By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday August 2nd and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

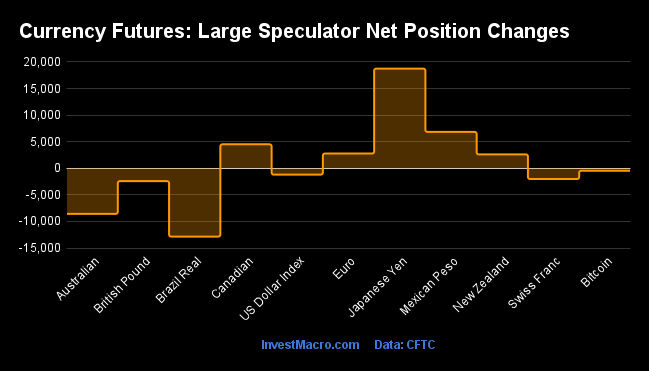

Weekly Speculator Changes

COT currency market speculator bets were slightly lower this week as five out of the eleven currency markets we cover had higher positioning while the other six markets recorded lower speculator contracts.

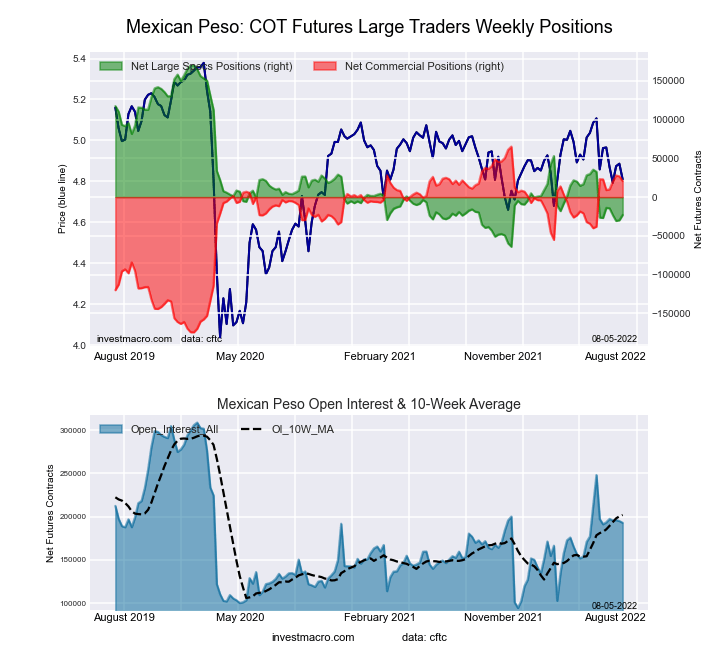

Leading the gains for the currency markets was Japanese yen (18,728 contracts) with the Mexican peso (6,845 contracts), the Canadian dollar (4,508 contracts), the Euro (2,773 contracts) and the New Zealand dollar (2,613 contracts) also making gains on the week.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

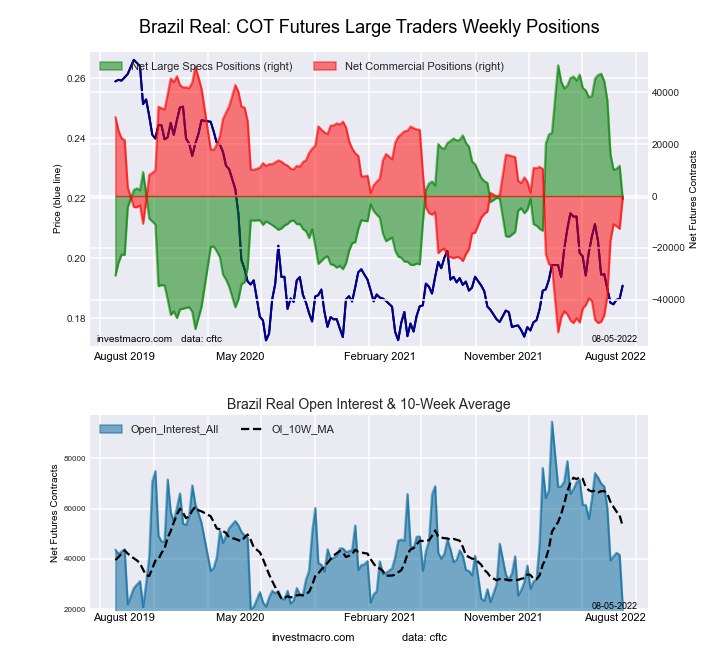

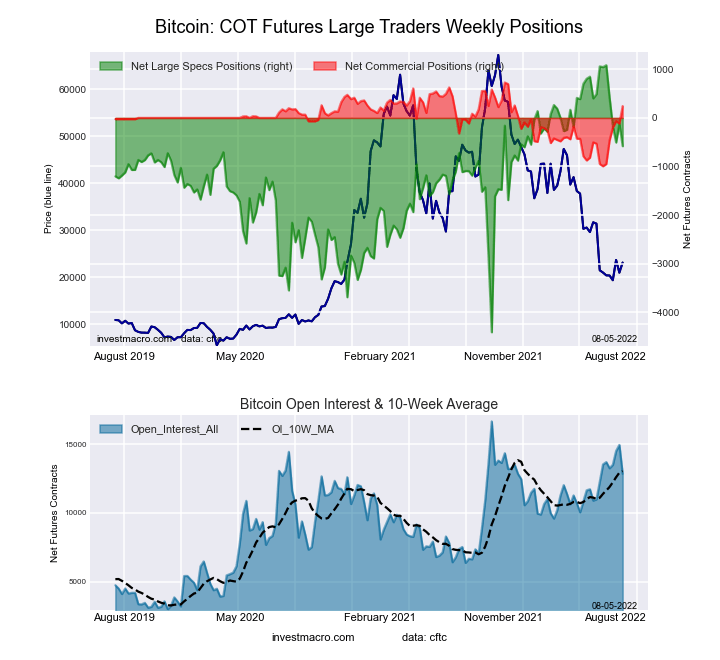

The currencies leading the declines in speculator bets this week were the Brazilian real (-12,842 contracts) and Australian dollar (-8,565 contracts) with the British pound sterling (-2,419 contracts), the Swiss franc (-2,009 contracts), the US Dollar Index (-1,188 contracts) and Bitcoin (-460 contracts) also seeing lower bets on the week.

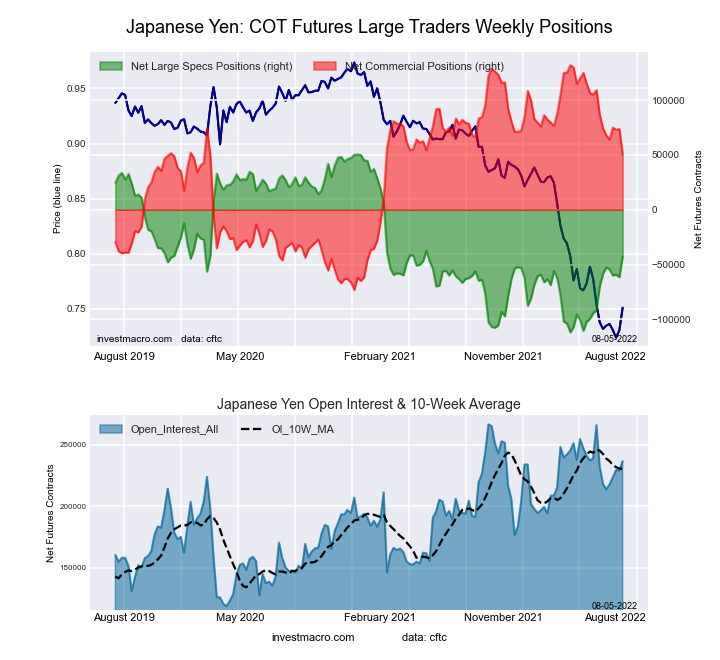

Highlighting the currency markets data this week was the rebound in the Japanese yen speculator bets. Yen bets jumped by +18,728 contracts this week which marks the highest positive change of the past seven weeks. The yen bets have been in an overall bearish level since March of 2021 with a recent bearish high on April 12th at a total of -111,827 contracts and were as high as -102,309 contracts on May 17th before speculators started to pare their bearish bets. Since May, the speculator positioning has improved by approximately 60,000 net contracts and has pushed the overall speculator position to the least bearish level since June 8th of 2021, a span of sixty weeks.

Brazilian Real speculator bets declined this week by over -12,000 contracts and the overall positioning dropped into a new bearish level at -1,130 contracts. This is the first bearish net position since February 1st, a span of the past twenty-six weeks. The decline in Real positions has happened fast and furious as speculator positions hit record high bullish levels in early March above +50,000 contracts and were as high as +44,345 contracts on June 21st. Since June 14th, speculator bets have fallen in five out of the past seven weeks for a total decline of -48,343 contracts over that time and erasing the bullish spec position.

| Aug-02-2022 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| USD Index | 57,054 | 82 | 39,347 | 91 | -42,159 | 9 | 2,812 | 47 |

| EUR | 683,883 | 75 | -38,811 | 23 | 15,520 | 80 | 23,291 | 13 |

| GBP | 226,987 | 61 | -56,409 | 30 | 72,577 | 74 | -16,168 | 22 |

| JPY | 236,737 | 80 | -42,753 | 43 | 50,254 | 60 | -7,501 | 38 |

| CHF | 45,874 | 33 | -13,308 | 23 | 23,279 | 81 | -9,971 | 24 |

| CAD | 145,914 | 27 | 20,277 | 62 | -30,407 | 43 | 10,130 | 50 |

| AUD | 167,931 | 58 | -55,950 | 33 | 62,124 | 65 | -6,174 | 37 |

| NZD | 45,274 | 34 | -1,573 | 69 | 4,858 | 38 | -3,285 | 14 |

| MXN | 192,971 | 46 | -23,053 | 18 | 20,696 | 81 | 2,357 | 53 |

| RUB | 20,930 | 4 | 7,543 | 31 | -7,150 | 69 | -393 | 24 |

| BRL | 21,194 | 1 | -1,130 | 49 | -561 | 51 | 1,691 | 85 |

| Bitcoin | 12,849 | 72 | -581 | 70 | 244 | 0 | 337 | 21 |

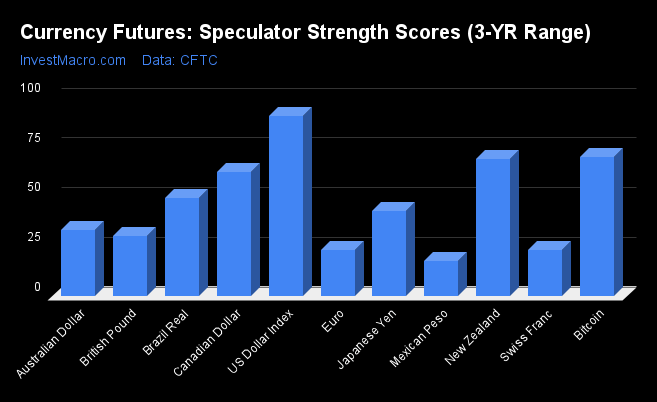

Strength Scores

Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is extreme bullish and below 20 is extreme bearish) showed that the US Dollar Index (90.6 percent) continued to lead the strength scores although it came down a bit from last week (92.5 percent) but still remains in a bullish extreme level. Bitcoin (69.7 percent), the New Zealand Dollar (68.6 percent) and the Canadian Dollar (62.1 percent) come in as the next highest in the currency markets for strength scores. On the downside, the Mexican Peso (17.5 percent) comes in at the lowest strength level currently and is in a bearish extreme level (below 20 percent). The Swiss Franc (22.8 percent), the Euro (23.1 percent) and the British Pound Sterling (29.9 percent) round out the next weakest strength scores this week.

Strength Statistics:

US Dollar Index (90.6 percent) vs US Dollar Index previous week (92.5 percent)

EuroFX (23.1 percent) vs EuroFX previous week (22.2 percent)

British Pound Sterling (29.9 percent) vs British Pound Sterling previous week (31.7 percent)

Japanese Yen (42.5 percent) vs Japanese Yen previous week (31.0 percent)

Swiss Franc (22.8 percent) vs Swiss Franc previous week (27.9 percent)

Canadian Dollar (62.1 percent) vs Canadian Dollar previous week (57.1 percent)

Australian Dollar (33.0 percent) vs Australian Dollar previous week (40.9 percent)

New Zealand Dollar (68.6 percent) vs New Zealand Dollar previous week (64.2 percent)

Mexican Peso (17.5 percent) vs Mexican Peso previous week (14.6 percent)

Brazil Real (49.3 percent) vs Brazil Real previous week (61.9 percent)

Bitcoin (69.7 percent) vs Bitcoin previous week (78.1 percent)

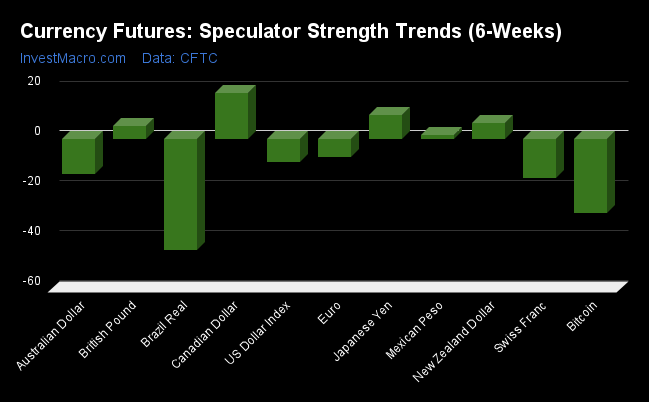

Strength Trends

Strength Score Trends (or move index, calculates the 6-week changes in strength scores) show that the Canadian Dollar (18.2 percent) leads the past six weeks trends for the currency markets this week. The Japanese Yen (9.7 percent), the New Zealand Dollar (6.5 percent) and the British Pound Sterling (5.2 percent) fill out the top movers in the latest trends data. The Brazil Real (-44.7 percent) leads the downside trend scores currently while the next market with lower trend scores were Bitcoin (-29.6 percent), the Swiss Franc (-15.6 percent) and the Australian Dollar (-14.2 percent) followed by the US Dollar Index (-9.4 percent).

Strength Trend Statistics:

US Dollar Index (-9.4 percent) vs US Dollar Index previous week (-6.6 percent)

EuroFX (-7.1 percent) vs EuroFX previous week (-10.9 percent)

British Pound Sterling (5.2 percent) vs British Pound Sterling previous week (8.8 percent)

Japanese Yen (9.7 percent) vs Japanese Yen previous week (5.1 percent)

Swiss Franc (-15.6 percent) vs Swiss Franc previous week (-11.4 percent)

Canadian Dollar (18.2 percent) vs Canadian Dollar previous week (-8.3 percent)

Australian Dollar (-14.2 percent) vs Australian Dollar previous week (-3.8 percent)

New Zealand Dollar (6.5 percent) vs New Zealand Dollar previous week (4.4 percent)

Mexican Peso (1.6 percent) vs Mexican Peso previous week (-1.5 percent)

Brazil Real (-44.7 percent) vs Brazil Real previous week (-34.9 percent)

Bitcoin (-29.6 percent) vs Bitcoin previous week (-21.5 percent)

Individual Markets:

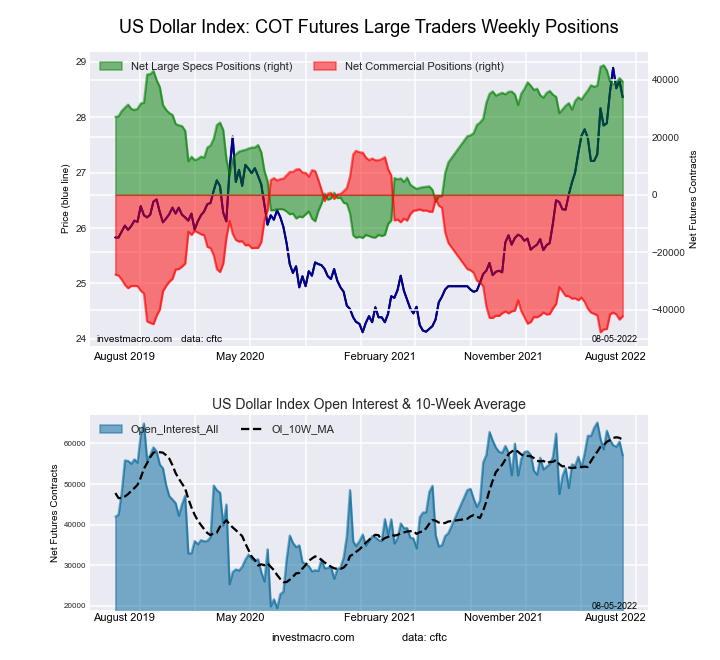

US Dollar Index Futures:

The US Dollar Index large speculator standing this week equaled a net position of 39,347 contracts in the data reported through Tuesday. This was a weekly reduction of -1,188 contracts from the previous week which had a total of 40,535 net contracts.

The US Dollar Index large speculator standing this week equaled a net position of 39,347 contracts in the data reported through Tuesday. This was a weekly reduction of -1,188 contracts from the previous week which had a total of 40,535 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 90.6 percent. The commercials are Bearish-Extreme with a score of 8.8 percent and the small traders (not shown in chart) are Bearish with a score of 47.3 percent.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 84.0 | 4.9 | 9.0 |

| – Percent of Open Interest Shorts: | 15.0 | 78.8 | 4.1 |

| – Net Position: | 39,347 | -42,159 | 2,812 |

| – Gross Longs: | 47,918 | 2,807 | 5,128 |

| – Gross Shorts: | 8,571 | 44,966 | 2,316 |

| – Long to Short Ratio: | 5.6 to 1 | 0.1 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 90.6 | 8.8 | 47.3 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.4 | 7.3 | 11.8 |

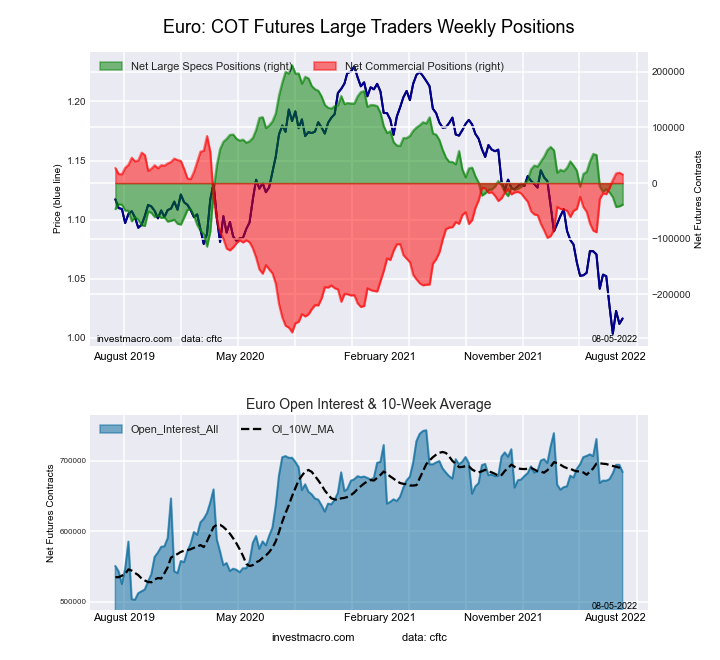

Euro Currency Futures:

The Euro Currency large speculator standing this week equaled a net position of -38,811 contracts in the data reported through Tuesday. This was a weekly lift of 2,773 contracts from the previous week which had a total of -41,584 net contracts.

The Euro Currency large speculator standing this week equaled a net position of -38,811 contracts in the data reported through Tuesday. This was a weekly lift of 2,773 contracts from the previous week which had a total of -41,584 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 23.1 percent. The commercials are Bullish-Extreme with a score of 80.4 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 13.0 percent.

| EURO Currency Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 28.0 | 57.3 | 12.1 |

| – Percent of Open Interest Shorts: | 33.7 | 55.0 | 8.7 |

| – Net Position: | -38,811 | 15,520 | 23,291 |

| – Gross Longs: | 191,692 | 391,841 | 82,466 |

| – Gross Shorts: | 230,503 | 376,321 | 59,175 |

| – Long to Short Ratio: | 0.8 to 1 | 1.0 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 23.1 | 80.4 | 13.0 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -7.1 | 9.6 | -17.4 |

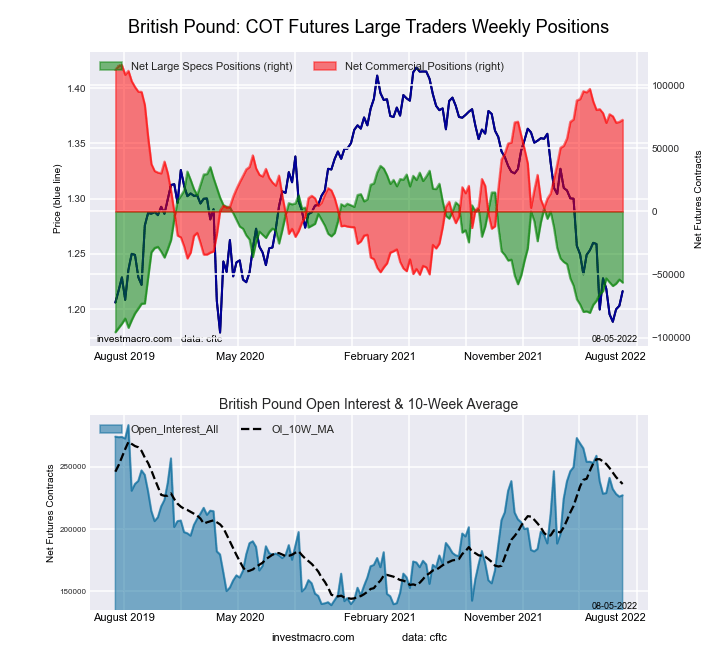

British Pound Sterling Futures:

The British Pound Sterling large speculator standing this week equaled a net position of -56,409 contracts in the data reported through Tuesday. This was a weekly reduction of -2,419 contracts from the previous week which had a total of -53,990 net contracts.

The British Pound Sterling large speculator standing this week equaled a net position of -56,409 contracts in the data reported through Tuesday. This was a weekly reduction of -2,419 contracts from the previous week which had a total of -53,990 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 29.9 percent. The commercials are Bullish with a score of 73.9 percent and the small traders (not shown in chart) are Bearish with a score of 22.1 percent.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 12.9 | 75.8 | 8.5 |

| – Percent of Open Interest Shorts: | 37.8 | 43.8 | 15.6 |

| – Net Position: | -56,409 | 72,577 | -16,168 |

| – Gross Longs: | 29,305 | 171,966 | 19,191 |

| – Gross Shorts: | 85,714 | 99,389 | 35,359 |

| – Long to Short Ratio: | 0.3 to 1 | 1.7 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 29.9 | 73.9 | 22.1 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 5.2 | -3.2 | -3.1 |

Japanese Yen Futures:

The Japanese Yen large speculator standing this week equaled a net position of -42,753 contracts in the data reported through Tuesday. This was a weekly increase of 18,728 contracts from the previous week which had a total of -61,481 net contracts.

The Japanese Yen large speculator standing this week equaled a net position of -42,753 contracts in the data reported through Tuesday. This was a weekly increase of 18,728 contracts from the previous week which had a total of -61,481 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 42.5 percent. The commercials are Bullish with a score of 60.2 percent and the small traders (not shown in chart) are Bearish with a score of 38.2 percent.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 21.3 | 66.5 | 10.7 |

| – Percent of Open Interest Shorts: | 39.4 | 45.2 | 13.9 |

| – Net Position: | -42,753 | 50,254 | -7,501 |

| – Gross Longs: | 50,433 | 157,333 | 25,358 |

| – Gross Shorts: | 93,186 | 107,079 | 32,859 |

| – Long to Short Ratio: | 0.5 to 1 | 1.5 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 42.5 | 60.2 | 38.2 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.7 | -11.8 | 17.0 |

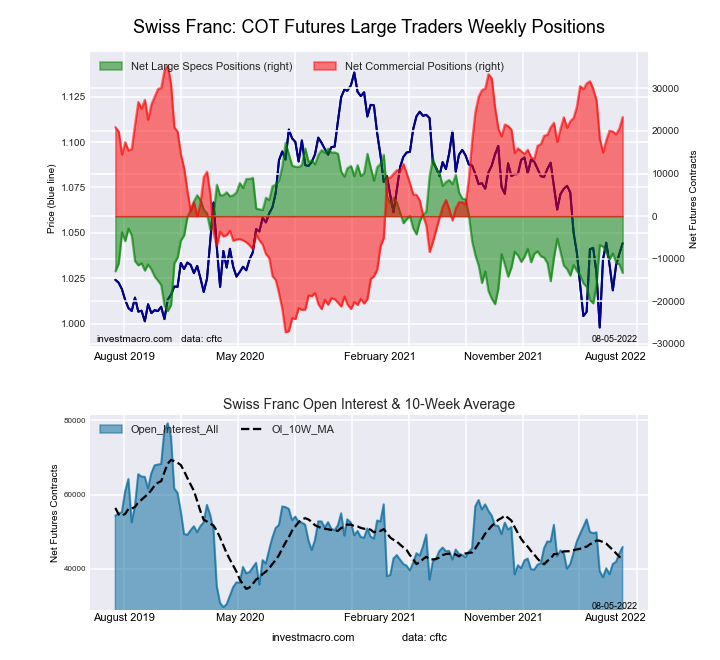

Swiss Franc Futures:

The Swiss Franc large speculator standing this week equaled a net position of -13,308 contracts in the data reported through Tuesday. This was a weekly decrease of -2,009 contracts from the previous week which had a total of -11,299 net contracts.

The Swiss Franc large speculator standing this week equaled a net position of -13,308 contracts in the data reported through Tuesday. This was a weekly decrease of -2,009 contracts from the previous week which had a total of -11,299 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 22.8 percent. The commercials are Bullish-Extreme with a score of 80.6 percent and the small traders (not shown in chart) are Bearish with a score of 23.8 percent.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.8 | 63.4 | 18.4 |

| – Percent of Open Interest Shorts: | 46.8 | 12.6 | 40.2 |

| – Net Position: | -13,308 | 23,279 | -9,971 |

| – Gross Longs: | 8,170 | 29,075 | 8,457 |

| – Gross Shorts: | 21,478 | 5,796 | 18,428 |

| – Long to Short Ratio: | 0.4 to 1 | 5.0 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 22.8 | 80.6 | 23.8 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -15.6 | 13.3 | -7.3 |

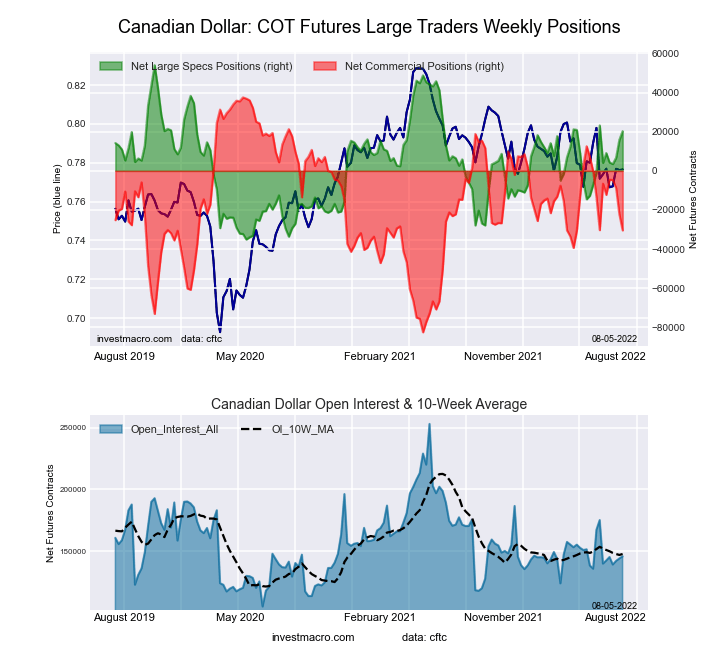

Canadian Dollar Futures:

The Canadian Dollar large speculator standing this week equaled a net position of 20,277 contracts in the data reported through Tuesday. This was a weekly gain of 4,508 contracts from the previous week which had a total of 15,769 net contracts.

The Canadian Dollar large speculator standing this week equaled a net position of 20,277 contracts in the data reported through Tuesday. This was a weekly gain of 4,508 contracts from the previous week which had a total of 15,769 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 62.1 percent. The commercials are Bearish with a score of 43.4 percent and the small traders (not shown in chart) are Bullish with a score of 50.5 percent.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 33.1 | 40.7 | 24.3 |

| – Percent of Open Interest Shorts: | 19.2 | 61.5 | 17.3 |

| – Net Position: | 20,277 | -30,407 | 10,130 |

| – Gross Longs: | 48,342 | 59,355 | 35,393 |

| – Gross Shorts: | 28,065 | 89,762 | 25,263 |

| – Long to Short Ratio: | 1.7 to 1 | 0.7 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 62.1 | 43.4 | 50.5 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 18.2 | -19.9 | 15.4 |

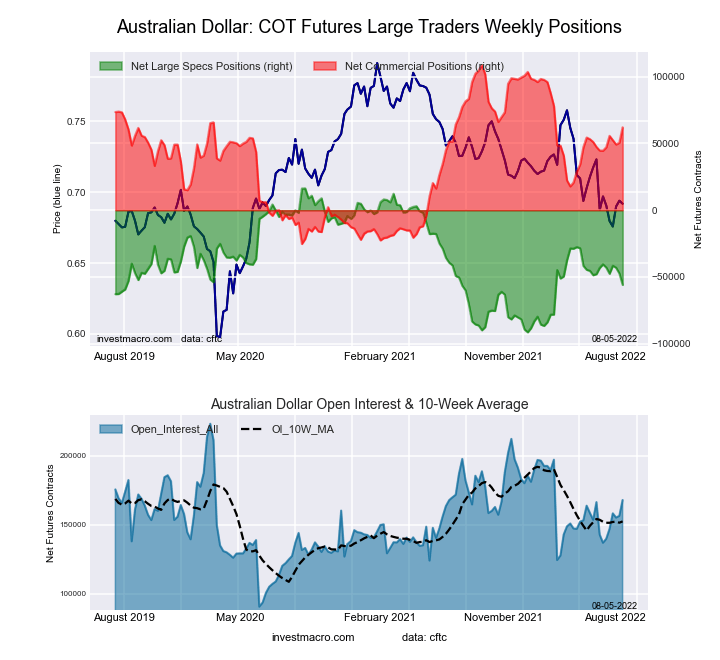

Australian Dollar Futures:

The Australian Dollar large speculator standing this week equaled a net position of -55,950 contracts in the data reported through Tuesday. This was a weekly lowering of -8,565 contracts from the previous week which had a total of -47,385 net contracts.

The Australian Dollar large speculator standing this week equaled a net position of -55,950 contracts in the data reported through Tuesday. This was a weekly lowering of -8,565 contracts from the previous week which had a total of -47,385 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 33.0 percent. The commercials are Bullish with a score of 65.2 percent and the small traders (not shown in chart) are Bearish with a score of 37.4 percent.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 18.4 | 68.6 | 10.6 |

| – Percent of Open Interest Shorts: | 51.7 | 31.6 | 14.3 |

| – Net Position: | -55,950 | 62,124 | -6,174 |

| – Gross Longs: | 30,835 | 115,141 | 17,863 |

| – Gross Shorts: | 86,785 | 53,017 | 24,037 |

| – Long to Short Ratio: | 0.4 to 1 | 2.2 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 33.0 | 65.2 | 37.4 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -14.2 | 13.1 | -5.3 |

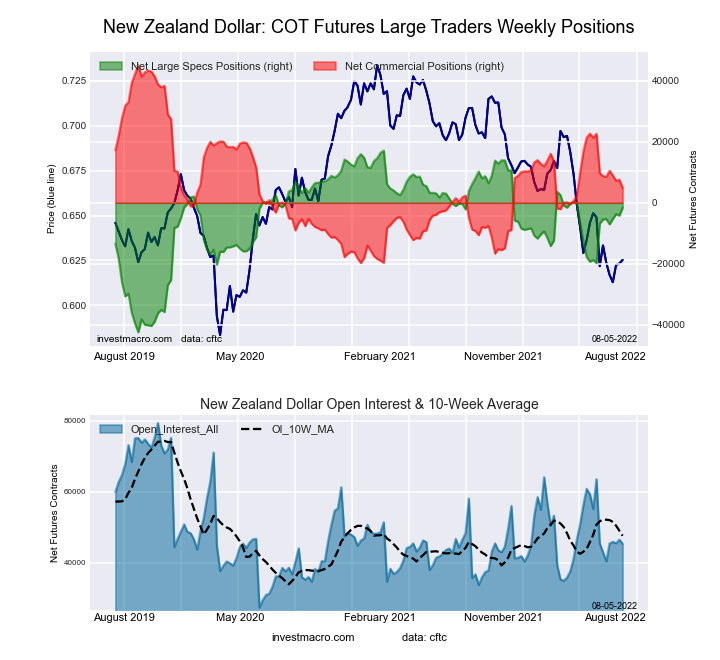

New Zealand Dollar Futures:

The New Zealand Dollar large speculator standing this week equaled a net position of -1,573 contracts in the data reported through Tuesday. This was a weekly advance of 2,613 contracts from the previous week which had a total of -4,186 net contracts.

The New Zealand Dollar large speculator standing this week equaled a net position of -1,573 contracts in the data reported through Tuesday. This was a weekly advance of 2,613 contracts from the previous week which had a total of -4,186 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 68.6 percent. The commercials are Bearish with a score of 37.9 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 13.9 percent.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 36.5 | 56.1 | 5.8 |

| – Percent of Open Interest Shorts: | 40.0 | 45.4 | 13.0 |

| – Net Position: | -1,573 | 4,858 | -3,285 |

| – Gross Longs: | 16,521 | 25,420 | 2,620 |

| – Gross Shorts: | 18,094 | 20,562 | 5,905 |

| – Long to Short Ratio: | 0.9 to 1 | 1.2 to 1 | 0.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 68.6 | 37.9 | 13.9 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 6.5 | -6.0 | 0.6 |

Mexican Peso Futures:

The Mexican Peso large speculator standing this week equaled a net position of -23,053 contracts in the data reported through Tuesday. This was a weekly boost of 6,845 contracts from the previous week which had a total of -29,898 net contracts.

The Mexican Peso large speculator standing this week equaled a net position of -23,053 contracts in the data reported through Tuesday. This was a weekly boost of 6,845 contracts from the previous week which had a total of -29,898 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 17.5 percent. The commercials are Bullish-Extreme with a score of 81.4 percent and the small traders (not shown in chart) are Bullish with a score of 53.0 percent.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 52.6 | 44.0 | 3.0 |

| – Percent of Open Interest Shorts: | 64.5 | 33.3 | 1.8 |

| – Net Position: | -23,053 | 20,696 | 2,357 |

| – Gross Longs: | 101,415 | 84,884 | 5,777 |

| – Gross Shorts: | 124,468 | 64,188 | 3,420 |

| – Long to Short Ratio: | 0.8 to 1 | 1.3 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 17.5 | 81.4 | 53.0 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.6 | -1.0 | -6.5 |

Brazilian Real Futures:

The Brazilian Real large speculator standing this week equaled a net position of -1,130 contracts in the data reported through Tuesday. This was a weekly fall of -12,842 contracts from the previous week which had a total of 11,712 net contracts.

The Brazilian Real large speculator standing this week equaled a net position of -1,130 contracts in the data reported through Tuesday. This was a weekly fall of -12,842 contracts from the previous week which had a total of 11,712 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 49.3 percent. The commercials are Bullish with a score of 50.7 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 84.6 percent.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 49.8 | 35.4 | 14.7 |

| – Percent of Open Interest Shorts: | 55.2 | 38.0 | 6.7 |

| – Net Position: | -1,130 | -561 | 1,691 |

| – Gross Longs: | 10,562 | 7,500 | 3,115 |

| – Gross Shorts: | 11,692 | 8,061 | 1,424 |

| – Long to Short Ratio: | 0.9 to 1 | 0.9 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 49.3 | 50.7 | 84.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -44.7 | 44.3 | 0.5 |

Bitcoin Futures:

The Bitcoin large speculator standing this week equaled a net position of -581 contracts in the data reported through Tuesday. This was a weekly decrease of -460 contracts from the previous week which had a total of -121 net contracts.

The Bitcoin large speculator standing this week equaled a net position of -581 contracts in the data reported through Tuesday. This was a weekly decrease of -460 contracts from the previous week which had a total of -121 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 69.7 percent. The commercials are Bullish with a score of 71.9 percent and the small traders (not shown in chart) are Bearish with a score of 20.6 percent.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 75.8 | 5.9 | 8.4 |

| – Percent of Open Interest Shorts: | 80.3 | 4.0 | 5.8 |

| – Net Position: | -581 | 244 | 337 |

| – Gross Longs: | 9,740 | 754 | 1,085 |

| – Gross Shorts: | 10,321 | 510 | 748 |

| – Long to Short Ratio: | 0.9 to 1 | 1.5 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 69.7 | 71.9 | 20.6 |

| – Strength Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -29.6 | 71.9 | 8.8 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024

- Bitcoin hits an all-time high above $88,000. Oil remains under pressure Nov 12, 2024

- Brent Crude Stumbles as Market Sentiments Turn Cautious Nov 12, 2024

- Bitcoin hits new record high just shy of $82,000! Nov 11, 2024

- The Dow Jones broke the 44 000 mark, and the S&P 500 topped 6 000 for the first time. The deflationary scenario continues in China Nov 11, 2024