By Ino.com

Intel Corporation (INTC), a prominent semiconductor company, is currently navigating a challenging phase characterized by a dwindling financial outlook and difficulties sustaining competitiveness within the semiconductor industry. Intel stands behind many tech stocks in the S&P 500 this year, while rival chipmaker NVIDIA Corporation (NVDA) emerges as the third-best performer in the index.

Now, we will evaluate the risks and opportunities associated with investing in Intel amidst competitive pressures.

Strategic Initiatives to Keep up With the Fierce Competition

Amid escalating competition in the tech arena, INTC, the foremost producer of processors driving PCs and laptops, has aggressively expanded its presence in the AI domain to remain abreast of its peers.

Last month, the company announced the creation of the world’s largest neuromorphic system, dubbed Hala Point, which is powered by Intel’s Loihi 2 processor. Initially deployed at Sandia National Laboratories, this system supports research for future brain-inspired AI and addresses challenges concerning AI efficiency and sustainability.

On April 9, Intel also unveiled a new AI chip called Gaudi 3, which was intended to compete against NVDA’s dominance in popular graphics processing units. The new chip boasts over twice the power efficiency and can run AI models one-and-a-half times faster than NVDA’s H100 GPU. The company expects more than $500 million in sales from its Gaudi 3 chips in the year’s second half.

In March, Reuters reported that INTC plans to spend $100 billion across four U.S. states to build and expand factories, bolstered by $19.5 billion in federal grants and loans (with an additional $25 billion in tax incentives in sight). CEO Pat Gelsinger envisions transforming vacant land near Columbus, Ohio, into “the largest AI chip manufacturing site globally” by 2027, forming the cornerstone of Intel’s ambitious five-year spending plan.

Such advancements enable the company to stay competitive and meet the growing demand for AI-driven solutions across various industries.

Solid First-Quarter Performance but Shaky Outlook

For the first quarter that ended March 30, 2024, INTC’s net revenue surged 8.6% year-over-year to $12.72 billion, primarily driven by growth in its personal computing, data center, and AI business. However, its revenue from the Foundry unit amounted to $4.40 billion, down about 10% year-over-year.

Intel’s gross margin grew 30.2% from the prior year’s quarter to $5.22 billion. Also, it reported a non-GAAP operating income of $723 million, compared to an operating loss of $294 million in 2023. Further, its non-GAAP net income and non-GAAP earnings per share came in at $759 million and $0.18 versus a net loss and loss per share of $169 million and $0.04, respectively, in the same quarter last year.

The solid financial performance underscores the vital innovation across its client, edge, and data center portfolios, driving double-digit product revenue growth. Total Intel Products chalked up $11.90 billion in revenue for the first quarter of 2024, resulting in a 17% year-over-year increase over the prior year’s period. Its Client Computing Group (CCG) contributed to about 31% of the gains of this unit.

However, the company lowered its outlook for the second quarter of 2024. The company expects its revenue to come between $12.5 billion and $13.5 billion, while its non-GAAP earnings per share is expected to be $0.10.

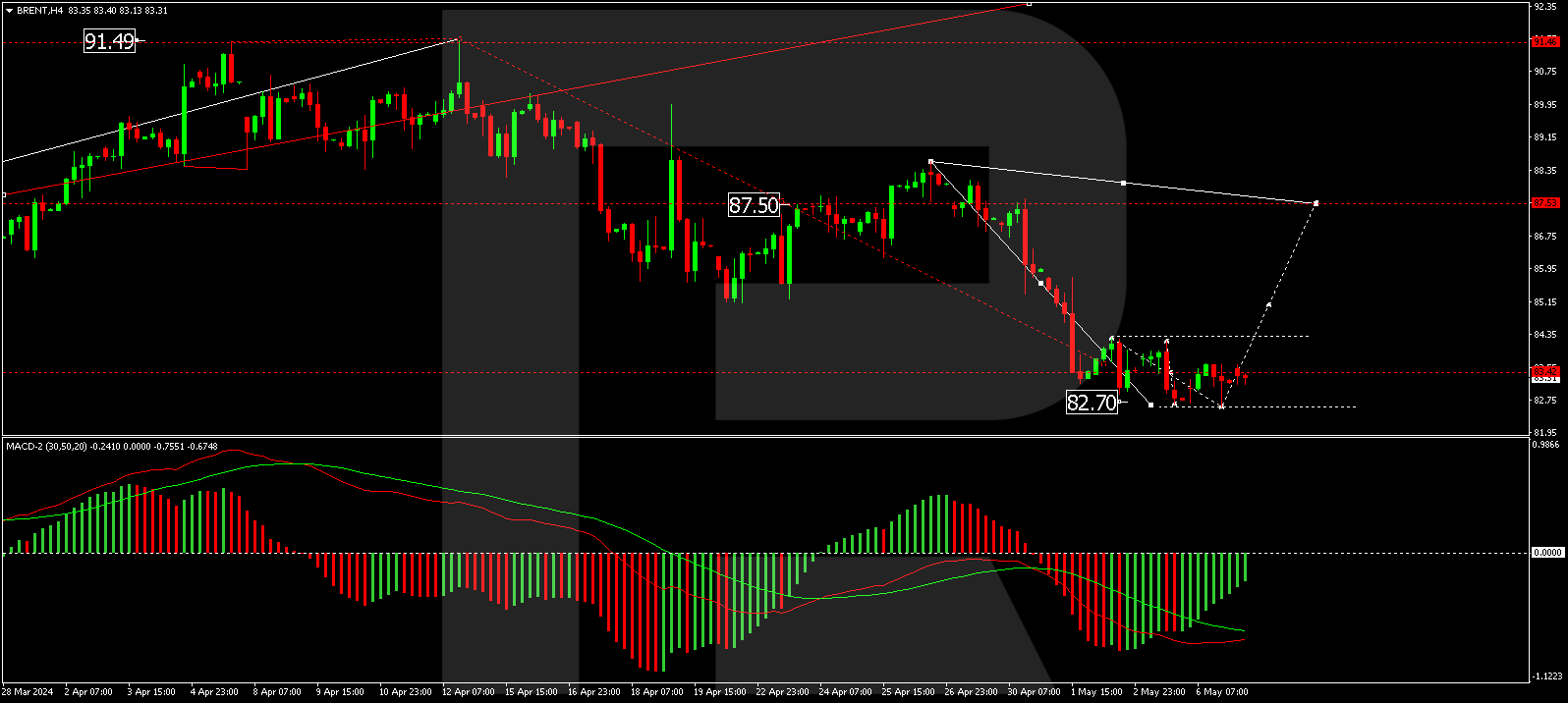

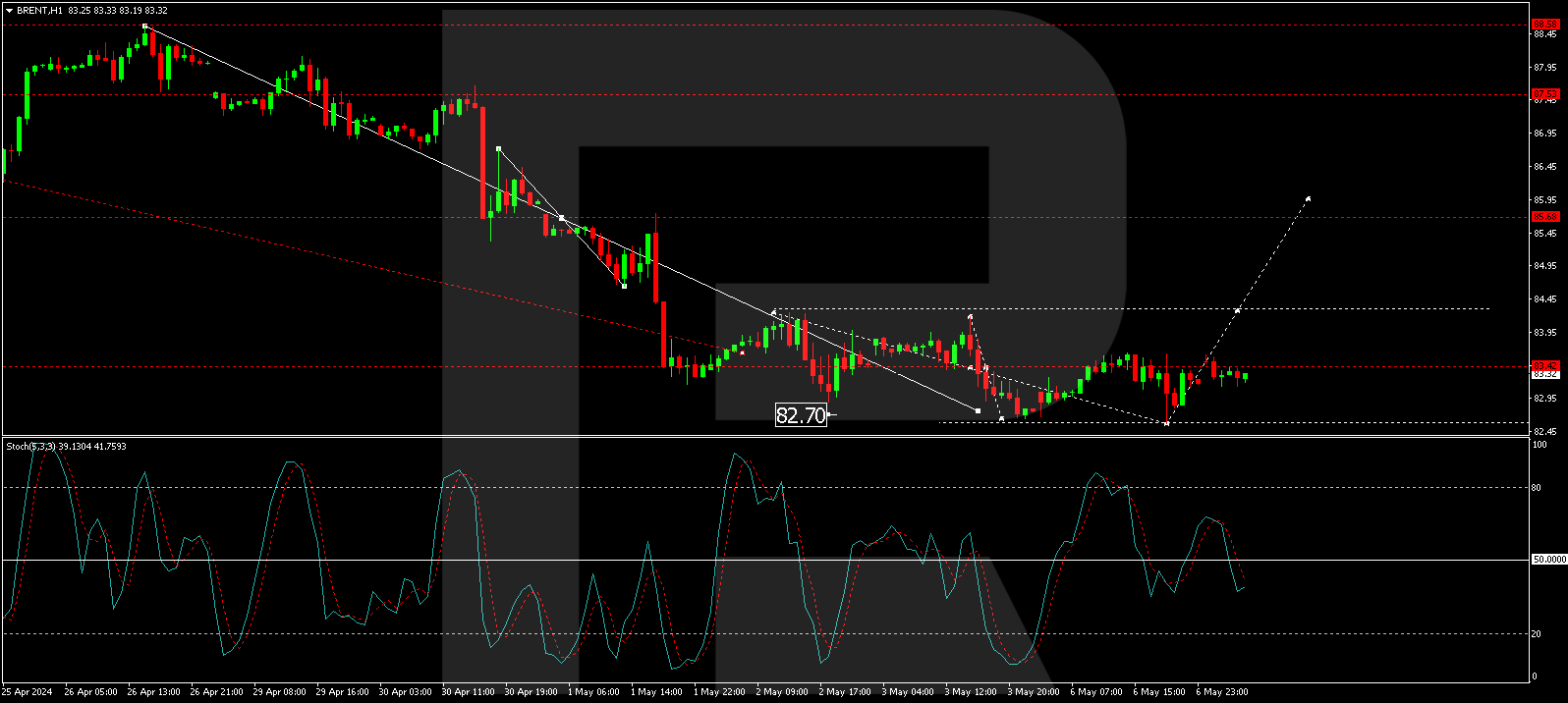

Following the company’s weak guidance for the ongoing quarter, Intel shares nosedived as much as 13% on Friday morning, overshadowing its first-quarter earnings beat. Also, the stock has plunged nearly 15% over the past six months and more than 39% year-to-date.

Bottom Line

INTC surpassed analyst estimates on the top and bottom lines in the first quarter of 2024, but achieving full recovery appears challenging. The chipmaker provided a weak outlook for the second quarter, validating concerns about its ongoing struggle to capitalize on the AI boom amid competition pressures.

Looking ahead, analysts expect INTC’s revenue to increase marginally year-over-year to $13.09 billion for the quarter ending June 2024. However, the company’s EPS for the current quarter is expected to fall 16.2% from the prior year’s period to $0.11.

For the fiscal year 2024, the consensus revenue and EPS estimates of $56.06 billion and $1.10 indicate increases of 3.4% and 5.2% year-over-year, respectively.

Recently, Goldman Sachs analysts slashed their price target for Intel stock by $5 to $34 per share and reaffirmed a ‘Sell’ rating in light of heightened competition in the artificial intelligence landscape.

Toshiya Hari noted that the company’s weak guidance was due to delayed recovery in traditional server demand, driven by cloud and enterprise customers’ focus on AI infrastructure spending. As a result, it could lead INTC to lose market share to competitors like NVDA and Arm Holdings plc (ARM) in the data center computing market.

Moreover, analysts at Bank of America decreased their price target on the stock from $44 to $40, citing rising costs, slower growth prospects, and intensified competition.

Additionally, INTC’s elevated valuation exacerbates market sensitivity. In terms of forward non-GAAP P/E, the stock trades at 27.58x, 18.9% above the industry average of 23.19x. Furthermore, its forward EV/Sales of 2.93x is 5.7% higher than the industry average of 2.77x. And the stock’s forward EV/EBIT of 31.80x compares to the industry average of 19.07x.

Also, the stock’s trailing-12-month gross profit and EBIT margins of 41.49% and 1.29% are 14.7% and 73.1% lower than the industry averages of 48.64% and 4.80%, respectively. Likewise, its asset turnover ratio of negative 0.29x compares to the industry average of 0.61x.

Given this backdrop, while we wouldn’t recommend investing in INTC now, keeping a close eye on the stock seems prudent.

By Ino.com – See our Trader Blog, INO TV Free & Market Analysis Alerts

Source: Is Intel (INTC) a Buy, Sell, or Hold Amidst Tough Competition?

Article by

Article by