By CountingPips.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday June 15 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

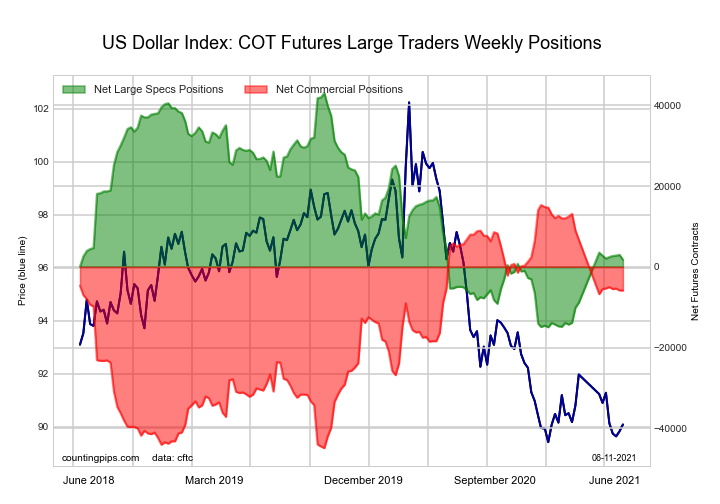

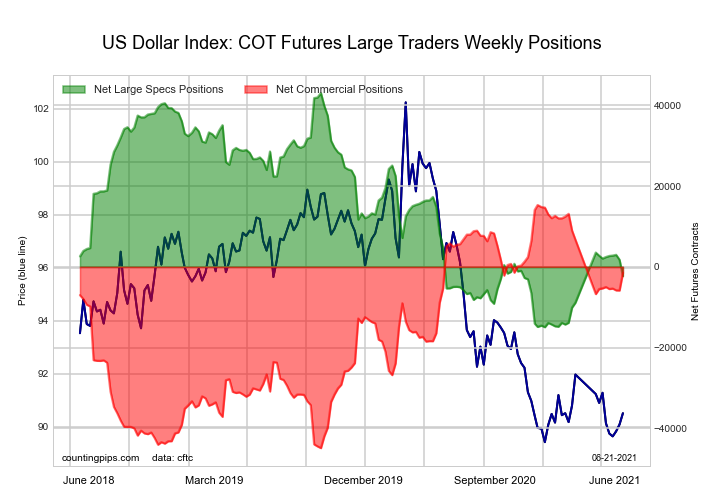

US Dollar Index Futures:

The US Dollar Index large speculator standing this week recorded a net position of -2,303 contracts in the data reported through Tuesday. This was a weekly fall of -4,054 contracts from the previous week which had a total of 1,751 net contracts.

The US Dollar Index large speculator standing this week recorded a net position of -2,303 contracts in the data reported through Tuesday. This was a weekly fall of -4,054 contracts from the previous week which had a total of 1,751 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 21.8 percent. The commercials are Bullish with a score of 72.1 percent and the small traders (not shown in chart) are Bullish with a score of 68.5 percent.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 68.4 | 8.3 | 17.6 |

| – Percent of Open Interest Shorts: | 74.5 | 12.3 | 7.4 |

| – Net Position: | -2,303 | -1,495 | 3,798 |

| – Gross Longs: | 25,618 | 3,120 | 6,577 |

| – Gross Shorts: | 27,921 | 4,615 | 2,779 |

| – Long to Short Ratio: | 0.9 to 1 | 0.7 to 1 | 2.4 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 21.8 | 72.1 | 68.5 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -7.5 | 6.4 | 6.6 |

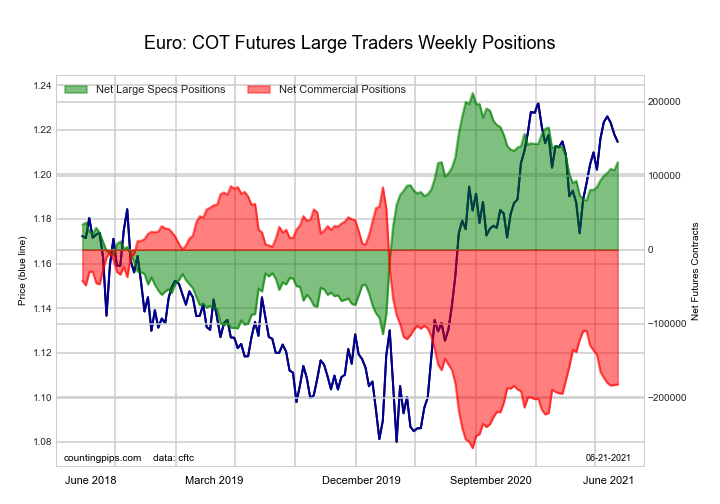

Euro Currency Futures:

The Euro Currency large speculator standing this week recorded a net position of 118,186 contracts in the data reported through Tuesday. This was a weekly gain of 10,973 contracts from the previous week which had a total of 107,213 net contracts.

The Euro Currency large speculator standing this week recorded a net position of 118,186 contracts in the data reported through Tuesday. This was a weekly gain of 10,973 contracts from the previous week which had a total of 107,213 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 71.3 percent. The commercials are Bearish with a score of 24.3 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 83.0 percent.

| EURO Currency Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 30.3 | 54.9 | 14.4 |

| – Percent of Open Interest Shorts: | 13.3 | 81.1 | 5.2 |

| – Net Position: | 118,186 | -182,091 | 63,905 |

| – Gross Longs: | 210,816 | 381,409 | 99,890 |

| – Gross Shorts: | 92,630 | 563,500 | 35,985 |

| – Long to Short Ratio: | 2.3 to 1 | 0.7 to 1 | 2.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 71.3 | 24.3 | 83.0 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 10.2 | -11.3 | 9.3 |

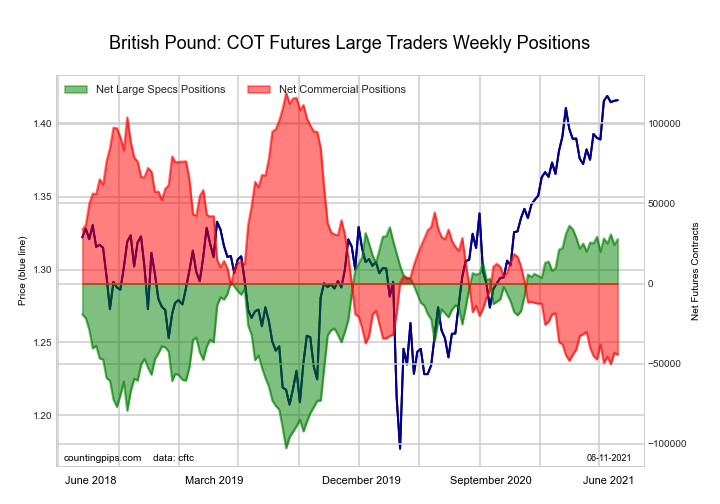

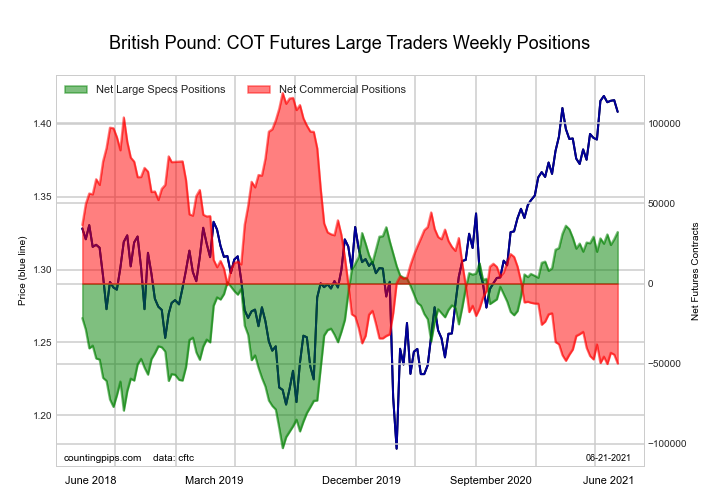

British Pound Sterling Futures:

The British Pound Sterling large speculator standing this week recorded a net position of 32,170 contracts in the data reported through Tuesday. This was a weekly lift of 4,456 contracts from the previous week which had a total of 27,714 net contracts.

The British Pound Sterling large speculator standing this week recorded a net position of 32,170 contracts in the data reported through Tuesday. This was a weekly lift of 4,456 contracts from the previous week which had a total of 27,714 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 97.2 percent. The commercials are Bearish-Extreme with a score of 0.2 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 92.4 percent.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 35.4 | 39.2 | 24.4 |

| – Percent of Open Interest Shorts: | 14.8 | 71.1 | 13.0 |

| – Net Position: | 32,170 | -49,883 | 17,713 |

| – Gross Longs: | 55,203 | 61,123 | 38,047 |

| – Gross Shorts: | 23,033 | 111,006 | 20,334 |

| – Long to Short Ratio: | 2.4 to 1 | 0.6 to 1 | 1.9 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 97.2 | 0.2 | 92.4 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 8.9 | -7.0 | -0.9 |

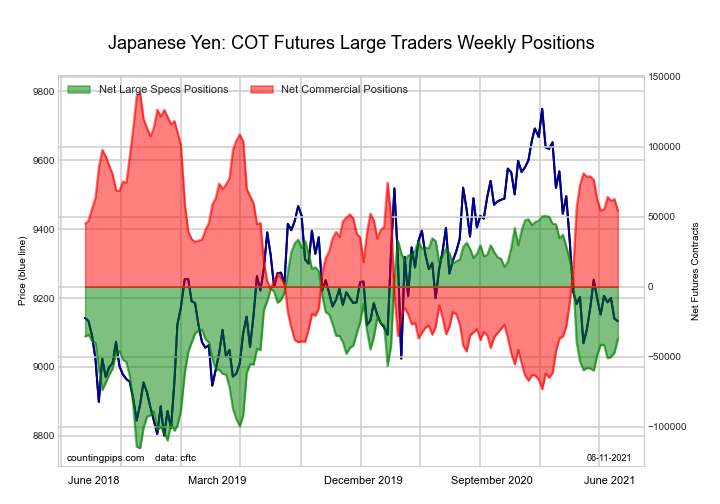

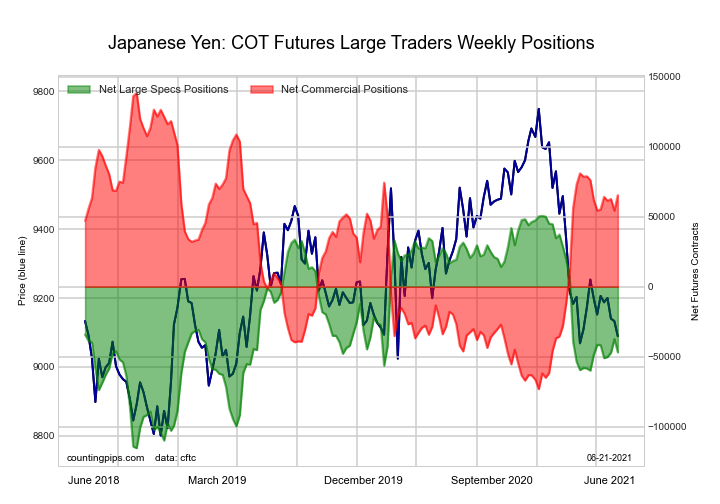

Japanese Yen Futures:

The Japanese Yen large speculator standing this week recorded a net position of -46,850 contracts in the data reported through Tuesday. This was a weekly reduction of -9,536 contracts from the previous week which had a total of -37,314 net contracts.

The Japanese Yen large speculator standing this week recorded a net position of -46,850 contracts in the data reported through Tuesday. This was a weekly reduction of -9,536 contracts from the previous week which had a total of -37,314 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 41.2 percent. The commercials are Bullish with a score of 65.5 percent and the small traders (not shown in chart) are Bearish with a score of 20.9 percent.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 14.8 | 72.6 | 12.2 |

| – Percent of Open Interest Shorts: | 44.9 | 30.6 | 24.0 |

| – Net Position: | -46,850 | 65,317 | -18,467 |

| – Gross Longs: | 22,974 | 112,798 | 18,879 |

| – Gross Shorts: | 69,824 | 47,481 | 37,346 |

| – Long to Short Ratio: | 0.3 to 1 | 2.4 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 41.2 | 65.5 | 20.9 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -3.2 | 5.2 | -10.8 |

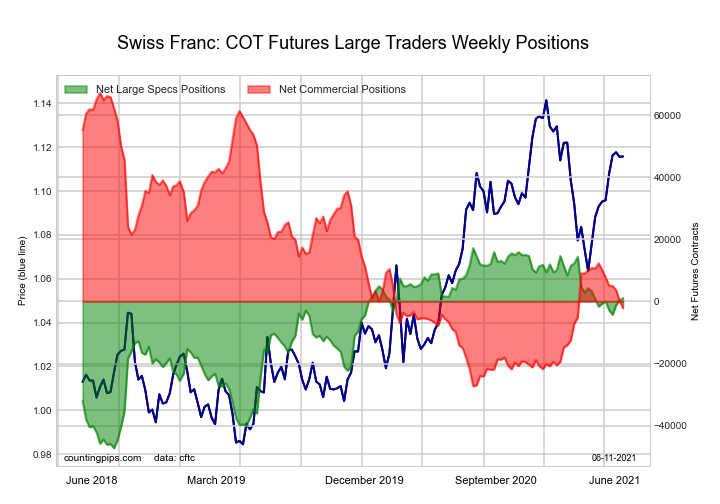

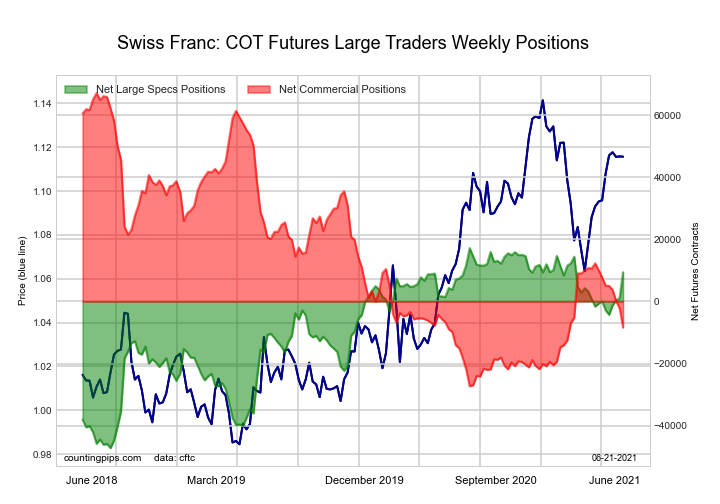

Swiss Franc Futures:

The Swiss Franc large speculator standing this week recorded a net position of 9,387 contracts in the data reported through Tuesday. This was a weekly rise of 8,311 contracts from the previous week which had a total of 1,076 net contracts.

The Swiss Franc large speculator standing this week recorded a net position of 9,387 contracts in the data reported through Tuesday. This was a weekly rise of 8,311 contracts from the previous week which had a total of 1,076 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 87.9 percent. The commercials are Bearish with a score of 20.0 percent and the small traders (not shown in chart) are Bullish with a score of 61.9 percent.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 40.1 | 19.5 | 40.3 |

| – Percent of Open Interest Shorts: | 14.8 | 42.2 | 43.0 |

| – Net Position: | 9,387 | -8,396 | -991 |

| – Gross Longs: | 14,875 | 7,231 | 14,949 |

| – Gross Shorts: | 5,488 | 15,627 | 15,940 |

| – Long to Short Ratio: | 2.7 to 1 | 0.5 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 87.9 | 20.0 | 61.9 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.5 | -17.1 | 19.1 |

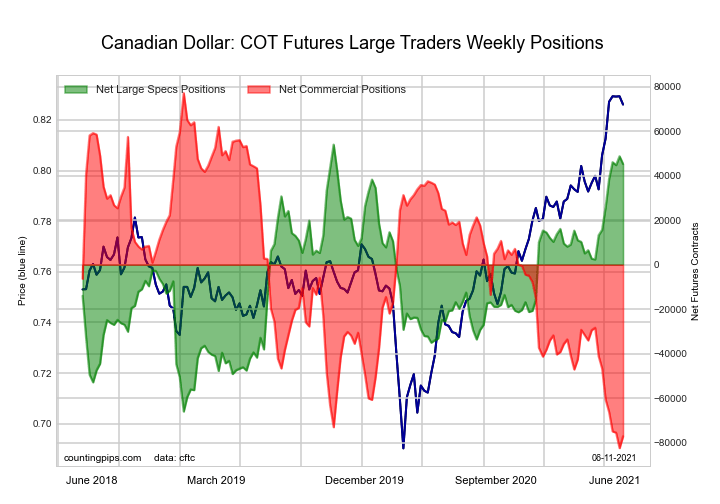

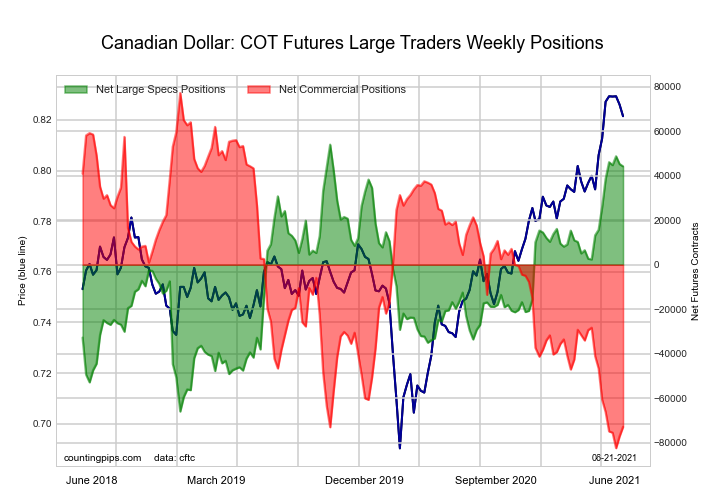

Canadian Dollar Futures:

The Canadian Dollar large speculator standing this week recorded a net position of 44,254 contracts in the data reported through Tuesday. This was a weekly reduction of -1,027 contracts from the previous week which had a total of 45,281 net contracts.

The Canadian Dollar large speculator standing this week recorded a net position of 44,254 contracts in the data reported through Tuesday. This was a weekly reduction of -1,027 contracts from the previous week which had a total of 45,281 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 91.9 percent. The commercials are Bearish-Extreme with a score of 6.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 90.0 percent.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 28.9 | 51.1 | 19.0 |

| – Percent of Open Interest Shorts: | 11.4 | 79.9 | 7.6 |

| – Net Position: | 44,254 | -72,921 | 28,667 |

| – Gross Longs: | 73,071 | 129,185 | 48,013 |

| – Gross Shorts: | 28,817 | 202,106 | 19,346 |

| – Long to Short Ratio: | 2.5 to 1 | 0.6 to 1 | 2.5 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 91.9 | 6.0 | 90.0 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 15.3 | -7.6 | -9.2 |

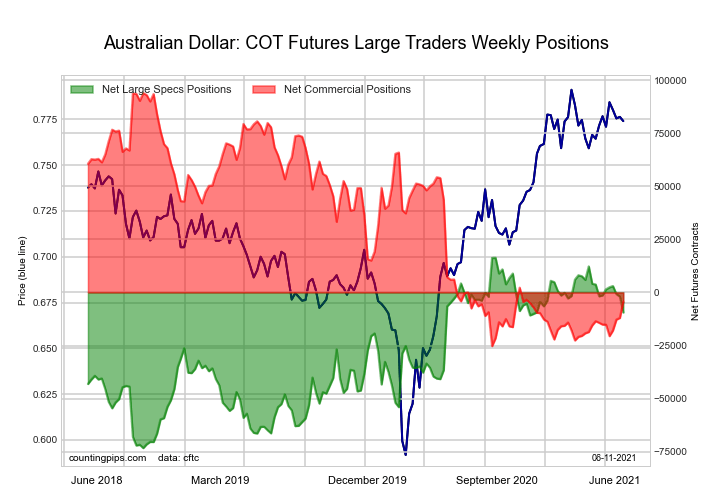

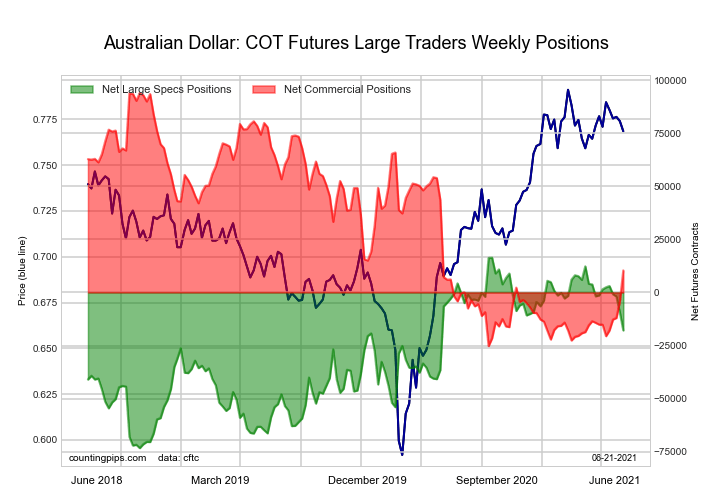

Australian Dollar Futures:

The Australian Dollar large speculator standing this week recorded a net position of -17,880 contracts in the data reported through Tuesday. This was a weekly decrease of -8,443 contracts from the previous week which had a total of -9,437 net contracts.

The Australian Dollar large speculator standing this week recorded a net position of -17,880 contracts in the data reported through Tuesday. This was a weekly decrease of -8,443 contracts from the previous week which had a total of -9,437 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 61.8 percent. The commercials are Bearish with a score of 29.9 percent and the small traders (not shown in chart) are Bullish with a score of 73.7 percent.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.3 | 45.8 | 21.2 |

| – Percent of Open Interest Shorts: | 46.7 | 37.5 | 15.1 |

| – Net Position: | -17,880 | 10,356 | 7,524 |

| – Gross Longs: | 40,139 | 56,902 | 26,262 |

| – Gross Shorts: | 58,019 | 46,546 | 18,738 |

| – Long to Short Ratio: | 0.7 to 1 | 1.2 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 61.8 | 29.9 | 73.7 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -21.6 | 21.4 | -13.6 |

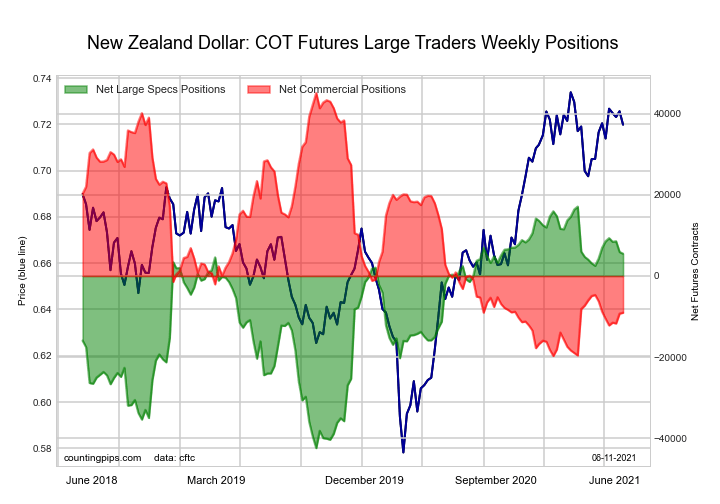

New Zealand Dollar Futures:

The New Zealand Dollar large speculator standing this week recorded a net position of 3,265 contracts in the data reported through Tuesday. This was a weekly fall of -2,241 contracts from the previous week which had a total of 5,506 net contracts.

The New Zealand Dollar large speculator standing this week recorded a net position of 3,265 contracts in the data reported through Tuesday. This was a weekly fall of -2,241 contracts from the previous week which had a total of 5,506 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 76.7 percent. The commercials are Bearish with a score of 21.7 percent and the small traders (not shown in chart) are Bullish with a score of 79.9 percent.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 48.7 | 34.2 | 15.3 |

| – Percent of Open Interest Shorts: | 40.1 | 49.1 | 9.0 |

| – Net Position: | 3,265 | -5,657 | 2,392 |

| – Gross Longs: | 18,466 | 12,962 | 5,787 |

| – Gross Shorts: | 15,201 | 18,619 | 3,395 |

| – Long to Short Ratio: | 1.2 to 1 | 0.7 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 76.7 | 21.7 | 79.9 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -8.9 | 7.6 | 4.6 |

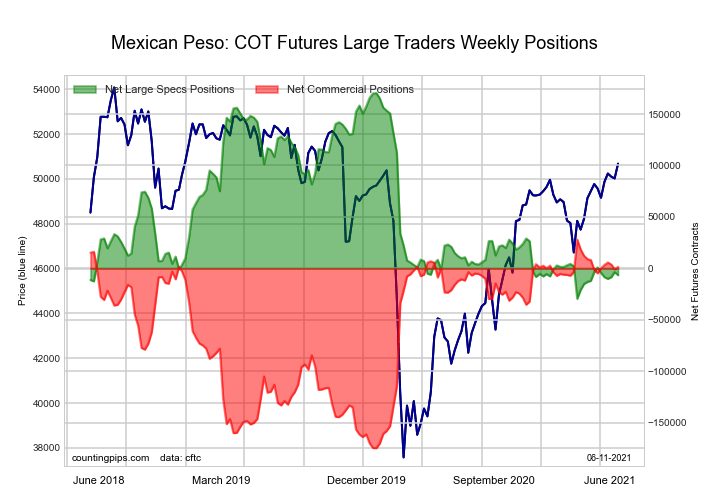

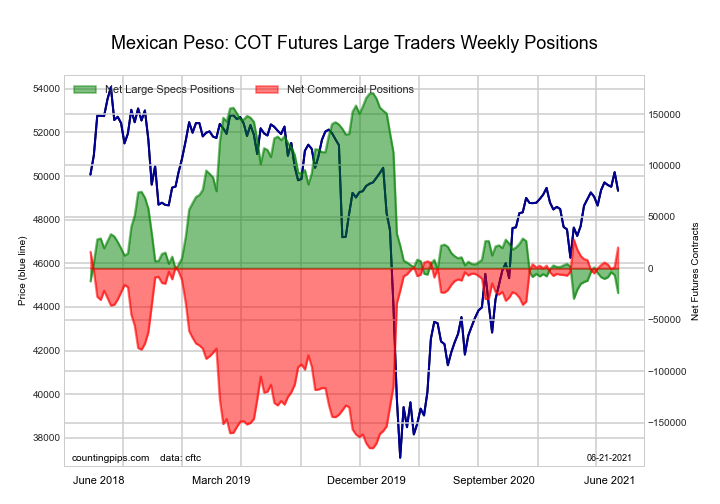

Mexican Peso Futures:

The Mexican Peso large speculator standing this week recorded a net position of -23,930 contracts in the data reported through Tuesday. This was a weekly decrease of -17,369 contracts from the previous week which had a total of -6,561 net contracts.

The Mexican Peso large speculator standing this week recorded a net position of -23,930 contracts in the data reported through Tuesday. This was a weekly decrease of -17,369 contracts from the previous week which had a total of -6,561 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 2.8 percent. The commercials are Bullish-Extreme with a score of 96.2 percent and the small traders (not shown in chart) are Bullish with a score of 58.0 percent.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 47.4 | 47.2 | 4.6 |

| – Percent of Open Interest Shorts: | 64.0 | 33.1 | 2.2 |

| – Net Position: | -23,930 | 20,397 | 3,533 |

| – Gross Longs: | 68,675 | 68,307 | 6,669 |

| – Gross Shorts: | 92,605 | 47,910 | 3,136 |

| – Long to Short Ratio: | 0.7 to 1 | 1.4 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 2.8 | 96.2 | 58.0 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.8 | 10.1 | -3.7 |

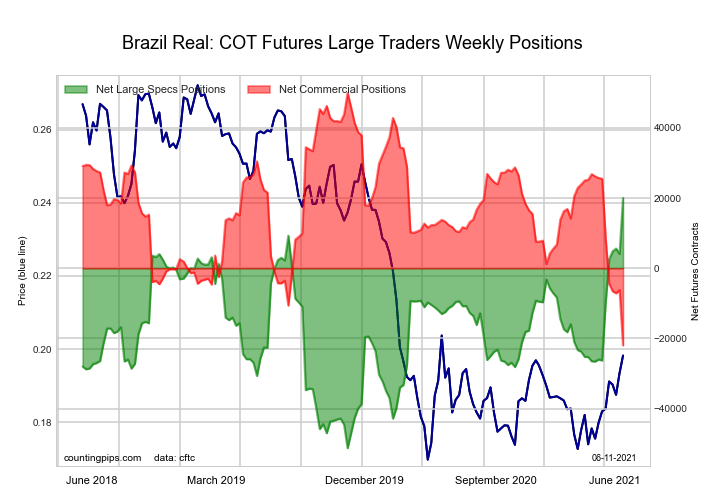

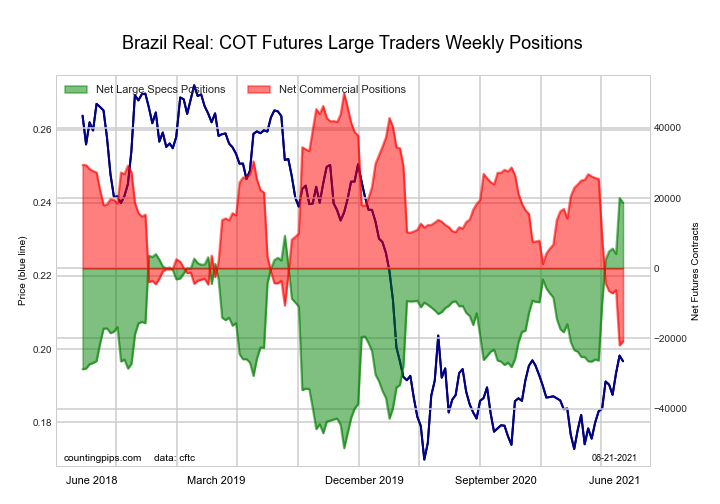

Brazilian Real Futures:

The Brazilian Real large speculator standing this week recorded a net position of 18,659 contracts in the data reported through Tuesday. This was a weekly reduction of -1,389 contracts from the previous week which had a total of 20,048 net contracts.

The Brazilian Real large speculator standing this week recorded a net position of 18,659 contracts in the data reported through Tuesday. This was a weekly reduction of -1,389 contracts from the previous week which had a total of 20,048 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 98.1 percent. The commercials are Bearish-Extreme with a score of 1.6 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 98.9 percent.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 68.6 | 20.4 | 10.5 |

| – Percent of Open Interest Shorts: | 22.2 | 72.2 | 5.1 |

| – Net Position: | 18,659 | -20,809 | 2,150 |

| – Gross Longs: | 27,564 | 8,209 | 4,209 |

| – Gross Shorts: | 8,905 | 29,018 | 2,059 |

| – Long to Short Ratio: | 3.1 to 1 | 0.3 to 1 | 2.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 98.1 | 1.6 | 98.9 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 40.0 | -41.0 | 12.0 |

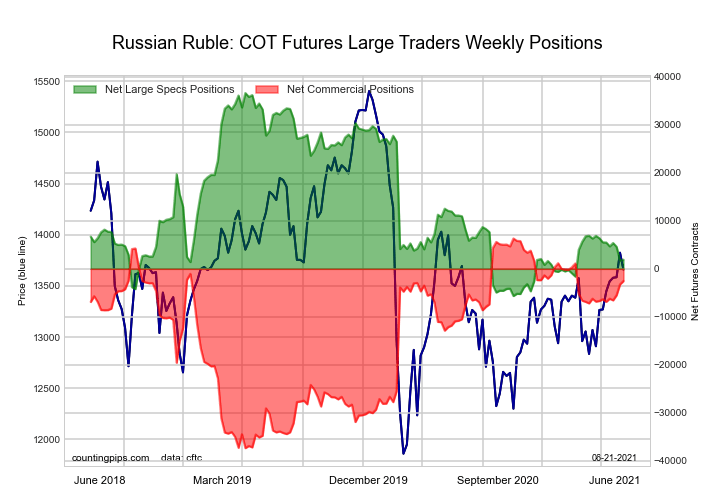

Russian Ruble Futures:

The Russian Ruble large speculator standing this week recorded a net position of 1,904 contracts in the data reported through Tuesday. This was a weekly advance of 164 contracts from the previous week which had a total of 1,740 net contracts.

The Russian Ruble large speculator standing this week recorded a net position of 1,904 contracts in the data reported through Tuesday. This was a weekly advance of 164 contracts from the previous week which had a total of 1,740 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 17.9 percent. The commercials are Bullish with a score of 79.7 percent and the small traders (not shown in chart) are Bullish with a score of 63.9 percent.

| RUSSIAN RUBLE Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.7 | 67.4 | 5.5 |

| – Percent of Open Interest Shorts: | 22.8 | 72.6 | 4.2 |

| – Net Position: | 1,904 | -2,540 | 636 |

| – Gross Longs: | 13,089 | 33,059 | 2,691 |

| – Gross Shorts: | 11,185 | 35,599 | 2,055 |

| – Long to Short Ratio: | 1.2 to 1 | 0.9 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 17.9 | 79.7 | 63.9 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -8.5 | 8.7 | -6.3 |

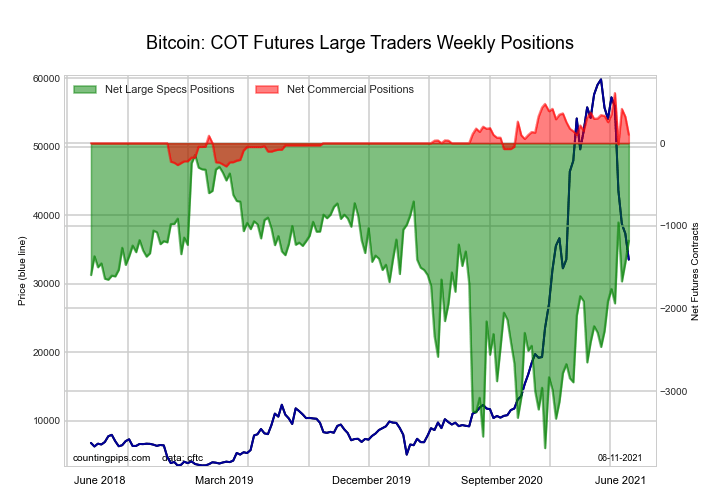

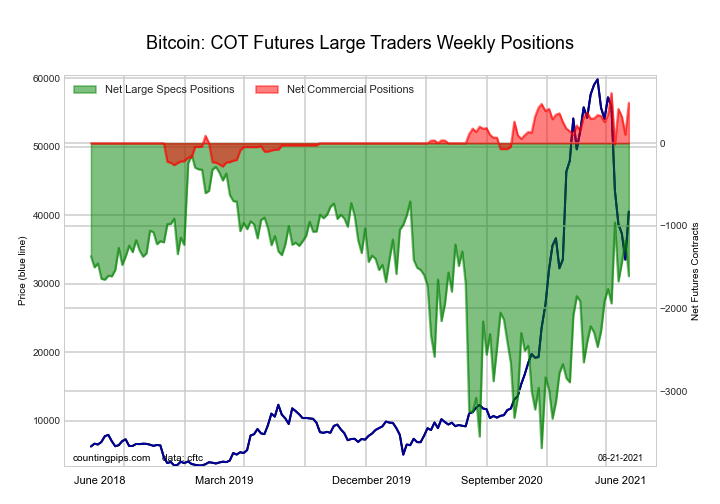

Bitcoin Futures:

The Bitcoin large speculator standing this week recorded a net position of -1,609 contracts in the data reported through Tuesday. This was a weekly reduction of -428 contracts from the previous week which had a total of -1,181 net contracts.

The Bitcoin large speculator standing this week recorded a net position of -1,609 contracts in the data reported through Tuesday. This was a weekly reduction of -428 contracts from the previous week which had a total of -1,181 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 58.7 percent. The commercials are Bullish-Extreme with a score of 86.7 percent and the small traders (not shown in chart) are Bearish with a score of 26.5 percent.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 57.4 | 8.4 | 24.6 |

| – Percent of Open Interest Shorts: | 78.8 | 1.9 | 9.7 |

| – Net Position: | -1,609 | 489 | 1,120 |

| – Gross Longs: | 4,320 | 631 | 1,851 |

| – Gross Shorts: | 5,929 | 142 | 731 |

| – Long to Short Ratio: | 0.7 to 1 | 4.4 to 1 | 2.5 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 58.7 | 86.7 | 26.5 |

| – COT Index Reading (3 Year Range): | Bullish | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 4.4 | 16.1 | -9.8 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).