By InvestMacro

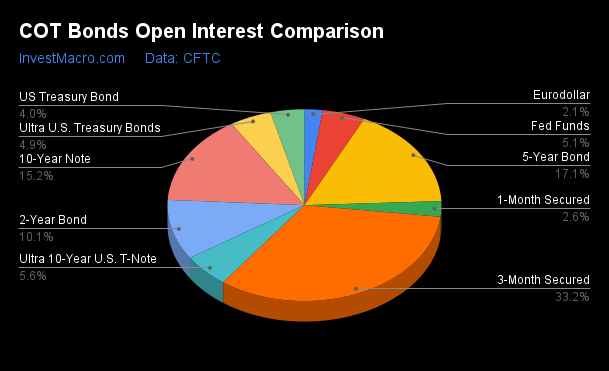

Here are the latest charts and statistics for the Commitment of Traders (COT) reports data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday May 9th and shows a quick view of how large traders (for-profit speculators and commercial hedgers) were positioned in the futures markets.

Weekly Speculator Changes led by SOFR 3-Months & 10-Year Bonds

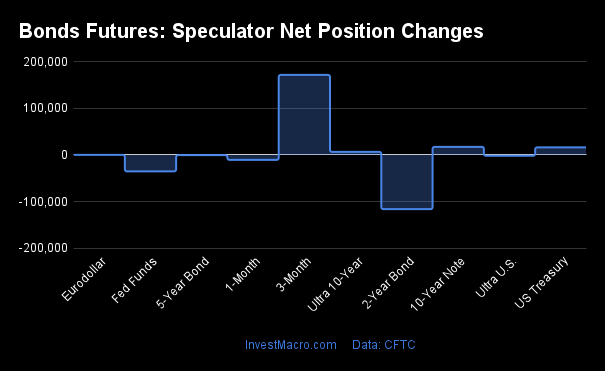

The COT bond market speculator bets were higher this week as five out of the nine bond markets we cover had higher positioning while the other four markets had lower speculator contracts.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Leading the gains for the bond markets was the SOFR 3-Months (172,071 contracts) with the 10-Year Bonds (17,449 contracts), the US Treasury Bonds (16,285 contracts), the Ultra 10-Year Bonds (6,690 contracts) and the Eurodollar (257 contracts) also showing positive weeks.

The bond markets with declines in speculator bets for the week were the 2-Year Bonds (-116,409 contracts), the Fed Funds (-35,180 contracts), the 5-Year Bonds (-412 contracts) and the Ultra Treasury Bonds (-1,713 contracts) also seeing lower bets on the week.

Speculators drop 2-Year and 5-Year Bonds bets to record lows

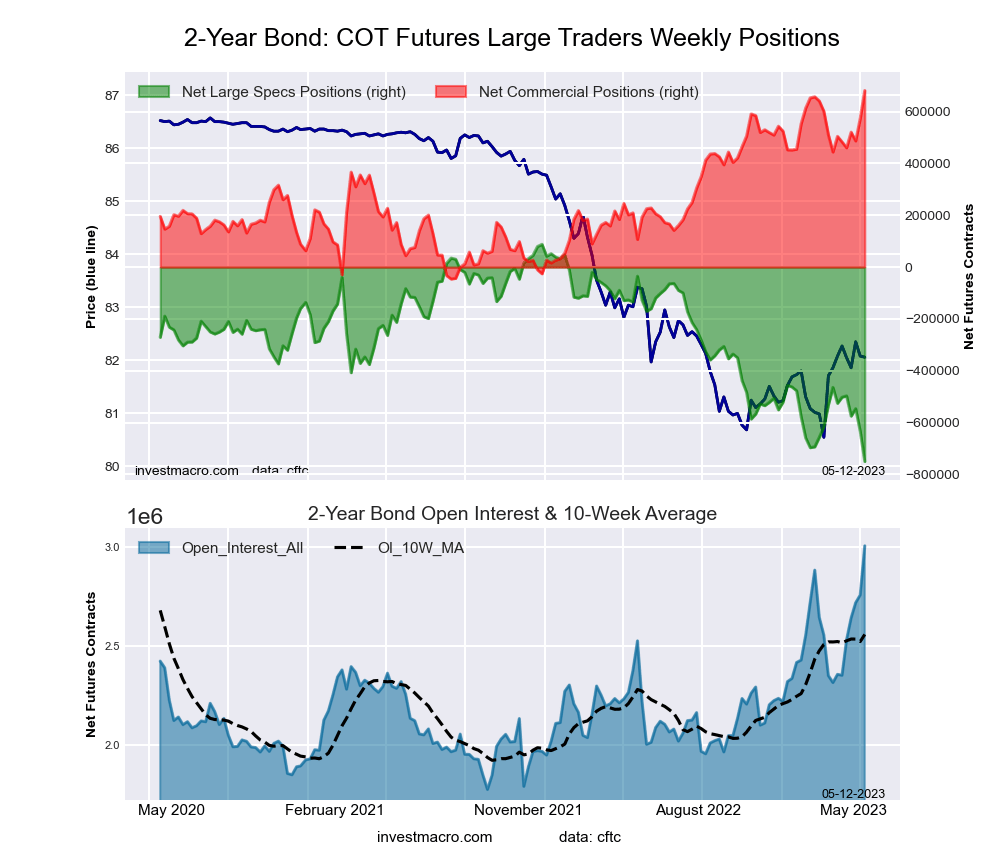

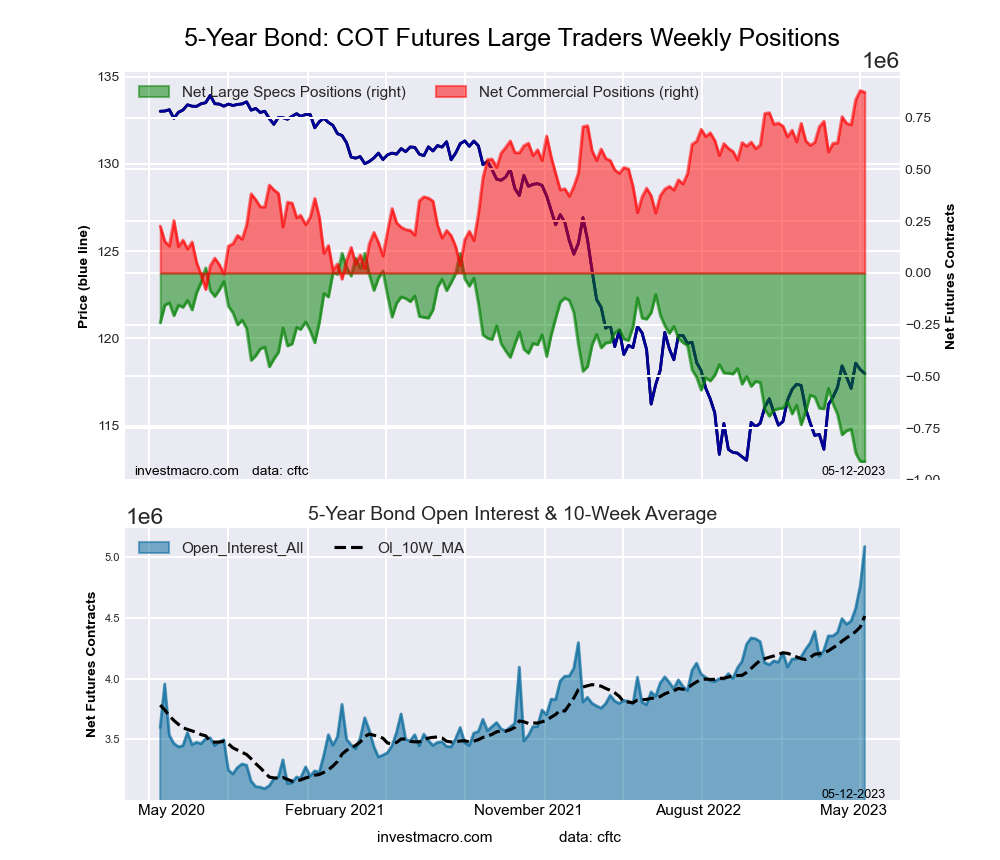

Highlighting the COT bonds data is this week’s record bearish speculator positioning in both the 2-Year and the 5-Year bonds.

The large speculators in the 2-Year bonds sharply added to their bearish bets for a second straight week this week and for the third time in the past four weeks. Speculators have now added a total of -253,044 contracts to the bearish position over the past four weeks alone. This weakness in sentiment has pushed the overall bearish standing to the highest level on record at a total of -749,885 contracts, according to CFTC data that goes back to 1990. This record bearish position surpassed the previous one that was recently registered on February 14th at a total of -696,686 contracts.

The 5-Year Bond speculator positions have also dropped their bets to a record low position this week and have done so for three straight weeks in succession. The 5-Year speculators have added a whopping -353,430 contracts to their net positions over the past eight weeks. This week’s record bearish position is at a total of -910,642 contracts which is the all-time low dating back to 1988, according to the CFTC.

Despite these all-time lows in both the 2-Year and 5-Years positions, their respective futures prices have not followed lower. The 2-Year futures price closed this week at 103.05 and is almost 2 percent higher than the low that was reached in early March at 101.09. Meanwhile, the 5-Year futures price closed at 110.01 this week and is approximately 4.35 percent higher than the low that was hit in October at 105.14. Overall in the longer view, the 5-Year price is down by approximately 13 percent from the highs of 2021 while the 2-Year prices are down by about 6.5 percent from 2021.

The outlook for both of these bonds will depend very much on the path forward for the benchmark interest rate controlled by the US Federal Reserve and how the economy evolves. The latest forecast for the next Fed meeting shows a high likelihood of an interest rate pause (almost 85 percent per the CME Fed tool). This pause would be a positive for bond prices while if an economic recession does take place, bond prices would likely be a place for safe haven investments. A recession could also prompt a Fed interest rate cut (bond price positive). However, further upside in inflation and followed by more Fed hikes would be a negative for bonds. The US debt ceiling is also an outlier risk event coming up that needs to be kept in mind as well.

| May-09-2023 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| Eurodollar | 632,242 | 0 | -55,110 | 73 | 58,414 | 23 | -3,304 | 99 |

| FedFunds | 1,502,281 | 47 | -75,317 | 30 | 104,070 | 73 | -28,753 | 35 |

| 2-Year | 3,007,292 | 100 | -749,885 | 0 | 681,291 | 100 | 68,594 | 89 |

| Long T-Bond | 1,189,414 | 54 | -73,129 | 61 | 2,355 | 11 | 70,774 | 100 |

| 10-Year | 4,510,018 | 100 | -731,698 | 2 | 641,595 | 90 | 90,103 | 100 |

| 5-Year | 5,086,319 | 100 | -910,642 | 0 | 872,302 | 99 | 38,340 | 92 |

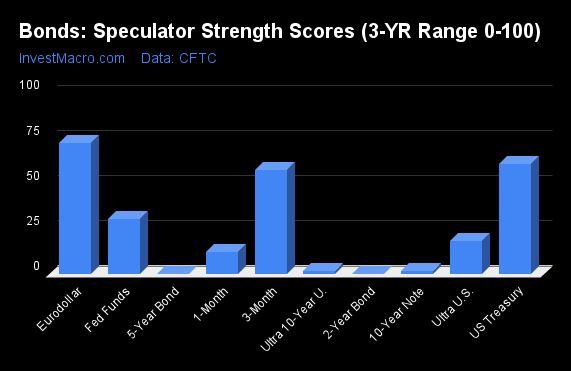

Strength Scores led by Eurodollar & US Treasury Bonds

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that the Eurodollar (73 percent) and the US Treasury Bonds (61 percent) lead the bond markets this week. The SOFR 3-Months (58 percent) comes in as the next highest in the weekly strength scores.

On the downside, the 5-Year Bonds (0 percent), the 2-Year Bonds (0 percent), the Ultra 10-Year Bonds (1 percent), the 10-Year Bonds (2 percent) and the Ultra US Treasury Bond (18.5 percent) come in at the lowest strength levels currently and are all in Extreme-Bearish territory (below 20 percent).

Strength Statistics:

Fed Funds (30.3 percent) vs Fed Funds previous week (34.7 percent)

2-Year Bond (0.0 percent) vs 2-Year Bond previous week (13.9 percent)

5-Year Bond (0.0 percent) vs 5-Year Bond previous week (0.0 percent)

10-Year Bond (1.9 percent) vs 10-Year Bond previous week (0.0 percent)

Ultra 10-Year Bond (1.4 percent) vs Ultra 10-Year Bond previous week (0.0 percent)

US Treasury Bond (60.8 percent) vs US Treasury Bond previous week (55.5 percent)

Ultra US Treasury Bond (18.5 percent) vs Ultra US Treasury Bond previous week (19.2 percent)

Eurodollar (72.6 percent) vs Eurodollar previous week (72.6 percent)

SOFR 3-Months (57.8 percent) vs SOFR 3-Months previous week (43.9 percent)

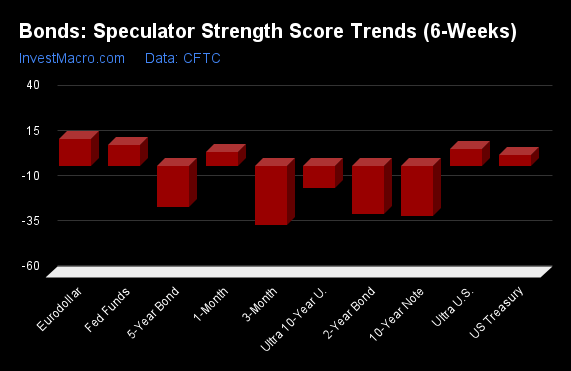

Eurodollar & Fed Funds top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that the Eurodollar (15 percent) and the Fed Funds (12 percent) lead the past six weeks trends for bonds. The Ultra Treasury Bonds (9 percent) and the US Treasury Bond (6 percent) are the next positive movers in the latest trends data.

The SOFR 3-Months (-33 percent) and the 10-Year Bonds (-28 percent) lead the downside trend scores currently with the 2-Year Bonds (-27 percent) and the 5-Year Bonds (-23 percent) following next with lower trend scores.

Strength Trend Statistics:

Fed Funds (11.5 percent) vs Fed Funds previous week (-1.9 percent)

2-Year Bond (-26.8 percent) vs 2-Year Bond previous week (-20.2 percent)

5-Year Bond (-22.7 percent) vs 5-Year Bond previous week (-27.7 percent)

10-Year Bond (-28.0 percent) vs 10-Year Bond previous week (-19.1 percent)

Ultra 10-Year Bond (-12.2 percent) vs Ultra 10-Year Bond previous week (-12.2 percent)

US Treasury Bond (5.9 percent) vs US Treasury Bond previous week (3.3 percent)

Ultra US Treasury Bond (9.0 percent) vs Ultra US Treasury Bond previous week (19.2 percent)

Eurodollar (14.7 percent) vs Eurodollar previous week (14.9 percent)

SOFR 3-Months (-32.9 percent) vs SOFR 3-Months previous week (-43.9 percent)

Individual Bond Markets:

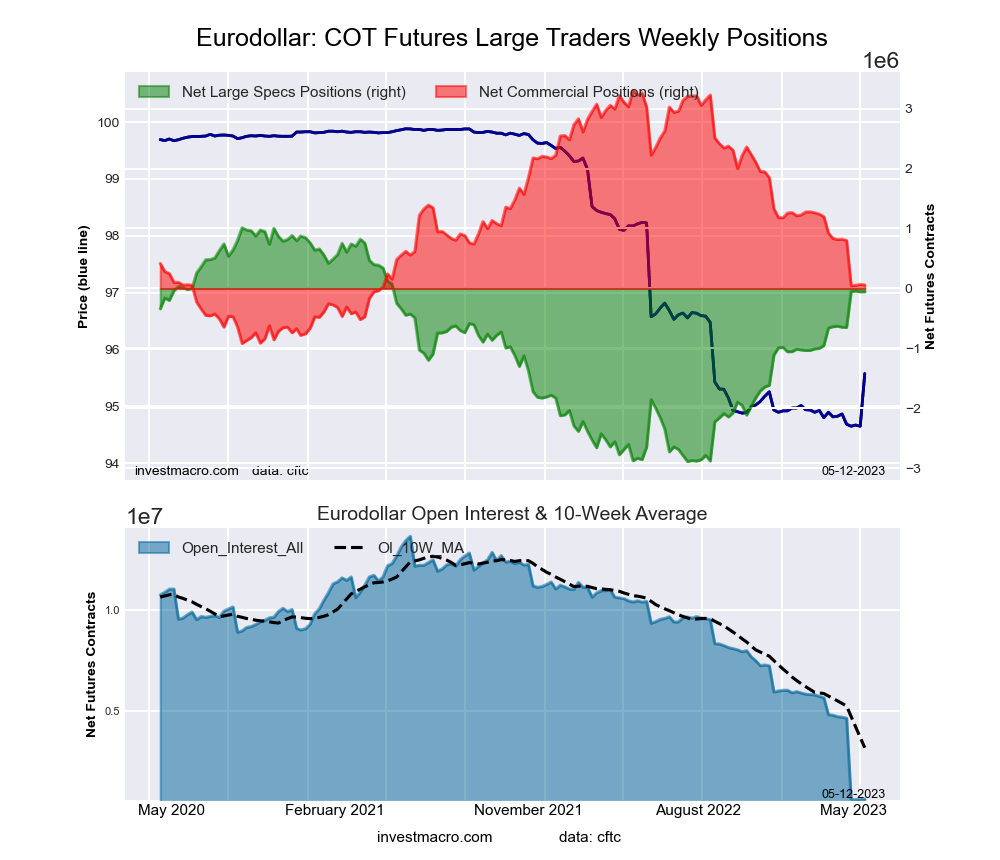

3-Month Eurodollars Futures:

The 3-Month Eurodollars large speculator standing this week resulted in a net position of -55,110 contracts in the data reported through Tuesday. This was a weekly advance of 257 contracts from the previous week which had a total of -55,367 net contracts.

The 3-Month Eurodollars large speculator standing this week resulted in a net position of -55,110 contracts in the data reported through Tuesday. This was a weekly advance of 257 contracts from the previous week which had a total of -55,367 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 72.6 percent. The commercials are Bearish with a score of 23.1 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 98.5 percent.

| 3-Month Eurodollars Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.9 | 63.2 | 10.5 |

| – Percent of Open Interest Shorts: | 33.6 | 53.9 | 11.1 |

| – Net Position: | -55,110 | 58,414 | -3,304 |

| – Gross Longs: | 157,203 | 399,297 | 66,638 |

| – Gross Shorts: | 212,313 | 340,883 | 69,942 |

| – Long to Short Ratio: | 0.7 to 1 | 1.2 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 72.6 | 23.1 | 98.5 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.7 | -18.0 | 38.2 |

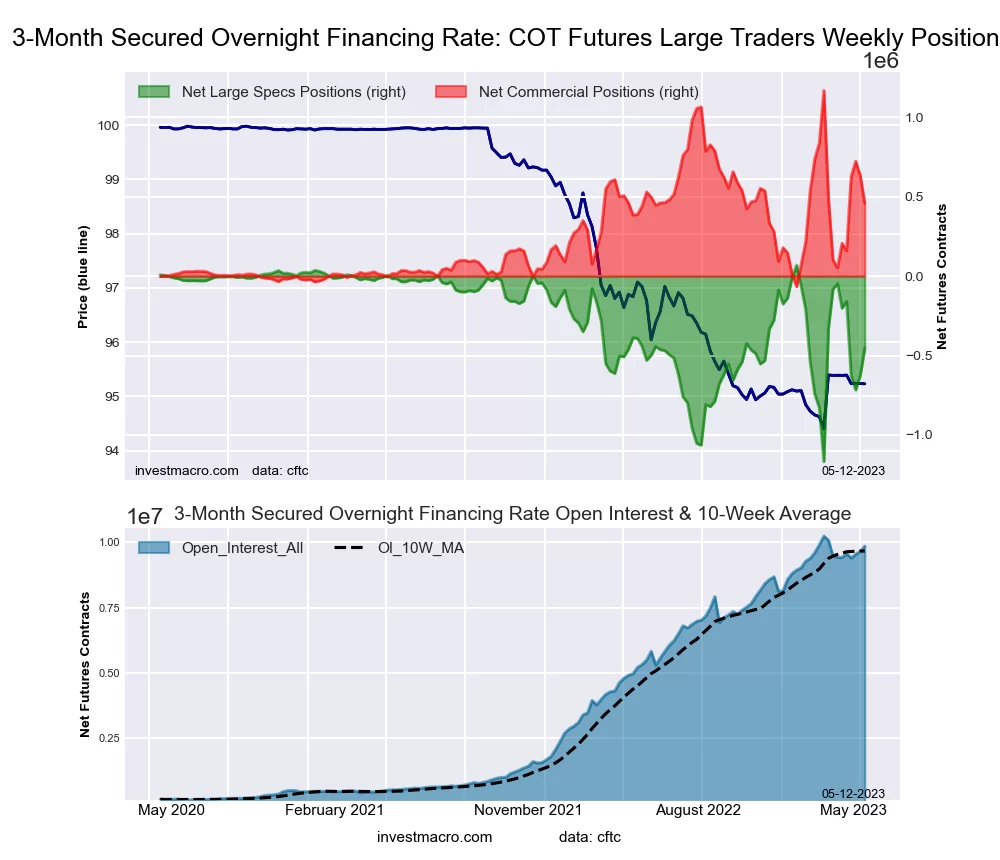

Secured Overnight Financing Rate (3-Month) Futures:

The Secured Overnight Financing Rate (3-Month) large speculator standing this week resulted in a net position of -452,828 contracts in the data reported through Tuesday. This was a weekly advance of 172,071 contracts from the previous week which had a total of -624,899 net contracts.

The Secured Overnight Financing Rate (3-Month) large speculator standing this week resulted in a net position of -452,828 contracts in the data reported through Tuesday. This was a weekly advance of 172,071 contracts from the previous week which had a total of -624,899 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 57.8 percent. The commercials are Bearish with a score of 42.5 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 85.3 percent.

| SOFR 3-Months Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 14.3 | 62.7 | 0.4 |

| – Percent of Open Interest Shorts: | 18.9 | 58.1 | 0.5 |

| – Net Position: | -452,828 | 457,566 | -4,738 |

| – Gross Longs: | 1,408,633 | 6,178,976 | 42,103 |

| – Gross Shorts: | 1,861,461 | 5,721,410 | 46,841 |

| – Long to Short Ratio: | 0.8 to 1 | 1.1 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 57.8 | 42.5 | 85.3 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -32.9 | 32.8 | 0.3 |

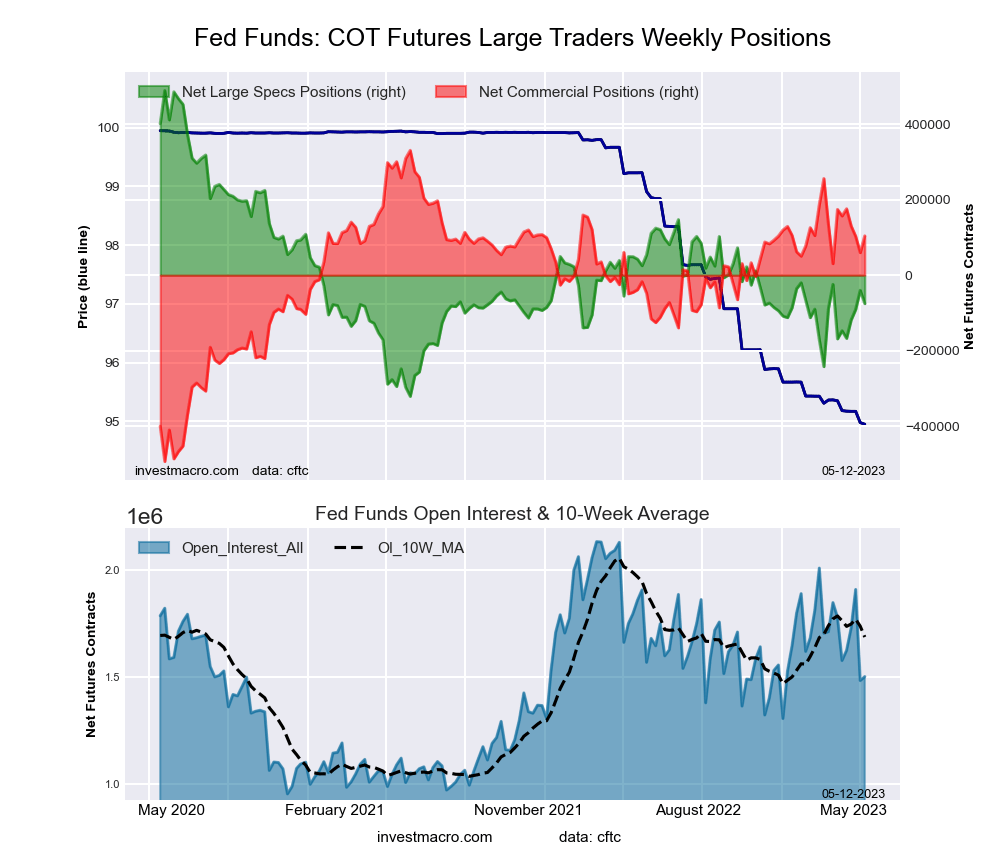

30-Day Federal Funds Futures:

The 30-Day Federal Funds large speculator standing this week resulted in a net position of -75,317 contracts in the data reported through Tuesday. This was a weekly fall of -35,180 contracts from the previous week which had a total of -40,137 net contracts.

The 30-Day Federal Funds large speculator standing this week resulted in a net position of -75,317 contracts in the data reported through Tuesday. This was a weekly fall of -35,180 contracts from the previous week which had a total of -40,137 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 30.3 percent. The commercials are Bullish with a score of 72.5 percent and the small traders (not shown in chart) are Bearish with a score of 34.6 percent.

| 30-Day Federal Funds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 4.0 | 78.4 | 2.3 |

| – Percent of Open Interest Shorts: | 9.0 | 71.5 | 4.2 |

| – Net Position: | -75,317 | 104,070 | -28,753 |

| – Gross Longs: | 59,367 | 1,178,447 | 34,793 |

| – Gross Shorts: | 134,684 | 1,074,377 | 63,546 |

| – Long to Short Ratio: | 0.4 to 1 | 1.1 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 30.3 | 72.5 | 34.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 11.5 | -8.5 | -45.8 |

2-Year Treasury Note Futures:

The 2-Year Treasury Note large speculator standing this week resulted in a net position of -749,885 contracts in the data reported through Tuesday. This was a weekly lowering of -116,409 contracts from the previous week which had a total of -633,476 net contracts.

The 2-Year Treasury Note large speculator standing this week resulted in a net position of -749,885 contracts in the data reported through Tuesday. This was a weekly lowering of -116,409 contracts from the previous week which had a total of -633,476 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 0.0 percent. The commercials are Bullish-Extreme with a score of 100.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 88.7 percent.

| 2-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 8.8 | 82.8 | 7.4 |

| – Percent of Open Interest Shorts: | 33.8 | 60.2 | 5.1 |

| – Net Position: | -749,885 | 681,291 | 68,594 |

| – Gross Longs: | 266,070 | 2,490,414 | 221,650 |

| – Gross Shorts: | 1,015,955 | 1,809,123 | 153,056 |

| – Long to Short Ratio: | 0.3 to 1 | 1.4 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 0.0 | 100.0 | 88.7 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -26.8 | 24.3 | 22.7 |

5-Year Treasury Note Futures:

The 5-Year Treasury Note large speculator standing this week resulted in a net position of -910,642 contracts in the data reported through Tuesday. This was a weekly reduction of -412 contracts from the previous week which had a total of -910,230 net contracts.

The 5-Year Treasury Note large speculator standing this week resulted in a net position of -910,642 contracts in the data reported through Tuesday. This was a weekly reduction of -412 contracts from the previous week which had a total of -910,230 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 0.0 percent. The commercials are Bullish-Extreme with a score of 99.1 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 91.5 percent.

| 5-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.4 | 81.5 | 7.1 |

| – Percent of Open Interest Shorts: | 27.3 | 64.4 | 6.3 |

| – Net Position: | -910,642 | 872,302 | 38,340 |

| – Gross Longs: | 477,767 | 4,146,935 | 361,166 |

| – Gross Shorts: | 1,388,409 | 3,274,633 | 322,826 |

| – Long to Short Ratio: | 0.3 to 1 | 1.3 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 0.0 | 99.1 | 91.5 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -22.7 | 25.4 | -4.3 |

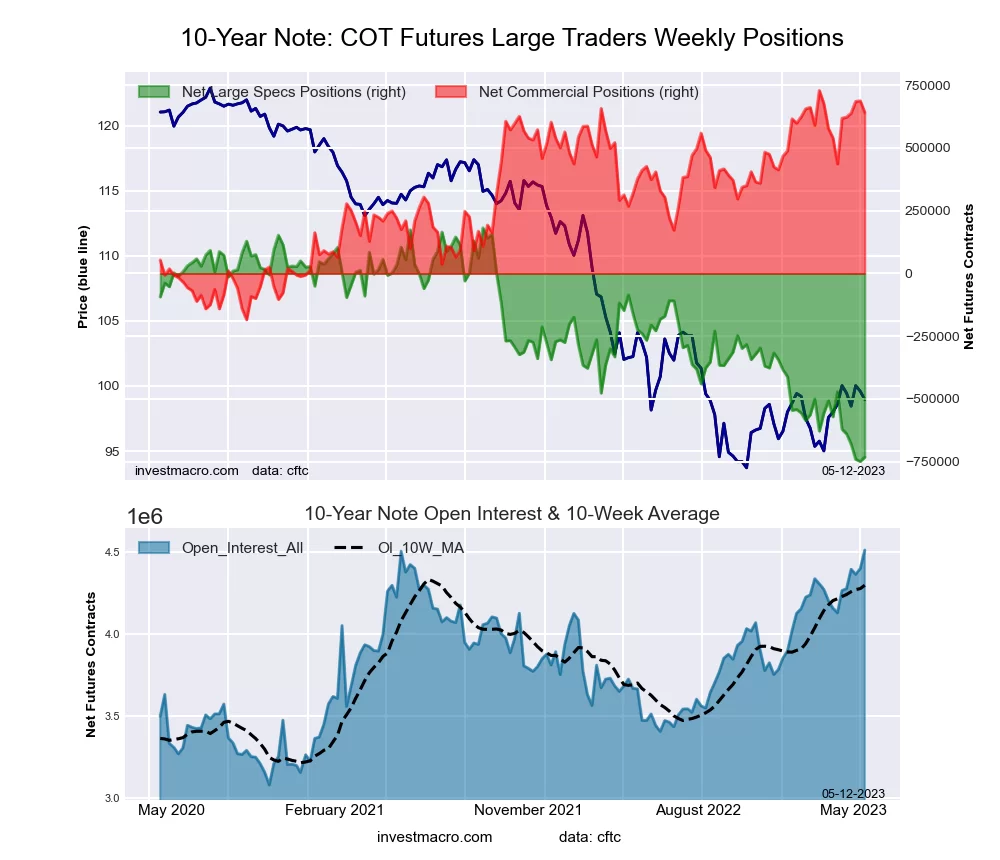

10-Year Treasury Note Futures:

The 10-Year Treasury Note large speculator standing this week resulted in a net position of -731,698 contracts in the data reported through Tuesday. This was a weekly rise of 17,449 contracts from the previous week which had a total of -749,147 net contracts.

The 10-Year Treasury Note large speculator standing this week resulted in a net position of -731,698 contracts in the data reported through Tuesday. This was a weekly rise of 17,449 contracts from the previous week which had a total of -749,147 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 1.9 percent. The commercials are Bullish-Extreme with a score of 90.4 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

| 10-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 10.0 | 78.1 | 9.4 |

| – Percent of Open Interest Shorts: | 26.3 | 63.9 | 7.4 |

| – Net Position: | -731,698 | 641,595 | 90,103 |

| – Gross Longs: | 453,077 | 3,522,275 | 425,427 |

| – Gross Shorts: | 1,184,775 | 2,880,680 | 335,324 |

| – Long to Short Ratio: | 0.4 to 1 | 1.2 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 1.9 | 90.4 | 100.0 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -28.0 | 22.5 | 12.9 |

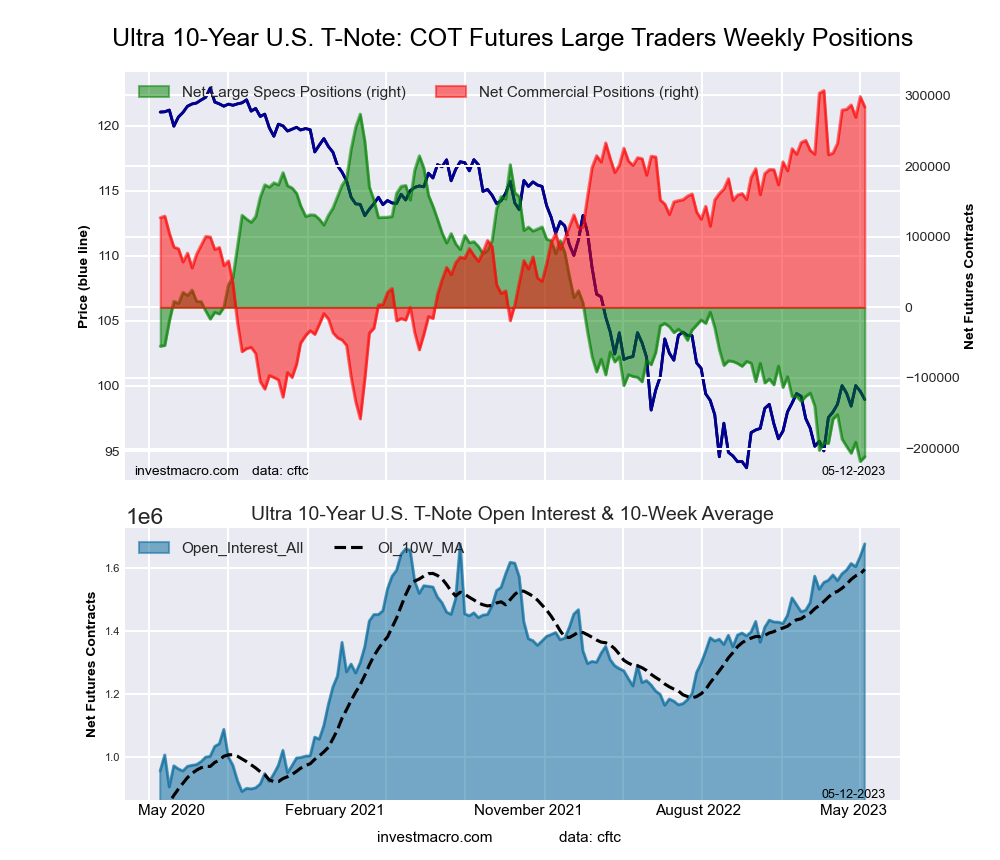

Ultra 10-Year Notes Futures:

The Ultra 10-Year Notes large speculator standing this week resulted in a net position of -211,598 contracts in the data reported through Tuesday. This was a weekly advance of 6,690 contracts from the previous week which had a total of -218,288 net contracts.

The Ultra 10-Year Notes large speculator standing this week resulted in a net position of -211,598 contracts in the data reported through Tuesday. This was a weekly advance of 6,690 contracts from the previous week which had a total of -218,288 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 1.4 percent. The commercials are Bullish-Extreme with a score of 95.0 percent and the small traders (not shown in chart) are Bullish with a score of 71.1 percent.

| Ultra 10-Year Notes Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.2 | 79.2 | 10.1 |

| – Percent of Open Interest Shorts: | 21.9 | 62.2 | 14.4 |

| – Net Position: | -211,598 | 283,856 | -72,258 |

| – Gross Longs: | 154,358 | 1,326,293 | 169,295 |

| – Gross Shorts: | 365,956 | 1,042,437 | 241,553 |

| – Long to Short Ratio: | 0.4 to 1 | 1.3 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 1.4 | 95.0 | 71.1 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -12.2 | 11.1 | 4.9 |

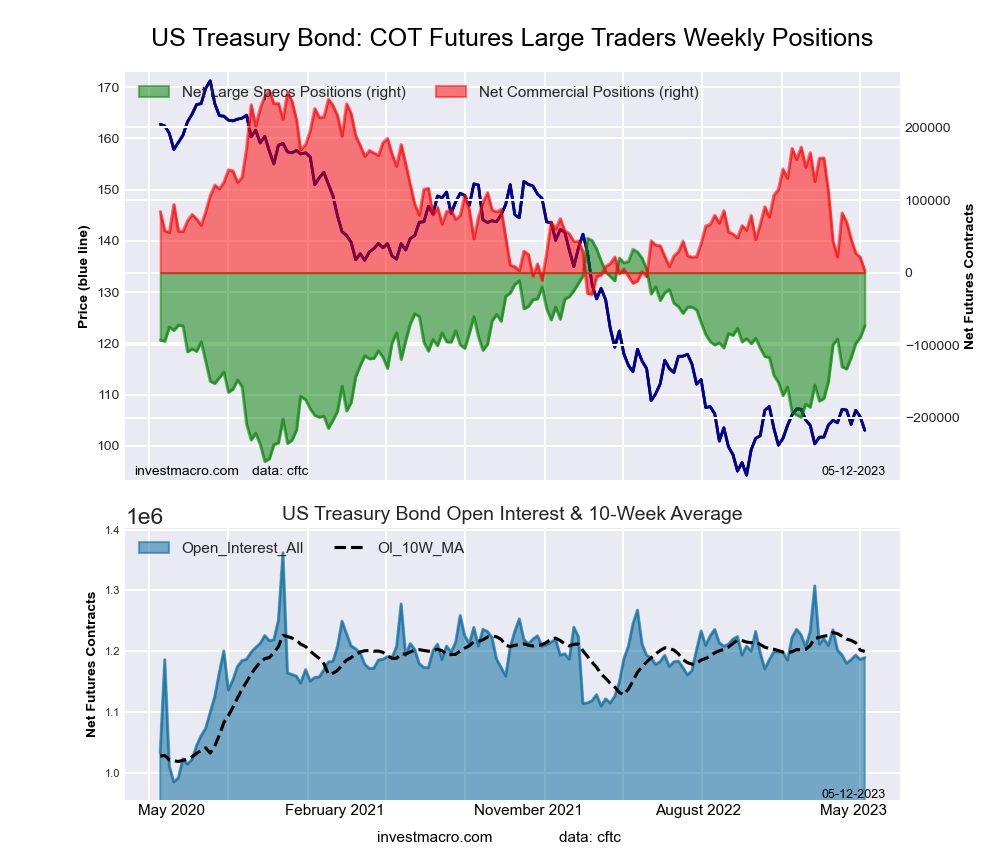

US Treasury Bonds Futures:

The US Treasury Bonds large speculator standing this week resulted in a net position of -73,129 contracts in the data reported through Tuesday. This was a weekly increase of 16,285 contracts from the previous week which had a total of -89,414 net contracts.

The US Treasury Bonds large speculator standing this week resulted in a net position of -73,129 contracts in the data reported through Tuesday. This was a weekly increase of 16,285 contracts from the previous week which had a total of -89,414 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 60.8 percent. The commercials are Bearish-Extreme with a score of 11.4 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

| US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 6.5 | 76.8 | 15.4 |

| – Percent of Open Interest Shorts: | 12.6 | 76.6 | 9.4 |

| – Net Position: | -73,129 | 2,355 | 70,774 |

| – Gross Longs: | 76,938 | 913,035 | 182,961 |

| – Gross Shorts: | 150,067 | 910,680 | 112,187 |

| – Long to Short Ratio: | 0.5 to 1 | 1.0 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 60.8 | 11.4 | 100.0 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 5.9 | -6.9 | 0.8 |

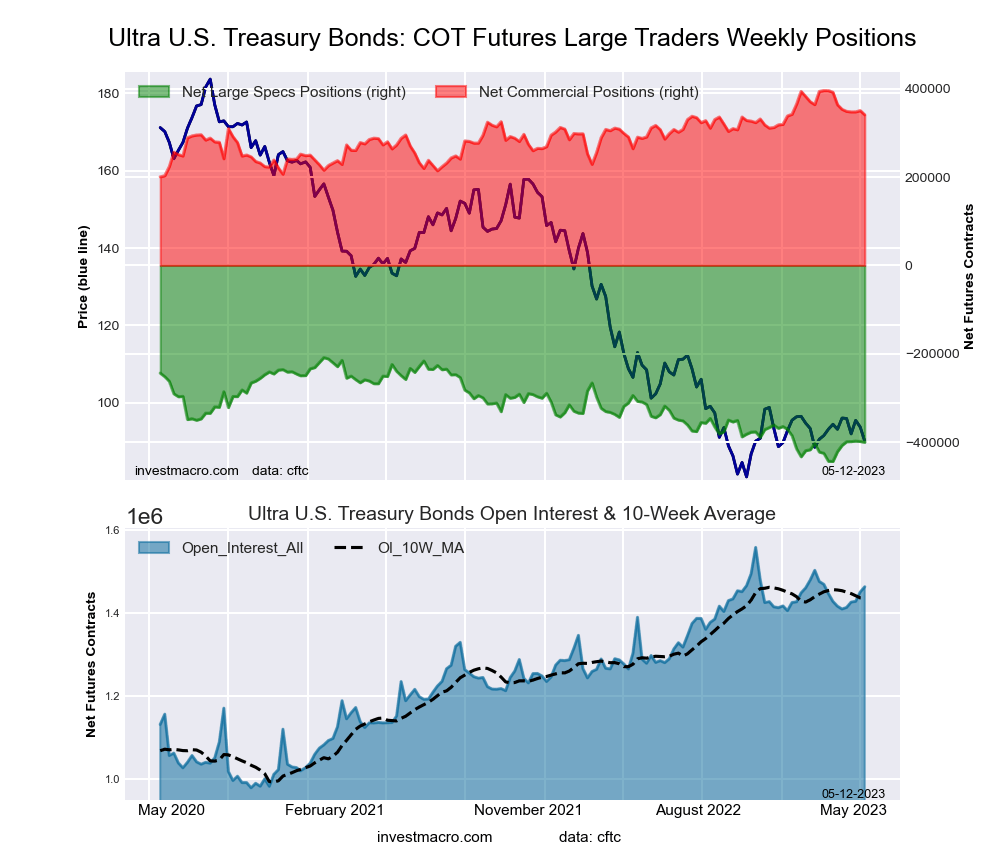

Ultra US Treasury Bonds Futures:

The Ultra US Treasury Bonds large speculator standing this week resulted in a net position of -400,519 contracts in the data reported through Tuesday. This was a weekly decrease of -1,713 contracts from the previous week which had a total of -398,806 net contracts.

The Ultra US Treasury Bonds large speculator standing this week resulted in a net position of -400,519 contracts in the data reported through Tuesday. This was a weekly decrease of -1,713 contracts from the previous week which had a total of -398,806 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 18.5 percent. The commercials are Bullish with a score of 71.9 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 99.4 percent.

| Ultra US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 6.1 | 81.3 | 12.2 |

| – Percent of Open Interest Shorts: | 33.5 | 58.0 | 8.1 |

| – Net Position: | -400,519 | 340,881 | 59,638 |

| – Gross Longs: | 89,706 | 1,188,568 | 178,139 |

| – Gross Shorts: | 490,225 | 847,687 | 118,501 |

| – Long to Short Ratio: | 0.2 to 1 | 1.4 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 18.5 | 71.9 | 99.4 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.0 | -11.7 | 1.6 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026