By JustMarkets

The US stock market traded mixed on Thursday. By the end of trading, the Dow Jones (US30) rose by 0.03%, the S&P 500 (US500) decreased by 0.54%, and the technology-heavy NASDAQ (US100) closed lower by 1.18%. The primary event of the day was the paradoxical reaction to Nvidia’s earnings report: despite strong financial results, the company’s shares tumbled by 5.5%. Investors began to harbor serious doubts that massive capital investments in artificial intelligence would pay off in the long term, triggering a chain reaction and a decline across other chipmakers. Amid the flight from the overheated AI sector, a notable rotation of capital toward more stable and defensive assets was observed.

Mexican peso (MXN) weakened to 17.2 per dollar. The main blow came from new US tariffs: following the Supreme Court’s February 20 decision, the Trump administration introduced a 15% global import surcharge. This sharply reduced the peso’s attractiveness, as Mexico is the United States’ largest trading partner with deeply integrated supply chains. The situation was exacerbated by weak labor market data: in January 2026, Mexico lost 8,100 formal jobs, marking the worst start to a year since 2014.

Equity markets in Europe rose sharply. The German DAX (DE40) increased by 0.45%, the French CAC 40 (FR40) closed up 0.72%, the Spanish IBEX 35 (ES35) rose by 0.19%, and the British FTSE 100 (UK100) finished 0.37% higher.

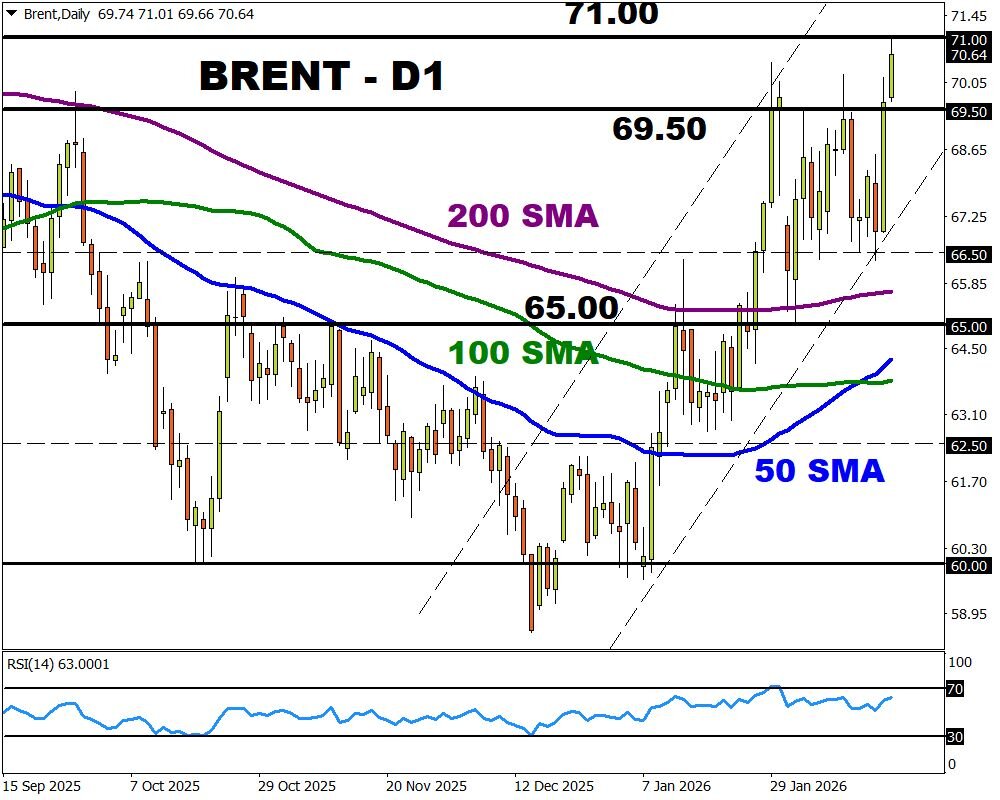

WTI oil prices demonstrated a sharp reversal, climbing 1.5% to the $66.30 per barrel level. Earlier in the session, prices had fallen nearly 3% amid optimistic comments from Omani mediators; however, market sentiment shifted abruptly following a harsh statement from Tehran. Iranian state media reported that the country would not allow the removal of enriched uranium, a key US demand, placing the Geneva negotiations on the brink of collapse. The situation is heating up as the deadline set by Donald Trump approaches: the President gave only a few days to reach a deal, threatening military action otherwise. The market immediately priced in a geopolitical premium, fearing supply disruptions from a major OPEC producer. At the same time, fundamental factors remain bearish: Saudi Arabian exports hit a three-year high, and on Sunday, March 1, OPEC+ countries will discuss increasing production by 137,000 barrels per day starting in April.

US natural gas (XNG) prices fell by more than 1.5%, dropping to the $2.82 per MMBtu mark. This is the lowest price level since last September. The primary bearish factor was the weekly report from the EIA, which showed an extremely weak inventory reduction of only 52 billion cubic feet (BCF). For comparison, in the same period in 2025, the withdrawal was 252 bcf, while the five-year average stands at 168 BCF. This dynamic led to a sharp shift in the market balance.

Asian markets traded with mixed results yesterday. The Japanese Nikkei 225 (JP225) rose by 0.29%, the Chinese FTSE China A50 (CHA50) showed a decline of 0.38%, the Hong Kong Hang Seng (HK50) fell by 1.44%, and the Australian ASX 200 (AU200) posted a positive result of 0.51%.

Investors moved into wait-and-see mode ahead of the “Two Sessions” in Beijing (March 4-11), where economic targets for 2026 will be established. The main event will be the presentation of the 15th Five-Year Plan (2026-2030), which will define China’s strategy for achieving technological independence and supporting domestic demand. The market is pricing in a budget deficit of 4% of GDP and a growth target of around 5%, which is keeping quotes from a deep correction.

On Friday, the Australian dollar (AUD) was holding near $0.711, approaching a three-year high. The “aussie” has become the top performer among G10 currencies in 2026 (+6% year-to-date), driven by the aggressive stance of the Reserve Bank of Australia (RBA). Following an unexpected jump in inflation, the market prices in an 80% probability of a rate hike in May, expecting it to peak at 4.10%. Next week, traders’ attention will shift to GDP data and manufacturing PMI indices. If the economy proves resilient to high rates, the Australian dollar could consolidate above the 0.72 level.

S&P 500 (US500) 6,908.86 −37.27 (−0.54%)

Dow Jones (US30) 49,499.20 +17.05 (+0.034%)

DAX (DE40) 25,289.02 +113.08 (+0.45%)

FTSE 100 (UK100) 10,846.70 +40.29 +(0.37%)

USD Index 97.76 +0.06% (+0.06%)

News feed for: 2026.02.27

- Japan Tokyo Core CPI (m/m) at 01:30 (GMT+2); – JPY (MED)

- Japan Industrial Production (m/m) at 01:50 (GMT+2); – JPY (LOW)

- Japan Retail Sales (m/m) at 01:50 (GMT+2); – JPY (MED)

- Switzerland Retal Sales (m/m) at 09:30 (GMT+2); – CHF (LOW)

- Switzerland GDP (q/q) at 10:00 (GMT+2); – CHF (MED)

- Switzerland KOF Leading Indicators (m/m) at 10:00 (GMT+2); – CHF (LOW)

- German Unemployment Rate (m/m) at 10:55 (GMT+2); – EUR (LOW)

- German Consumer Price Index (m/m) at 15:00 (GMT+2); – EUR (MED)

- Canada GDP (q/q) at 15:30 (GMT+2); – CAD (MED)

- US Producer Price Index (m/m) at 15:30 (GMT+2); – USD (HIGH)

- US Chicago PMI (m/m) at 16:45 (GMT+2). – USD (MED)

By JustMarkets

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.

Article by

Article by