By JustMarkets

On Thursday, trading on the US stock market ended in a decline. By the end of the day, the Dow Jones (US30) fell by 1.20%, the S&P 500 (US500) decreased by 1.23%, and the tech-heavy Nasdaq (US100) closed lower by 1.59%. Pressure intensified in the consumer discretionary and communication services segments, where investors trimmed positions in overcrowded mega-cap stocks. Alphabet contributed to the negative trend, as its plans to sharply increase AI investments raised fresh questions about the monetization timeline for massive capital expenditures. Weakness also spread through the semiconductor sector following cautious guidance from Qualcomm, which pointed to cooling demand and inventory issues, dragging down the entire chip segment. Risk-off sentiment was reinforced by macro statistics: a rise in initial jobless claims and a sharp spike in corporate layoff announcements strengthened signals of a labor market slowdown and increased pressure on equities.

The Mexican peso (MXN) weakened after the Bank of Mexico decided to maintain its key interest rate at 7.00% and adopted a more cautious stance regarding future easing. The regulator pointed to intensifying inflationary risks, raised its long-term price growth prognoses, and emphasized a gradual approach for further steps, which cooled interest in carry trades and lowered expectations for sustained high real yields.

Bitcoin (BTC) dropped below $70,000 for the first time since October 2024, losing about a quarter of its value since the start of the year amid a massive reduction in speculative positions across the risk asset spectrum. The sharp decline was accompanied by deteriorating sentiment toward digital assets, undermining their reputation as a hedge against inflation and geopolitical uncertainty, especially given the simultaneous drop in gold prices. Bitcoin’s vulnerability was further exacerbated by its higher share in institutional portfolios, making it sensitive to broad risk-reduction regimes following spikes in volatility and tightening margin requirements.

European equity markets declined on Thursday. The German DAX (DE40) fell by 0.46%, the French CAC 40 (FR40) closed down 0.29%, the Spanish IBEX 35 (ES35) dropped by 1.97%, and the British FTSE 100 (UK100) ended at 0.90%. The European Central Bank (ECB), as expected, kept rates unchanged. However, Christine Lagarde’s comments cooled easing expectations, as the regulator took a restrained stance regarding slowing inflation and the strength of the euro.

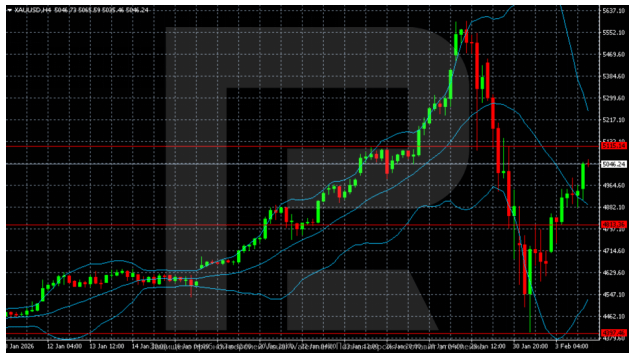

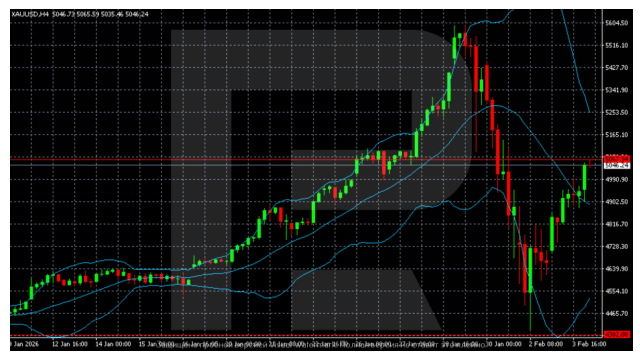

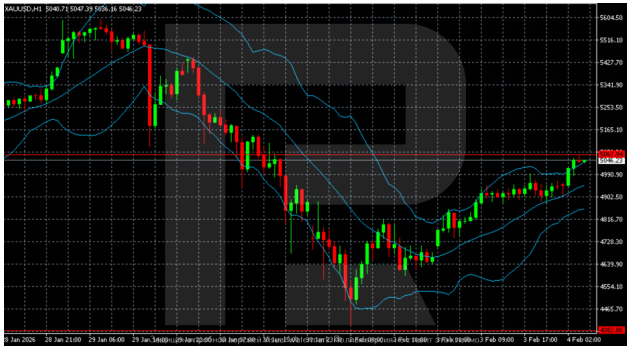

Silver prices (XAG) fell sharply, dropping to $64.1 per ounce on Friday before recovering to levels above $70 per ounce, highlighting a surge in precious metals volatility. The decline occurred amid a broad reduction in risk appetite and the deleveraging of positions, which caused silver to look weaker than other safe-haven assets. Pressure was compounded by signals of a cooling US labor market, including rising unemployment claims and significant corporate layoffs, which bolstered expectations for a Fed policy easing toward the end of the year. However, the initial investor reaction was risk-off, triggering margin selling following last week’s sharp rise. Additional uncertainty stems from the discussion of Kevin Warsh’s candidacy for Fed Chair, while easing geopolitical tensions surrounding Iran temporarily reduced safe-haven demand.

WTI crude oil prices reversed sharply downward on Thursday, losing more than 3% and falling toward the $63 per barrel area, erasing the gains of the previous two sessions. Pressure on quotes was driven by easing geopolitical tensions following confirmation of upcoming talks between Iran and the US, which reduced fears of supply disruptions from a key OPEC producer and diminished the Middle East risk premium.

Asian markets mostly declined yesterday. The Japanese Nikkei 225 (JP225) fell by 0.88%, the FTSE China A50 (CHA50) dropped 0.08%, Hong Kong’s Hang Seng (HK50) rose by 0.14%, and the Australian ASX 200 (AU200) posted a negative result of 0.43%.

On Friday, the Indonesian Rupiah (IDR) weakened to 16,880 per dollar, nearing its recent record low amid a sharp deterioration in investor sentiment. Pressure intensified after Moody’s downgraded Indonesia’s sovereign rating outlook to “negative,” citing decreased predictability of economic policy. This move followed an MSCI warning regarding transparency issues, which previously triggered a massive capital outflow from the local market and fueled doubts about governance quality. The domestic backdrop also remained weak: 2025 economic growth fell below the government target, strengthening expectations for additional policy easing by Bank Indonesia.

S&P 500 (US500) 6,798.40 −84.32 (−1.23%)

Dow Jones (US30) 48,908.72 −592.58 (−1.20%)

DAX (DE40) 24,491.06 −111.98 (−0.46%)

FTSE 100 (UK100) 10,309.22 −93.12 (−0.90%)

USD Index 97.93 +0.32% (+0.32%)

News feed for: 2026.02.06

- German Trade Balance (m/m) at 09:00 (GMT+2); – EUR (LOW)

- Sweden Inflation Rate (m/m) at 09:00 (GMT+2); – SEK (MED)

- Switzerland Unemployment Rate (m/m) at 10:00 (GMT+2); – CHF (MED)

- Canada Unemployment Rate (m/m) at 15:30 (GMT+2); – CAD (HIGH)

- US Michigan Inflation Expectations (m/m) at 17:00 (GMT+2); – USD (MED)

- Canada Ivey PMI (m/m) at 17:00 (GMT+2). – CAD (MED)

By JustMarkets

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.

Article by

Article by