By InvestMacro

The latest update for the weekly Commitment of Traders (COT) report was released by the Commodity Futures Trading Commission (CFTC) on Friday for data ending on November 29th.

This weekly Extreme Positions report highlights the Top Most Bullish and Top Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.

To signify an extreme position, we use the Strength Index (also known as the COT Index) of each instrument, a common method of measuring COT data. The Strength Index is simply a comparison of current trader positions against the range of positions over the previous 3 years. We use over 80 percent as extremely bullish and under 20 percent as extremely bearish. (Compare Strength Index scores across all markets in the data table or cot leaders table)

Speculators or Non-Commercials Notes:

Speculators, classified as non-commercial traders by the CFTC, are made up of large commodity funds, hedge funds and other significant for-profit participants. The Specs are generally regarded as trend-followers in their behavior towards price action – net speculator bets and prices tend to go in the same directions. These traders often look to buy when prices are rising and sell when prices are falling. To illustrate this point, many times speculator contracts can be found at their most extremes (bullish or bearish) when prices are also close to their highest or lowest levels.

These extreme levels can be dangerous for the large speculators as the trade is most crowded, there is less trading ammunition still sitting on the sidelines to push the trend further and prices have moved a significant distance. When the trend becomes exhausted, some speculators take profits while others look to also exit positions when prices fail to continue in the same direction. This process usually plays out over many months to years and can ultimately create a reverse effect where prices start to fall and speculators start a process of selling when prices are falling.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Here Are This Week’s Most Bullish Speculator Positions:

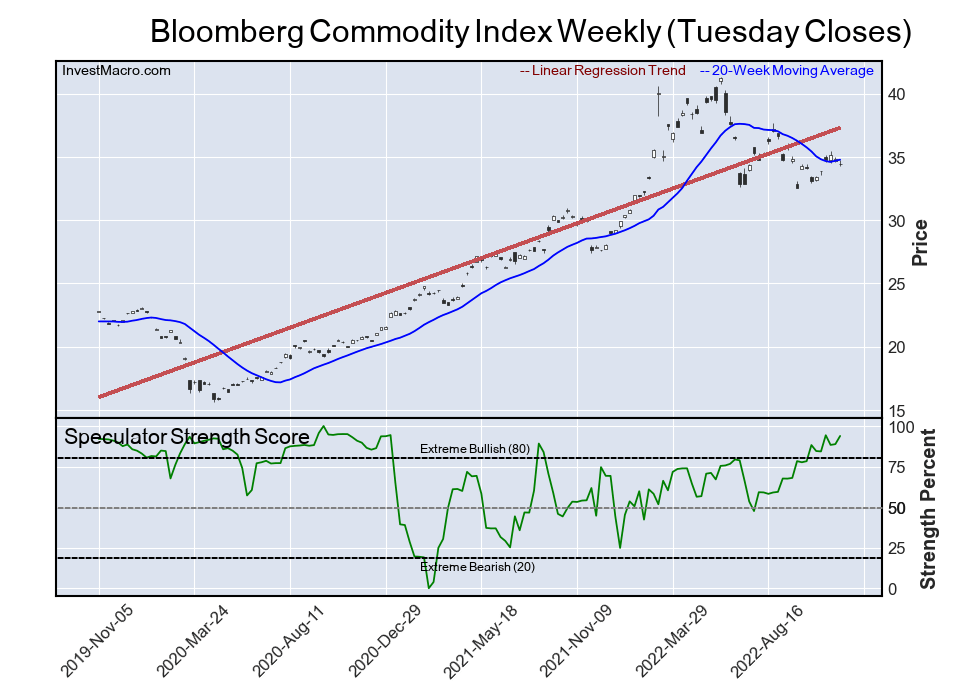

Bloomberg Commodity Index

The Bloomberg Commodity Index speculator position comes in as the most bullish extreme standing this week. The Bloomberg Commodity Index speculator level is currently at a 93.9 percent score of its 3-year range.

The overall net speculator position totaled -3,559 net contracts this week. This market usually has a bearish speculator position and currently it is at the lower end of its range that has averaged a weekly position of -10,636 contracts in 2022.

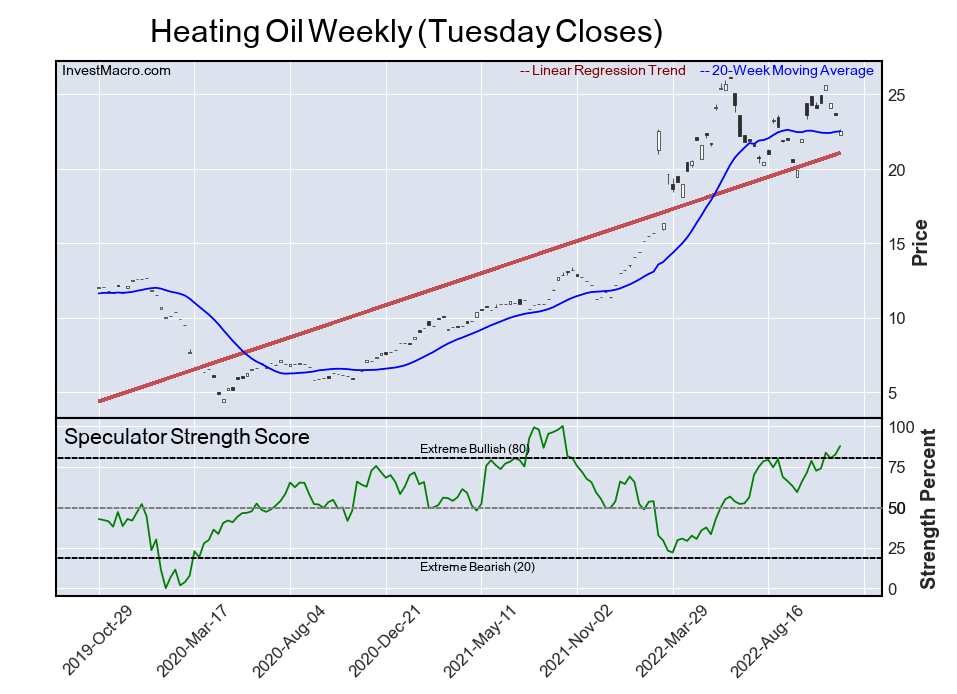

Heating Oil

The Heating Oil speculator position comes next in the extreme standings this week. The Heating Oil speculator level is now at a 87.6 percent score of its 3-year range.

The speculator position was 30,733 net contracts this week after rising by 3,561 contracts for the week.

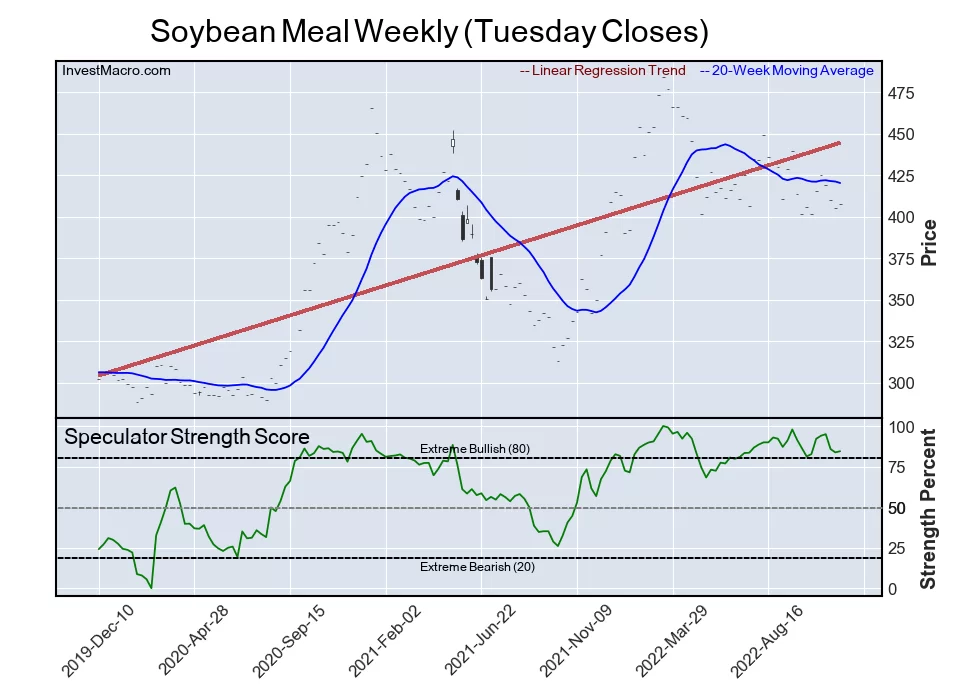

Soybean Meal

The Soybean Meal speculator position comes in third this week in the extreme standings. The Soybean Meal speculator level resides at a 84.5 percent score of its 3-year range.

The speculator position was 102,339 net contracts this week and edged up by 1,269 contracts through Tuesday.

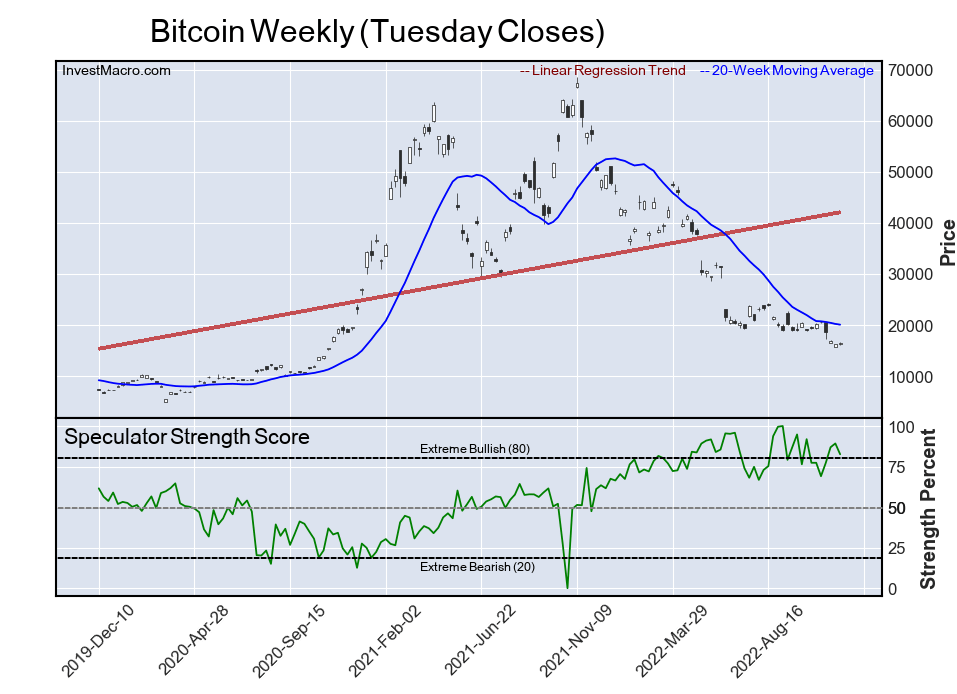

Bitcoin

The Bitcoin speculator position comes up number four in the extreme standings this week. The Bitcoin speculator level is at a 82.6 percent score of its 3-year range.

The speculator position was a total of 324 net contracts this week after falling by -382 speculator contracts this week.

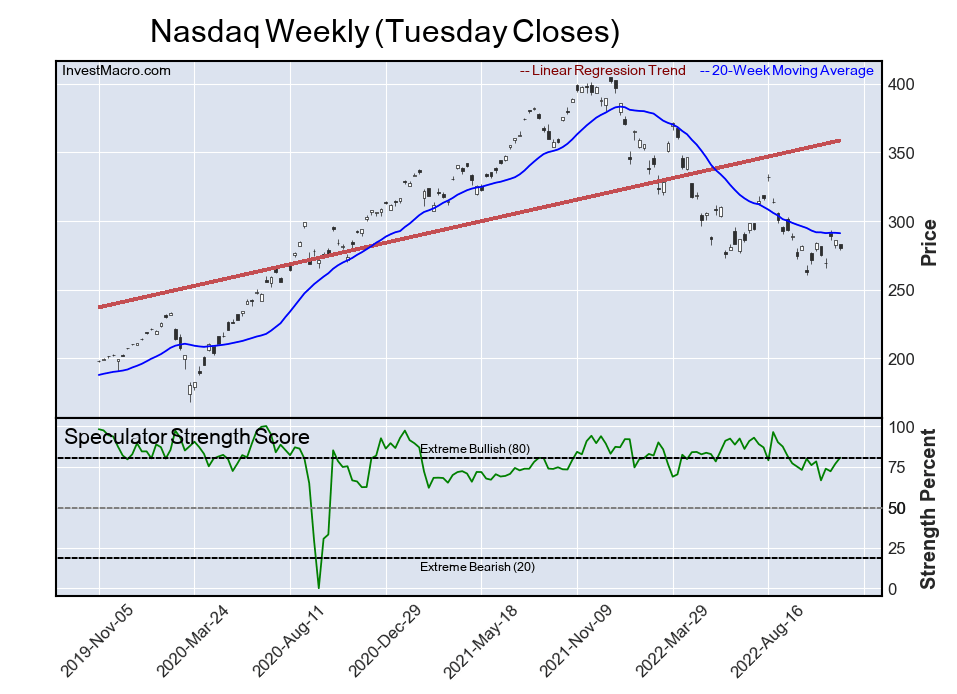

Nasdaq

The Nasdaq speculator position rounds out the top five in this week’s bullish extreme standings. The Nasdaq speculator level sits at a 80.5 percent score of its 3-year range.

The speculator position was 9,755 net contracts this week and saw an increase of 6,709 contracts through Tuesday.

This Week’s Most Bearish Speculator Positions:

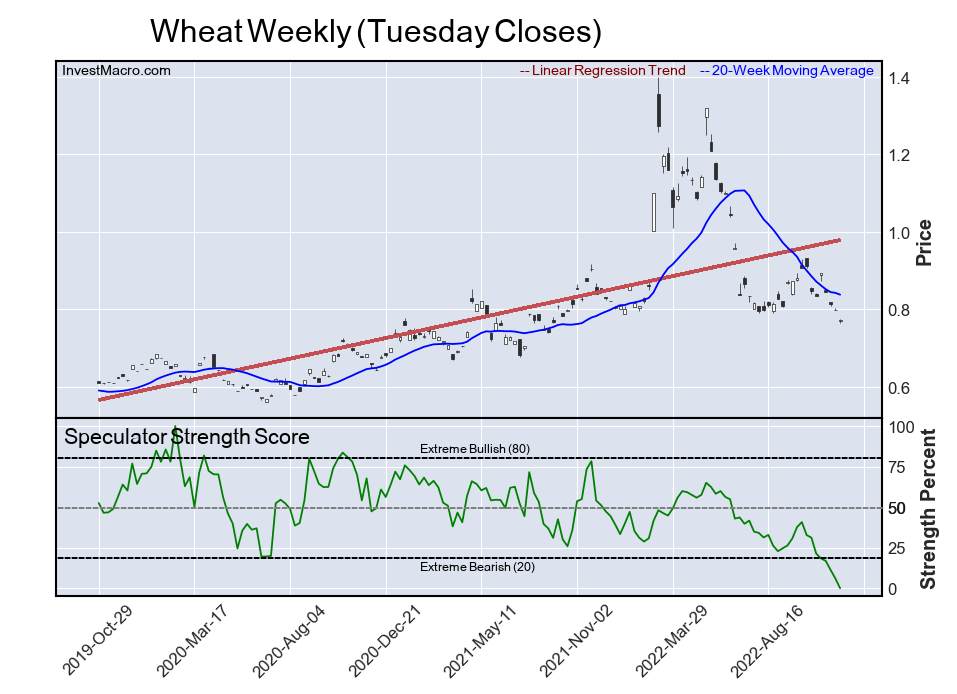

Wheat

The Wheat speculator position comes in as the most bearish extreme standing this week. The Wheat speculator level is at a 0.0 percent score of its 3-year range.

The speculator position was -33,305 net contracts this week as the position fell by -5,787 contracts this week.

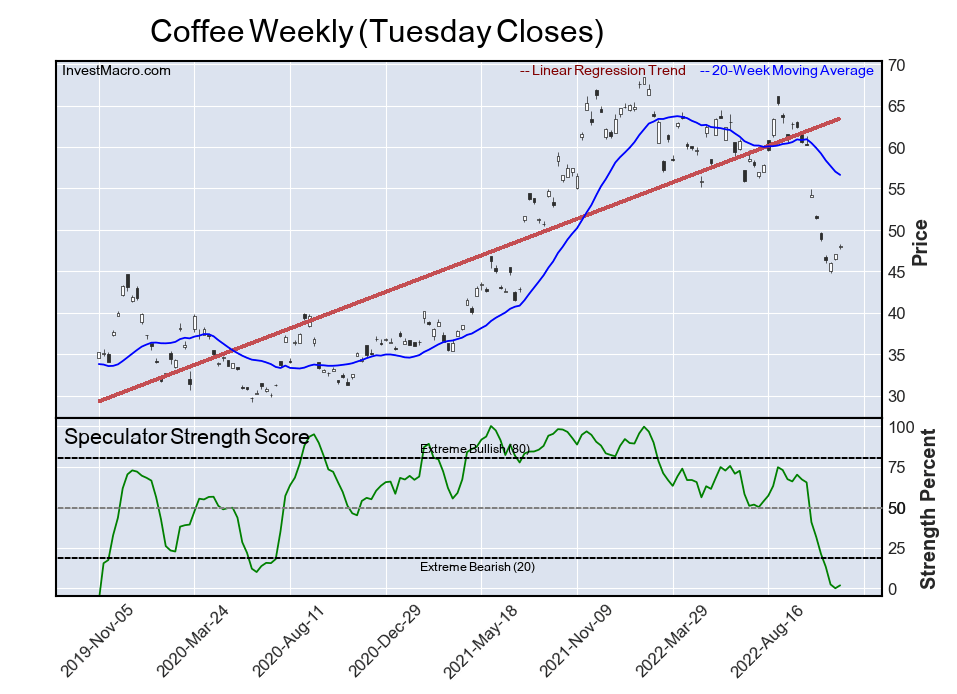

Coffee

The Coffee speculator position comes in next for the most bearish extreme standing on the week. The Coffee speculator level is at a 1.8 percent score of its 3-year range.

The speculator position was a total of -14,636 net contracts this week. Coffee bets rose by 1,550 contracts this week but had fallen for the previous eight straight weeks.

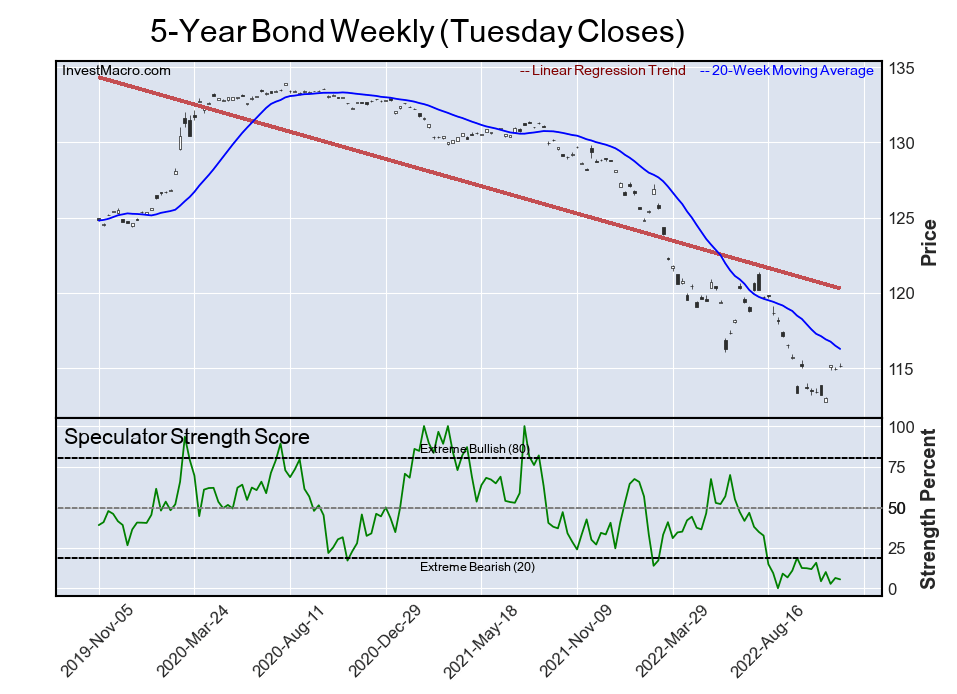

5-Year Bond

The 5-Year Bond speculator position comes in as third most bearish extreme standing of the week. The 5-Year Bond speculator level resides at a 5.5 percent score of its 3-year range.

The speculator position was -529,349 net contracts this week and saw a dip by -5,695 contracts for the week.

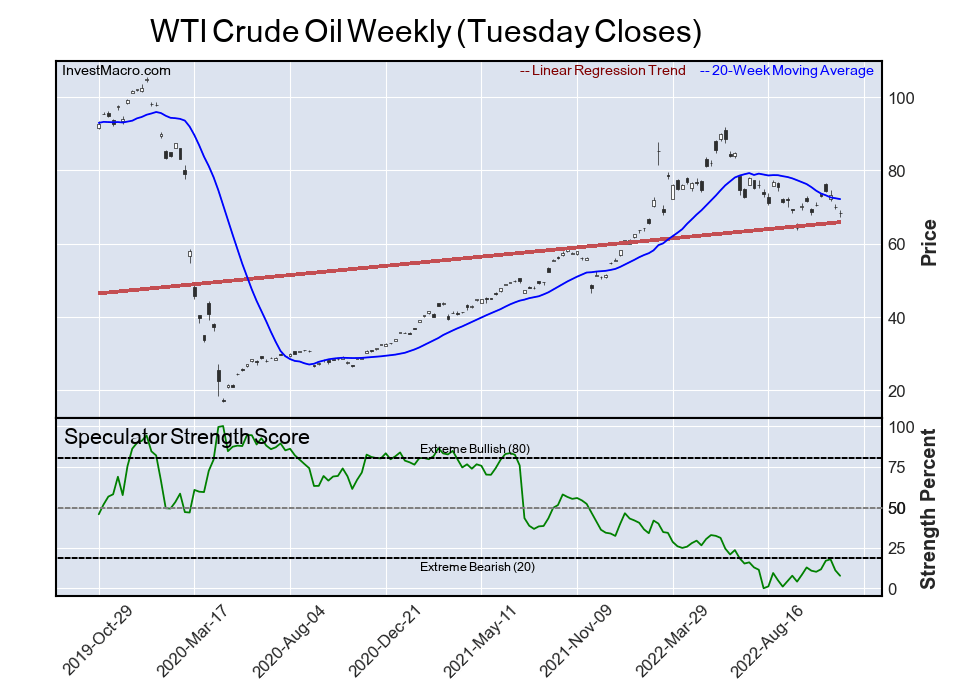

WTI Crude Oil

The WTI Crude Oil speculator position comes in as this week’s next most bearish extreme standing. The WTI Crude Oil speculator level is at a 7.7 percent score of its 3-year range.

The speculator position was 239,739 net contracts this week after a decline of -12,736 contracts through Tuesday’s data cutoff.

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- Trump announces exemption of key tech goods from imposed tariffs Apr 14, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Platinum & Silver Apr 13, 2025

- COT Bonds Charts: Speculator Bets led by SOFR-3M, Fed Funds & Ultra Treasury Bonds Apr 13, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil & Wheat Apr 13, 2025

- COT Stock Market Charts: Speculator Bets led higher by Nasdaq, Russell & DowJones Apr 13, 2025

- The US stocks are back to selling off. The US raised tariffs on China to 145% Apr 11, 2025

- EUR/USD Hits Three-Year High as the US Dollar Suffers Heavy Losses Apr 11, 2025

- Markets rallied sharply on the back of a 90-day tariff postponement. China became an exception with tariffs of 125% Apr 10, 2025

- Pound Rallies Sharply Weak Dollar Boosts GBP, but BoE Rate Outlook May Complicate Future Gains Apr 10, 2025

- Tariffs on US imports come into effect today. The RBNZ expectedly lowered the rate by 0.25% Apr 9, 2025