By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC). This week’s reports are delayed due to last week’s Veteran’s Day holiday.

The latest COT data is updated through Tuesday November 9th 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

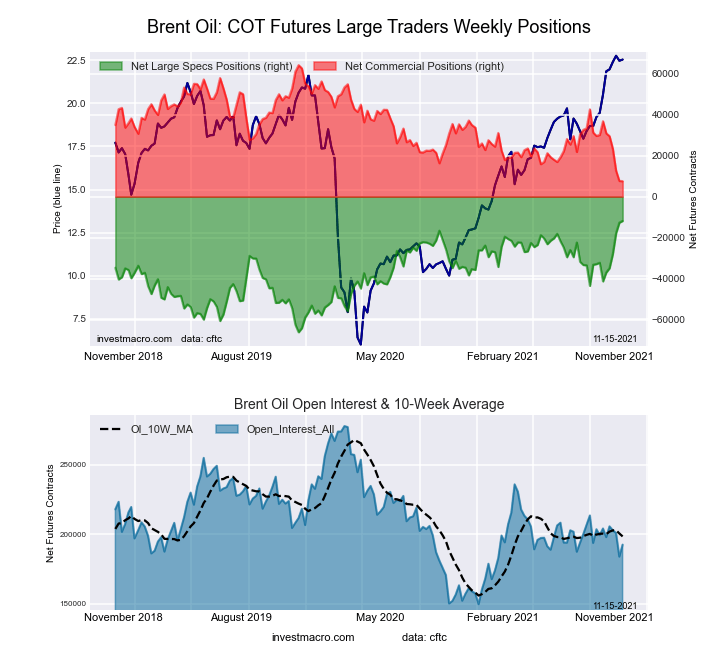

Highlighting the latest COT Energy data is the rising position of the Brent Oil (Last Day) bets. Brent speculative positions have been steadily improving in the past two months and have now gained for six consecutive weeks. The speculative positions for Brent historically are usually bearish and the net position has continually remained in a bearish overall standing since 2013. The speculator betting is currently trending closer to the neutral zone with the net position at just -11,851 contracts. This latest standing for Brent crude bets puts the positioning at their best level of the past 159 weeks, dating all the way back to October 30th of 2018.

| Nov-09-2021 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| WTI Crude | 2,081,385 | 22 | 421,312 | 46 | -461,964 | 44 | 40,652 | 72 |

| Gold | 571,025 | 43 | 250,181 | 71 | -275,489 | 30 | 25,308 | 42 |

| Silver | 144,370 | 11 | 36,915 | 59 | -53,669 | 46 | 16,754 | 38 |

| Copper | 213,365 | 36 | 22,789 | 59 | -33,194 | 37 | 10,405 | 85 |

| Palladium | 11,819 | 24 | -2,954 | 2 | 3,003 | 97 | -49 | 42 |

| Platinum | 57,866 | 18 | 17,630 | 28 | -24,263 | 74 | 6,633 | 55 |

| Natural Gas | 1,305,687 | 45 | -142,191 | 36 | 98,418 | 62 | 43,773 | 90 |

| Brent | 192,398 | 33 | -11,851 | 100 | 7,567 | 0 | 4,284 | 82 |

| Heating Oil | 421,299 | 61 | 20,022 | 72 | -42,921 | 26 | 22,899 | 78 |

| Soybeans | 644,317 | 9 | 27,584 | 37 | 9,085 | 68 | -36,669 | 11 |

| Corn | 1,540,731 | 28 | 375,298 | 78 | -320,877 | 26 | -54,421 | 12 |

| Coffee | 312,143 | 67 | 60,820 | 93 | -65,365 | 9 | 4,545 | 20 |

| Sugar | 897,739 | 22 | 212,031 | 80 | -260,761 | 19 | 48,730 | 68 |

| Wheat | 405,438 | 37 | 19,203 | 63 | -13,409 | 28 | -5,794 | 74 |

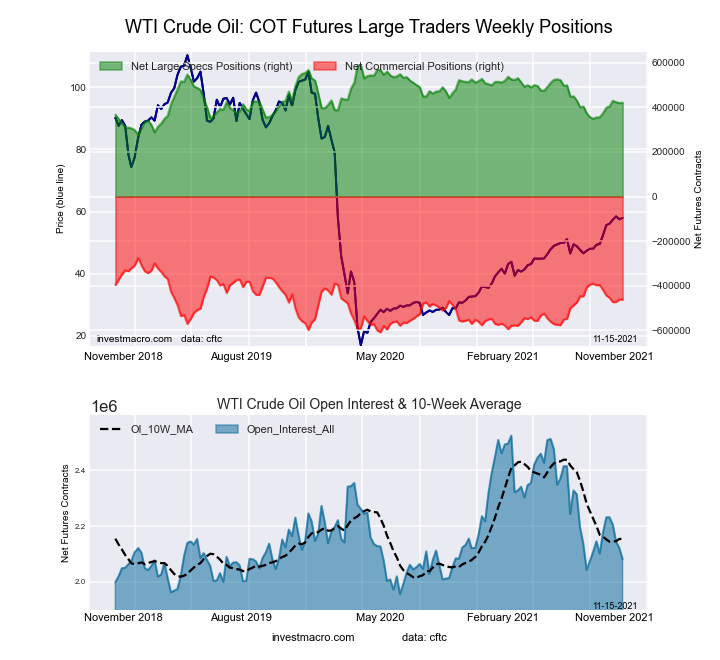

WTI Crude Oil Futures:

The WTI Crude Oil Futures large speculator standing this week equaled a net position of 421,312 contracts in the data reported through Tuesday. This was a weekly rise of 2,019 contracts from the previous week which had a total of 419,293 net contracts.

The WTI Crude Oil Futures large speculator standing this week equaled a net position of 421,312 contracts in the data reported through Tuesday. This was a weekly rise of 2,019 contracts from the previous week which had a total of 419,293 net contracts.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 46.2 percent. The commercials are Bearish with a score of 44.0 percent and the small traders (not shown in chart) are Bullish with a score of 72.3 percent.

| WTI Crude Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.5 | 33.9 | 4.6 |

| – Percent of Open Interest Shorts: | 6.3 | 56.1 | 2.6 |

| – Net Position: | 421,312 | -461,964 | 40,652 |

| – Gross Longs: | 552,579 | 705,286 | 95,755 |

| – Gross Shorts: | 131,267 | 1,167,250 | 55,103 |

| – Long to Short Ratio: | 4.2 to 1 | 0.6 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 46.2 | 44.0 | 72.3 |

| – COT Index Reading (3 Year Range): | Bearish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 15.2 | -12.9 | -6.2 |

Brent Crude Oil Futures:

The Brent Crude Oil Futures large speculator standing this week equaled a net position of -11,851 contracts in the data reported through Tuesday. This was a weekly gain of 863 contracts from the previous week which had a total of -12,714 net contracts.

The Brent Crude Oil Futures large speculator standing this week equaled a net position of -11,851 contracts in the data reported through Tuesday. This was a weekly gain of 863 contracts from the previous week which had a total of -12,714 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 100.0 percent. The commercials are Bearish-Extreme with a score of 0.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 82.2 percent.

| Brent Crude Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.9 | 39.4 | 3.9 |

| – Percent of Open Interest Shorts: | 31.1 | 35.5 | 1.7 |

| – Net Position: | -11,851 | 7,567 | 4,284 |

| – Gross Longs: | 47,922 | 75,867 | 7,540 |

| – Gross Shorts: | 59,773 | 68,300 | 3,256 |

| – Long to Short Ratio: | 0.8 to 1 | 1.1 to 1 | 2.3 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 100.0 | 0.0 | 82.2 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 54.3 | -51.7 | -2.4 |

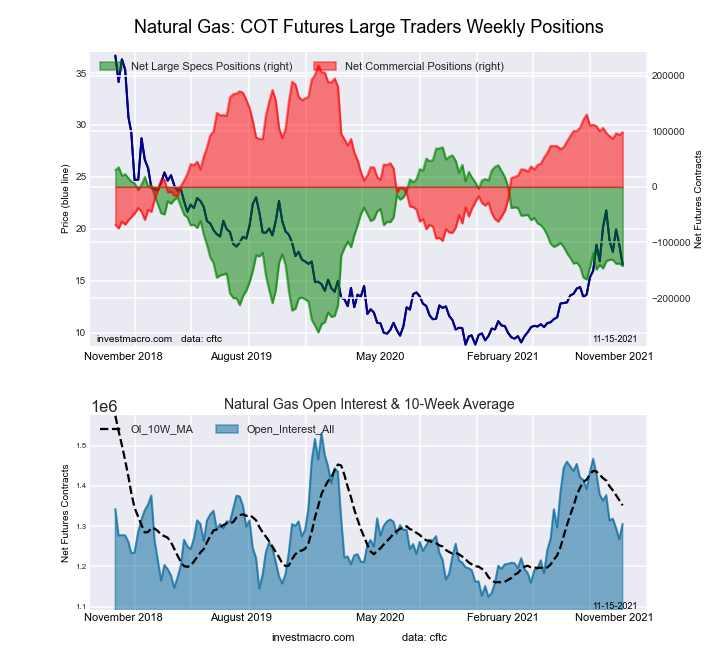

Natural Gas Futures:

The Natural Gas Futures large speculator standing this week equaled a net position of -142,191 contracts in the data reported through Tuesday. This was a weekly decrease of -4,478 contracts from the previous week which had a total of -137,713 net contracts.

The Natural Gas Futures large speculator standing this week equaled a net position of -142,191 contracts in the data reported through Tuesday. This was a weekly decrease of -4,478 contracts from the previous week which had a total of -137,713 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 35.9 percent. The commercials are Bullish with a score of 61.9 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 89.8 percent.

| Natural Gas Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 19.4 | 43.4 | 5.2 |

| – Percent of Open Interest Shorts: | 30.3 | 35.9 | 1.9 |

| – Net Position: | -142,191 | 98,418 | 43,773 |

| – Gross Longs: | 253,588 | 566,746 | 67,961 |

| – Gross Shorts: | 395,779 | 468,328 | 24,188 |

| – Long to Short Ratio: | 0.6 to 1 | 1.2 to 1 | 2.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 35.9 | 61.9 | 89.8 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.4 | -2.4 | 7.7 |

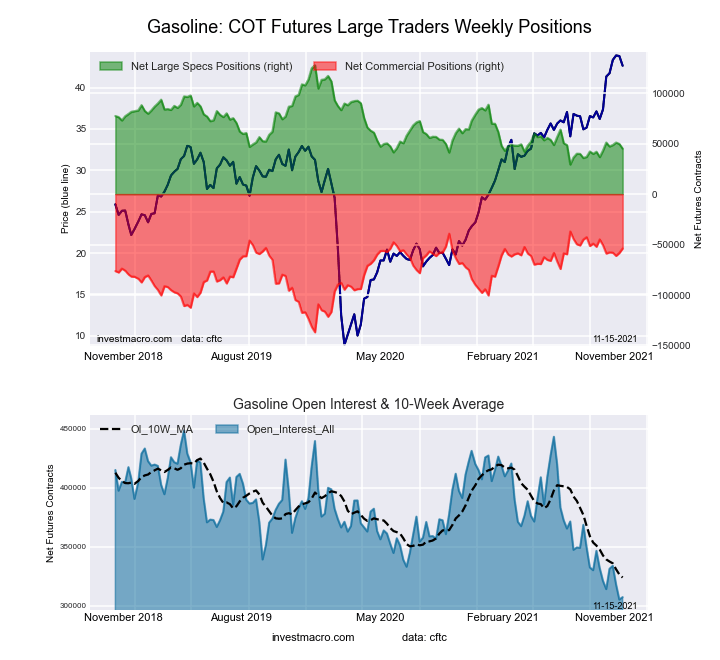

Gasoline Blendstock Futures:

The Gasoline Blendstock Futures large speculator standing this week equaled a net position of 45,069 contracts in the data reported through Tuesday. This was a weekly reduction of -4,628 contracts from the previous week which had a total of 49,697 net contracts.

The Gasoline Blendstock Futures large speculator standing this week equaled a net position of 45,069 contracts in the data reported through Tuesday. This was a weekly reduction of -4,628 contracts from the previous week which had a total of 49,697 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 16.0 percent. The commercials are Bullish-Extreme with a score of 83.1 percent and the small traders (not shown in chart) are Bullish with a score of 64.3 percent.

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.6 | 45.9 | 7.3 |

| – Percent of Open Interest Shorts: | 17.9 | 63.4 | 4.4 |

| – Net Position: | 45,069 | -53,896 | 8,827 |

| – Gross Longs: | 100,218 | 141,151 | 22,325 |

| – Gross Shorts: | 55,149 | 195,047 | 13,498 |

| – Long to Short Ratio: | 1.8 to 1 | 0.7 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 16.0 | 83.1 | 64.3 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.9 | -3.2 | 7.9 |

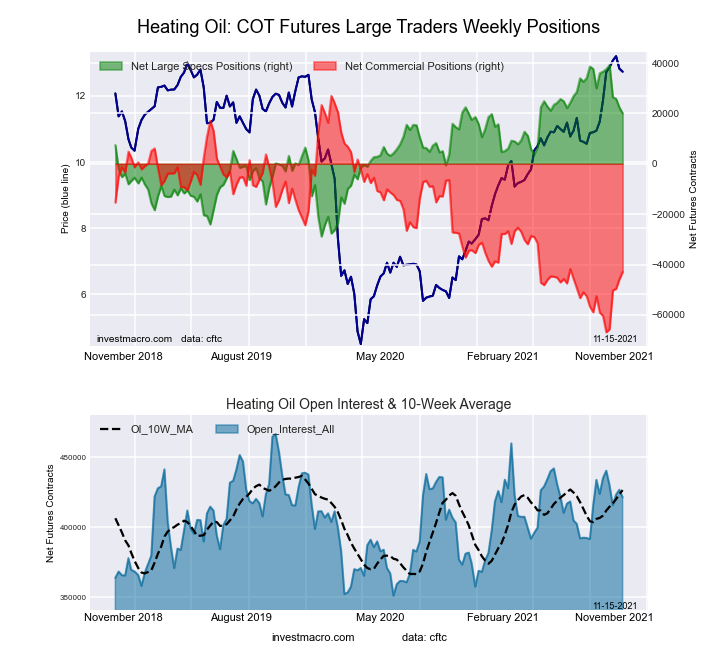

#2 Heating Oil NY-Harbor Futures:

The #2 Heating Oil NY-Harbor Futures large speculator standing this week equaled a net position of 20,022 contracts in the data reported through Tuesday. This was a weekly decline of -2,362 contracts from the previous week which had a total of 22,384 net contracts.

The #2 Heating Oil NY-Harbor Futures large speculator standing this week equaled a net position of 20,022 contracts in the data reported through Tuesday. This was a weekly decline of -2,362 contracts from the previous week which had a total of 22,384 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 71.9 percent. The commercials are Bearish with a score of 25.5 percent and the small traders (not shown in chart) are Bullish with a score of 77.7 percent.

| Heating Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 12.9 | 54.5 | 11.1 |

| – Percent of Open Interest Shorts: | 8.1 | 64.7 | 5.7 |

| – Net Position: | 20,022 | -42,921 | 22,899 |

| – Gross Longs: | 54,200 | 229,756 | 46,970 |

| – Gross Shorts: | 34,178 | 272,677 | 24,071 |

| – Long to Short Ratio: | 1.6 to 1 | 0.8 to 1 | 2.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 71.9 | 25.5 | 77.7 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -24.4 | 18.6 | -3.0 |

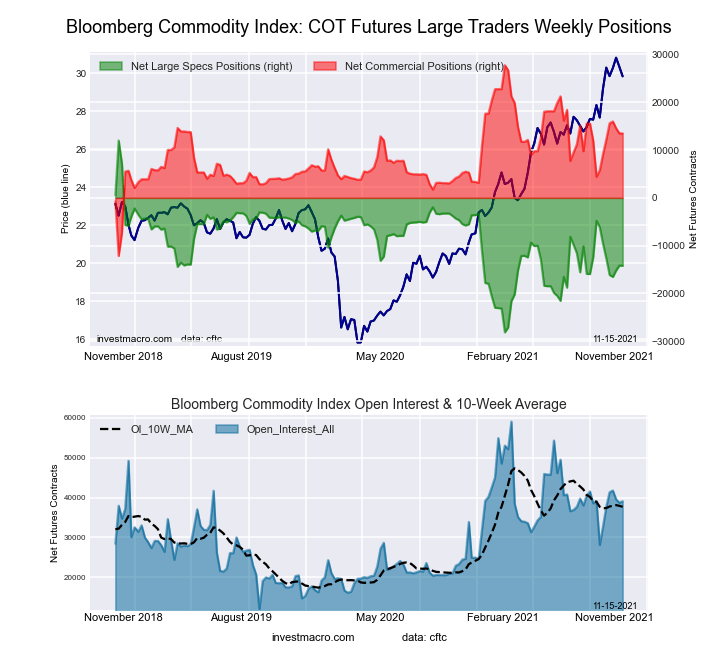

Bloomberg Commodity Index Futures:

The Bloomberg Commodity Index Futures large speculator standing this week equaled a net position of -14,191 contracts in the data reported through Tuesday. This was a weekly decrease of -45 contracts from the previous week which had a total of -14,146 net contracts.

The Bloomberg Commodity Index Futures large speculator standing this week equaled a net position of -14,191 contracts in the data reported through Tuesday. This was a weekly decrease of -45 contracts from the previous week which had a total of -14,146 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 34.7 percent. The commercials are Bullish with a score of 64.3 percent and the small traders (not shown in chart) are Bullish with a score of 55.1 percent.

| Bloomberg Index Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 53.8 | 39.7 | 2.0 |

| – Percent of Open Interest Shorts: | 90.1 | 5.2 | 0.2 |

| – Net Position: | -14,191 | 13,490 | 701 |

| – Gross Longs: | 21,027 | 15,506 | 769 |

| – Gross Shorts: | 35,218 | 2,016 | 68 |

| – Long to Short Ratio: | 0.6 to 1 | 7.7 to 1 | 11.3 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 34.7 | 64.3 | 55.1 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.4 | 10.8 | 11.5 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

- Goldman Sachs has updated its economic projections for 2025. EU countries are looking for alternative sources of natural gas Dec 23, 2024

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & 10-Year Bonds Dec 21, 2024

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Palladium Dec 21, 2024

- COT Soft Commodities Charts: Speculator Bets led by Live Cattle, Lean Hogs & Coffee Dec 21, 2024

- COT Stock Market Charts: Speculator Bets led by S&P500 & Russell-2000 Dec 21, 2024

- Riksbank and Banxico cut interest rates by 0.25%. BoE, Norges Bank, and PBoC left rates unchanged Dec 20, 2024

- Brent Oil Under Pressure Again: USD and China in Focus Dec 20, 2024

- Market round-up: BoE & BoJ hold, Fed delivers ‘hawkish’ cut Dec 19, 2024

- NZD/USD at a New Low: The Problem is the US Dollar and Local GDP Dec 19, 2024

- The Dow Jones has fallen for 9 consecutive trading sessions. Inflationary pressures are easing in Canada. Dec 18, 2024