By InvestMacro

The latest update for the weekly Commitment of Traders (COT) report was released by the Commodity Futures Trading Commission (CFTC) on Friday for data ending on Tuesday October 4th.

This weekly Extreme Positions report highlights the Top Most Bullish and Top Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.

To signify an extreme position, we use the Strength Index (also known as the COT Index) of each instrument, a common method of measuring COT data. The Strength Index is simply a comparison of current trader positions against the range of positions over the previous 3 years. We use over 80 percent as extremely bullish and under 20 percent as extremely bearish.

Compare Strength Index scores across all markets in the data table or cot leaders table, see a profile of speculators in COT markets in our cot reports guide.

Here Are This Week’s Most Bullish Speculator Positions:

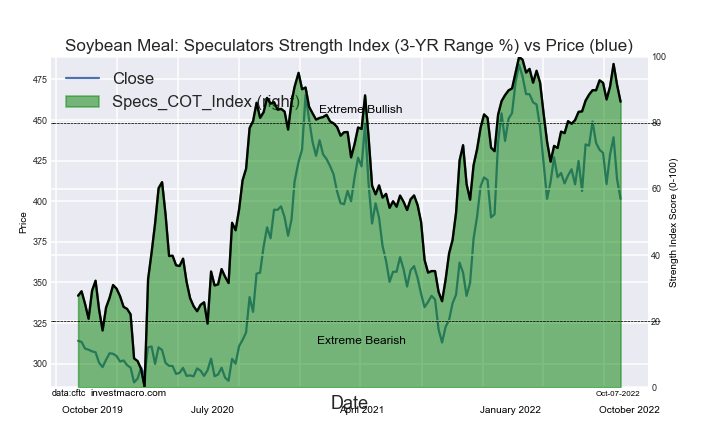

Soybean Meal – 86.4 percent

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

This week there are only two bullish markets (above the 80 percent) and Soybean Meal is the most bullish market of the week. This market has come in near the top of the most bullish markets for several weeks now. The strength score for Soybean Meal is currently 86.4 percent, down from 91.5 percent last week and 97.9 percent the week before.

The net speculator positioning for Soybean Meal dipped for a second straight this week but the overall net position has remained above the +100,000 contract level for the thirteenth consecutive week. This is the longest such streak since the middle of 2018.

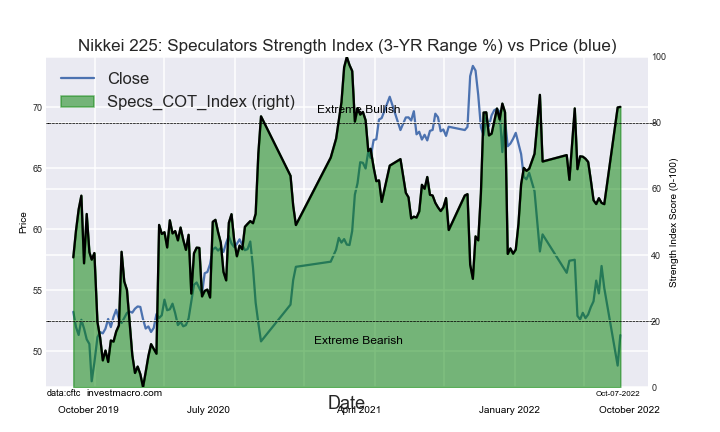

Nikkei 225 – 84.9 percent

The Nikkei 225 speculator futures position comes in as the second most bullish extreme standing this week. The Nikkei 225 speculator level is currently at a 85 percent score of its 3-year range.

The speculator position totaled 1,558 net contracts this week which was a change of just 38 contracts from last week. The Nikkei strength score is near the top of the list because over the past 3 years, speculators have usually held a bearish position and this has changed over the past two weeks (both bullish levels).

This Week’s Most Bearish Speculator Positions:

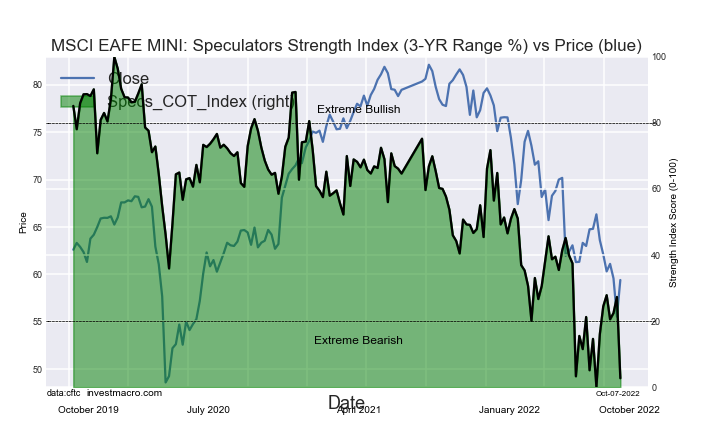

MSCI EAFE MINI – 2.7 percent

The EAFE Mini registered as the most bearish of the markets this week. The EAFE came in with a strength score of just 2.7 percent out of its 3-year range, near the very bottom of its range.

Speculators sharply cut their net positions this week by -22,448 contracts and pushed the overall net positioning for speculators to the lowest level since July.

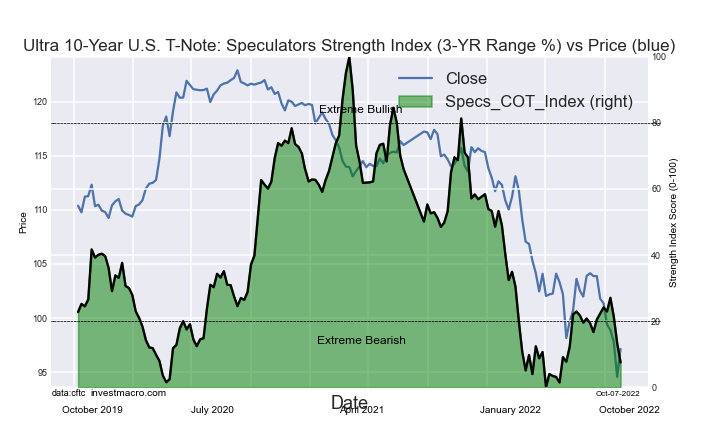

Ultra 10-Year U.S. T-Note – 7.4 percent

The Ultra 10-Year Bond large speculator position comes in as the next bearish extreme standing this week. The Ultra 10-Year Bond speculator level is currently at a 7.4 percent score of its 3-year range.

The speculator position was a total of -82,091 net contracts this week, a weekly change of -22,331 contracts from last week. This market has seen a total speculator net position decline of -75,305 contracts over the past three weeks and has pushed the net position to the lowest level since May 31st.

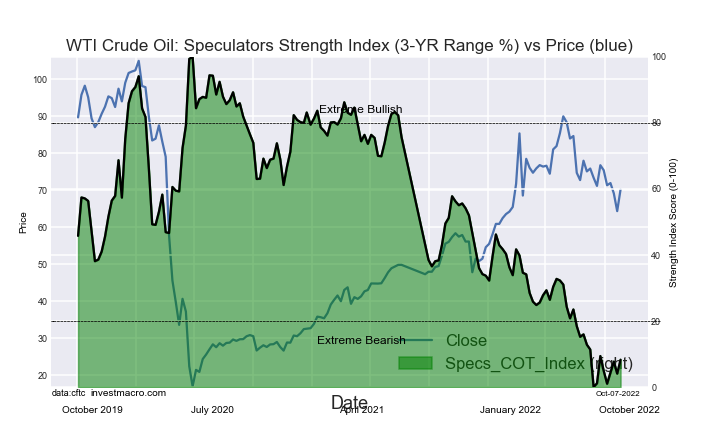

WTI Crude Oil – 8.3 percent

The WTI Crude Oil speculator position is next in line of the most bearish extreme standings on the week. The WTI Crude speculator level is currently residing at a 8.3 percent score of its 3-year range.

The speculator position was a total of 241,999 net contracts this week which had a positive gain by 15,919 contracts from last week. Overall, the net position for WTI futures has been under the +300,000 net contract level for the past sixteen weeks, something that has not happened since 2015.

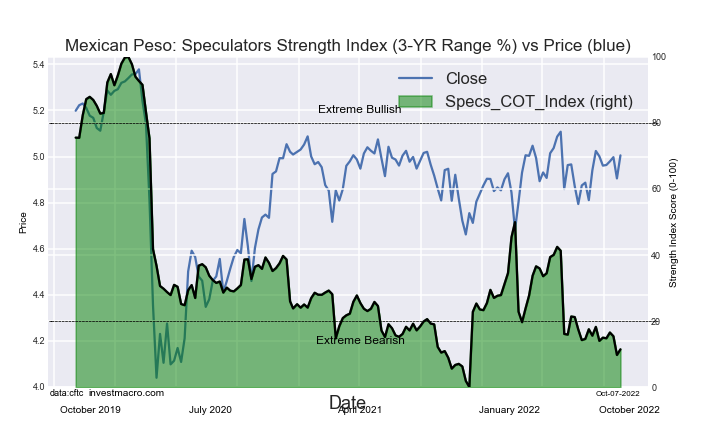

Mexican Peso – 11.4 percent

The Mexican Peso speculator position comes in as the next most bearish extreme standing of the week. The MXN speculator level currently sits at a 11.4 percent score of its 3-year range.

The speculator position was -37,321 net contracts this week and had a gain by 4,001 contracts from last week. The peso net contract positioning has been lower in two out of the past three weeks and touched the lowest level in forty-two weeks last week (before this week’s gain by 4,001 contracts).

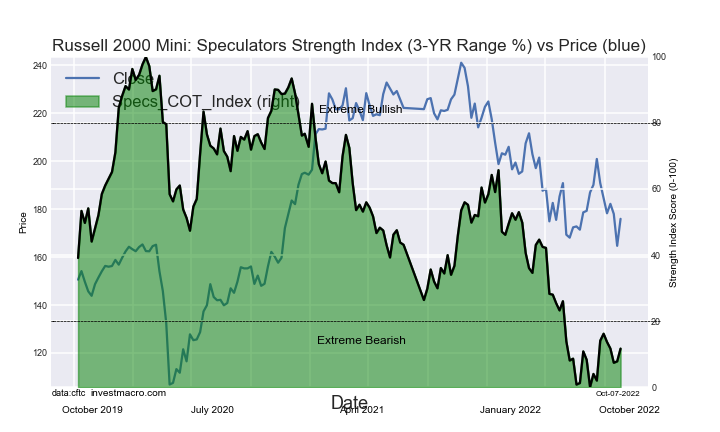

Russell 2000 Mini – 11.6 percent

The Russell 2000 Mini speculator position comes in as the next most bearish extreme standing of the week. The Russell 2000 Mini speculator level is currently at a 11.6 percent score of its 3-year range.

The overall large speculator position was -99,193 net contracts this week and had a gain by 6,868 contracts from last week. The Russell Mini has now been in a continuous bearish position for the past eighty weeks, dating back to March of 2021.

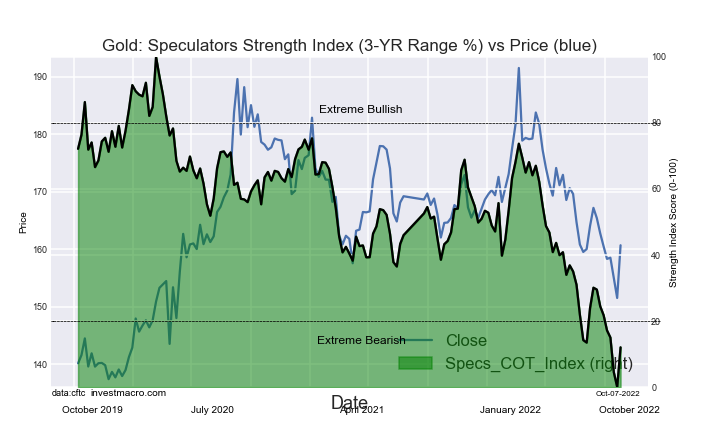

Gold – 12 percent

Finally, the Gold speculator position comes in as the sixth most bearish extreme standing for this week. The Gold speculator level is currently at a 12 percent score of its 3-year range.

The speculator position was 88,385 net contracts this week and bounced back from multiple weeks of declines to rise by 36,304 contracts from last week.

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026