By CountingPips.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday August 17 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

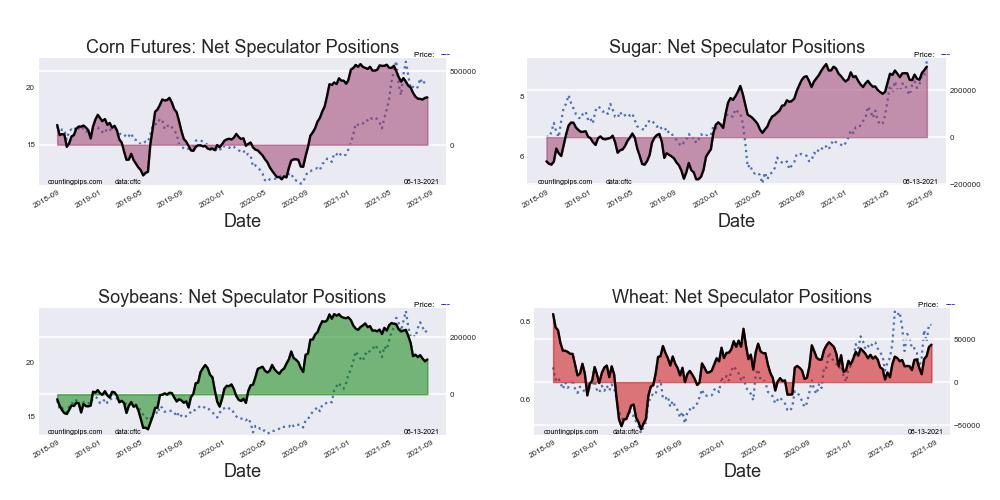

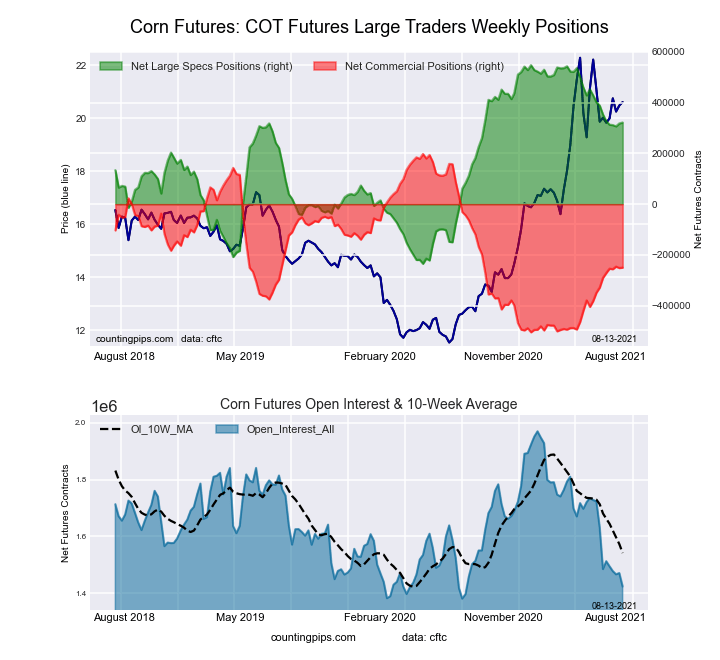

CORN Futures:

The CORN large speculator standing this week was a net position of 345,846 contracts in the data reported through Tuesday. This was a weekly gain of 24,287 contracts from the previous week which had a total of 321,559 net contracts.

The CORN large speculator standing this week was a net position of 345,846 contracts in the data reported through Tuesday. This was a weekly gain of 24,287 contracts from the previous week which had a total of 321,559 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 74.2 percent. The commercials are Bearish with a score of 33.3 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 0.0 percent.

| CORN Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 30.1 | 47.6 | 8.4 |

| – Percent of Open Interest Shorts: | 6.0 | 66.5 | 13.6 |

| – Net Position: | 345,846 | -270,993 | -74,853 |

| – Gross Longs: | 432,298 | 683,412 | 119,894 |

| – Gross Shorts: | 86,452 | 954,405 | 194,747 |

| – Long to Short Ratio: | 5.0 to 1 | 0.7 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 74.2 | 33.3 | 0.0 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 2.4 | 0.1 | -11.2 |

SUGAR Futures:

The SUGAR large speculator standing this week was a net position of 302,267 contracts in the data reported through Tuesday. This was a weekly rise of 4,846 contracts from the previous week which had a total of 297,421 net contracts.

The SUGAR large speculator standing this week was a net position of 302,267 contracts in the data reported through Tuesday. This was a weekly rise of 4,846 contracts from the previous week which had a total of 297,421 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 98.7 percent. The commercials are Bearish-Extreme with a score of 0.4 percent and the small traders (not shown in chart) are Bullish with a score of 76.0 percent.

| SUGAR Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.9 | 42.8 | 9.3 |

| – Percent of Open Interest Shorts: | 3.6 | 77.4 | 3.9 |

| – Net Position: | 302,267 | -357,406 | 55,139 |

| – Gross Longs: | 339,414 | 442,141 | 95,926 |

| – Gross Shorts: | 37,147 | 799,547 | 40,787 |

| – Long to Short Ratio: | 9.1 to 1 | 0.6 to 1 | 2.4 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 98.7 | 0.4 | 76.0 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 7.9 | -7.2 | -0.6 |

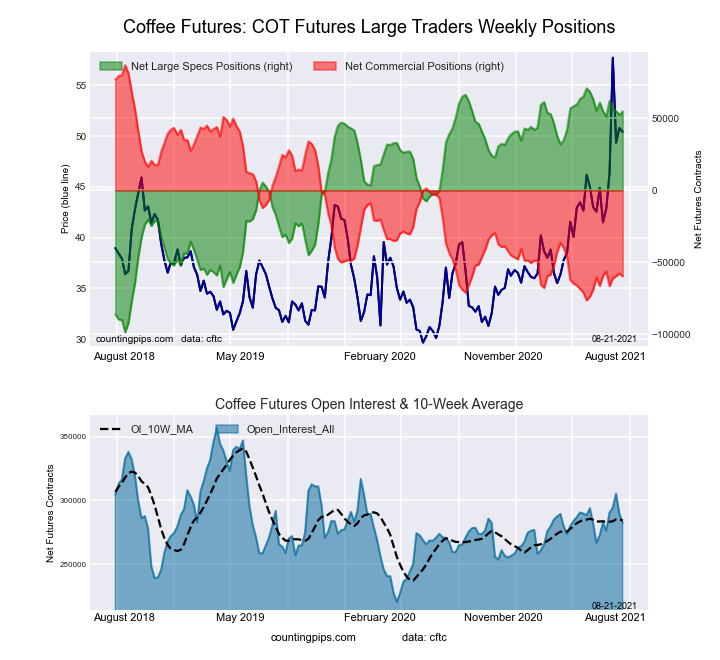

COFFEE Futures:

The COFFEE large speculator standing this week was a net position of 54,797 contracts in the data reported through Tuesday. This was a weekly gain of 2,531 contracts from the previous week which had a total of 52,266 net contracts.

The COFFEE large speculator standing this week was a net position of 54,797 contracts in the data reported through Tuesday. This was a weekly gain of 2,531 contracts from the previous week which had a total of 52,266 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 90.6 percent. The commercials are Bearish-Extreme with a score of 10.2 percent and the small traders (not shown in chart) are Bearish with a score of 21.9 percent.

| COFFEE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.3 | 46.0 | 3.9 |

| – Percent of Open Interest Shorts: | 6.9 | 67.1 | 2.2 |

| – Net Position: | 54,797 | -59,643 | 4,846 |

| – Gross Longs: | 74,249 | 129,838 | 11,124 |

| – Gross Shorts: | 19,452 | 189,481 | 6,278 |

| – Long to Short Ratio: | 3.8 to 1 | 0.7 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 90.6 | 10.2 | 21.9 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -0.1 | -0.2 | 3.8 |

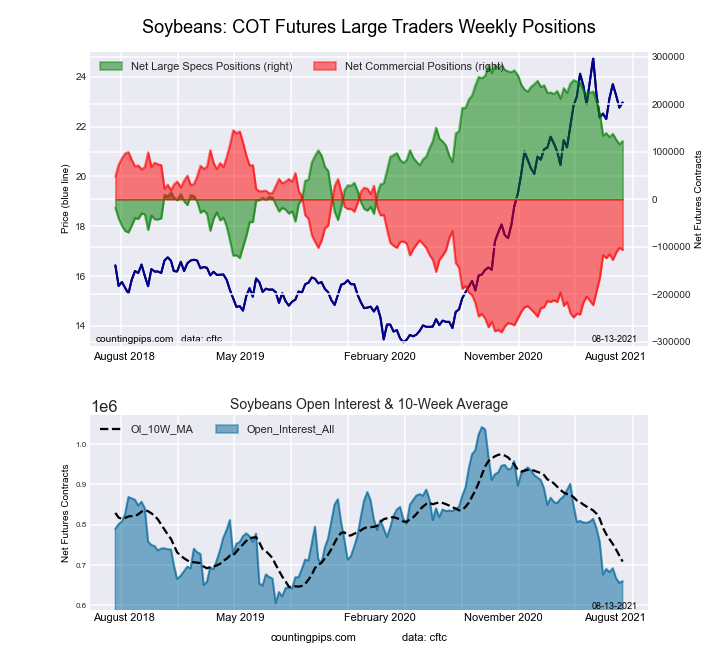

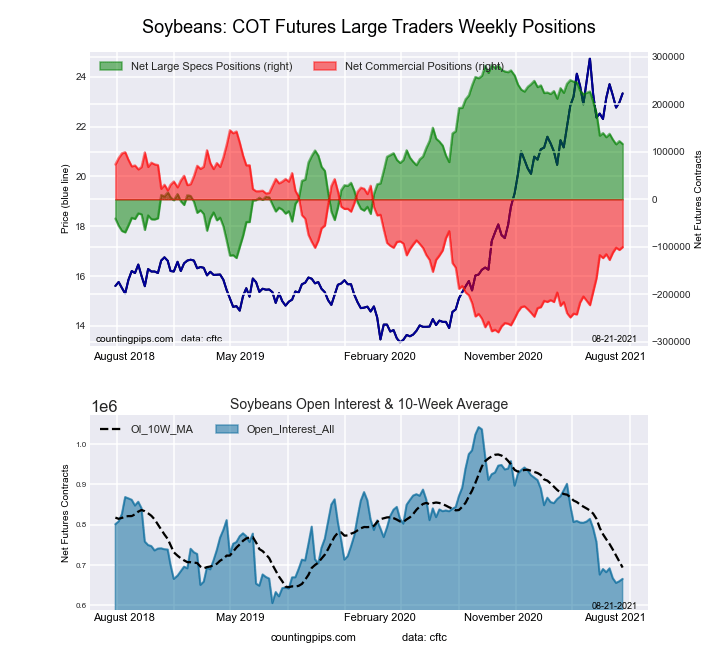

SOYBEANS Futures:

The SOYBEANS large speculator standing this week was a net position of 116,404 contracts in the data reported through Tuesday. This was a weekly reduction of -5,992 contracts from the previous week which had a total of 122,396 net contracts.

The SOYBEANS large speculator standing this week was a net position of 116,404 contracts in the data reported through Tuesday. This was a weekly reduction of -5,992 contracts from the previous week which had a total of 122,396 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 59.1 percent. The commercials are Bearish with a score of 42.2 percent and the small traders (not shown in chart) are Bearish with a score of 45.5 percent.

| SOYBEANS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 27.4 | 51.6 | 6.9 |

| – Percent of Open Interest Shorts: | 9.9 | 66.7 | 9.3 |

| – Net Position: | 116,404 | -100,593 | -15,811 |

| – Gross Longs: | 182,539 | 343,275 | 45,953 |

| – Gross Shorts: | 66,135 | 443,868 | 61,764 |

| – Long to Short Ratio: | 2.8 to 1 | 0.8 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 59.1 | 42.2 | 45.5 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.6 | 5.4 | -0.3 |

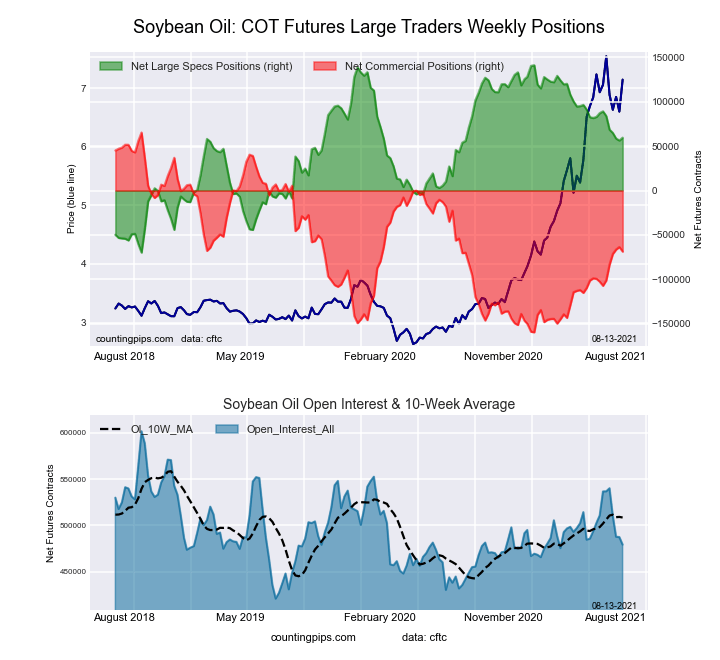

SOYBEAN OIL Futures:

The SOYBEAN OIL large speculator standing this week was a net position of 59,517 contracts in the data reported through Tuesday. This was a weekly gain of 3,102 contracts from the previous week which had a total of 56,415 net contracts.

The SOYBEAN OIL large speculator standing this week was a net position of 59,517 contracts in the data reported through Tuesday. This was a weekly gain of 3,102 contracts from the previous week which had a total of 56,415 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 61.3 percent. The commercials are Bearish with a score of 40.4 percent and the small traders (not shown in chart) are Bearish with a score of 47.7 percent.

| SOYBEAN OIL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 19.8 | 50.9 | 7.2 |

| – Percent of Open Interest Shorts: | 7.4 | 65.2 | 5.3 |

| – Net Position: | 59,517 | -68,690 | 9,173 |

| – Gross Longs: | 95,068 | 243,983 | 34,536 |

| – Gross Shorts: | 35,551 | 312,673 | 25,363 |

| – Long to Short Ratio: | 2.7 to 1 | 0.8 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 61.3 | 40.4 | 47.7 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -14.1 | 17.1 | -32.9 |

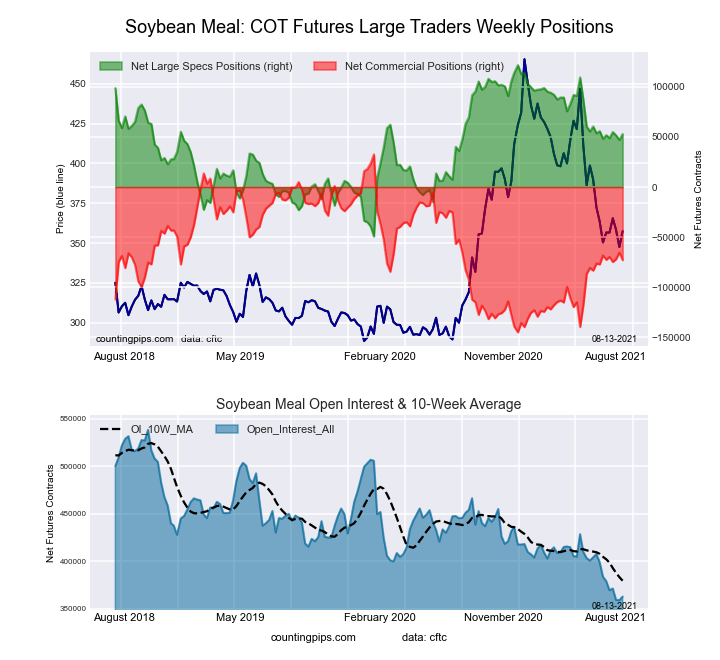

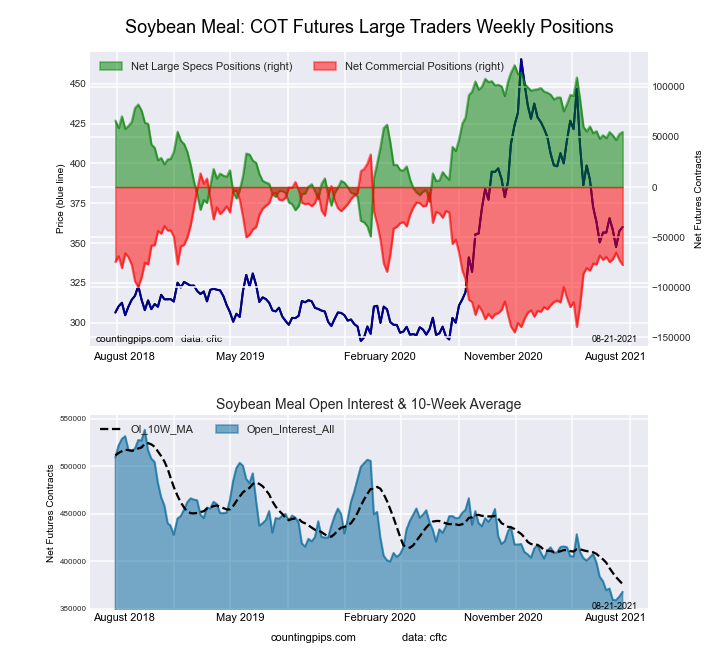

SOYBEAN MEAL Futures:

The SOYBEAN MEAL large speculator standing this week was a net position of 54,947 contracts in the data reported through Tuesday. This was a weekly increase of 2,089 contracts from the previous week which had a total of 52,858 net contracts.

The SOYBEAN MEAL large speculator standing this week was a net position of 54,947 contracts in the data reported through Tuesday. This was a weekly increase of 2,089 contracts from the previous week which had a total of 52,858 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 61.0 percent. The commercials are Bearish with a score of 37.9 percent and the small traders (not shown in chart) are Bullish with a score of 62.2 percent.

| SOYBEAN MEAL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 22.9 | 51.5 | 12.8 |

| – Percent of Open Interest Shorts: | 8.0 | 72.7 | 6.6 |

| – Net Position: | 54,947 | -77,800 | 22,853 |

| – Gross Longs: | 84,323 | 189,483 | 47,117 |

| – Gross Shorts: | 29,376 | 267,283 | 24,264 |

| – Long to Short Ratio: | 2.9 to 1 | 0.7 to 1 | 1.9 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 61.0 | 37.9 | 62.2 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.9 | -2.9 | 8.0 |

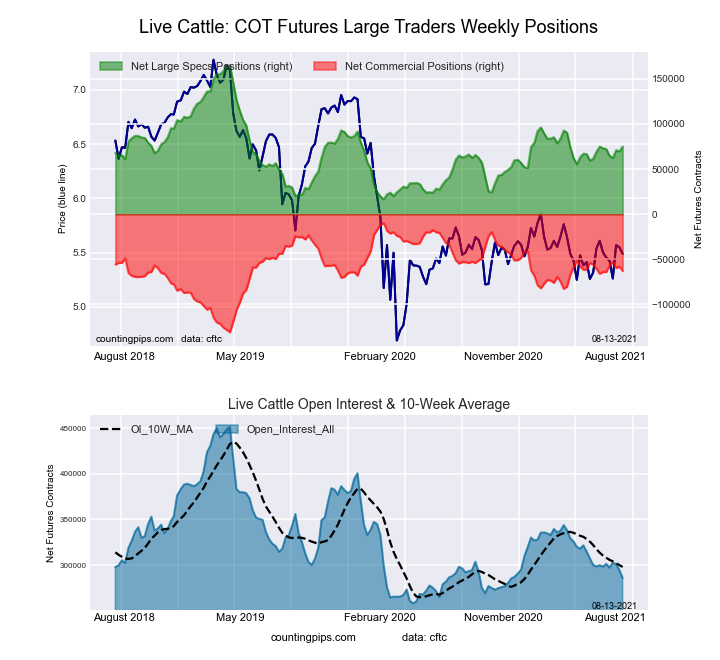

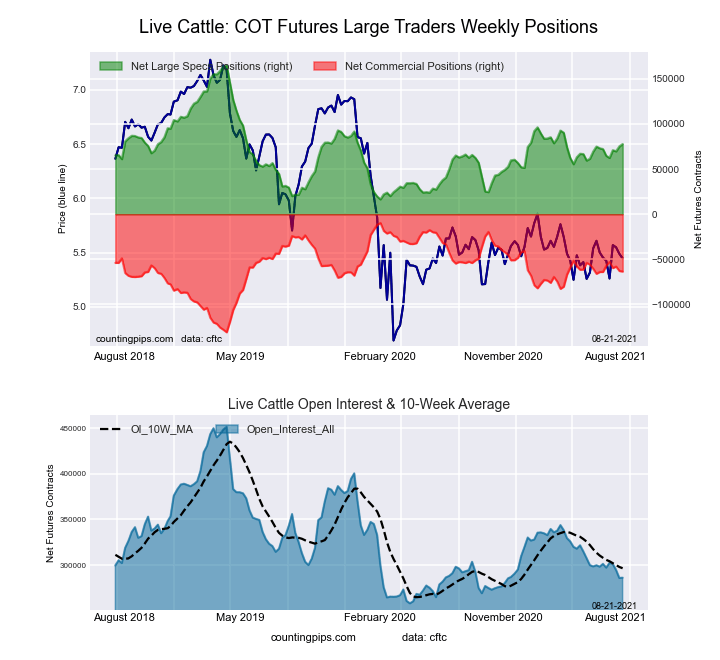

LIVE CATTLE Futures:

The LIVE CATTLE large speculator standing this week was a net position of 77,785 contracts in the data reported through Tuesday. This was a weekly increase of 2,709 contracts from the previous week which had a total of 75,076 net contracts.

The LIVE CATTLE large speculator standing this week was a net position of 77,785 contracts in the data reported through Tuesday. This was a weekly increase of 2,709 contracts from the previous week which had a total of 75,076 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 41.3 percent. The commercials are Bullish with a score of 55.6 percent and the small traders (not shown in chart) are Bullish with a score of 52.2 percent.

| LIVE CATTLE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 39.2 | 39.8 | 9.5 |

| – Percent of Open Interest Shorts: | 12.0 | 62.0 | 14.5 |

| – Net Position: | 77,785 | -63,483 | -14,302 |

| – Gross Longs: | 112,252 | 113,928 | 27,221 |

| – Gross Shorts: | 34,467 | 177,411 | 41,523 |

| – Long to Short Ratio: | 3.3 to 1 | 0.6 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 41.3 | 55.6 | 52.2 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 3.8 | 0.4 | -15.0 |

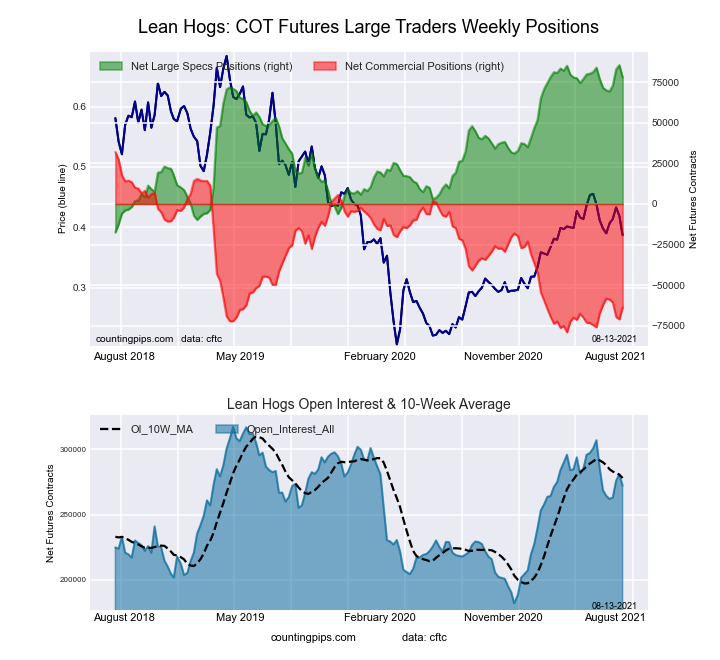

LEAN HOGS Futures:

The LEAN HOGS large speculator standing this week was a net position of 73,725 contracts in the data reported through Tuesday. This was a weekly decrease of -4,363 contracts from the previous week which had a total of 78,088 net contracts.

The LEAN HOGS large speculator standing this week was a net position of 73,725 contracts in the data reported through Tuesday. This was a weekly decrease of -4,363 contracts from the previous week which had a total of 78,088 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 87.9 percent. The commercials are Bearish-Extreme with a score of 18.3 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 10.7 percent.

| LEAN HOGS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 44.5 | 30.4 | 7.3 |

| – Percent of Open Interest Shorts: | 16.9 | 52.7 | 12.6 |

| – Net Position: | 73,725 | -59,577 | -14,148 |

| – Gross Longs: | 118,725 | 81,135 | 19,482 |

| – Gross Shorts: | 45,000 | 140,712 | 33,630 |

| – Long to Short Ratio: | 2.6 to 1 | 0.6 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 87.9 | 18.3 | 10.7 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 3.8 | -1.2 | -11.4 |

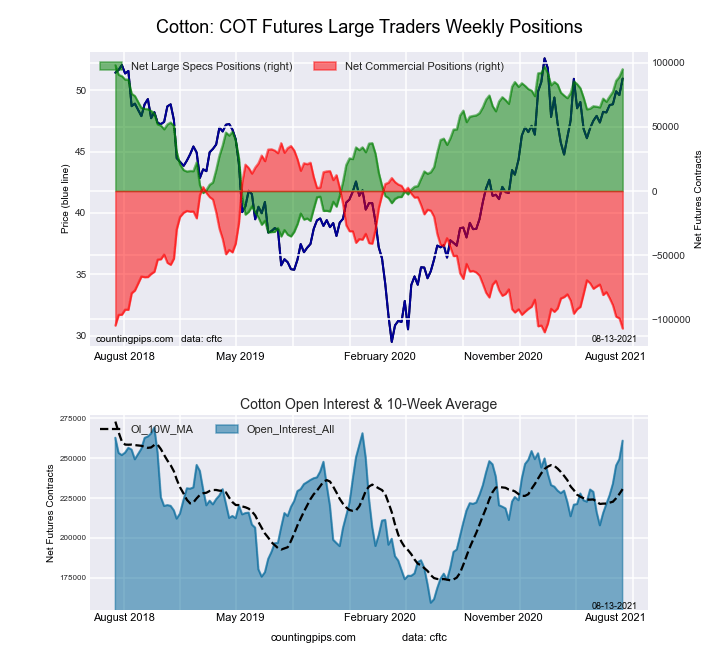

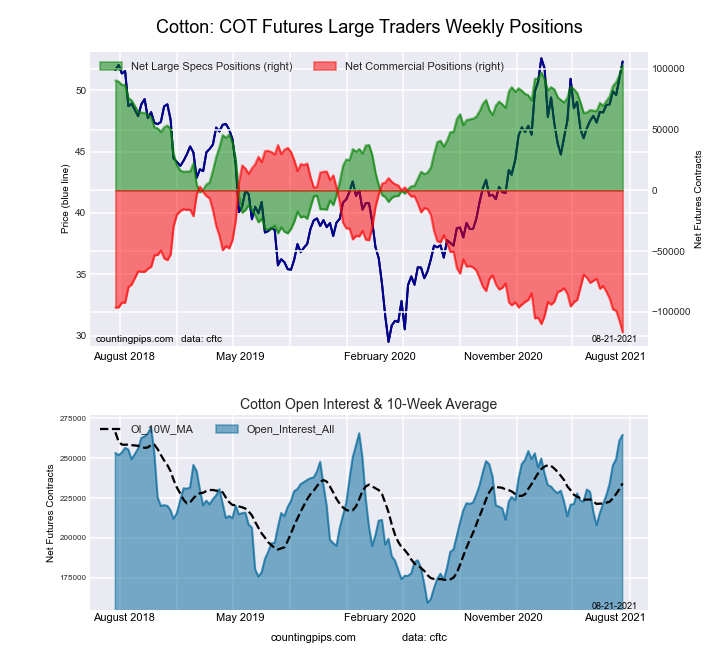

COTTON Futures:

The COTTON large speculator standing this week was a net position of 103,031 contracts in the data reported through Tuesday. This was a weekly lift of 8,119 contracts from the previous week which had a total of 94,912 net contracts.

The COTTON large speculator standing this week was a net position of 103,031 contracts in the data reported through Tuesday. This was a weekly lift of 8,119 contracts from the previous week which had a total of 94,912 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 100.0 percent. The commercials are Bearish-Extreme with a score of 0.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

| COTTON Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 44.4 | 35.7 | 7.9 |

| – Percent of Open Interest Shorts: | 5.5 | 79.9 | 2.6 |

| – Net Position: | 103,031 | -116,881 | 13,850 |

| – Gross Longs: | 117,526 | 94,528 | 20,808 |

| – Gross Shorts: | 14,495 | 211,409 | 6,958 |

| – Long to Short Ratio: | 8.1 to 1 | 0.4 to 1 | 3.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 100.0 | 0.0 | 100.0 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 24.2 | -24.8 | 29.3 |

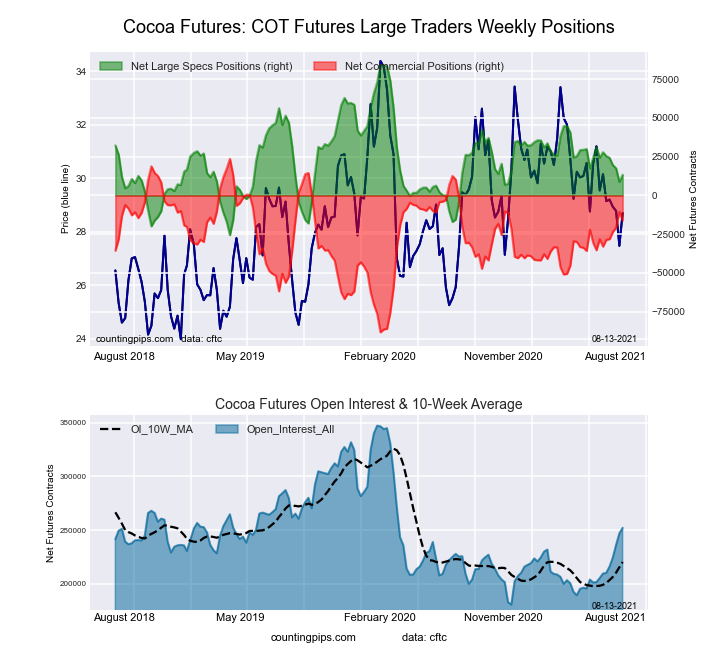

COCOA Futures:

The COCOA large speculator standing this week was a net position of 13,326 contracts in the data reported through Tuesday. This was a weekly gain of 4,559 contracts from the previous week which had a total of 8,767 net contracts.

The COCOA large speculator standing this week was a net position of 13,326 contracts in the data reported through Tuesday. This was a weekly gain of 4,559 contracts from the previous week which had a total of 8,767 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 35.5 percent. The commercials are Bullish with a score of 64.5 percent and the small traders (not shown in chart) are Bearish with a score of 39.9 percent.

| COCOA Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 27.3 | 48.2 | 4.7 |

| – Percent of Open Interest Shorts: | 22.0 | 54.6 | 3.6 |

| – Net Position: | 13,326 | -16,092 | 2,766 |

| – Gross Longs: | 68,772 | 121,390 | 11,767 |

| – Gross Shorts: | 55,446 | 137,482 | 9,001 |

| – Long to Short Ratio: | 1.2 to 1 | 0.9 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 35.5 | 64.5 | 39.9 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -13.3 | 15.1 | -26.6 |

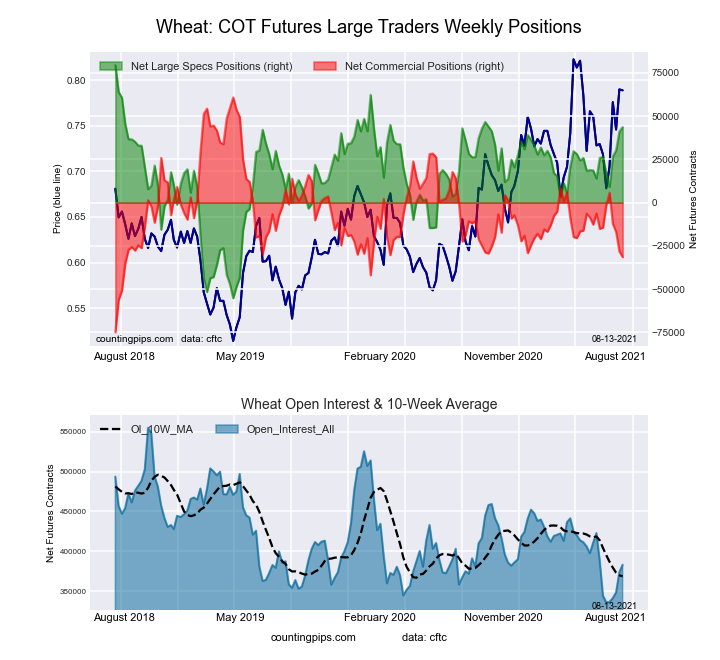

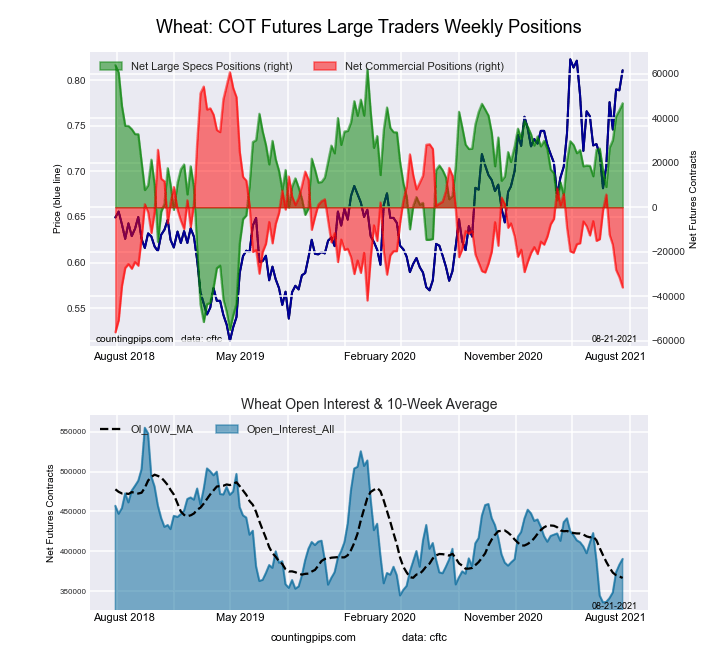

WHEAT Futures:

The WHEAT large speculator standing this week was a net position of 46,794 contracts in the data reported through Tuesday. This was a weekly increase of 3,162 contracts from the previous week which had a total of 43,632 net contracts.

The WHEAT large speculator standing this week was a net position of 46,794 contracts in the data reported through Tuesday. This was a weekly increase of 3,162 contracts from the previous week which had a total of 43,632 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 85.6 percent. The commercials are Bearish-Extreme with a score of 17.2 percent and the small traders (not shown in chart) are Bullish with a score of 50.4 percent.

| WHEAT Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 35.2 | 35.5 | 7.7 |

| – Percent of Open Interest Shorts: | 23.2 | 44.7 | 10.5 |

| – Net Position: | 46,794 | -36,088 | -10,706 |

| – Gross Longs: | 137,475 | 138,516 | 30,181 |

| – Gross Shorts: | 90,681 | 174,604 | 40,887 |

| – Long to Short Ratio: | 1.5 to 1 | 0.8 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 85.6 | 17.2 | 50.4 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 25.4 | -29.7 | 21.6 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).