By InvestMacro

The latest update for the weekly Commitment of Traders (COT) report was released by the Commodity Futures Trading Commission (CFTC) on Friday for data ending on June 4th.

This weekly Extreme Positions report highlights the Most Bullish and Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.

To signify an extreme position, we use the Strength Index (also known as the COT Index) of each instrument, a common method of measuring COT data. The Strength Index is simply a comparison of current trader positions against the range of positions over the previous 3 years. We use over 80 percent as extremely bullish and under 20 percent as extremely bearish. (Compare Strength Index scores across all markets in the data table or cot leaders table)

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

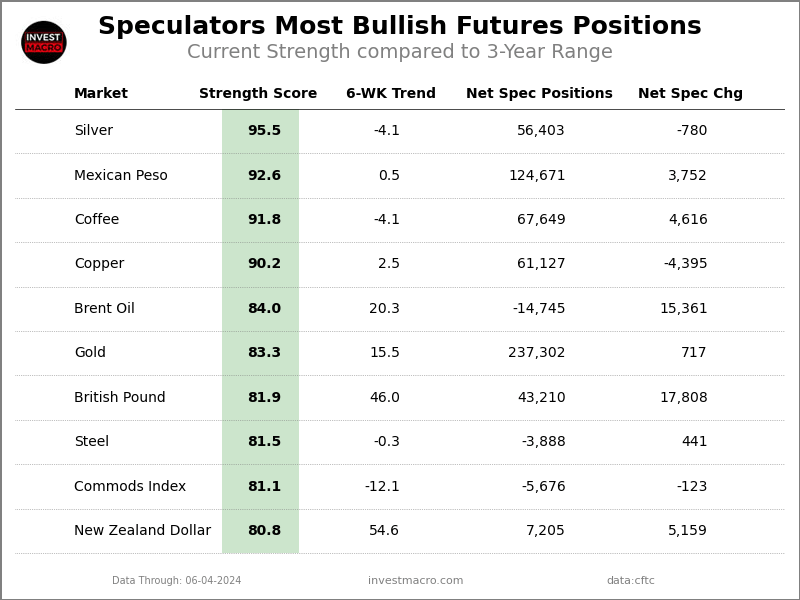

Here Are This Week’s Most Bullish Speculator Positions:

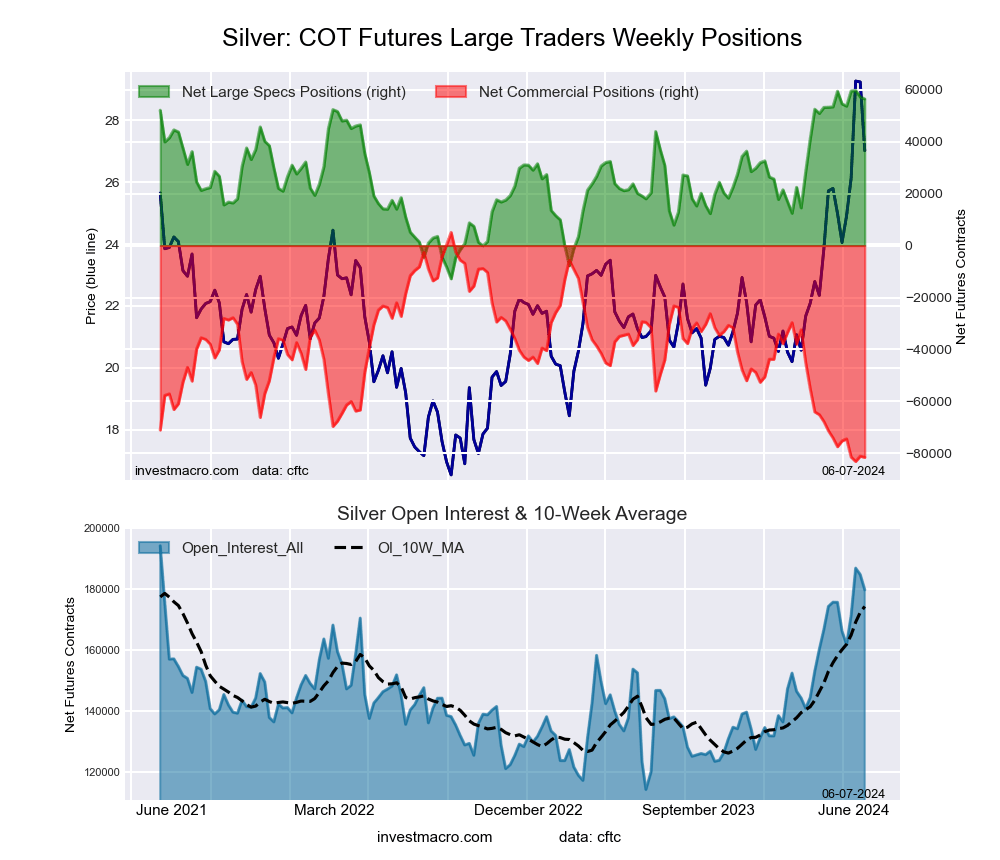

Silver

The Silver speculator position comes in as the most bullish extreme standing this week. The Silver speculator level is currently at a 95.5 percent score of its 3-year range.

The six-week trend for the percent strength score totaled -4.1 this week. The overall net speculator position was a total of 56,403 net contracts this week with a decline of -780 contract in the weekly speculator bets.

Speculators or Non-Commercials Notes:

Speculators, classified as non-commercial traders by the CFTC, are made up of large commodity funds, hedge funds and other significant for-profit participants. The Specs are generally regarded as trend-followers in their behavior towards price action – net speculator bets and prices tend to go in the same directions. These traders often look to buy when prices are rising and sell when prices are falling. To illustrate this point, many times speculator contracts can be found at their most extremes (bullish or bearish) when prices are also close to their highest or lowest levels.

These extreme levels can be dangerous for the large speculators as the trade is most crowded, there is less trading ammunition still sitting on the sidelines to push the trend further and prices have moved a significant distance. When the trend becomes exhausted, some speculators take profits while others look to also exit positions when prices fail to continue in the same direction. This process usually plays out over many months to years and can ultimately create a reverse effect where prices start to fall and speculators start a process of selling when prices are falling.

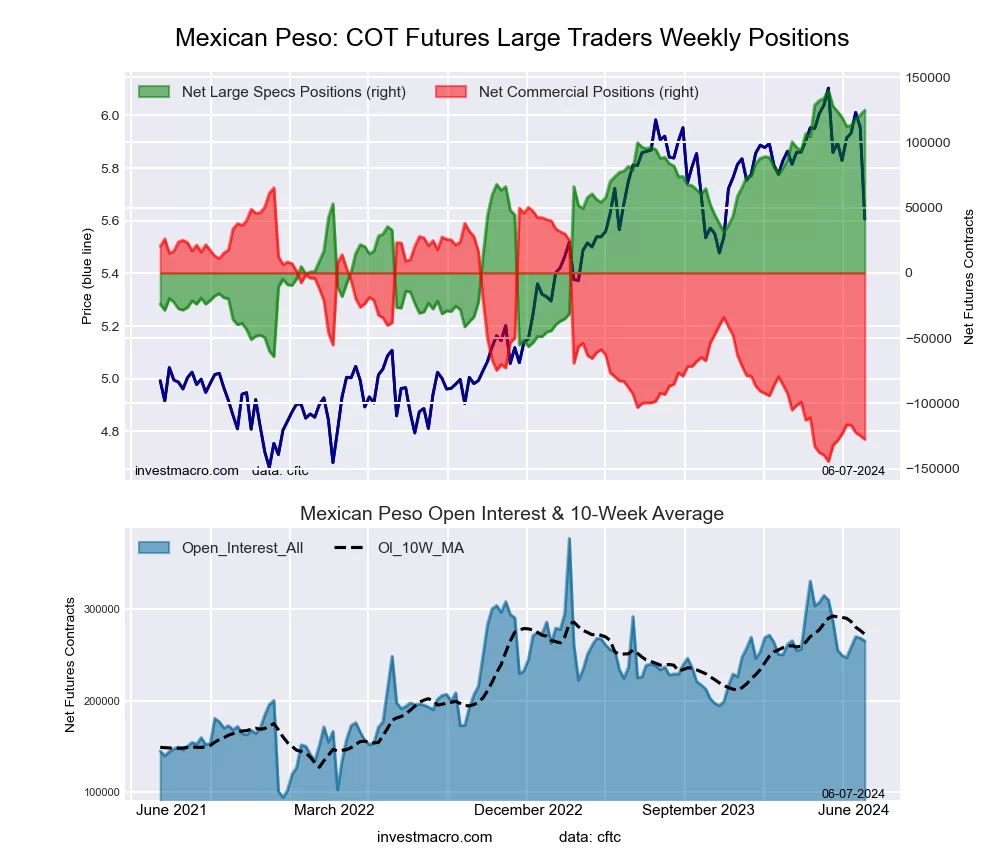

Mexican Peso

The Mexican Peso speculator position comes next in the extreme standings this week. The Mexican Peso speculator level is now at a 92.6 percent score of its 3-year range.

The six-week trend for the percent strength score was 0.5 this week. The speculator position registered 124,671 net contracts this week with a weekly rise of 3,752 contracts in speculator bets.

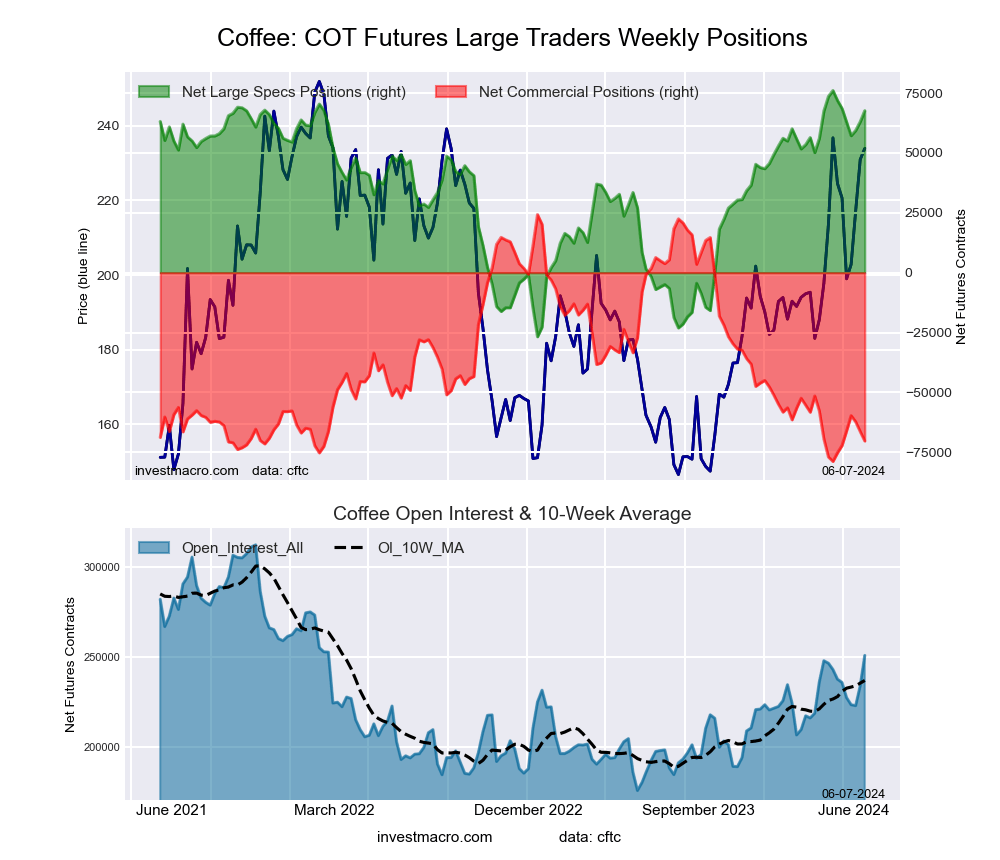

Coffee

The Coffee speculator position comes in third this week in the extreme standings. The Coffee speculator level resides at a 91.8 percent score of its 3-year range.

The six-week trend for the speculator strength score came in at -4.1 this week. The overall speculator position was 67,649 net contracts this week with a boost of 4,616 contracts in the weekly speculator bets.

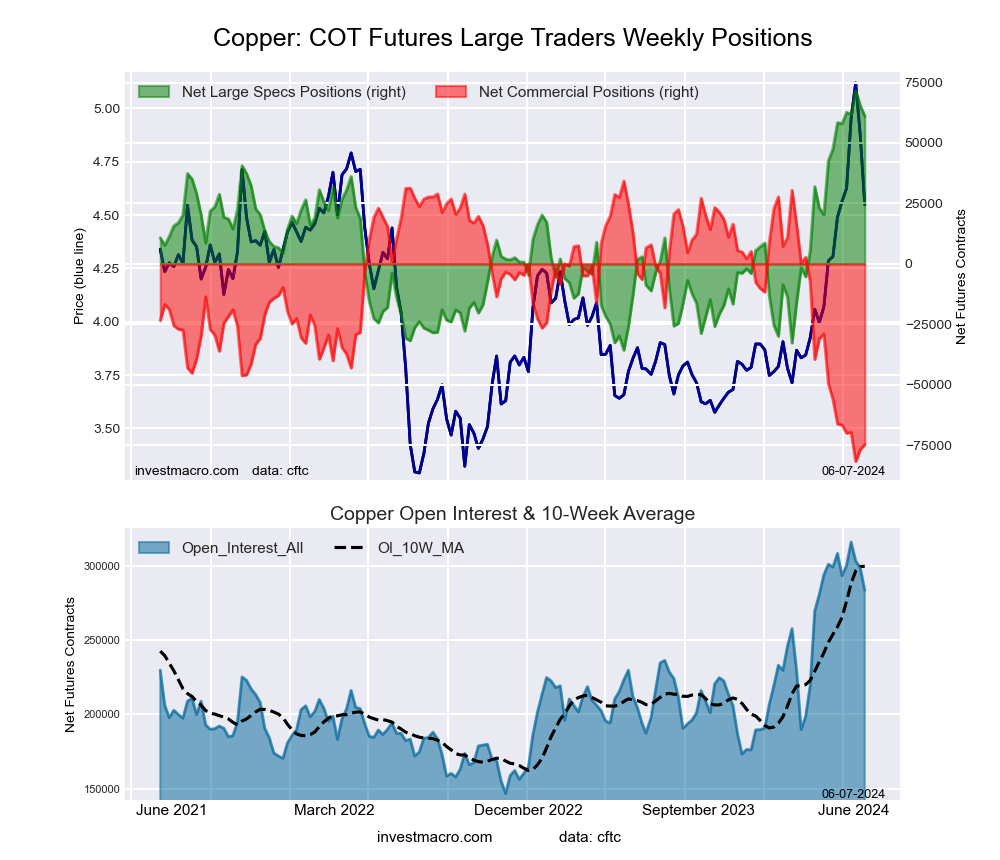

Copper

The Copper speculator position comes up number four in the extreme standings this week. The Copper speculator level is at a 90.2 percent score of its 3-year range.

The six-week trend for the speculator strength score totaled a change of 2.5 this week. The overall speculator position was 61,127 net contracts this week with a drop of -4,395 contracts in the speculator bets.

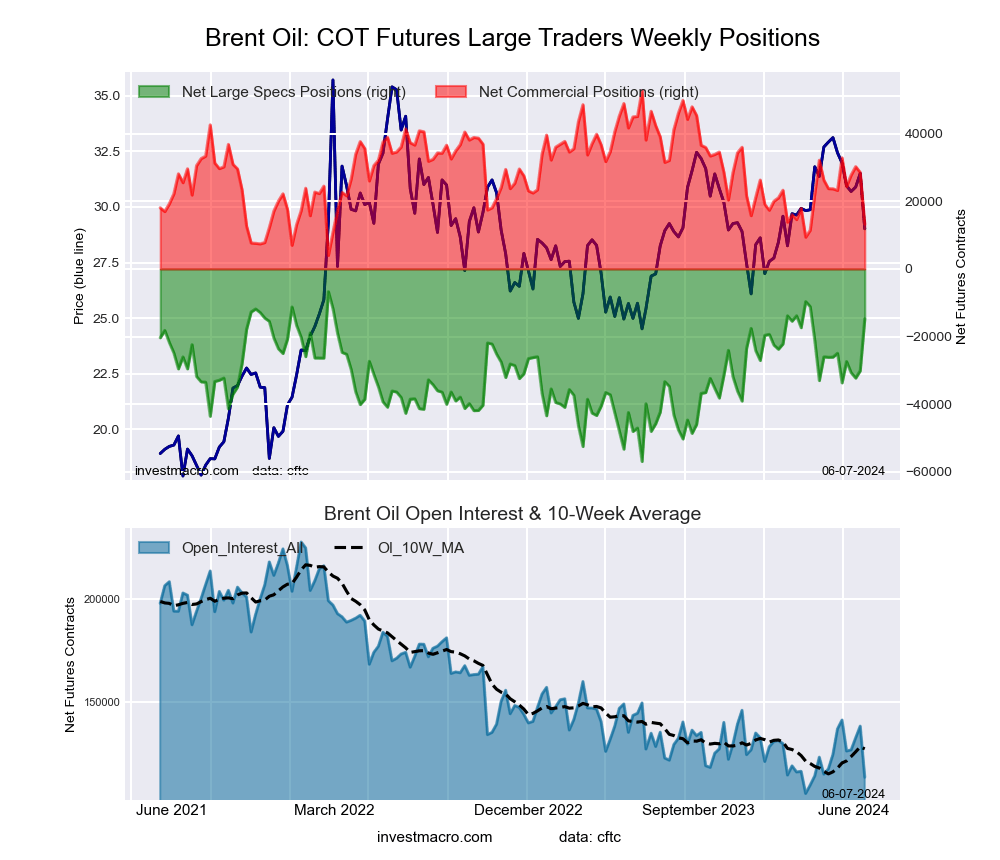

Brent Oil

The Brent Oil speculator position rounds out the top five in this week’s bullish extreme standings. The Brent Oil speculator level sits at a 84.0 percent score of its 3-year range. The six-week trend for the speculator strength score was 20.3 this week.

The speculator position was -14,745 net contracts this week with a gain of 15,361 contracts in the weekly speculator bets.

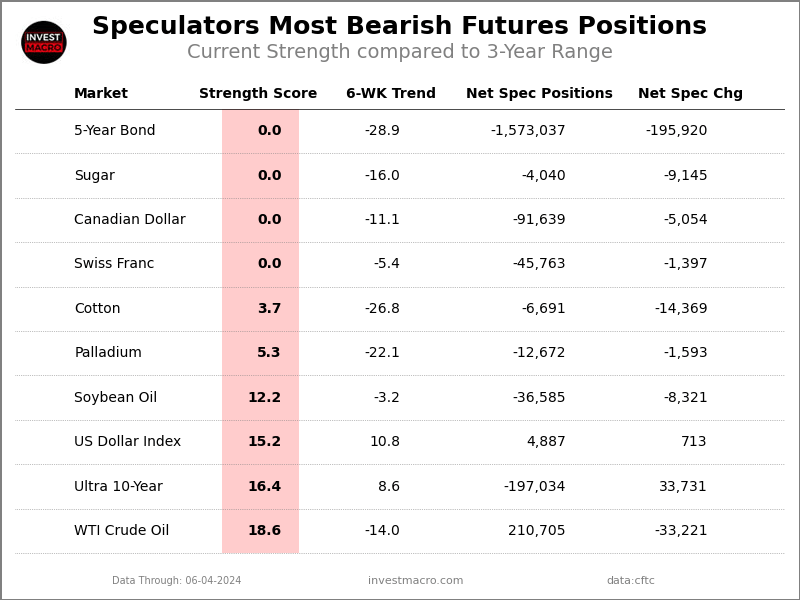

This Week’s Most Bearish Speculator Positions:

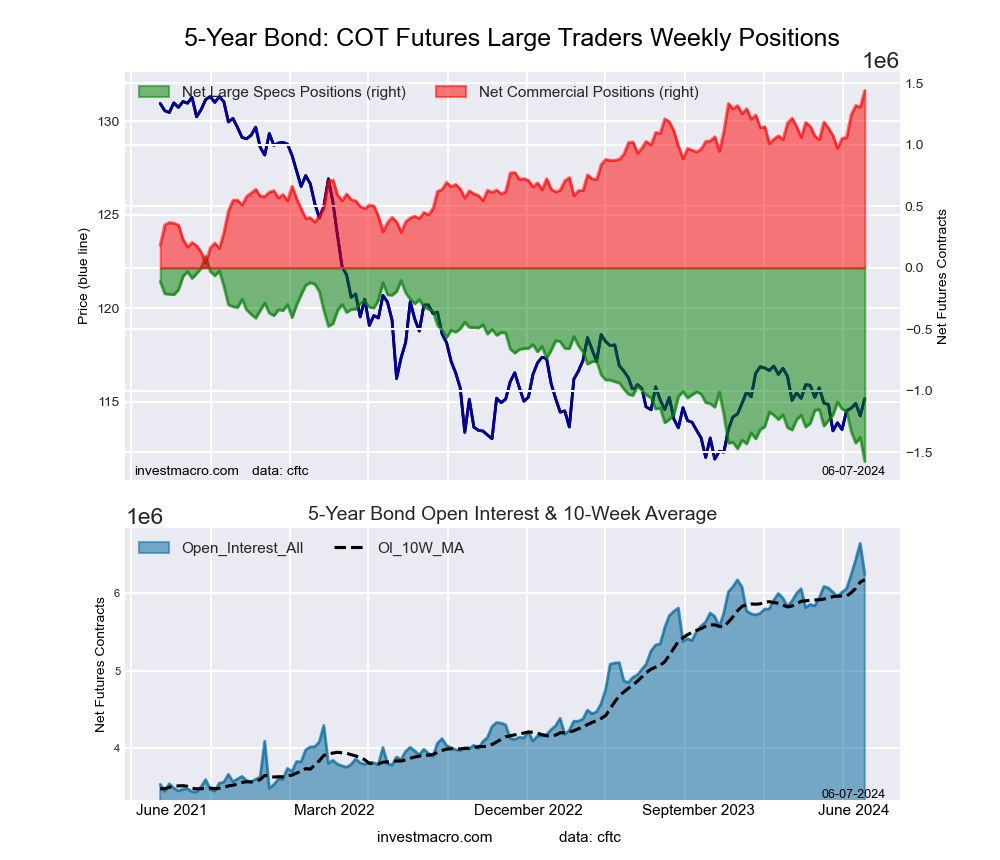

5-Year Bond

The 5-Year Bond speculator position comes in as the most bearish extreme standing this week. The 5-Year Bond speculator level is at a 0.0 percent score of its 3-year range.

The six-week trend for the speculator strength score was -28.9 this week. The overall speculator position was -1,573,037 net contracts this week with a decrease by -195,920 contracts in the speculator bets.

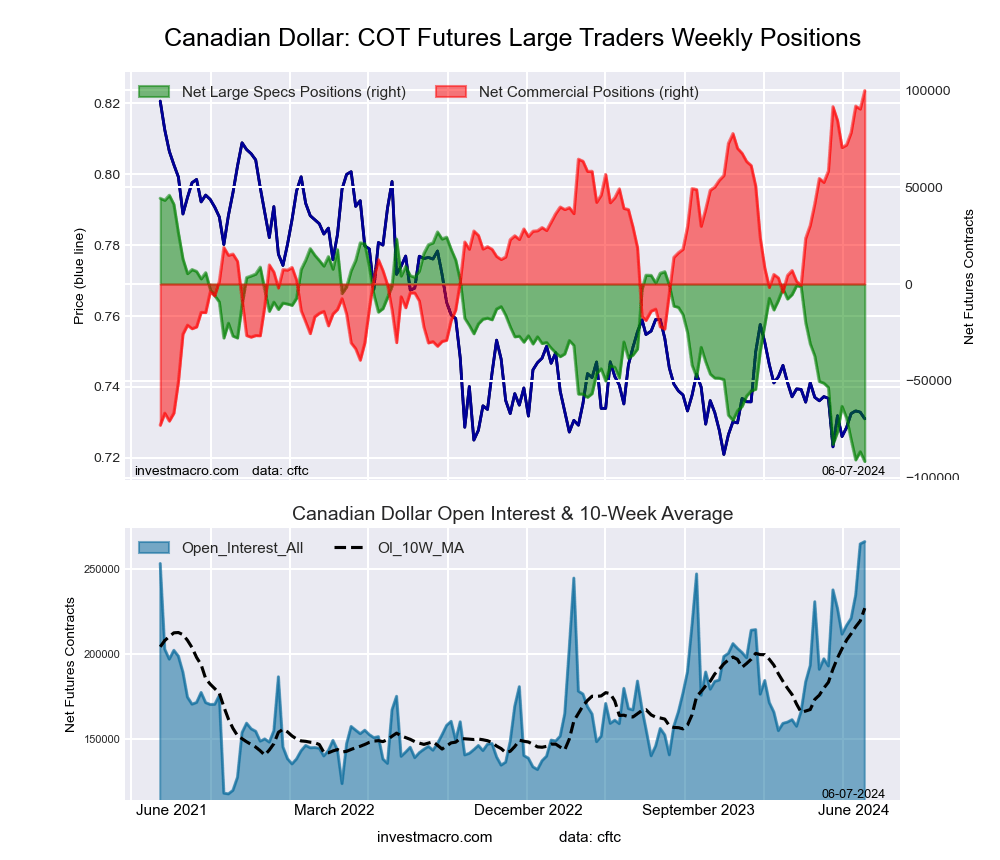

Canadian Dollar

The Canadian Dollar speculator position comes in next for the most bearish extreme standing on the week. The Canadian Dollar speculator level is at a 0.0 percent score of its 3-year range.

The six-week trend for the speculator strength score was -11.1 this week. The speculator position was -91,639 net contracts this week with a decline of -5,054 contracts in the weekly speculator bets.

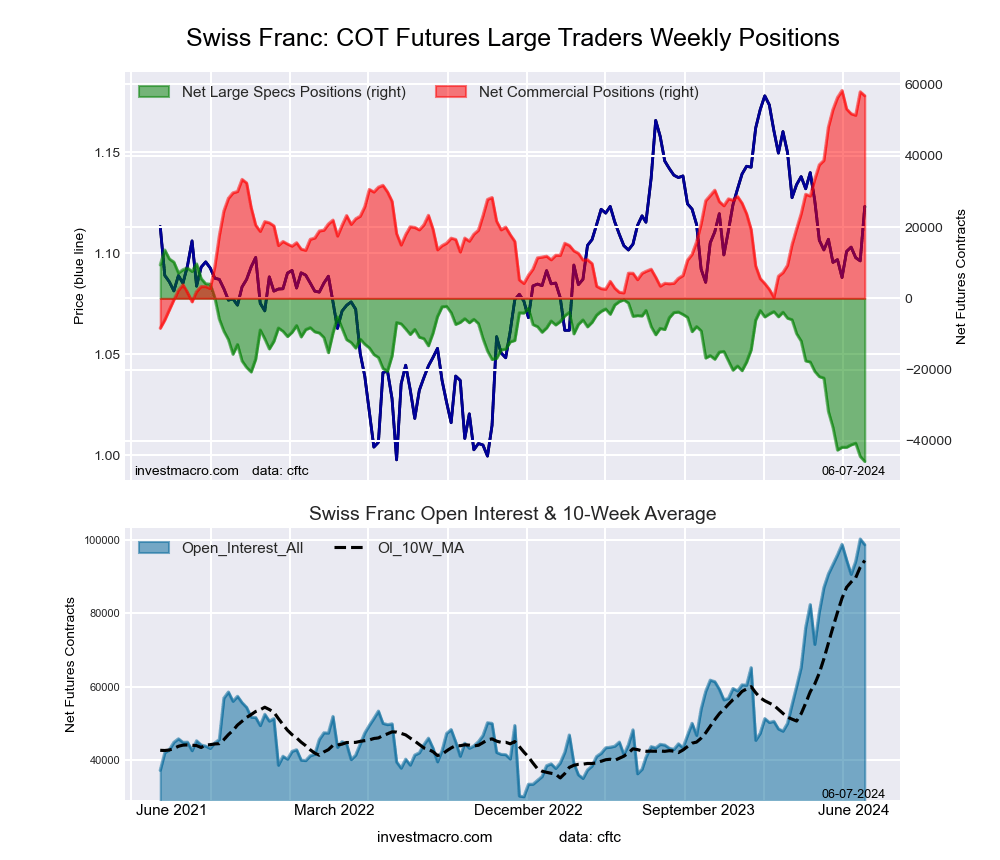

Swiss Franc

The Swiss Franc speculator position comes in as third most bearish extreme standing of the week. The Swiss Franc speculator level resides at a 0.0 percent score of its 3-year range.

The six-week trend for the speculator strength score was -5.4 this week. The overall speculator position was -45,763 net contracts this week with a dip of -1,397 contracts in the speculator bets.

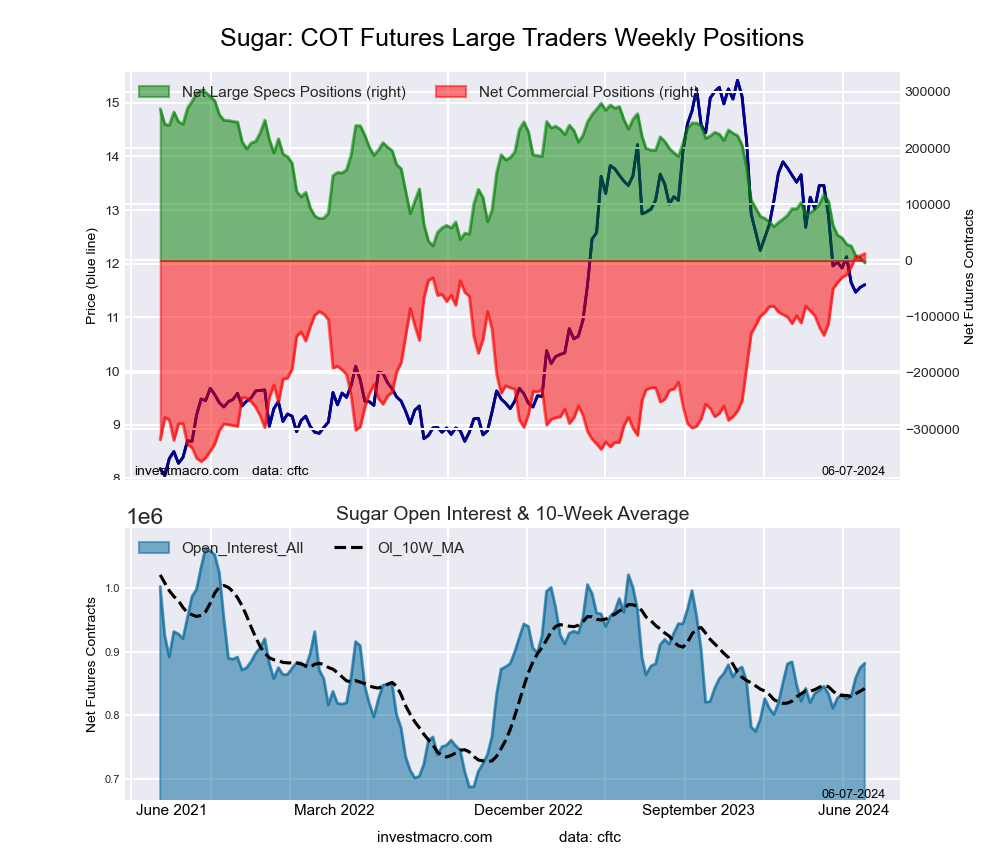

Sugar

The Sugar speculator position comes in as this week’s fourth most bearish extreme standing. The Sugar speculator level is at a 0.0 percent score of its 3-year range.

The six-week trend for the speculator strength score was -16.0 this week. The speculator position was -4,040 net contracts this week with a decline of -9,145 contracts in the weekly speculator bets.

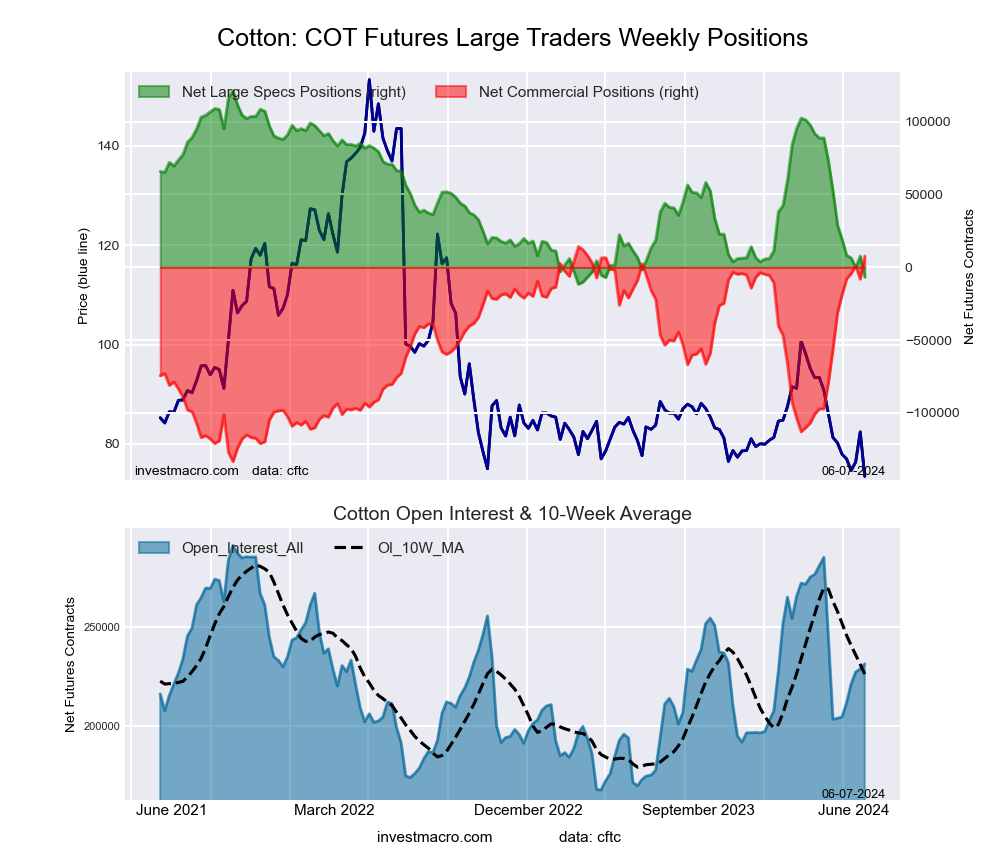

Cotton

Finally, the Cotton speculator position comes in as the fifth most bearish extreme standing for this week. The Cotton speculator level is at a 3.7 percent score of its 3-year range.

The six-week trend for the speculator strength score was -26.8 this week. The speculator position was -6,691 net contracts this week with a reduction by -14,369 contracts in the weekly speculator bets.

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026