By Lukman Otunuga Research Analyst, ForexTime

It was a week defined by fluctuating bond yields, easing inflation fears, monetary bazookas, and U.S stimulus hopes.

Market sentiment was influenced by the developments in the global bond markets with the risk pendulum swinging back and forth. This was reflected across equities, currencies, and even commodities.

As the mood across the board improved on easing inflation fears and Congressional approval of Joe Biden’s $1.9 trillion relief package, the risk-on sentiment strengthened. Asian shares were mostly mixed on Friday thanks to a spike in U.S Treasury yields. European stocks have opened higher after the European Central Bank said it would ramp up the speed of its bond purchases. The positive vibe from Europe could find its way into Wall Street later today, especially after the S&P 500 hit a new closing high overnight.

With so much going across the board, it may be wise to fasten your seat belts and prepare for more volatility next week.

In the meantime, keep calm because it’s Friday!

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

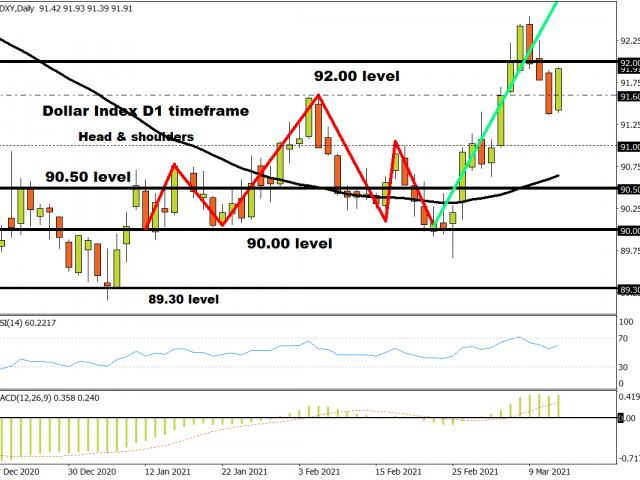

Dollar eyes 92.00

The recent jump in yields has injected dollar bulls with fresh confidence.

Prices are trading below the 92.00 resistance level as of writing. A breakout above this point could open the doors towards 92.50 and possibly higher in the week ahead. Should 92.00 prove to be reliable resistance, a decline towards 91.60 could be on the cards.

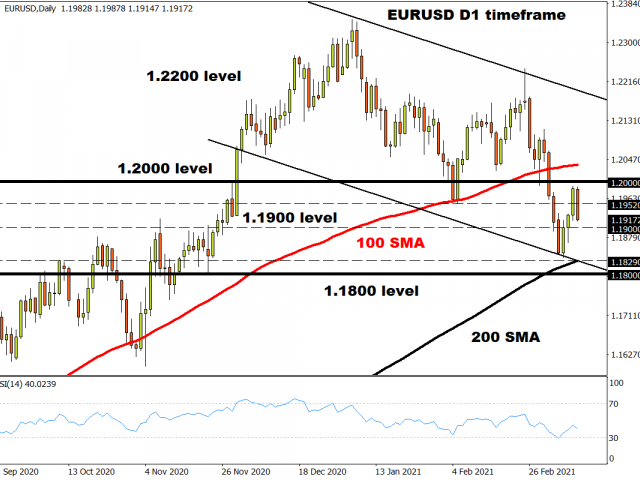

EURUSD to resume downtrend?

In a move to address rising bond yields, the European Central Bank pledged to ramp up buying government debt in the coming months.

The purchases in the next quarter will be conducted at a significantly higher pace during the first months of this year. It must be kept in mind that the overall size of the 1.85 trillion-euro pandemic-buying program remained unchanged.

The Euro tumbled following the announcement with prices approaching the 1.1900 level. Earlier in the week, we discussed the possibility of prices hitting the 1.1800 level. Well, this could become reality next week if the downside momentum holds.

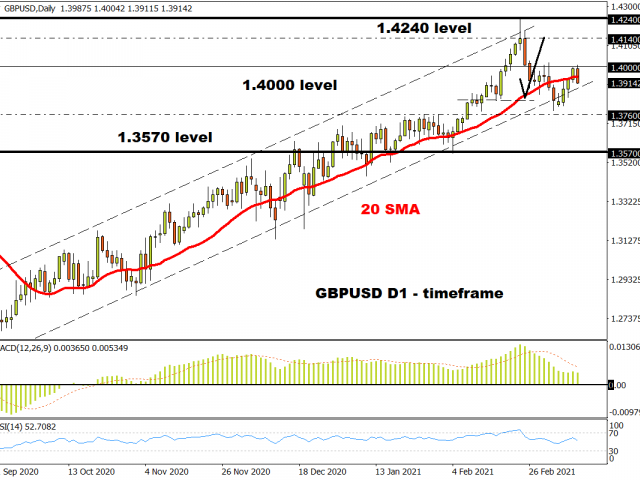

GBPUSD capped below 1.4000?

There is something about the 1.4000 resistance level.

Over the past two weeks, prices have struggled to break above this point. Although the trend remains bullish on the daily charts, a move back below 1.3760 could spoil the party for bulls. Should 1.4000 prove to be an unbreakable resistance level, the GBPUSD could find itself in a downtrend in the medium to longer term.

Commodity spotlight – Gold

If one word could be used to describe Gold prices this week, the best fit could be volatile.

The precious metal was heavily influenced by fluctuating bond yields, the Dollar’s performance, and overall risk sentiment. Given how yields are rising once again, this has capped Gold’s gains with prices pressured below the $1730 level. Should the Dollar extend gains in the week ahead, this may result in the precious metal slipping below $1675 to levels seen since April 2020 around $1650. Technically, bears remain in control as there have been consistently lower lows and lower highs.

Prices are likely to trend lower until the Relative Strength Index hits the 30.00 oversold level on the daily charts.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Australia will release its annual budget today. Rising inflation expectations hurt US stock indices May 14, 2024

- JPY declines again May 14, 2024

- Trade of the Week: CHINAH to extend lead as Asia’s winner? May 13, 2024

- The German index has hit an all-time high. China sees rising consumer inflation May 13, 2024

- Brent crude oil faces downward pressure amid demand uncertainties May 13, 2024

- COT Metals Charts: Speculator bets led by Platinum & Copper May 11, 2024

- COT Bonds Charts: Speculator bets led by Fed Funds & Ultra 10-Year Bonds May 11, 2024

- COT Stock Market Charts: Speculator bets led by DowJones & Russell 2000 May 11, 2024

- COT Soft Commodities Charts: Speculator bets led by Corn & Soybeans May 11, 2024

- Natural gas prices are rising amid falling inventories. The Bank of England expectedly kept the rate May 10, 2024