By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC). The latest COT data is updated through Tuesday December 14th 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

Highlighting the COT stock market data is the third straight weekly decrease in the VIX Volatility futures bearish bets. The speculative net position in the VIX futures saw bearish bets fall by 2,453 contracts this week following drops by 20,782 contracts and 13,751 contracts in the previous two weeks, respectively. The VIX speculator position (currently at -44,950 contracts) is now at the least bearish level of the past eighty-one weeks, dating back to May 26th of 2020.

The stock markets that saw rising speculator bets this week were VIX (2,453 contracts), S&P500 Mini (2,378 contracts), Nasdaq Mini (7,685 contracts), Nikkei 225 USD (-9,025 contracts) and the MSCI EAFE Mini (1,071 contracts).

The markets with lower speculator bets this week were MSCI Emerging Markets Mini (-2,219 contracts), Russell 2000 Mini (-713 contracts) and the Dow Jones Industrial Average Mini (-2,124 contracts).

| Dec-14-2021 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| S&P500-Mini | 2,754,633 | 17 | 167,774 | 98 | -203,537 | 29 | 35,763 | 34 |

| Nikkei 225 | 15,643 | 4 | -7,814 | 30 | 7,429 | 78 | 385 | 32 |

| Nasdaq-Mini | 269,716 | 54 | 33,463 | 94 | -34,203 | 5 | 740 | 46 |

| DowJones-Mini | 120,668 | 99 | -6,677 | 28 | 3,713 | 67 | 2,964 | 54 |

| VIX | 296,559 | 26 | -44,950 | 67 | 57,858 | 38 | -12,908 | 7 |

| Nikkei 225 Yen | 41,070 | 16 | 6,806 | 40 | 11,496 | 67 | -18,302 | 43 |

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

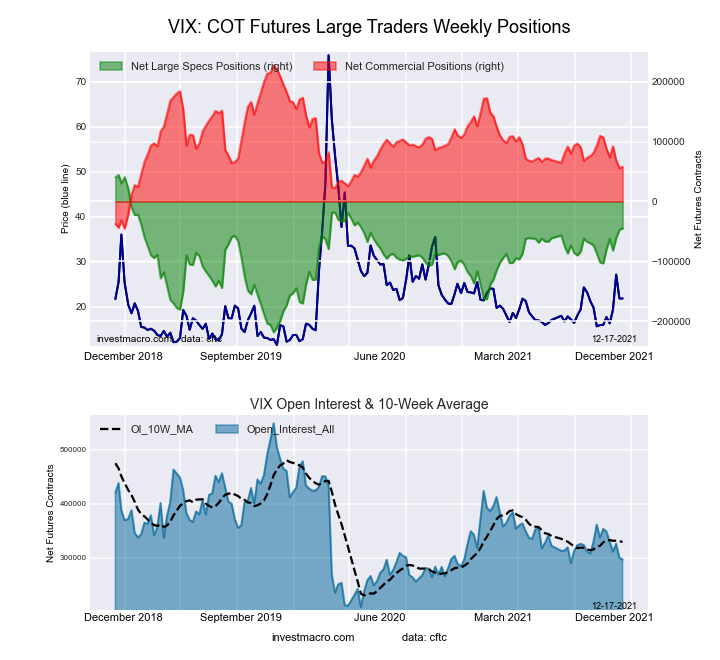

VIX Volatility Futures:

The VIX Volatility large speculator standing this week resulted in a net position of -44,950 contracts in the data reported through Tuesday. This was a weekly increase of 2,453 contracts from the previous week which had a total of -47,403 net contracts.

The VIX Volatility large speculator standing this week resulted in a net position of -44,950 contracts in the data reported through Tuesday. This was a weekly increase of 2,453 contracts from the previous week which had a total of -47,403 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 67.0 percent. The commercials are Bearish with a score of 37.8 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 7.4 percent.

| VIX Volatility Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 21.9 | 47.7 | 5.9 |

| – Percent of Open Interest Shorts: | 37.0 | 28.2 | 10.2 |

| – Net Position: | -44,950 | 57,858 | -12,908 |

| – Gross Longs: | 64,840 | 141,574 | 17,442 |

| – Gross Shorts: | 109,790 | 83,716 | 30,350 |

| – Long to Short Ratio: | 0.6 to 1 | 1.7 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 67.0 | 37.8 | 7.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 22.5 | -18.0 | -35.3 |

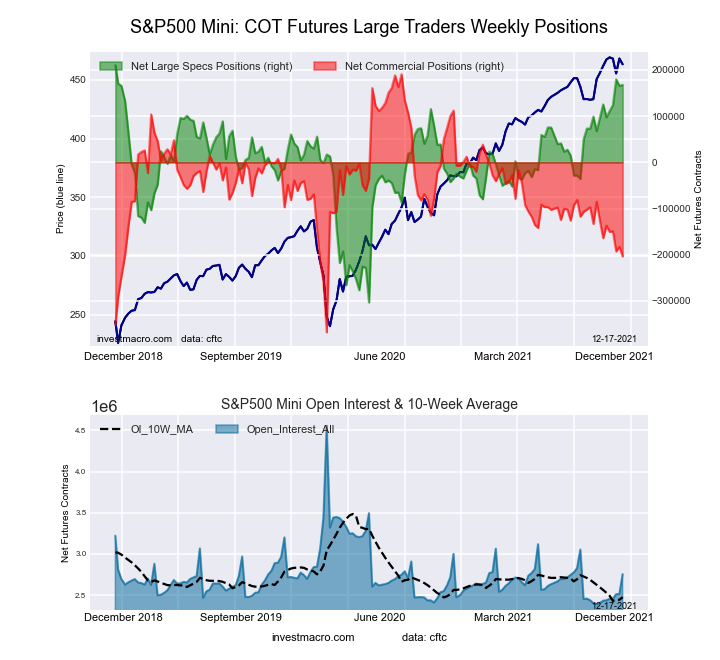

S&P500 Mini Futures:

The S&P500 Mini large speculator standing this week resulted in a net position of 167,774 contracts in the data reported through Tuesday. This was a weekly boost of 2,378 contracts from the previous week which had a total of 165,396 net contracts.

The S&P500 Mini large speculator standing this week resulted in a net position of 167,774 contracts in the data reported through Tuesday. This was a weekly boost of 2,378 contracts from the previous week which had a total of 165,396 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 97.5 percent. The commercials are Bearish with a score of 29.4 percent and the small traders (not shown in chart) are Bearish with a score of 33.9 percent.

| S&P500 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 16.0 | 65.6 | 11.8 |

| – Percent of Open Interest Shorts: | 9.9 | 73.0 | 10.5 |

| – Net Position: | 167,774 | -203,537 | 35,763 |

| – Gross Longs: | 441,419 | 1,808,330 | 325,418 |

| – Gross Shorts: | 273,645 | 2,011,867 | 289,655 |

| – Long to Short Ratio: | 1.6 to 1 | 0.9 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 97.5 | 29.4 | 33.9 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 8.8 | -7.1 | -0.6 |

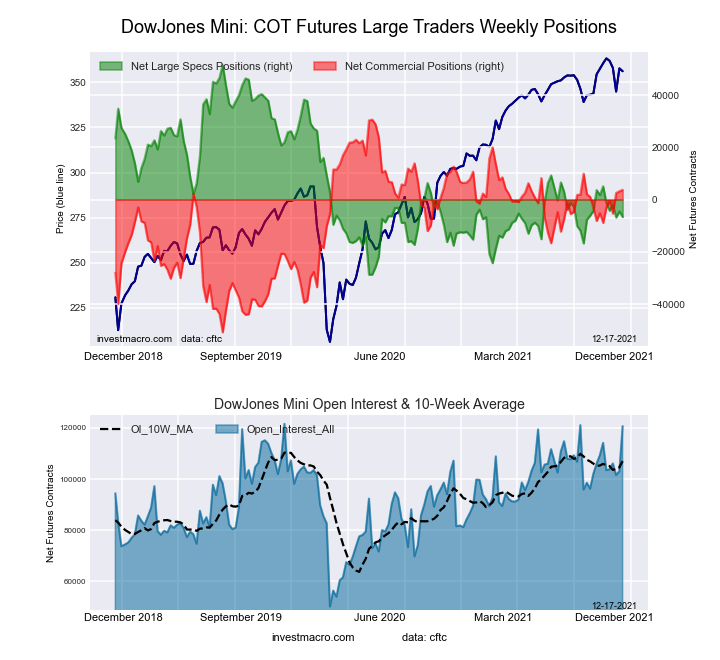

Dow Jones Mini Futures:

The Dow Jones Mini large speculator standing this week resulted in a net position of -6,677 contracts in the data reported through Tuesday. This was a weekly reduction of -2,124 contracts from the previous week which had a total of -4,553 net contracts.

The Dow Jones Mini large speculator standing this week resulted in a net position of -6,677 contracts in the data reported through Tuesday. This was a weekly reduction of -2,124 contracts from the previous week which had a total of -4,553 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 27.5 percent. The commercials are Bullish with a score of 67.0 percent and the small traders (not shown in chart) are Bullish with a score of 54.3 percent.

| Dow Jones Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 25.8 | 54.5 | 15.9 |

| – Percent of Open Interest Shorts: | 31.4 | 51.5 | 13.5 |

| – Net Position: | -6,677 | 3,713 | 2,964 |

| – Gross Longs: | 31,182 | 65,821 | 19,224 |

| – Gross Shorts: | 37,859 | 62,108 | 16,260 |

| – Long to Short Ratio: | 0.8 to 1 | 1.1 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 27.5 | 67.0 | 54.3 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -14.7 | 15.5 | -4.6 |

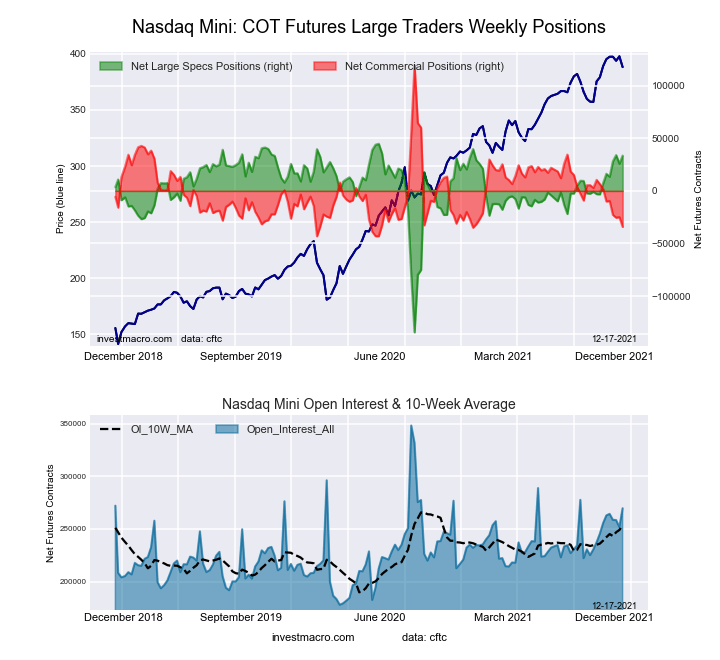

Nasdaq Mini Futures:

The Nasdaq Mini large speculator standing this week resulted in a net position of 33,463 contracts in the data reported through Tuesday. This was a weekly increase of 7,685 contracts from the previous week which had a total of 25,778 net contracts.

The Nasdaq Mini large speculator standing this week resulted in a net position of 33,463 contracts in the data reported through Tuesday. This was a weekly increase of 7,685 contracts from the previous week which had a total of 25,778 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 93.7 percent. The commercials are Bearish-Extreme with a score of 5.5 percent and the small traders (not shown in chart) are Bearish with a score of 45.6 percent.

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.5 | 46.0 | 16.5 |

| – Percent of Open Interest Shorts: | 19.1 | 58.7 | 16.2 |

| – Net Position: | 33,463 | -34,203 | 740 |

| – Gross Longs: | 85,036 | 124,070 | 44,448 |

| – Gross Shorts: | 51,573 | 158,273 | 43,708 |

| – Long to Short Ratio: | 1.6 to 1 | 0.8 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 93.7 | 5.5 | 45.6 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.7 | -22.1 | 21.8 |

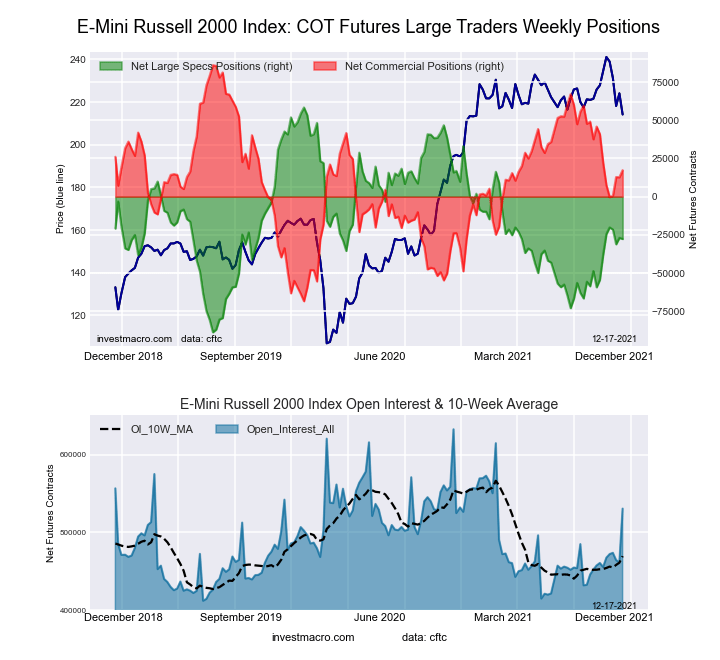

Russell 2000 Mini Futures:

The Russell 2000 Mini large speculator standing this week resulted in a net position of -27,714 contracts in the data reported through Tuesday. This was a weekly decrease of -713 contracts from the previous week which had a total of -27,001 net contracts.

The Russell 2000 Mini large speculator standing this week resulted in a net position of -27,714 contracts in the data reported through Tuesday. This was a weekly decrease of -713 contracts from the previous week which had a total of -27,001 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 41.5 percent. The commercials are Bullish with a score of 55.5 percent and the small traders (not shown in chart) are Bullish with a score of 62.4 percent.

| Russell 2000 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 12.6 | 77.5 | 6.3 |

| – Percent of Open Interest Shorts: | 17.8 | 74.2 | 4.3 |

| – Net Position: | -27,714 | 17,302 | 10,412 |

| – Gross Longs: | 66,744 | 410,815 | 33,169 |

| – Gross Shorts: | 94,458 | 393,513 | 22,757 |

| – Long to Short Ratio: | 0.7 to 1 | 1.0 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 41.5 | 55.5 | 62.4 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 7.1 | -3.3 | -15.3 |

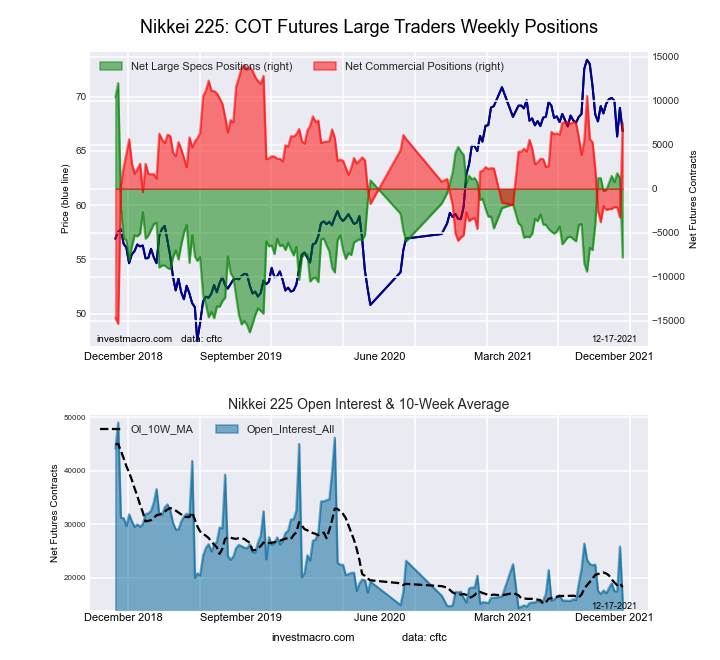

Nikkei Stock Average (USD) Futures:

The Nikkei Stock Average (USD) large speculator standing this week resulted in a net position of -7,814 contracts in the data reported through Tuesday. This was a weekly lowering of -9,025 contracts from the previous week which had a total of 1,211 net contracts.

The Nikkei Stock Average (USD) large speculator standing this week resulted in a net position of -7,814 contracts in the data reported through Tuesday. This was a weekly lowering of -9,025 contracts from the previous week which had a total of 1,211 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 30.0 percent. The commercials are Bullish with a score of 77.5 percent and the small traders (not shown in chart) are Bearish with a score of 31.7 percent.

| Nikkei Stock Average Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 10.4 | 65.4 | 24.0 |

| – Percent of Open Interest Shorts: | 60.4 | 18.0 | 21.6 |

| – Net Position: | -7,814 | 7,429 | 385 |

| – Gross Longs: | 1,633 | 10,237 | 3,759 |

| – Gross Shorts: | 9,447 | 2,808 | 3,374 |

| – Long to Short Ratio: | 0.2 to 1 | 3.6 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 30.0 | 77.5 | 31.7 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -27.1 | 33.5 | -27.6 |

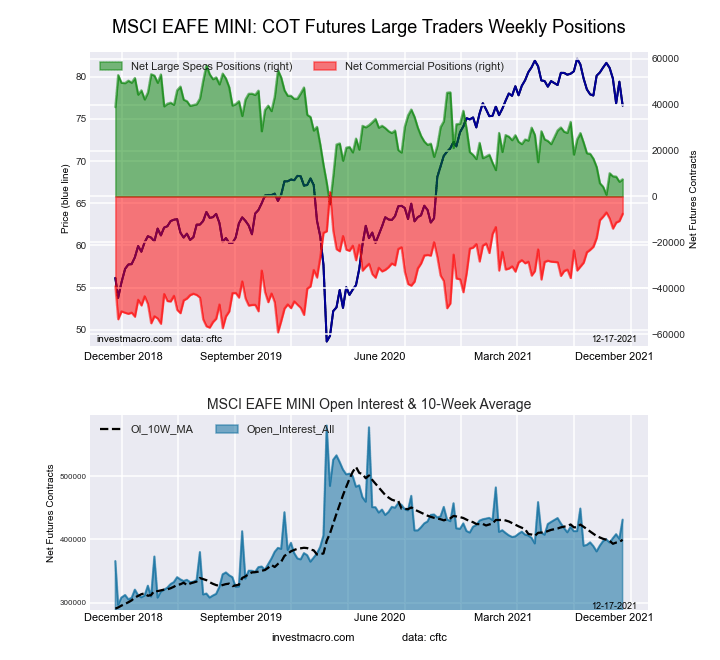

MSCI EAFE Mini Futures:

The MSCI EAFE Mini large speculator standing this week resulted in a net position of 7,480 contracts in the data reported through Tuesday. This was a weekly boost of 1,071 contracts from the previous week which had a total of 6,409 net contracts.

The MSCI EAFE Mini large speculator standing this week resulted in a net position of 7,480 contracts in the data reported through Tuesday. This was a weekly boost of 1,071 contracts from the previous week which had a total of 6,409 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 17.9 percent. The commercials are Bullish-Extreme with a score of 84.5 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 16.6 percent.

| MSCI EAFE Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 5.7 | 90.7 | 2.5 |

| – Percent of Open Interest Shorts: | 4.0 | 92.4 | 2.5 |

| – Net Position: | 7,480 | -7,567 | 87 |

| – Gross Longs: | 24,572 | 391,047 | 10,826 |

| – Gross Shorts: | 17,092 | 398,614 | 10,739 |

| – Long to Short Ratio: | 1.4 to 1 | 1.0 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 17.9 | 84.5 | 16.6 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 5.4 | 2.0 | -41.1 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024