By Patrick W. Keys, Colorado State University; Curtis Bell, US Naval War College; Elizabeth A. Barnes, Colorado State University; James W. Hurrell, Colorado State University, and Noah Diffenbaugh, Stanford University

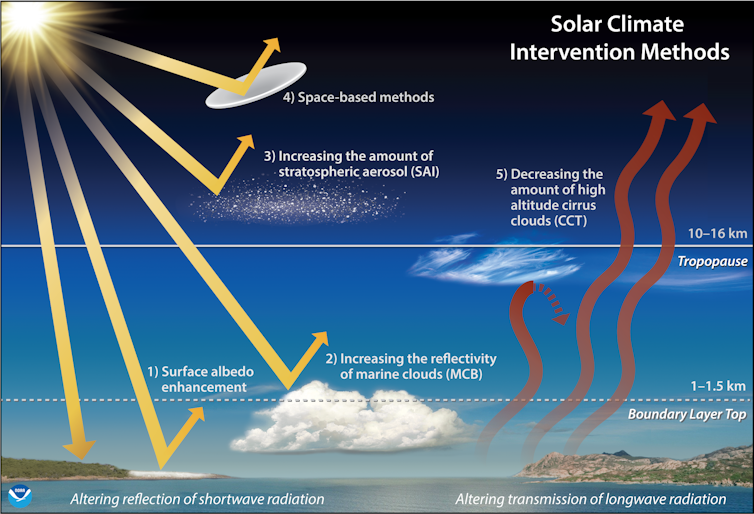

Imagine a future where, despite efforts to reduce greenhouse gas emissions quickly, parts of the world have become unbearably hot. Some governments might decide to “geoengineer” the planet by spraying substances into the upper atmosphere to form fine reflective aerosols – a process known as stratospheric aerosol injection.

Theoretically, those tiny particles would reflect a little more sunlight back to space, dampening the effects of global warming. Some people envision it having the effect of a volcanic eruption, like Mount Pinatubo in 1991, which cooled the planet by about half a degree Celsius on average for many months. However, like that eruption, the effects could vary widely across the surface of the globe.

How quickly might you expect to notice your local temperatures falling? One year? Five years? Ten years?

What if your local temperatures seem to be going up?

As it turns out, that is exactly what could happen. While modeling studies show that stratospheric aerosol injection could stop global temperatures from increasing further, our research shows that temperatures locally or regionally might continue to increase over the following few years. This insight is essential for the general public and policymakers to understand so that climate policies are evaluated fairly and interpreted based on the best available science.

Why local temperatures might continue to rise

In an article published in the Proceedings of the National Academy of Sciences on Sept. 27, 2022, we explore how the effectiveness of stratospheric aerosol injection could be hidden by the natural variability of Earth’s climate.

Natural climate variability refers to variations in climate that are not driven by humans, such as chaotic, unpredictable interactions within and between the ocean, atmosphere, land and sea ice. One example of natural climate variability is the El Niño Southern Oscillation phenomena. During an El Niño year – or its opposite, La Niña – many parts of the world experience warmer or cooler conditions than they might otherwise. These are inescapable features of Earth’s climate system.

We looked at 10 climate model simulations that include stratospheric aerosol injection and analyzed the temperatures that people might experience over a 10-year period if enough aerosols were added to limit the rise in global temperatures to 1.5 degrees Celsius (2.7 F) above preindustrial levels, the U.N. Paris climate agreement goal.

Chelsea Thompson, NOAA/CIRES

We found that a substantial fraction of the Earth’s population could experience continued warming even as average temperatures decreased at a global scale, with as much as 55% still experiencing rising temperatures for a decade after stratospheric aerosol injection begins.

This could be true in parts of the largest and richest countries in the world, including the United States, China, India and parts of Europe. The very countries that have the ability to attempt stratospheric aerosol injection in the future could be those most likely to still see temperatures rise.

Consequences are still poorly understood

Many different types of solar radiation modification have been proposed, but most experts consider stratospheric aerosol injection to be both the most effective and least expensive approach.

The basic idea would be to produce tiny, reflective particles in part of the stratosphere between about 12 and 16 miles (20 and 25 kilometers) in altitude – which is above where airplanes typically fly. While some science fiction stories suggest that rockets might be used to do this, most experts think that modified aircraft would be required to distribute aerosols both high enough and consistently enough.

In 2021, the U.S. National Academies of Sciences, Engineering, and Medicine released a report on the topic of solar radiation modification, including stratospheric aerosol injection. The report was written by a committee of climate scientists, economists, lawyers and others. The group came to the conclusion that the U.S. should fund research on the topic. It recommended this in part because the consequences of solar radiation modification were still poorly understood.

This lack of understanding is quite a risk, since it remains unknown what might happen if the world pursues strategies like stratospheric aerosol injection, let alone if a specific country or organization decides to pursue these interventions by itself.

In our view, research into the potential consequences of stratospheric aerosol injection should include studies to examine potential changes in crop yields, shifts in global rainfall patterns or changes in critical regions of the Earth’s biosphere, like the Amazon rainforest. The fact is that we don’t know very well what would happen with stratospheric aerosol injection – which is why research on this topic is so critical.

Reducing emissions is fundamental to curb climate change

We want to be absolutely clear that we are not advocating for the actual use of stratospheric aerosol injection.

The most direct way to avoid the uncertainty of solar radiation modification strategies like stratospheric aerosol injection is to address the root cause of global warming. That, as documented by many scientific studies, will require the aggressive reduction of emissions of carbon dioxide, methane and other greenhouse gases into the atmosphere.![]()

About the Authors:

Patrick W. Keys, Assistant Professor, Department of Atmospheric Science, Colorado State University; Curtis Bell, Associate Professor of Maritime Security and Governance, US Naval War College; Elizabeth A. Barnes, Professor of Atmospheric Science, Colorado State University; James W. Hurrell, Professor and Scott Presidential Chair in Environmental Science and Engineering, Colorado State University, and Noah Diffenbaugh, Professor of Earth System Science, Stanford University

This article is republished from The Conversation under a Creative Commons license. Read the original article.