By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday April 12th and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

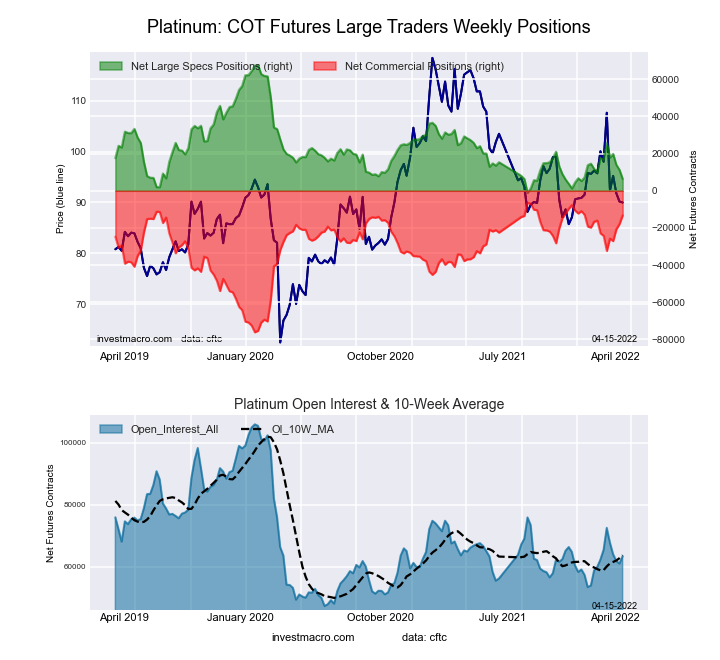

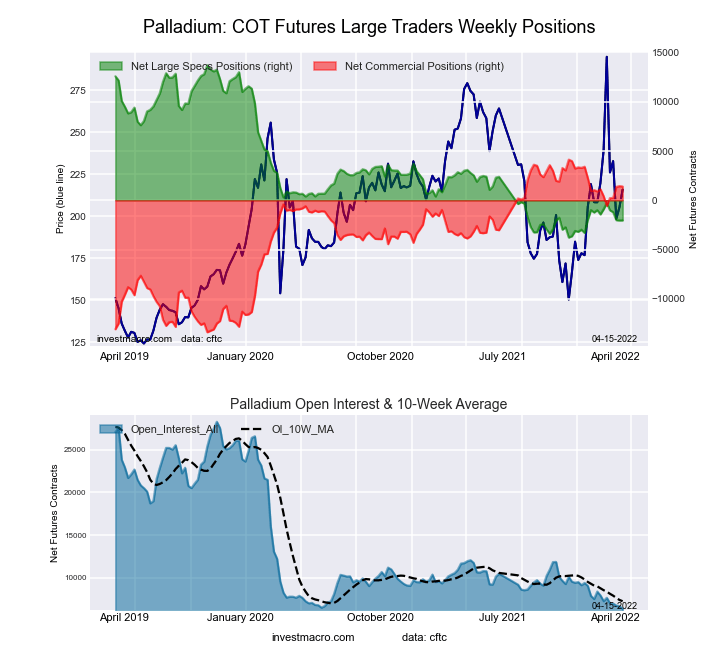

Highlighting the COT metals data is the recent declines in the Platinum futures bets. The speculative net position in Platinum futures has fallen for three consecutive weeks and in four out of the past five weeks. Speculator positions have dropped by a total of -19,418 contracts over those past five weeks and the current speculator standing has now decreased to the lowest level in the past thirteen weeks, dating back to November 11th. Despite a strong environment in general for commodities, Platinum speculator bets are under performing in 2022 with a weekly average of +13,284 contracts compared to weekly contract averages of +25,542 contracts in all of 2020 and +19,324 contracts in all of 2021. Overall, Platinum and Palladium (-2,033 net position this week) have been seeing weakness in their speculative positions as well as their prices compared to the other metals (Gold, Silver and Copper).

The metals markets with higher speculator bets this week were Silver (952 contracts), Gold (8,746 contracts) and Palladium (8 contracts) while the metals markets with declining speculator bets this week were Copper (-12,792 contracts) and Platinum (-4,875 contracts).

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

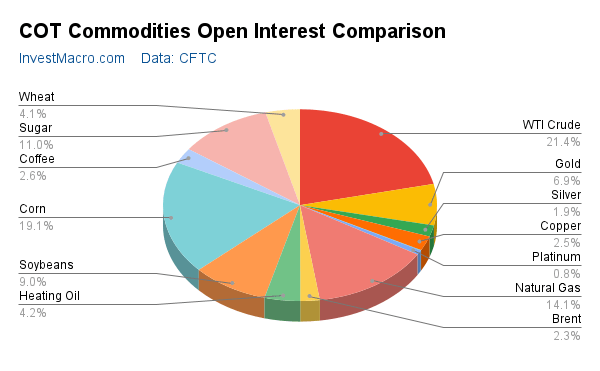

Speculator strength standings for each Commodity where strength index is current net position compared to past three years, above 80 is bullish extreme, below 20 is bearish extreme

OI Strength = Current Open Interest level compared to last 3 years range

Spec Strength = Current Net Speculator level compared to last 3 years range

Strength Move = Six week change of Spec Strength

| Apr-12-2022 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| WTI Crude | 1,783,725 | 0 | 304,778 | 0 | -350,603 | 100 | 45,825 | 80 |

| Gold | 577,639 | 40 | 254,287 | 69 | -288,093 | 30 | 33,806 | 60 |

| Silver | 158,813 | 24 | 45,986 | 68 | -63,690 | 36 | 17,704 | 46 |

| Copper | 204,825 | 30 | 23,350 | 59 | -29,249 | 39 | 5,899 | 59 |

| Palladium | 6,340 | 0 | -2,033 | 10 | 1,402 | 84 | 631 | 80 |

| Platinum | 63,363 | 27 | 6,415 | 11 | -13,233 | 90 | 6,818 | 57 |

| Natural Gas | 1,170,828 | 20 | -137,549 | 37 | 90,221 | 59 | 47,328 | 99 |

| Brent | 190,488 | 32 | -36,318 | 50 | 33,933 | 50 | 2,385 | 41 |

| Heating Oil | 349,618 | 31 | 6,455 | 52 | -32,434 | 37 | 25,979 | 88 |

| Soybeans | 752,157 | 34 | 198,295 | 79 | -170,694 | 26 | -27,601 | 24 |

| Corn | 1,589,848 | 36 | 495,581 | 93 | -443,706 | 9 | -51,875 | 13 |

| Coffee | 214,938 | 0 | 47,929 | 83 | -52,716 | 19 | 4,787 | 24 |

| Sugar | 916,130 | 23 | 239,864 | 86 | -301,628 | 11 | 61,764 | 84 |

| Wheat | 338,271 | 1 | 23,886 | 67 | -21,258 | 20 | -2,628 | 99 |

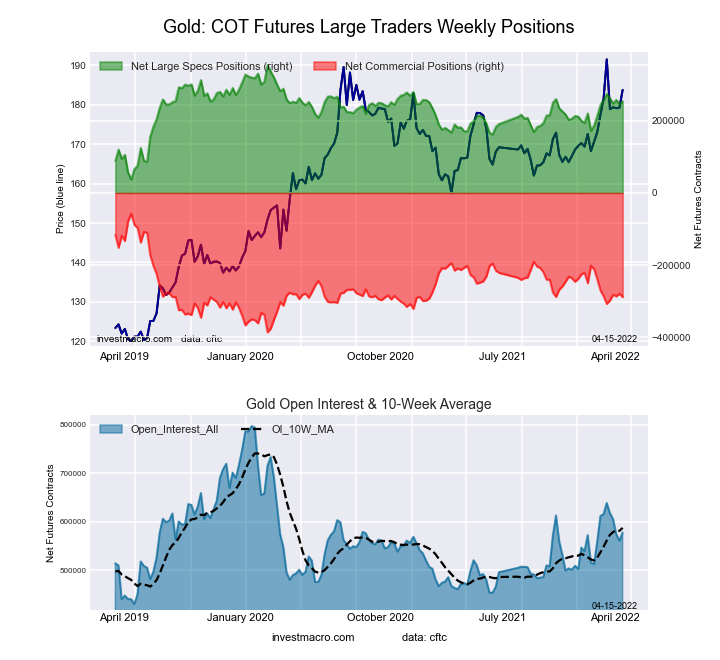

Gold Comex Futures:

The Gold Comex Futures large speculator standing this week equaled a net position of 254,287 contracts in the data reported through Tuesday. This was a weekly lift of 8,746 contracts from the previous week which had a total of 245,541 net contracts.

The Gold Comex Futures large speculator standing this week equaled a net position of 254,287 contracts in the data reported through Tuesday. This was a weekly lift of 8,746 contracts from the previous week which had a total of 245,541 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 68.6 percent. The commercials are Bearish with a score of 29.7 percent and the small traders (not shown in chart) are Bullish with a score of 60.1 percent.

| Gold Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 58.5 | 21.7 | 9.6 |

| – Percent of Open Interest Shorts: | 14.5 | 71.6 | 3.7 |

| – Net Position: | 254,287 | -288,093 | 33,806 |

| – Gross Longs: | 338,164 | 125,627 | 55,264 |

| – Gross Shorts: | 83,877 | 413,720 | 21,458 |

| – Long to Short Ratio: | 4.0 to 1 | 0.3 to 1 | 2.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 68.6 | 29.7 | 60.1 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -1.1 | -0.7 | 16.0 |

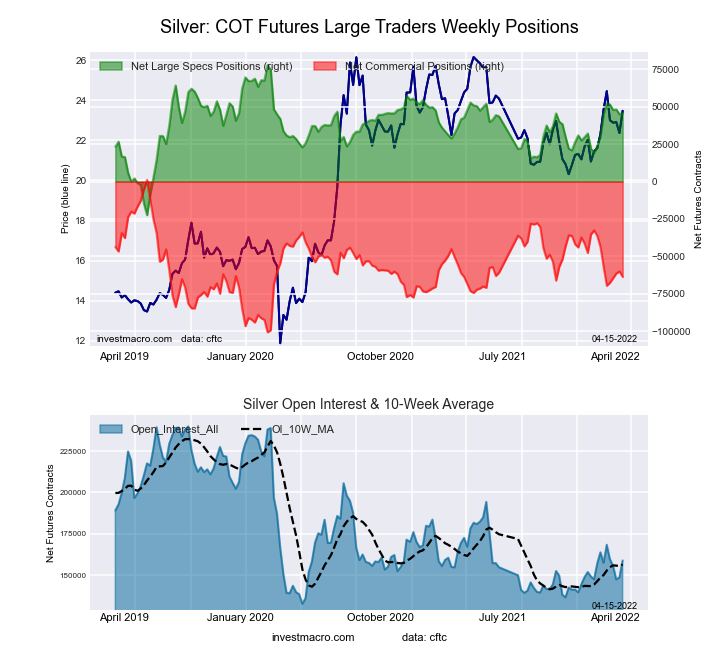

Silver Comex Futures:

The Silver Comex Futures large speculator standing this week equaled a net position of 45,986 contracts in the data reported through Tuesday. This was a weekly lift of 952 contracts from the previous week which had a total of 45,034 net contracts.

The Silver Comex Futures large speculator standing this week equaled a net position of 45,986 contracts in the data reported through Tuesday. This was a weekly lift of 952 contracts from the previous week which had a total of 45,034 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 68.2 percent. The commercials are Bearish with a score of 36.4 percent and the small traders (not shown in chart) are Bearish with a score of 46.0 percent.

| Silver Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 41.8 | 32.2 | 18.8 |

| – Percent of Open Interest Shorts: | 12.8 | 72.3 | 7.7 |

| – Net Position: | 45,986 | -63,690 | 17,704 |

| – Gross Longs: | 66,356 | 51,139 | 29,877 |

| – Gross Shorts: | 20,370 | 114,829 | 12,173 |

| – Long to Short Ratio: | 3.3 to 1 | 0.4 to 1 | 2.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 68.2 | 36.4 | 46.0 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.0 | -6.4 | 32.0 |

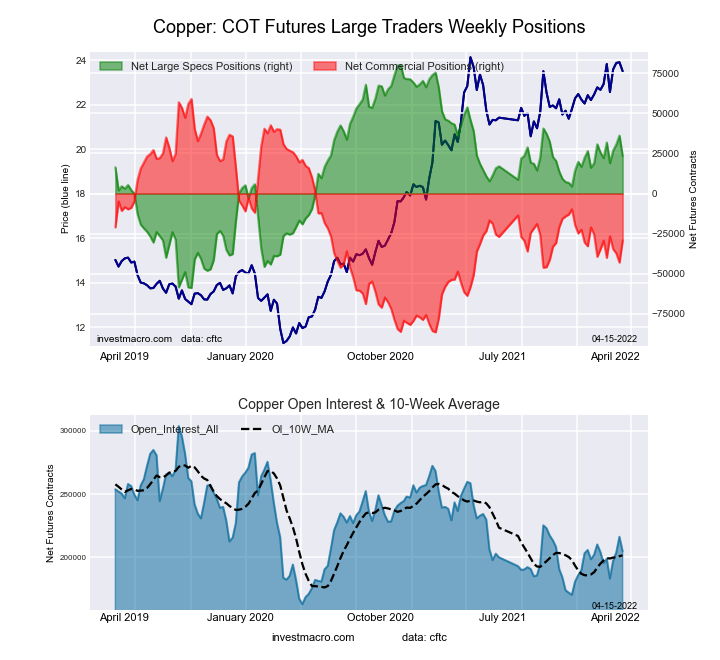

Copper Grade #1 Futures:

The Copper Grade #1 Futures large speculator standing this week equaled a net position of 23,350 contracts in the data reported through Tuesday. This was a weekly decline of -12,792 contracts from the previous week which had a total of 36,142 net contracts.

The Copper Grade #1 Futures large speculator standing this week equaled a net position of 23,350 contracts in the data reported through Tuesday. This was a weekly decline of -12,792 contracts from the previous week which had a total of 36,142 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 59.2 percent. The commercials are Bearish with a score of 39.4 percent and the small traders (not shown in chart) are Bullish with a score of 59.4 percent.

| Copper Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 40.0 | 39.8 | 8.8 |

| – Percent of Open Interest Shorts: | 28.6 | 54.1 | 5.9 |

| – Net Position: | 23,350 | -29,249 | 5,899 |

| – Gross Longs: | 81,940 | 81,559 | 17,972 |

| – Gross Shorts: | 58,590 | 110,808 | 12,073 |

| – Long to Short Ratio: | 1.4 to 1 | 0.7 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 59.2 | 39.4 | 59.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.9 | 0.1 | -8.0 |

Platinum Futures:

The Platinum Futures large speculator standing this week equaled a net position of 6,415 contracts in the data reported through Tuesday. This was a weekly decline of -4,875 contracts from the previous week which had a total of 11,290 net contracts.

The Platinum Futures large speculator standing this week equaled a net position of 6,415 contracts in the data reported through Tuesday. This was a weekly decline of -4,875 contracts from the previous week which had a total of 11,290 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 10.9 percent. The commercials are Bullish-Extreme with a score of 90.1 percent and the small traders (not shown in chart) are Bullish with a score of 57.2 percent.

| Platinum Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 45.0 | 34.0 | 16.5 |

| – Percent of Open Interest Shorts: | 34.9 | 54.9 | 5.7 |

| – Net Position: | 6,415 | -13,233 | 6,818 |

| – Gross Longs: | 28,544 | 21,537 | 10,461 |

| – Gross Shorts: | 22,129 | 34,770 | 3,643 |

| – Long to Short Ratio: | 1.3 to 1 | 0.6 to 1 | 2.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 10.9 | 90.1 | 57.2 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -15.3 | 15.7 | -6.8 |

Palladium Futures:

The Palladium Futures large speculator standing this week equaled a net position of -2,033 contracts in the data reported through Tuesday. This was a weekly gain of 8 contracts from the previous week which had a total of -2,041 net contracts.

The Palladium Futures large speculator standing this week equaled a net position of -2,033 contracts in the data reported through Tuesday. This was a weekly gain of 8 contracts from the previous week which had a total of -2,041 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 10.0 percent. The commercials are Bullish-Extreme with a score of 84.5 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 80.4 percent.

| Palladium Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.1 | 51.6 | 21.7 |

| – Percent of Open Interest Shorts: | 58.1 | 29.5 | 11.7 |

| – Net Position: | -2,033 | 1,402 | 631 |

| – Gross Longs: | 1,653 | 3,273 | 1,374 |

| – Gross Shorts: | 3,686 | 1,871 | 743 |

| – Long to Short Ratio: | 0.4 to 1 | 1.7 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 10.0 | 84.5 | 80.4 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -6.5 | 5.6 | 8.7 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024

- USDJPY bulls venture into intervention zone Nov 20, 2024

- The PBoC kept interest rates. The escalating war between Ukraine and Russia is negatively affecting investor sentiment Nov 20, 2024

- AUD/USD Consolidates After Recent Gains Nov 20, 2024

- The RBA will maintain a restrictive monetary policy until the end of the year. Nov 19, 2024

- Safe-haven assets rally on nuclear concerns Nov 19, 2024

- Gold Rebounds Amid USD Weakness and Geopolitical Uncertainties Nov 19, 2024