By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday August 30th and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

WTI Crude Oil, Brent and Gasoline lead Weekly Speculator Changes lower

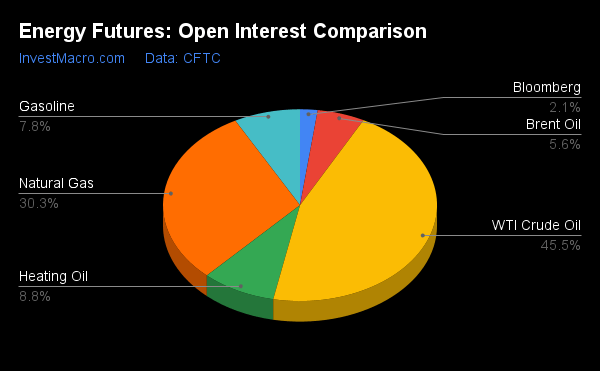

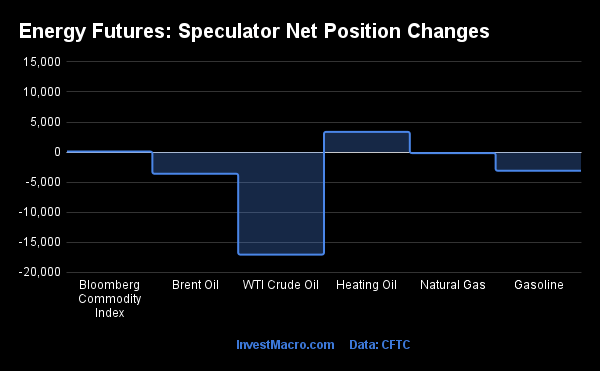

The COT energy market speculator bets were lower this week as two out of the six energy markets we cover had higher positioning this week while the other two markets had lower contracts.

Leading the gains for energy markets was Heating Oil (3,373 contracts) with the Bloomberg Commodity Index (98 contracts) also showing a positive week.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

The energy market leading the declines in speculator bets this week was WTI Crude Oil (-17,031 contracts) with Brent Crude Oil (-3,589 contracts), Gasoline (-3,088 contracts) and Natural Gas (-155 contracts) also registering lower bets on the week.

| Aug-30-2022 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| WTI Crude | 1,470,207 | 0 | 229,189 | 5 | -256,248 | 95 | 27,059 | 48 |

| Gold | 459,165 | 2 | 117,734 | 10 | -129,679 | 92 | 11,945 | 2 |

| Silver | 138,714 | 6 | -8,271 | 0 | 265 | 100 | 8,006 | 8 |

| Copper | 158,390 | 0 | -23,255 | 19 | 24,985 | 83 | -1,730 | 15 |

| Palladium | 5,875 | 0 | -1,129 | 16 | 1,323 | 82 | -194 | 33 |

| Platinum | 70,747 | 40 | -5,378 | 1 | 646 | 99 | 4,732 | 28 |

| Natural Gas | 978,881 | 4 | -128,765 | 40 | 92,463 | 60 | 36,302 | 66 |

| Brent | 180,952 | 24 | -40,013 | 44 | 36,585 | 54 | 3,428 | 56 |

| Heating Oil | 283,427 | 29 | 25,196 | 79 | -43,761 | 25 | 18,565 | 63 |

| Soybeans | 605,924 | 7 | 83,562 | 40 | -52,791 | 68 | -30,771 | 19 |

| Corn | 1,267,735 | 0 | 283,397 | 66 | -225,759 | 40 | -57,638 | 10 |

| Coffee | 193,889 | 7 | 48,687 | 81 | -50,983 | 23 | 2,296 | 21 |

| Sugar | 752,642 | 9 | 62,551 | 49 | -72,593 | 54 | 10,042 | 20 |

| Wheat | 288,545 | 0 | -11,499 | 4 | 14,914 | 81 | -3,415 | 93 |

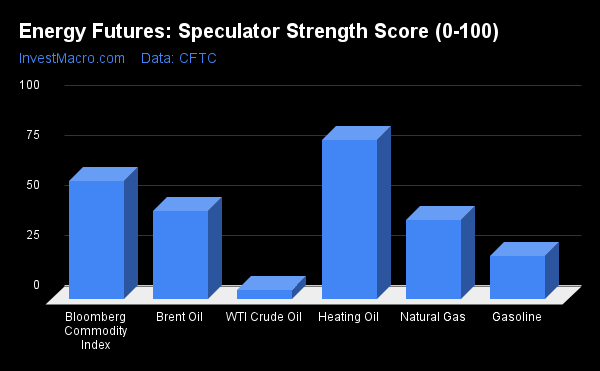

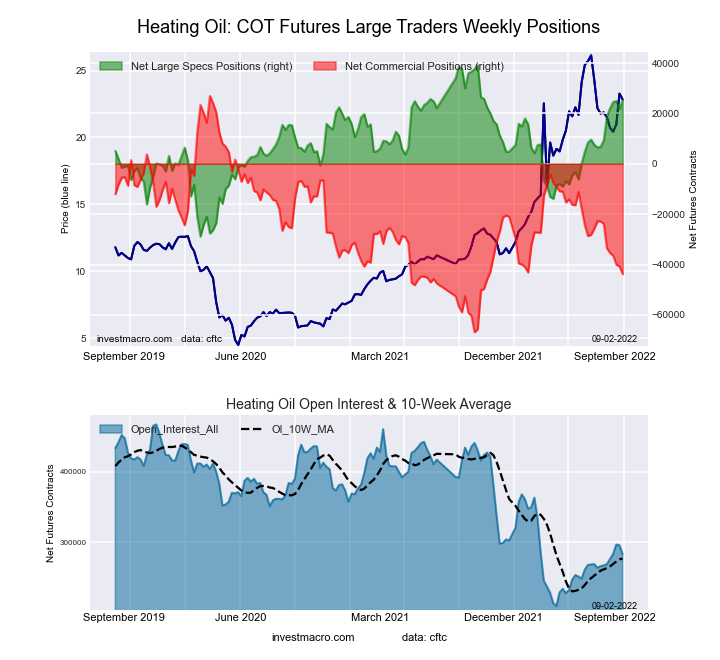

Heating Oil leads the Strength Scores

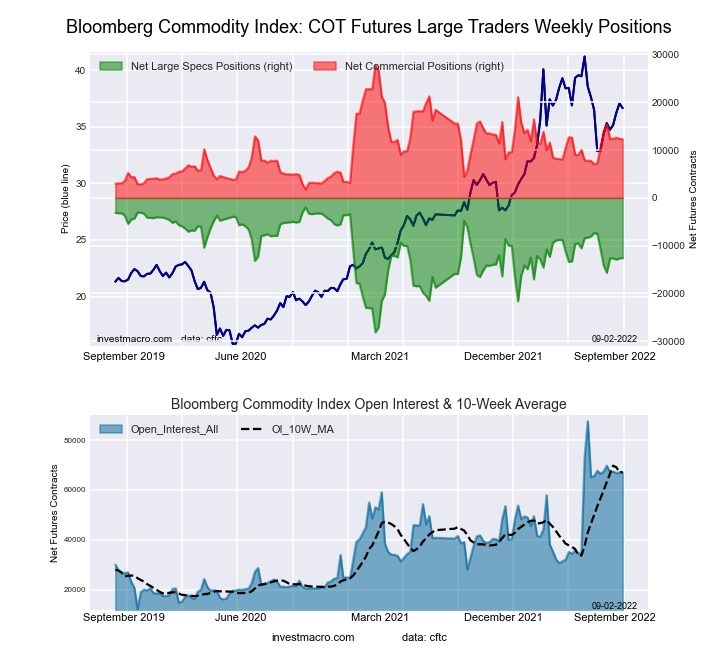

Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is extreme bullish and below 20 is extreme bearish) showed that Heating Oil (79.5 percent) leads the energy markets and is just under the bullish extreme position threshold (above 80 percent). The Bloomberg Commodity Index (59.4 percent) comes in as the next highest energy market in strength scores.

On the downside, WTI Crude Oil (4.9 percent) comes in at the lowest strength level currently and is in a bearish extreme position (below 20 percent). The next lowest is Gasoline (21.7 percent) followed by Natural Gas (39.9 percent) and Brent Crude Oil (44.0 percent).

Strength Statistics:

WTI Crude Oil (4.9 percent) vs WTI Crude Oil previous week (9.4 percent)

Brent Crude Oil (44.0 percent) vs Brent Crude Oil previous week (50.1 percent)

Natural Gas (39.9 percent) vs Natural Gas previous week (40.0 percent)

Gasoline (21.7 percent) vs Gasoline previous week (24.8 percent)

Heating Oil (79.5 percent) vs Heating Oil previous week (74.5 percent)

Bloomberg Commodity Index (59.4 percent) vs Bloomberg Commodity Index previous week (59.0 percent)

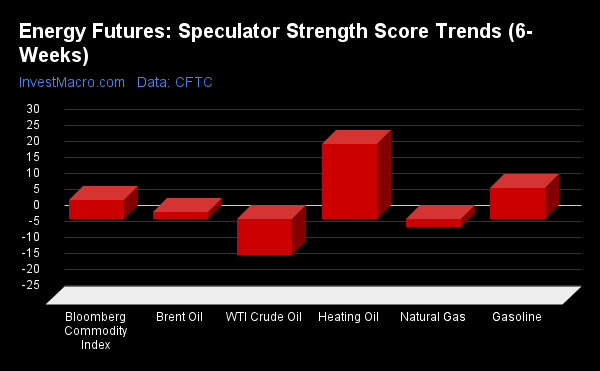

Heating Oil also leads the 6-Week Strength Trends

Strength Score Trends (or move index, calculates the 6-week changes in strength scores) show that Heating Oil (23.5 percent) leads the past six weeks trends for energy this week. Gasoline (9.9 percent), the Bloomberg Commodity Index (6.0 percent) and Brent Crude Oil (2.2 percent) round out the rest of the positive movers in the latest trends data.

WTI Crude Oil (-11.1 percent) leads the downside trend scores currently while the next market with lower trend scores was Natural Gas (-2.5 percent).

Strength Trend Statistics:

WTI Crude Oil (-11.1 percent) vs WTI Crude Oil previous week (-5.8 percent)

Brent Crude Oil (2.2 percent) vs Brent Crude Oil previous week (3.3 percent)

Natural Gas (-2.5 percent) vs Natural Gas previous week (0.9 percent)

Gasoline (9.9 percent) vs Gasoline previous week (20.1 percent)

Heating Oil (23.5 percent) vs Heating Oil previous week (22.2 percent)

Bloomberg Commodity Index (6.0 percent) vs Bloomberg Commodity Index previous week (-7.5 percent)

Individual Markets:

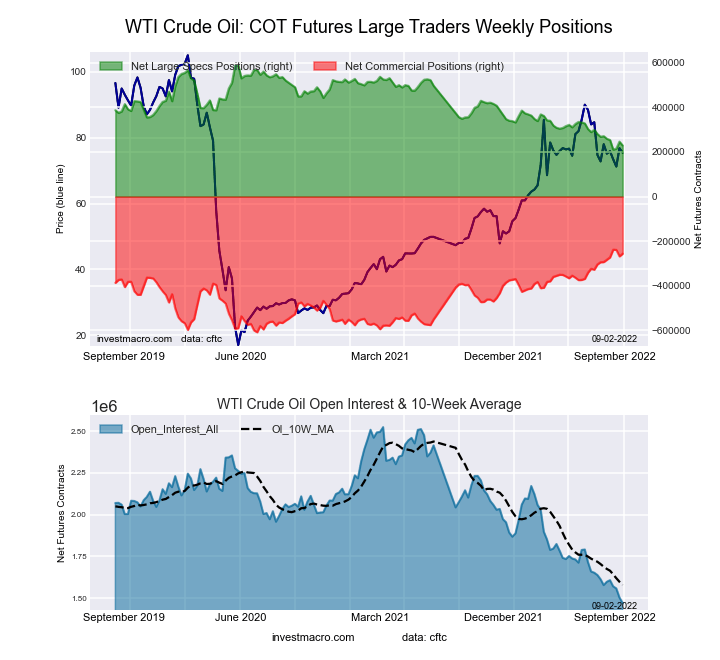

WTI Crude Oil Futures:

The WTI Crude Oil Futures large speculator standing this week reached a net position of 229,189 contracts in the data reported through Tuesday. This was a weekly decline of -17,031 contracts from the previous week which had a total of 246,220 net contracts.

The WTI Crude Oil Futures large speculator standing this week reached a net position of 229,189 contracts in the data reported through Tuesday. This was a weekly decline of -17,031 contracts from the previous week which had a total of 246,220 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 4.9 percent. The commercials are Bullish-Extreme with a score of 95.1 percent and the small traders (not shown in chart) are Bearish with a score of 48.3 percent.

| WTI Crude Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 22.6 | 40.0 | 5.3 |

| – Percent of Open Interest Shorts: | 7.0 | 57.5 | 3.4 |

| – Net Position: | 229,189 | -256,248 | 27,059 |

| – Gross Longs: | 332,415 | 588,601 | 77,360 |

| – Gross Shorts: | 103,226 | 844,849 | 50,301 |

| – Long to Short Ratio: | 3.2 to 1 | 0.7 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 4.9 | 95.1 | 48.3 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.1 | 10.1 | 6.9 |

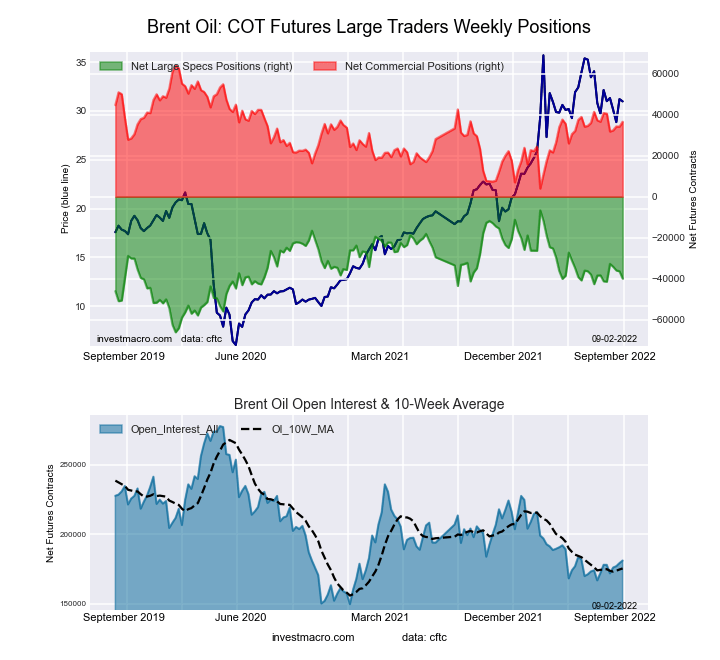

Brent Crude Oil Futures:

The Brent Crude Oil Futures large speculator standing this week reached a net position of -40,013 contracts in the data reported through Tuesday. This was a weekly reduction of -3,589 contracts from the previous week which had a total of -36,424 net contracts.

The Brent Crude Oil Futures large speculator standing this week reached a net position of -40,013 contracts in the data reported through Tuesday. This was a weekly reduction of -3,589 contracts from the previous week which had a total of -36,424 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 44.0 percent. The commercials are Bullish with a score of 54.1 percent and the small traders (not shown in chart) are Bullish with a score of 55.6 percent.

| Brent Crude Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 18.0 | 51.8 | 5.0 |

| – Percent of Open Interest Shorts: | 40.1 | 31.6 | 3.2 |

| – Net Position: | -40,013 | 36,585 | 3,428 |

| – Gross Longs: | 32,556 | 93,680 | 9,137 |

| – Gross Shorts: | 72,569 | 57,095 | 5,709 |

| – Long to Short Ratio: | 0.4 to 1 | 1.6 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 44.0 | 54.1 | 55.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 2.2 | -7.1 | 40.2 |

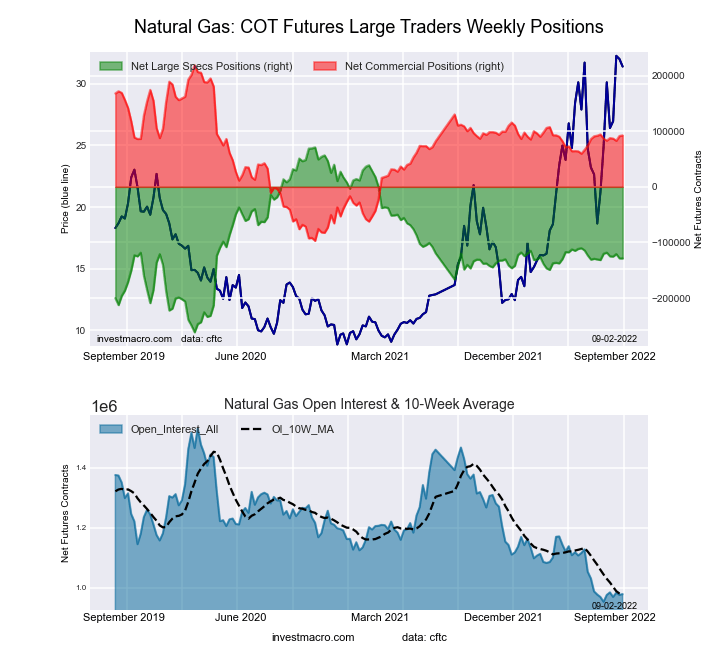

Natural Gas Futures:

The Natural Gas Futures large speculator standing this week reached a net position of -128,765 contracts in the data reported through Tuesday. This was a weekly decrease of -155 contracts from the previous week which had a total of -128,610 net contracts.

The Natural Gas Futures large speculator standing this week reached a net position of -128,765 contracts in the data reported through Tuesday. This was a weekly decrease of -155 contracts from the previous week which had a total of -128,610 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 39.9 percent. The commercials are Bullish with a score of 60.0 percent and the small traders (not shown in chart) are Bullish with a score of 66.1 percent.

| Natural Gas Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.3 | 42.0 | 6.7 |

| – Percent of Open Interest Shorts: | 30.4 | 32.5 | 3.0 |

| – Net Position: | -128,765 | 92,463 | 36,302 |

| – Gross Longs: | 168,924 | 410,930 | 65,677 |

| – Gross Shorts: | 297,689 | 318,467 | 29,375 |

| – Long to Short Ratio: | 0.6 to 1 | 1.3 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 39.9 | 60.0 | 66.1 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -2.5 | 1.8 | 6.3 |

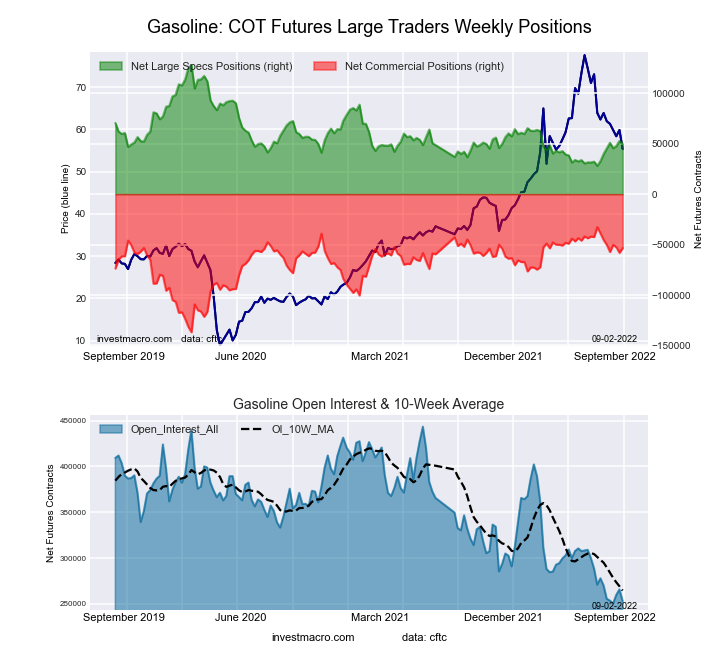

Gasoline Blendstock Futures:

The Gasoline Blendstock Futures large speculator standing this week reached a net position of 49,702 contracts in the data reported through Tuesday. This was a weekly decline of -3,088 contracts from the previous week which had a total of 52,790 net contracts.

The Gasoline Blendstock Futures large speculator standing this week reached a net position of 49,702 contracts in the data reported through Tuesday. This was a weekly decline of -3,088 contracts from the previous week which had a total of 52,790 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 21.7 percent. The commercials are Bullish-Extreme with a score of 80.1 percent and the small traders (not shown in chart) are Bearish with a score of 37.6 percent.

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.9 | 47.3 | 7.3 |

| – Percent of Open Interest Shorts: | 12.3 | 68.4 | 5.8 |

| – Net Position: | 49,702 | -53,438 | 3,736 |

| – Gross Longs: | 80,794 | 119,875 | 18,480 |

| – Gross Shorts: | 31,092 | 173,313 | 14,744 |

| – Long to Short Ratio: | 2.6 to 1 | 0.7 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 21.7 | 80.1 | 37.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.9 | -7.6 | -13.0 |

#2 Heating Oil NY-Harbor Futures:

The #2 Heating Oil NY-Harbor Futures large speculator standing this week reached a net position of 25,196 contracts in the data reported through Tuesday. This was a weekly advance of 3,373 contracts from the previous week which had a total of 21,823 net contracts.

The #2 Heating Oil NY-Harbor Futures large speculator standing this week reached a net position of 25,196 contracts in the data reported through Tuesday. This was a weekly advance of 3,373 contracts from the previous week which had a total of 21,823 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 79.5 percent. The commercials are Bearish with a score of 24.7 percent and the small traders (not shown in chart) are Bullish with a score of 62.7 percent.

| Heating Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.3 | 51.5 | 14.6 |

| – Percent of Open Interest Shorts: | 8.5 | 66.9 | 8.0 |

| – Net Position: | 25,196 | -43,761 | 18,565 |

| – Gross Longs: | 49,157 | 145,893 | 41,370 |

| – Gross Shorts: | 23,961 | 189,654 | 22,805 |

| – Long to Short Ratio: | 2.1 to 1 | 0.8 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 79.5 | 24.7 | 62.7 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 23.5 | -21.3 | 13.9 |

Bloomberg Commodity Index Futures:

The Bloomberg Commodity Index Futures large speculator standing this week reached a net position of -12,567 contracts in the data reported through Tuesday. This was a weekly lift of 98 contracts from the previous week which had a total of -12,665 net contracts.

The Bloomberg Commodity Index Futures large speculator standing this week reached a net position of -12,567 contracts in the data reported through Tuesday. This was a weekly lift of 98 contracts from the previous week which had a total of -12,665 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 59.4 percent. The commercials are Bearish with a score of 40.4 percent and the small traders (not shown in chart) are Bearish with a score of 22.3 percent.

| Bloomberg Index Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 23.7 | 74.3 | 0.6 |

| – Percent of Open Interest Shorts: | 42.5 | 56.0 | 0.1 |

| – Net Position: | -12,567 | 12,243 | 324 |

| – Gross Longs: | 15,868 | 49,746 | 419 |

| – Gross Shorts: | 28,435 | 37,503 | 95 |

| – Long to Short Ratio: | 0.6 to 1 | 1.3 to 1 | 4.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 59.4 | 40.4 | 22.3 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 6.0 | -6.4 | 4.0 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- Today, investors’ focus is on the PCE Price Index inflation report Apr 26, 2024

- Gold price recovers amid uncertain US economic outlook Apr 26, 2024

- This “Bullish Buzz” Reaches Highest Level in 53 Years Apr 26, 2024

- FastSpring and EBANX Forge Partnership to Expand Pix Payments for Digital Products in Brazil Apr 25, 2024

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024