By JustMarkets

At the end of Tuesday, the Dow Jones Index (US30) fell by 0.62%. The S&P 500 Index (US500) was down 1.07%. The Nasdaq Technology Index (US100) lost 1.66%. Tesla shares fell by 5.3% after RBC Capital Markets lowered its price target, citing increasing EV competition. Alphabet shares fell by 2.3% after news that Google will acquire cloud security company Wiz for $32 billion. Other tech giants including Nvidia and Palantir also fell in price by 3.4% and 4% respectively. Investors are on edge ahead of Wednesday’s Federal Reserve decision, with markets generally expecting rates to remain unchanged. Meanwhile, a stronger-than-expected rise in housing starts contrasted with inflation concerns over pressure on import prices, adding to market uncertainty.

Equity markets in Europe rose steadily yesterday. Germany’s DAX (DE40) rose by 0.98%, France’s CAC 40 (FR40) closed 0.50% higher, Spain’s IBEX 35 (ES35) gained 1.58%, and the UK’s FTSE 100 (UK100) closed positive 0.29%. Germany’s outgoing parliament approved a significant increase in government borrowing, including a major overhaul of the country’s debt rules. The deal, negotiated by the election-winning conservative CDU/CSU bloc, as well as the SPD and Greens, exempts defense spending from debt limits and sets out a €500 billion infrastructure investment plan. As for monetary policy, traders have lowered expectations for ECB rate cuts this year and are now only looking at two cuts, likely in April and June. In addition, interest rates are not expected to fall below 2%.

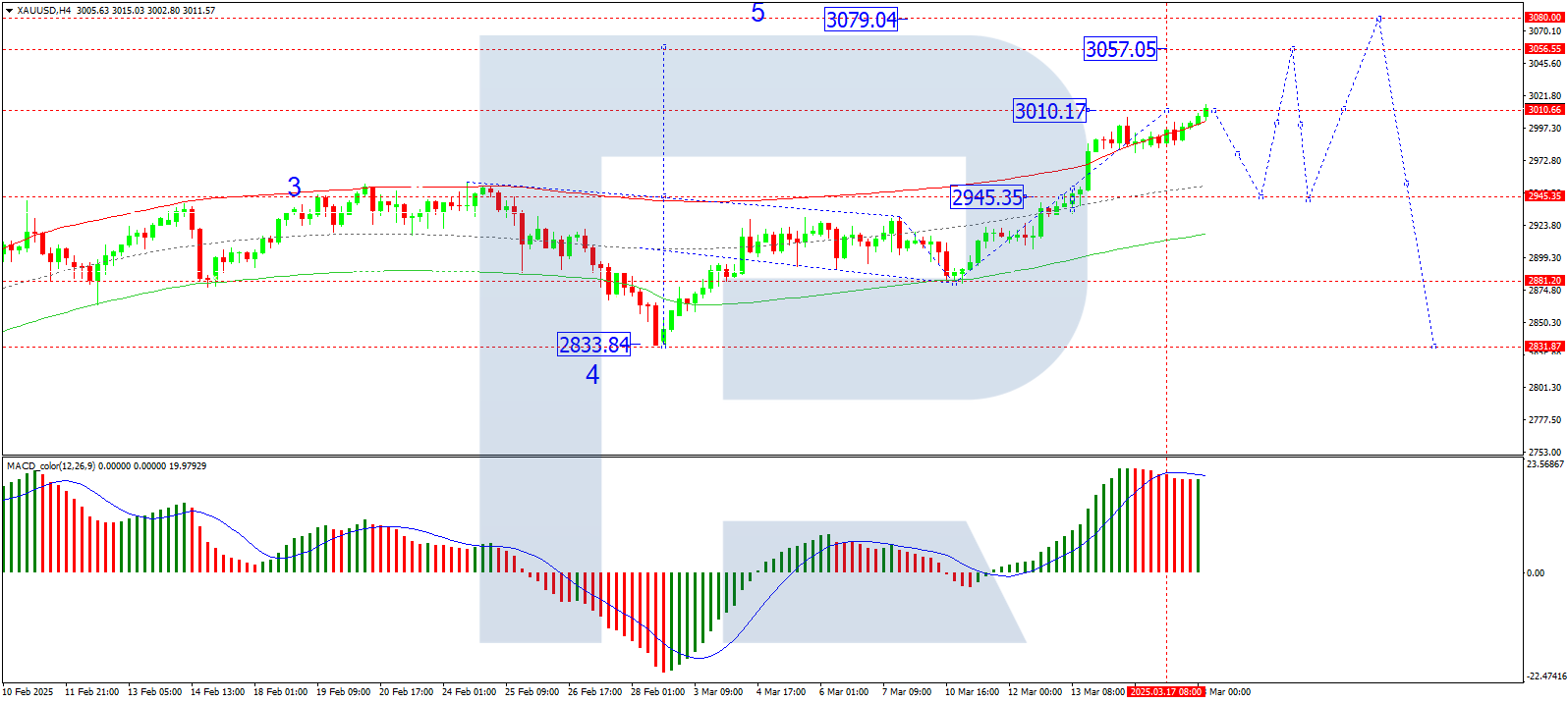

WTI crude oil prices fell to $66.9 a barrel on Tuesday, wiping out gains over the past two sessions as the market is pressured by oversupply concerns. Oil demand is slowing due to weakening global trade and shipping, exacerbated by the ongoing trade war unleashed by US President Donald Trump, which continues to weigh on major economies and reduce growth. In addition, OPEC and its allies are set to increase production by 138,000 barrels per day, the first increase since 2022, leading to an expected surplus. Meanwhile, hopes for a ceasefire in Ukraine have led to speculation that sanctions on Russian oil could be lifted, potentially leading to a rebound in supplies.

The US natural gas prices (XNG/USD) rose more than 2% to $4.1 per mmbpd on Tuesday on record LNG exports and lower daily production. Output fell to a three-week low of 104.1 bcf/d, although the monthly average remains above February’s record.

Asian markets were mostly rising yesterday. Japan’s Nikkei 225 (JP225) rose by 1.20%, China’s FTSE China A50 (CHA50) fell by 0.16%, Hong Kong’s Hang Seng (HK50) gained 2.46%, and Australia’s ASX 200 (AU200) was positive 0.08%. Mainland Chinese stocks retreated from multi-month highs as investors booked profits following a strong rally in Chinese technology and artificial intelligence-related stocks. The sector was also pressured by a renewed sell-off in shares of US tech giants.

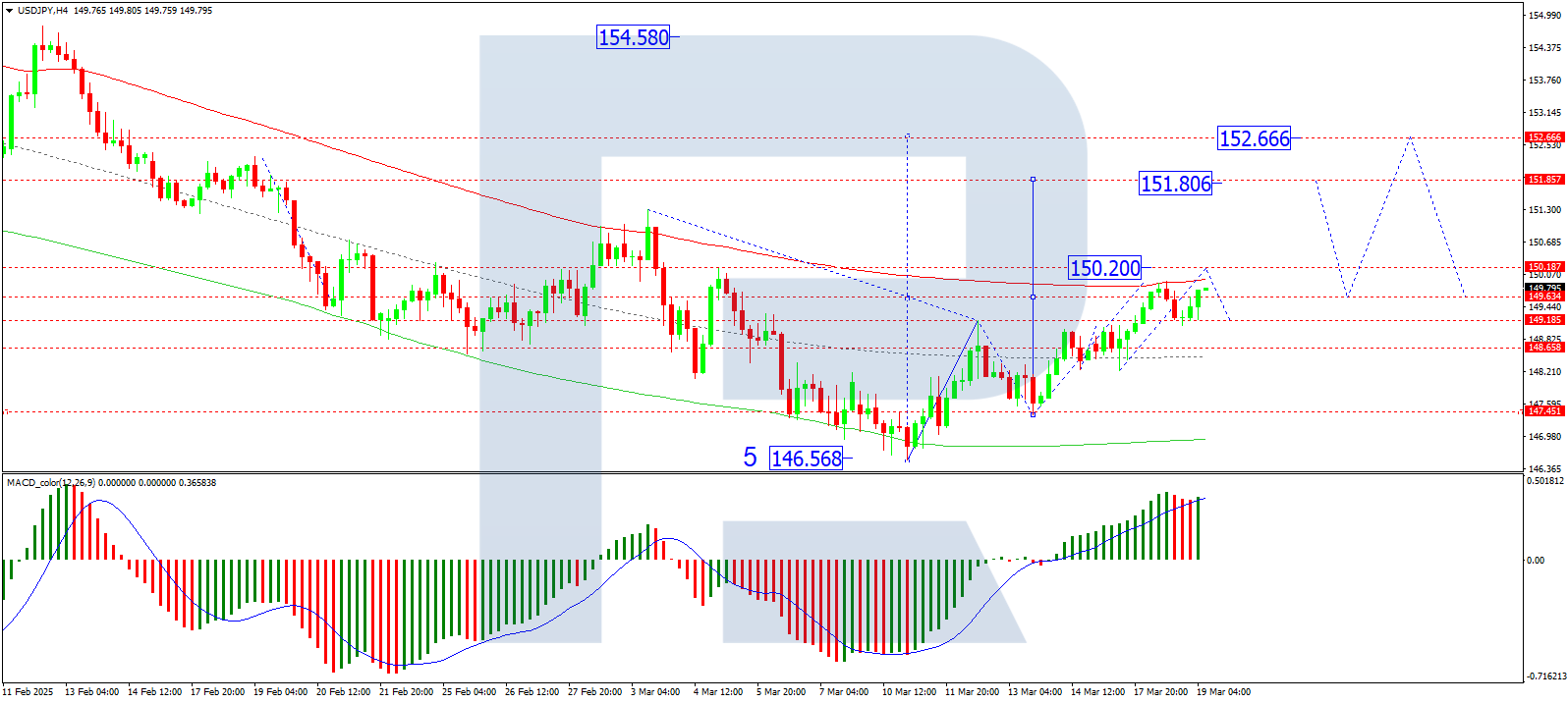

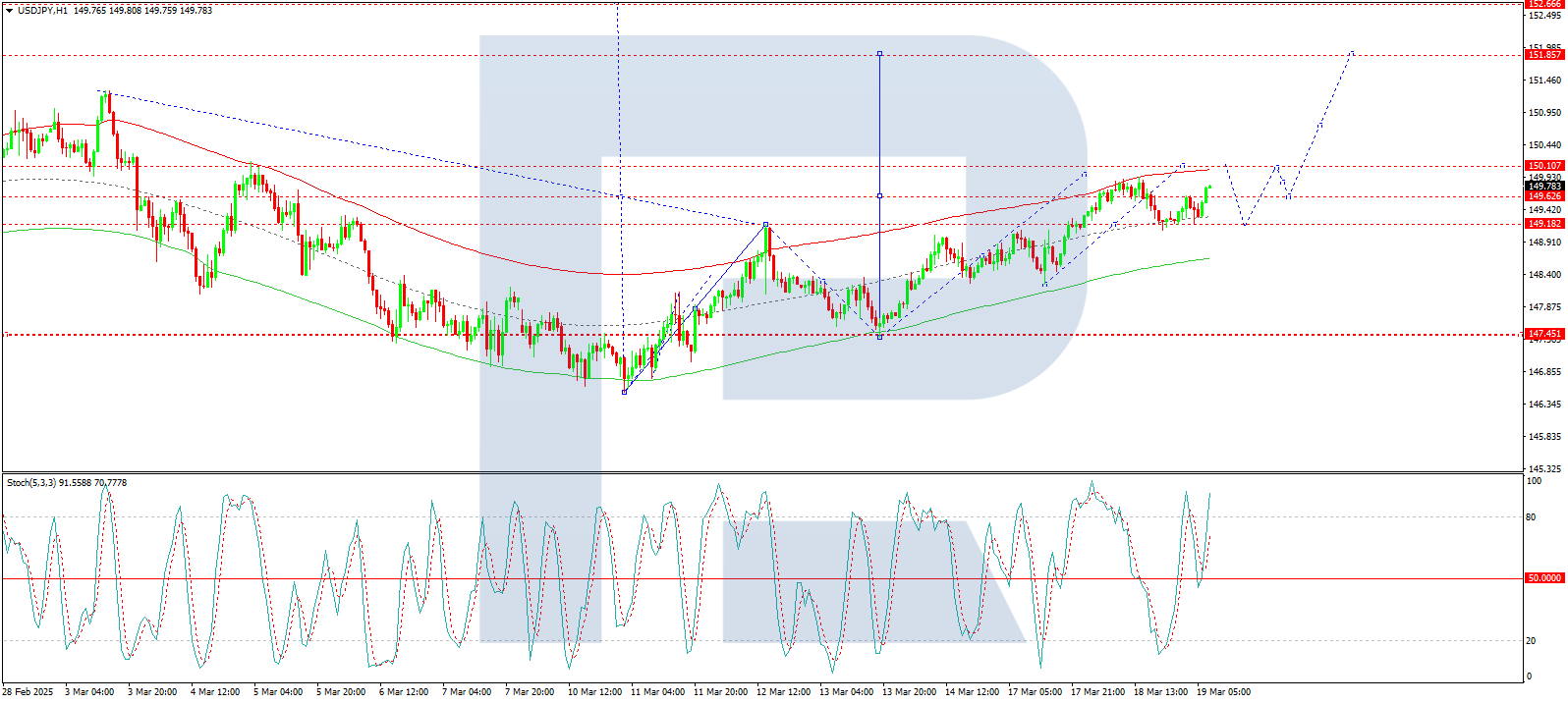

The Bank of Japan left interest rates unchanged at 0.5%, as expected. The Central Bank maintained its expectations that Japan’s economy is likely to continue growing above potential but acknowledged some signs of weakness. Policymakers also favored giving more time to assess the impact of rising global economic risks, particularly higher US tariffs. Meanwhile, the monthly Tankan survey showed Japanese manufacturers were pessimistic in March amid concerns over US tariffs and a slowdown in China’s economy. Separate data showed Japan’s trade balance turned into a surplus in February, helped by strong exports.

The Australian dollar stabilized near $0.636 on Wednesday after a volatile start to the week as investors continued to assess the Reserve Bank of Australia’s monetary policy outlook. On Tuesday, RBA assistant governor Sarah Hunter said the February interest rate cut was aimed at easing restrictive policy, but emphasized that the board remains more cautious than markets about further rate cuts.

S&P 500 (US500) 5,614.66 −60.46 (−1.07%)

Dow Jones (US30) 41,581.31 −260.32 (−0.62%)

DAX (DE40) 23,380.70 +226.13 (+0.98%)

FTSE 100 (UK100) 8,705.23 +24.94 (+0.29%)

USD Index 103.26 −0.11 (−0.11%)

News feed for: 2025.03.19

- Japan Trade Balance at 01:50 (GMT+2);

- Japan BoJ Policy Rate at 05:00 (GMT+2);

- Japan BoJ Monetary Policy Statement at 05:00 (GMT+2);

- Japan BoJ Press Conference at 06:45 (GMT+2);

- Indonesian Interest Rate Decision at 09:30 (GMT+2);

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+2);

- US Crude Oil Reserves (w/w) at 16:30 (GMT+2);

- US FOMC Federal Funds Rate at 20:00 (GMT+2);

- US FOMC Statement at 20:00 (GMT+2);

- US FOMC Economic Projections at 20:00 (GMT+2);

- US FOMC Press Conference at 20:30 (GMT+2);

- New Zealand GDP (m/m) at 23:45 (GMT+2).

By JustMarkets

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.