By CountingPips.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday April 27 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

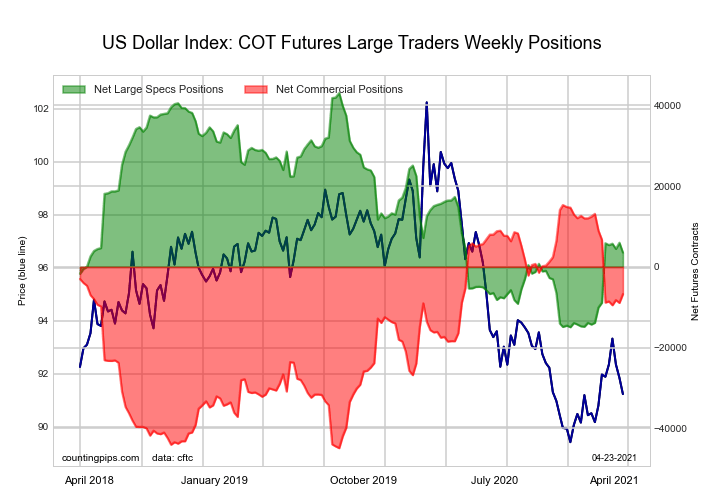

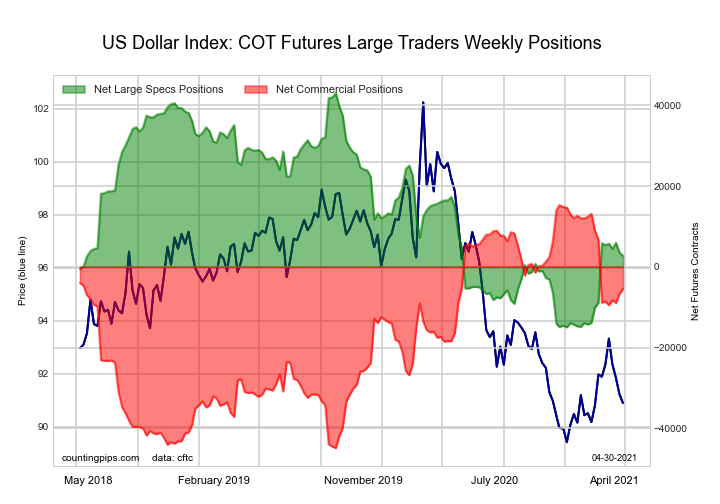

US Dollar Index Futures:

The US Dollar Index large speculator standing this week totaled a net position of 2,746 contracts in the data reported through Tuesday. This was a weekly lowering of -772 contracts from the previous week which had a total of 3,518 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 30.5 percent. The commercials are Bullish with a score of 65.5 percent and the small traders (not shown in chart) are Bullish with a score of 55.0 percent.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 65.2 | 8.4 | 16.3 |

| – Percent of Open Interest Shorts: | 57.7 | 23.4 | 8.8 |

| – Net Position: | 2,746 | -5,496 | 2,750 |

| – Gross Longs: | 23,852 | 3,074 | 5,970 |

| – Gross Shorts: | 21,106 | 8,570 | 3,220 |

| – Long to Short Ratio: | 1.1 to 1 | 0.4 to 1 | 1.9 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 30.5 | 65.5 | 55.0 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.3 | 5.6 | -3.4 |

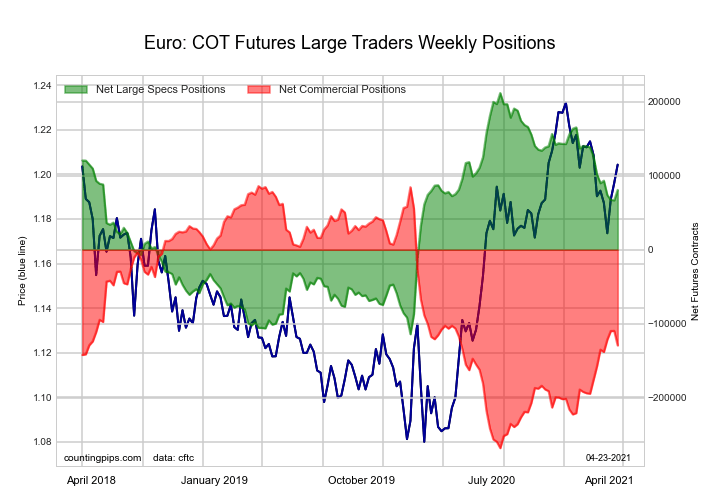

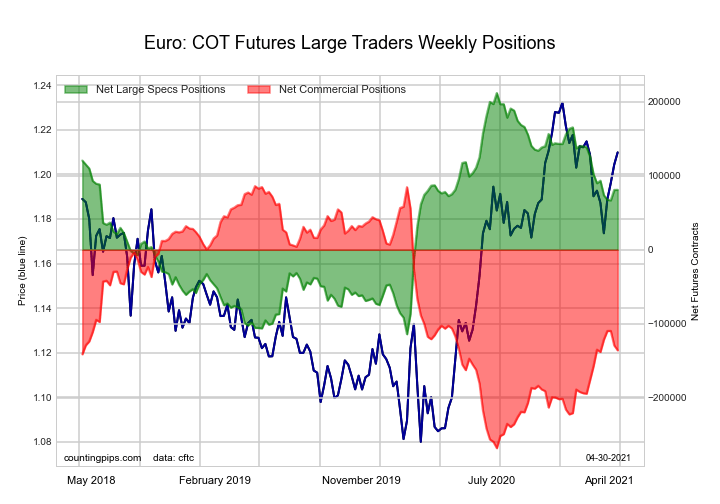

Euro Currency Futures:

The Euro Currency Futures large speculator standing this week totaled a net position of 80,967 contracts in the data reported through Tuesday. This was a weekly lift of 159 contracts from the previous week which had a total of 80,808 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 59.9 percent. The commercials are Bearish with a score of 37.3 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 86.8 percent.

| EURO Currency Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 29.8 | 54.9 | 14.3 |

| – Percent of Open Interest Shorts: | 17.8 | 75.1 | 6.1 |

| – Net Position: | 80,967 | -135,833 | 54,866 |

| – Gross Longs: | 200,415 | 368,662 | 95,959 |

| – Gross Shorts: | 119,448 | 504,495 | 41,093 |

| – Long to Short Ratio: | 1.7 to 1 | 0.7 to 1 | 2.3 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 59.9 | 37.3 | 86.8 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -2.8 | -0.2 | 17.3 |

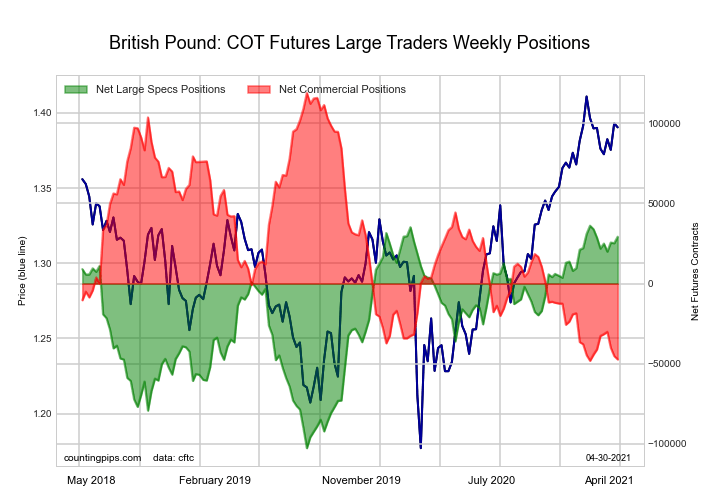

British Pound Sterling Futures:

The British Pound Sterling large speculator standing this week totaled a net position of 29,218 contracts in the data reported through Tuesday. This was a weekly increase of 4,040 contracts from the previous week which had a total of 25,178 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 95.1 percent. The commercials are Bearish-Extreme with a score of 0.5 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 95.9 percent.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 37.2 | 37.7 | 24.0 |

| – Percent of Open Interest Shorts: | 19.0 | 67.1 | 12.8 |

| – Net Position: | 29,218 | -47,334 | 18,116 |

| – Gross Longs: | 59,917 | 60,835 | 38,732 |

| – Gross Shorts: | 30,699 | 108,169 | 20,616 |

| – Long to Short Ratio: | 2.0 to 1 | 0.6 to 1 | 1.9 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 95.1 | 0.5 | 95.9 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.4 | -3.7 | 12.0 |

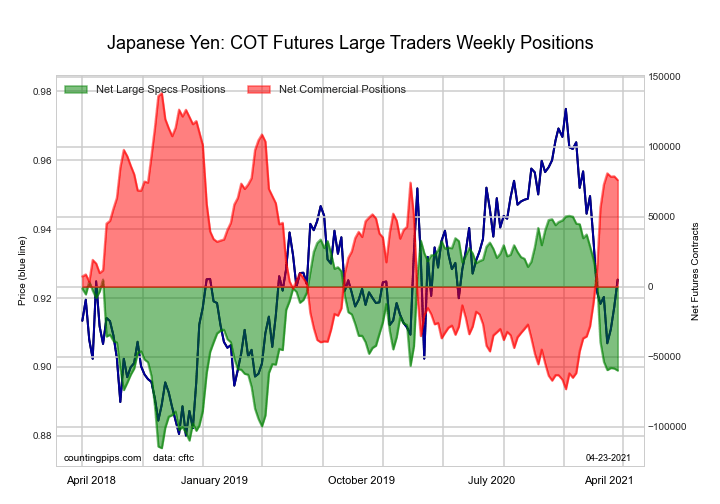

Japanese Yen Futures:

The Japanese Yen large speculator standing this week totaled a net position of -48,509 contracts in the data reported through Tuesday. This was a weekly rise of 11,310 contracts from the previous week which had a total of -59,819 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 40.2 percent. The commercials are Bullish with a score of 63.9 percent and the small traders (not shown in chart) are Bearish with a score of 30.6 percent.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 19.2 | 67.1 | 12.9 |

| – Percent of Open Interest Shorts: | 50.5 | 27.2 | 21.6 |

| – Net Position: | -48,509 | 61,928 | -13,419 |

| – Gross Longs: | 29,673 | 103,999 | 19,987 |

| – Gross Shorts: | 78,182 | 42,071 | 33,406 |

| – Long to Short Ratio: | 0.4 to 1 | 2.5 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 40.2 | 63.9 | 30.6 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.5 | 2.7 | 6.7 |

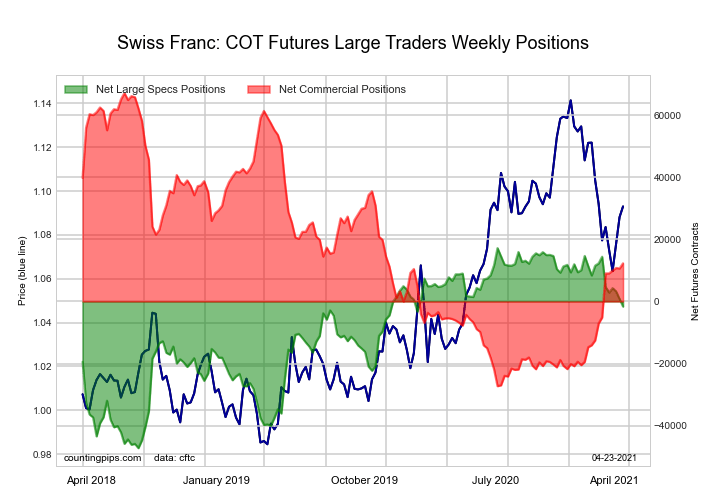

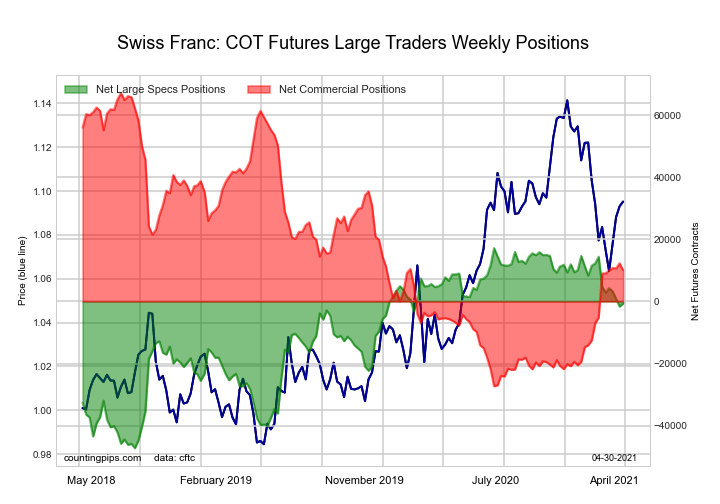

Swiss Franc Futures:

The Swiss Franc large speculator standing this week totaled a net position of -686 contracts in the data reported through Tuesday. This was a weekly rise of 956 contracts from the previous week which had a total of -1,642 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 72.3 percent. The commercials are Bearish with a score of 39.5 percent and the small traders (not shown in chart) are Bearish with a score of 40.2 percent.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 27.3 | 47.3 | 24.8 |

| – Percent of Open Interest Shorts: | 28.9 | 22.7 | 47.8 |

| – Net Position: | -686 | 10,051 | -9,365 |

| – Gross Longs: | 11,116 | 19,301 | 10,126 |

| – Gross Shorts: | 11,802 | 9,250 | 19,491 |

| – Long to Short Ratio: | 0.9 to 1 | 2.1 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 72.3 | 39.5 | 40.2 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -8.3 | 1.1 | 11.8 |

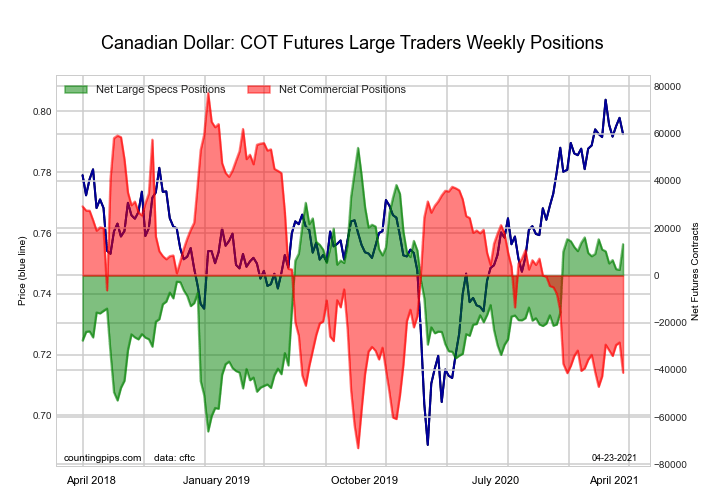

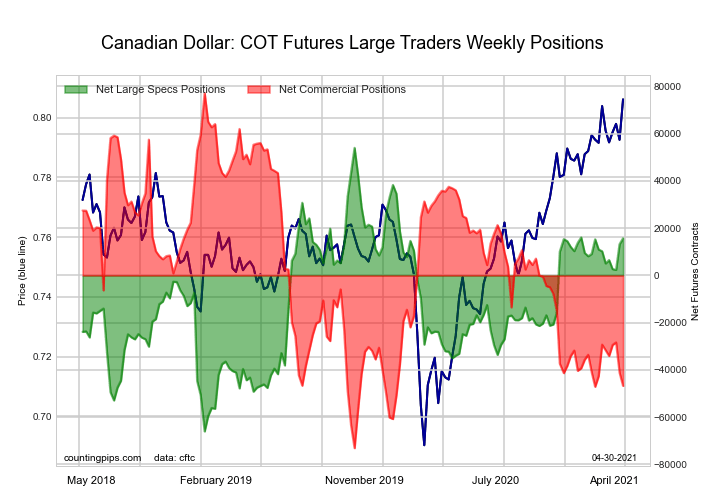

Canadian Dollar Futures:

The Canadian Dollar large speculator standing this week totaled a net position of 15,722 contracts in the data reported through Tuesday. This was a weekly lift of 2,476 contracts from the previous week which had a total of 13,246 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 68.1 percent. The commercials are Bearish-Extreme with a score of 17.5 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 93.5 percent.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.4 | 40.3 | 27.8 |

| – Percent of Open Interest Shorts: | 22.7 | 66.2 | 10.6 |

| – Net Position: | 15,722 | -46,705 | 30,983 |

| – Gross Longs: | 56,675 | 72,924 | 50,186 |

| – Gross Shorts: | 40,953 | 119,629 | 19,203 |

| – Long to Short Ratio: | 1.4 to 1 | 0.6 to 1 | 2.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 68.1 | 17.5 | 93.5 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 4.5 | -11.6 | 18.1 |

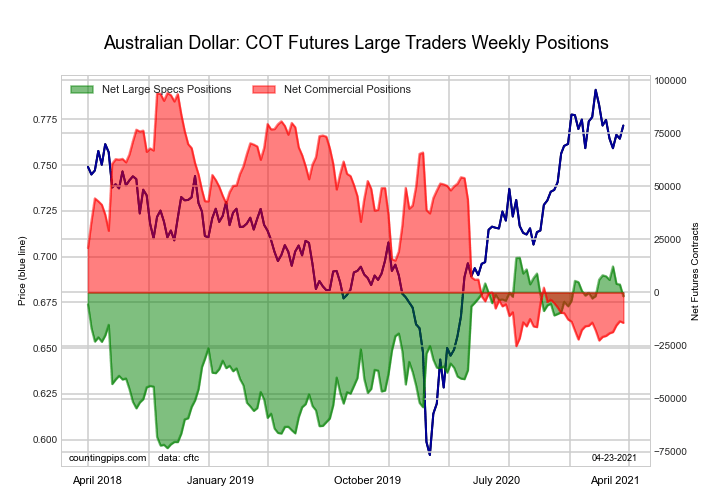

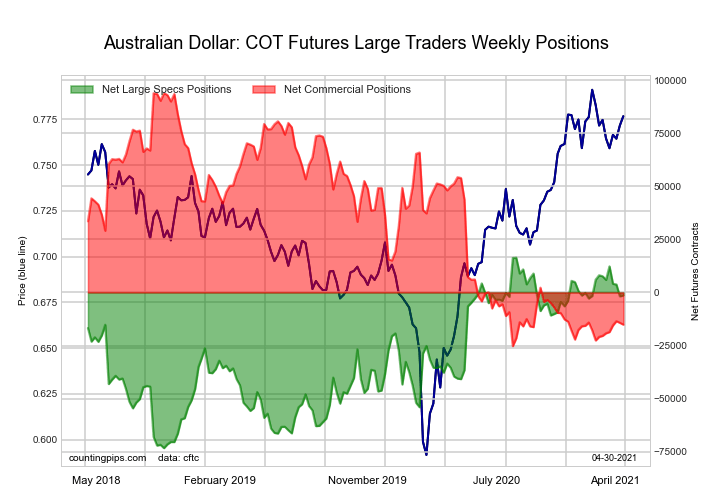

Australian Dollar Futures:

The Australian Dollar large speculator standing this week totaled a net position of -1,410 contracts in the data reported through Tuesday. This was a weekly advance of 396 contracts from the previous week which had a total of -1,806 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 80.2 percent. The commercials are Bearish-Extreme with a score of 8.5 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 93.5 percent.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 42.4 | 33.3 | 23.3 |

| – Percent of Open Interest Shorts: | 43.4 | 44.0 | 11.5 |

| – Net Position: | -1,410 | -15,139 | 16,549 |

| – Gross Longs: | 59,735 | 46,828 | 32,760 |

| – Gross Shorts: | 61,145 | 61,967 | 16,211 |

| – Long to Short Ratio: | 1.0 to 1 | 0.8 to 1 | 2.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 80.2 | 8.5 | 93.5 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -10.1 | 4.5 | 8.2 |

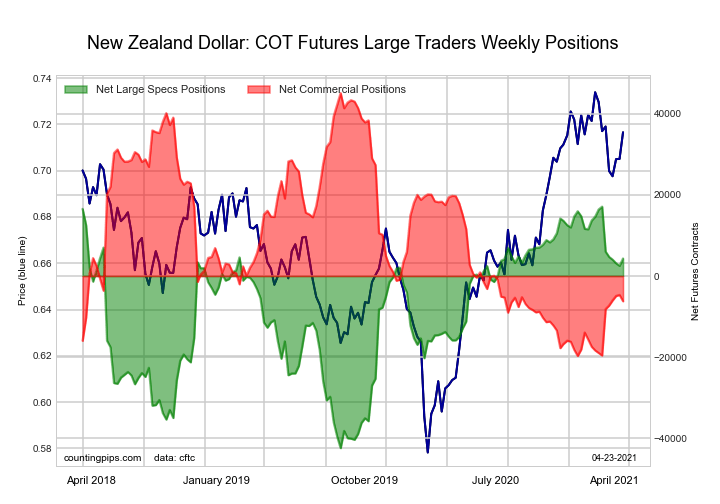

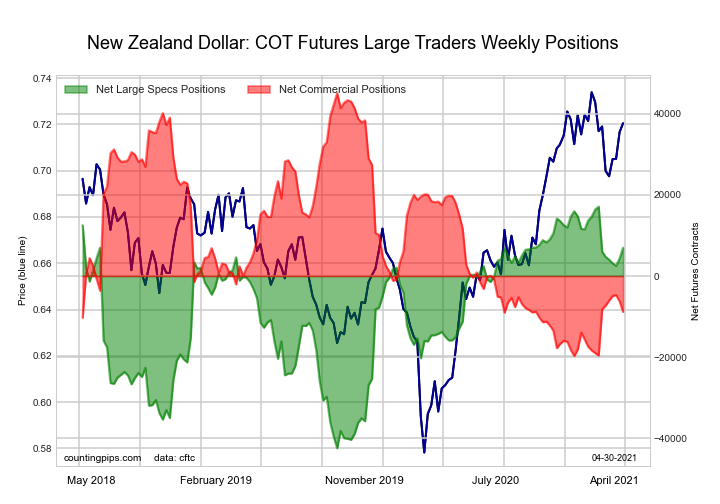

New Zealand Dollar Futures:

The New Zealand Dollar large speculator standing this week totaled a net position of 6,979 contracts in the data reported through Tuesday. This was a weekly rise of 2,657 contracts from the previous week which had a total of 4,322 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 83.0 percent. The commercials are Bearish-Extreme with a score of 16.8 percent and the small traders (not shown in chart) are Bullish with a score of 73.9 percent.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 58.6 | 28.0 | 11.5 |

| – Percent of Open Interest Shorts: | 42.8 | 48.0 | 7.3 |

| – Net Position: | 6,979 | -8,829 | 1,850 |

| – Gross Longs: | 25,852 | 12,348 | 5,069 |

| – Gross Shorts: | 18,873 | 21,177 | 3,219 |

| – Long to Short Ratio: | 1.4 to 1 | 0.6 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 83.0 | 16.8 | 73.9 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.6 | -1.0 | -3.1 |

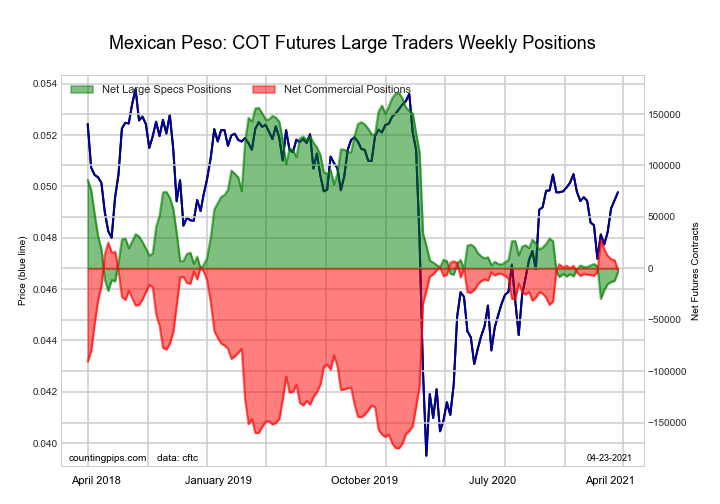

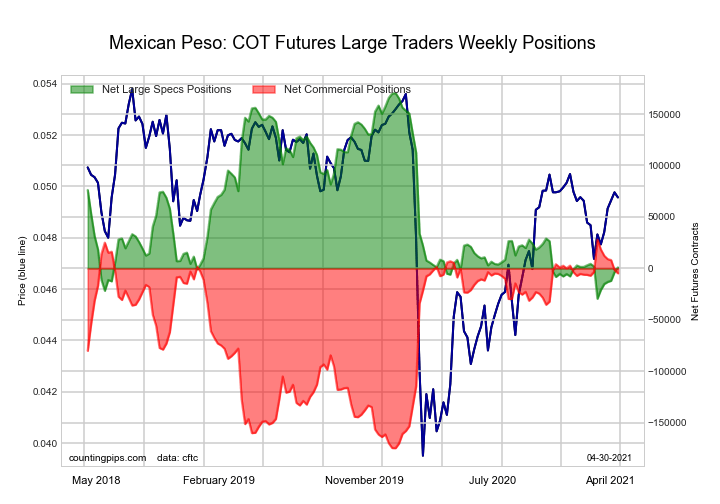

Mexican Peso Futures:

The Mexican Peso large speculator standing this week totaled a net position of 960 contracts in the data reported through Tuesday. This was a weekly lift of 4,514 contracts from the previous week which had a total of -3,554 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 15.2 percent. The commercials are Bullish-Extreme with a score of 83.8 percent and the small traders (not shown in chart) are Bullish with a score of 58.9 percent.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 48.8 | 45.5 | 5.0 |

| – Percent of Open Interest Shorts: | 48.2 | 48.6 | 2.6 |

| – Net Position: | 960 | -4,717 | 3,757 |

| – Gross Longs: | 75,554 | 70,520 | 7,706 |

| – Gross Shorts: | 74,594 | 75,237 | 3,949 |

| – Long to Short Ratio: | 1.0 to 1 | 0.9 to 1 | 2.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 15.2 | 83.8 | 58.9 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 15.2 | -16.2 | 9.9 |

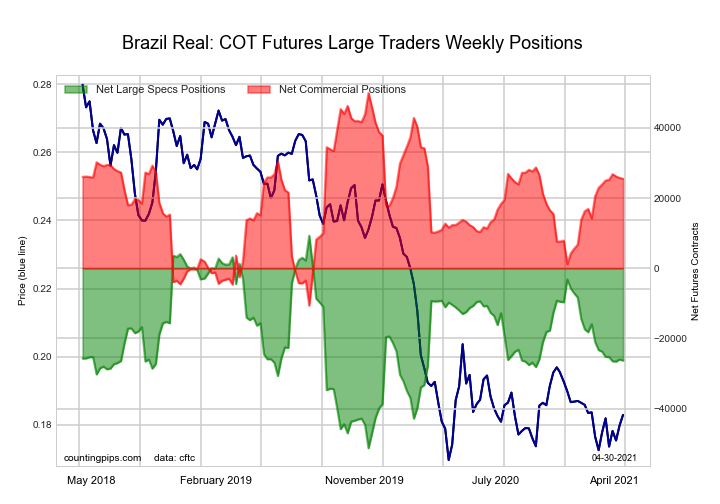

Brazilian Real Futures:

The Brazilian Real large speculator standing this week totaled a net position of -26,286 contracts in the data reported through Tuesday. This was a weekly fall of -291 contracts from the previous week which had a total of -25,995 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 41.3 percent. The commercials are Bullish with a score of 59.7 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 81.1 percent.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.0 | 68.8 | 6.3 |

| – Percent of Open Interest Shorts: | 77.7 | 16.6 | 4.8 |

| – Net Position: | -26,286 | 25,516 | 770 |

| – Gross Longs: | 11,727 | 33,630 | 3,094 |

| – Gross Shorts: | 38,013 | 8,114 | 2,324 |

| – Long to Short Ratio: | 0.3 to 1 | 4.1 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 41.3 | 59.7 | 81.1 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.2 | 2.6 | 11.9 |

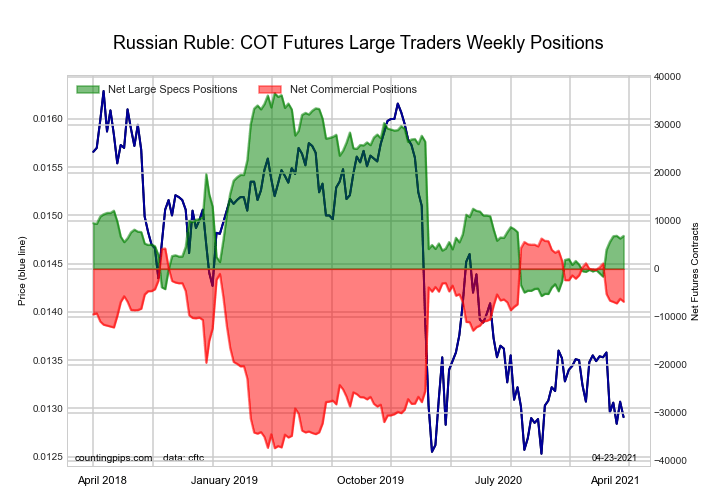

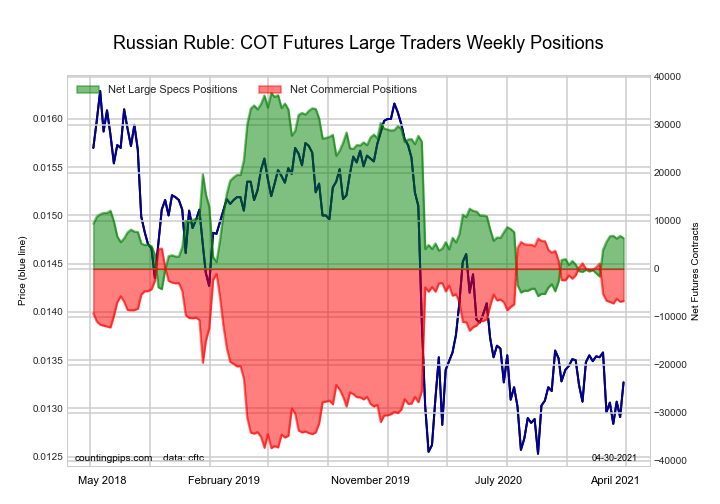

Russian Ruble Futures:

The Russian Ruble large speculator standing this week totaled a net position of 6,378 contracts in the data reported through Tuesday. This was a weekly lowering of -474 contracts from the previous week which had a total of 6,852 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 28.5 percent. The commercials are Bullish with a score of 70.2 percent and the small traders (not shown in chart) are Bullish with a score of 53.1 percent.

| RUSSIAN RUBLE Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.7 | 60.6 | 6.7 |

| – Percent of Open Interest Shorts: | 10.7 | 83.7 | 5.6 |

| – Net Position: | 6,378 | -6,691 | 313 |

| – Gross Longs: | 9,472 | 17,574 | 1,948 |

| – Gross Shorts: | 3,094 | 24,265 | 1,635 |

| – Long to Short Ratio: | 3.1 to 1 | 0.7 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 28.5 | 70.2 | 53.1 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 5.7 | -3.4 | -31.4 |

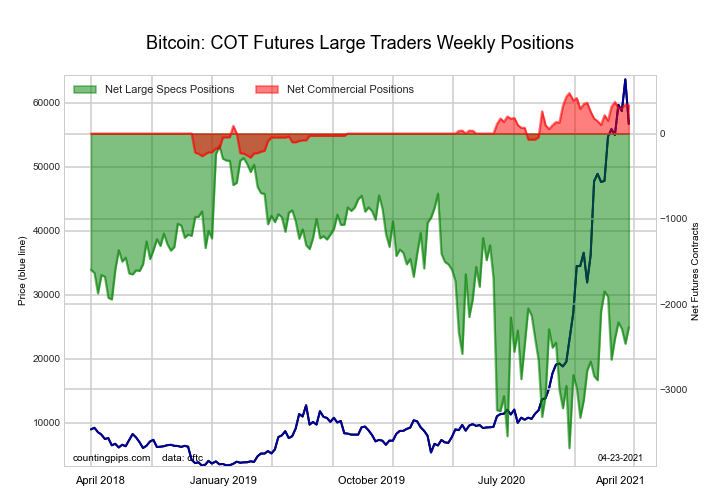

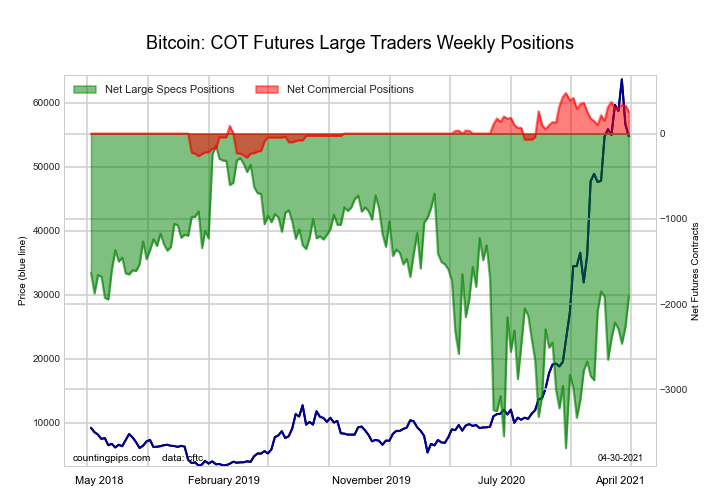

Bitcoin Futures:

The Bitcoin Futures large speculator standing this week totaled a net position of -1,909 contracts in the data reported through Tuesday. This was a weekly rise of 363 contracts from the previous week which had a total of -2,272 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 50.2 percent. The commercials are Bullish with a score of 70.9 percent and the small traders (not shown in chart) are Bearish with a score of 44.1 percent.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 52.6 | 5.4 | 31.9 |

| – Percent of Open Interest Shorts: | 75.2 | 2.4 | 12.2 |

| – Net Position: | -1,909 | 255 | 1,654 |

| – Gross Longs: | 4,431 | 458 | 2,685 |

| – Gross Shorts: | 6,340 | 203 | 1,031 |

| – Long to Short Ratio: | 0.7 to 1 | 2.3 to 1 | 2.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 50.2 | 70.9 | 44.1 |

| – COT Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 20.9 | -7.8 | -22.5 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).