By Lukman Otunuga Research Analyst, ForexTime

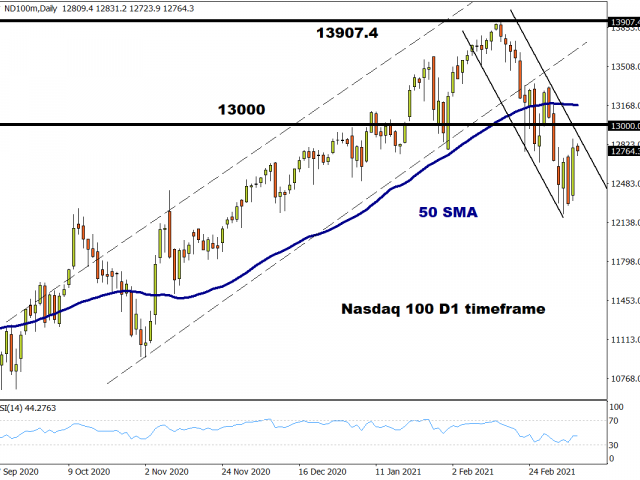

Dovish major central bank. Tick. Passage of another couple of trillion dollars relief plan. Tick. Bond yields lower. Tick. Stocks in the green. Tick! The Dow is starting its fifth straight day of gains with more record highs, while the Nasdaq is in a hurry to reclaim its 50-day moving average.

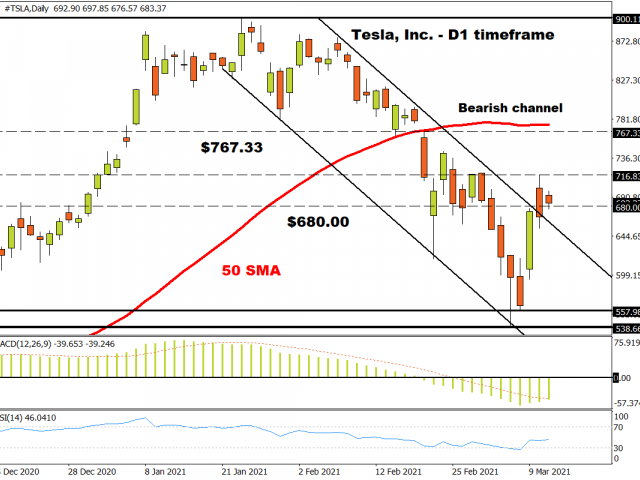

Tech stocks are leading the way with Tesla now approaching $700 while the EuroStoxx 600 benchmark is within touching distance of its pre-pandemic high reached last February.

ECB to ramp up bond purchases

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

The main event of the day was the ECB meeting, where President Lagarde and the governing council decided to increase the rate of its pandemic emergency purchase program at a “significantly higher” pace over the next quarter. This speeding up of bond buying is to prevent financing conditions tightening too much which would be inconsistent with countering the downward impact of the pandemic crisis on the projected path of inflation.

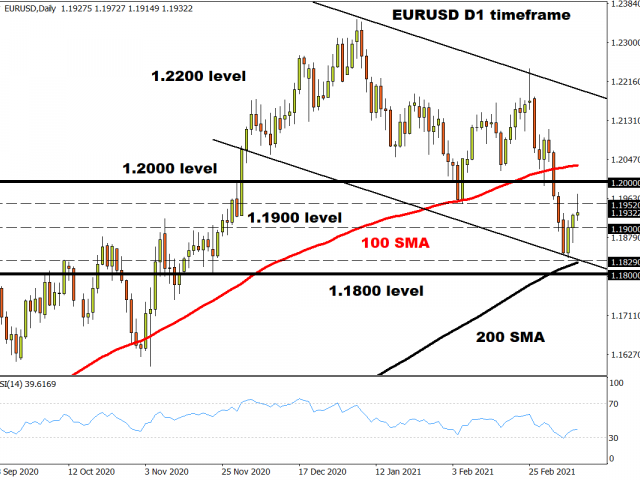

The effect of this more dovish than expected measure from the region’s central bank has seen the euro sell off modestly and bond yields also move lower. Remember that Germany’s benchmark bond yield has risen sharply this year and threatened to increase borrowing costs of the region’s companies where the vaccine rollout has been slow and economies are set to take longer to recover than the US.

Technically, EUR/USD is fairly neutral at the moment, with the February lows at 1.1952 proving resistance for a move toward the 1.20 mark and near-term support comes in at 1.1915/20.

The single currency is also trying to break its six-day losing streak versus pound sterling and remains in slightly oversold territory on the RSI.

Upstream, downstream, multifaceted, holistic…

President Lagarde still seems to mystify markets sometimes and this press conference was no exception with her explanation of the ECB’s reaction function. Was this the desired clarity that markets were looking for? It is debatable and she admitted herself that market watchers wouldn’t ordinarily hear these words at a central bank press conference!

The bottom line is that the bank will frontload its bond buying to underscore the fact it is looking through higher inflation prints in the months to come.

But the balance of risks is now seen as balanced – which may have more to do with the wide spectrum of views and opinions that make up the governing council.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- European indices grow on the ECB’s “dovish” position. Quarterly reports of mega-companies support the broad market Apr 29, 2024

- Japanese yen shows volatility amid speculation of intervention Apr 29, 2024

- COT Bonds Charts: Speculator Weekly Changes led by 5-Year & 10-Year Bonds Apr 28, 2024

- COT Stock Market Charts: Speculator Bets led by VIX & Russell-Mini Apr 28, 2024

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Apr 28, 2024

- Today, investors’ focus is on the PCE Price Index inflation report Apr 26, 2024

- Gold price recovers amid uncertain US economic outlook Apr 26, 2024

- This “Bullish Buzz” Reaches Highest Level in 53 Years Apr 26, 2024

- FastSpring and EBANX Forge Partnership to Expand Pix Payments for Digital Products in Brazil Apr 25, 2024

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024