhere to the CFA Institute guidelines for analyst independence. Atrium Research Ratings System BUY: The stock is expected to generate returns of over 20% over the next 24 months. HOLD: The stock is expected to generate returns of 0-20% over the next 24 months. SELL: The stock is expected to generate negative returns over the next 24 months. NOT RATED (N/R): Atrium does not provide research coverage on the respective company. RATING COVERED COMPANIES BUY 25 HOLD 0 SELL 0 About Atrium Research Atrium Research provides institutional quality issuer paid research on public equities in North America. Our investment philosophy takes a 3-5 year view on equities currently being overlooked by the market. Our research process emphasizes understanding the key performance metrics for each specific company, trustworthy management teams, unit economics, and an in-depth valuation analysis. For further information on our team, please visit https://www.atriumresearch.ca/team. General Information Atrium Research Corporation (ARC) has created and distributed this report. This report is based on information we considered reliable; we have not been provided with any material non-public information by the company (or companies) discussed in this report. We do not represent that this report is accurate or complete and it should not be relied upon as such; further any information in this report is subject to change without any formal or type of notice provided. Investors should consider this report as only one factor in their investment decisions; this report is not intended as a replacement for investor’s independent judgment. ARC is not an IIROC registered dealer and does not offer investment-banking services to its clients. ARC (and its employees) do not own, trade or have a beneficial interest in the securities of the companies we provide research services for and does not serve as an officer or Director of the companies discussed in this report. ARC does not make a market in any securities. This report is not disseminated in connection with any distribution of securities and is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. ARC does not make any warranties, expressed or implied, as to the results to be obtained from using this information and makes no express of implied warranties for particular use. Anyone using this report assumes full responsibility for whatever results they obtain. This does not constitute a personal recommendation or take into account any financial or investment objectives, financial situations or needs of individuals. This report has not been prepared for any particular individual or institution. Recipients should consider whether any information in this report is suitable for their particular circumstances and should seek professional advice. Past performance is not a guide for future results, future returns are not guaranteed, and loss of original capital may occur. Neither ARC nor any person employed by ARC accepts any liability whatsoever for any direct or indirect loss resulting from any use of its research or the information it contains. This report contains “forward looking” statements. Forward-looking statements regarding the Company and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Such statements involve a number of risks and uncertainties such as competition, technology shifts, market demand and the company’s (and management’s) ability to correctly forecast financial estimates; please see the company’s MD&A “Risk Factors” Section for a more complete discussion of company specific risks for the company discussed in this report. ARC is receiving a cash compensation from Andean Precious Metals Corp. for 12-months of research coverage. This report was disseminated on behalf of Andean Precious Metals Corp. ARC retains full editorial control over its research content. ARC does not have investment banking relationships and does not expect to receive any investment banking driven income. ARC reports are primarily disseminated electronically and, in some cases, printed form. Electronic reports are simultaneously available to all recipients in any form. Reprints of ARC reports are prohibited without permission. To receive future reports on covered companies please visit https://www.atriumresearch.ca/research or subscribe on our website. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.

Article by

Article by