By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday January 31st and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

*** This data is almost a month old because the CFTC up-to-date data has been delayed due to a cybersecurity event that happened in early February to ION Cleared Derivatives (a subsidiary of ION Markets). This hack of ION has created a problem for the large trader positions to be reported and reconciled. The CFTC states that they will be back-filling the data over the next couple weeks and will get the data back up to date.

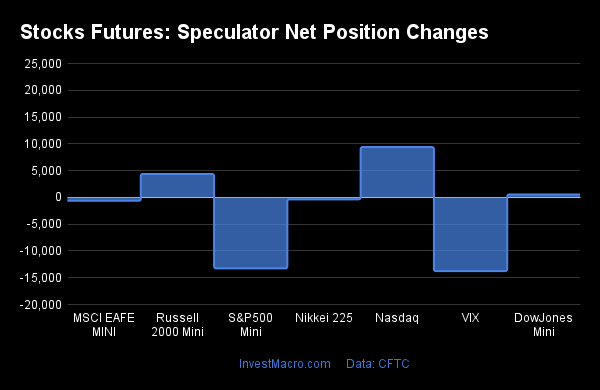

Weekly Speculator Changes led by Nasdaq-Mini

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

The COT stock markets speculator bets were mixed as four out of the eight stock markets we cover had higher positioning while the other four markets had lower speculator contracts.

Leading the gains for the stock markets was the Nasdaq-Mini (9,403 contracts) with the Russell-Mini (4,377 contracts), Nikkei 225 Yen (2,632 contracts) and DowJones-Mini (538 contracts) also showing positive weeks.

The markets with the declines in speculator bets for the week were the S&P500-Mini (-13,266 contracts) and VIX (-13,769 contracts) with the MSCI EAFE-Mini (-638 contracts) and the Nikkei 225 (-360 contracts) also registering lower bets on the week.

Jan-31-2023 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| S&P500-Mini | 2,061,419 | 4 | -222,257 | 15 | 234,786 | 82 | -12,529 | 24 |

| VIX | 310,475 | 42 | -66,918 | 66 | 69,707 | 32 | -2,789 | 78 |

| Nasdaq-Mini | 278,449 | 59 | -15,858 | 66 | 32,053 | 46 | -16,195 | 21 |

| DowJones-Mini | 80,386 | 43 | -9,428 | 33 | 12,077 | 71 | -2,649 | 27 |

| Nikkei 225 Yen | 36,496 | 13 | 9,112 | 62 | -4,201 | 0 | -4,911 | 70 |

| Nikkei 225 | 14,330 | 10 | -5,072 | 53 | 5,452 | 57 | -380 | 24 |

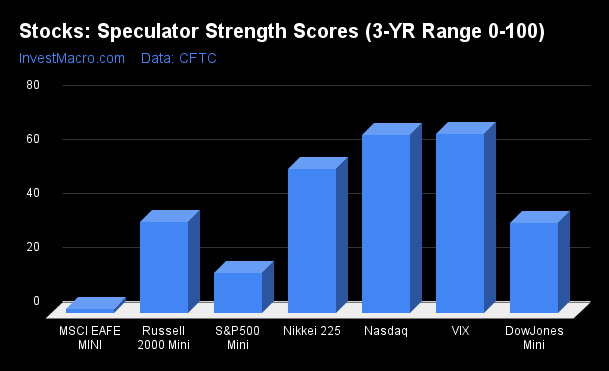

Strength Scores led by Nasdaq-Mini & VIX

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that the Nasdaq-Mini (66 percent) and the VIX (66 percent) led the stock markets. The Nikkei 225 Yen (62 percent) and Nikkei 225 (53 percent) come in as the next highest in the weekly strength scores.

On the downside, the MSCI EAFE-Mini (2 percent) and the S&P500-Mini (15 percent) come in at the lowest strength level currently and were in Extreme-Bearish territory (below 20 percent).

Strength Statistics:

VIX (66.5 percent) vs VIX previous week (76.0 percent)

S&P500-Mini (15.0 percent) vs S&P500-Mini previous week (17.5 percent)

DowJones-Mini (33.4 percent) vs DowJones-Mini previous week (32.4 percent)

Nasdaq-Mini (66.2 percent) vs Nasdaq-Mini previous week (60.9 percent)

Russell2000-Mini (33.9 percent) vs Russell2000-Mini previous week (31.3 percent)

Nikkei USD (53.4 percent) vs Nikkei USD previous week (55.1 percent)

EAFE-Mini (1.6 percent) vs EAFE-Mini previous week (2.4 percent)

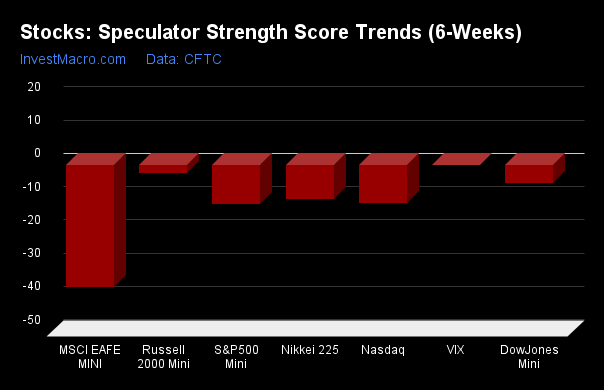

VIX led the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that just about all the markets had lower trend scores. The VIX was the only market with a score above 0 at a 0.2 percent trend score. The EAFE-Mini (-36.5 percent) had the lowest or most negative score that week followed by the S&P500-Mini (-11.6 percent).

Strength Trend Statistics:

VIX (0.2 percent) vs VIX previous week (20.6 percent)

S&P500-Mini (-11.6 percent) vs S&P500-Mini previous week (3.9 percent)

DowJones-Mini (-5.2 percent) vs DowJones-Mini previous week (4.4 percent)

Nasdaq-Mini (-11.4 percent) vs Nasdaq-Mini previous week (-24.8 percent)

Russell2000-Mini (-2.4 percent) vs Russell2000-Mini previous week (-2.2 percent)

Nikkei USD (-10.0 percent) vs Nikkei USD previous week (-10.0 percent)

EAFE-Mini (-36.5 percent) vs EAFE-Mini previous week (-23.7 percent)

Individual Stock Market Charts:

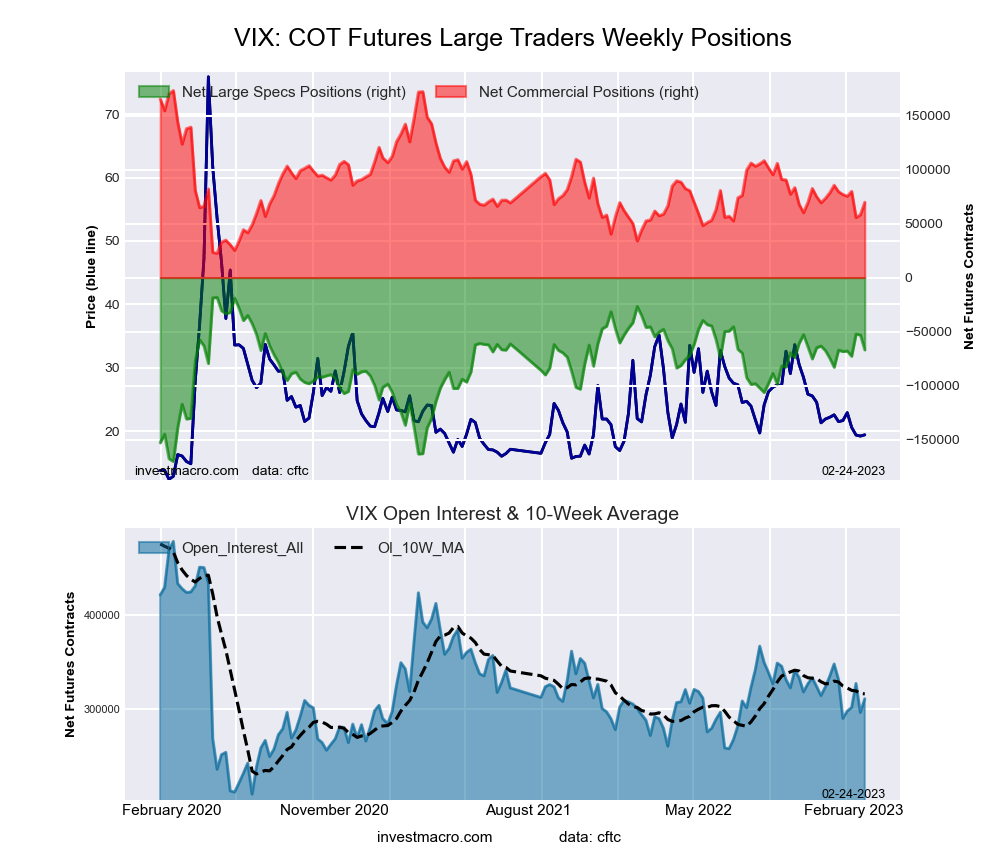

VIX Volatility Futures:

The VIX Volatility large speculator standing for the week totaled a net position of -66,918 contracts in the data reported through January 31st. This was a weekly lowering of -13,769 contracts from the previous week which had a total of -53,149 net contracts.

The VIX Volatility large speculator standing for the week totaled a net position of -66,918 contracts in the data reported through January 31st. This was a weekly lowering of -13,769 contracts from the previous week which had a total of -53,149 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 66.5 percent. The commercials are Bearish with a score of 31.5 percent and the small traders (not shown in chart) are Bullish with a score of 77.7 percent.

| VIX Volatility Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.0 | 57.7 | 7.9 |

| – Percent of Open Interest Shorts: | 38.6 | 35.2 | 8.8 |

| – Net Position: | -66,918 | 69,707 | -2,789 |

| – Gross Longs: | 52,935 | 178,998 | 24,430 |

| – Gross Shorts: | 119,853 | 109,291 | 27,219 |

| – Long to Short Ratio: | 0.4 to 1 | 1.6 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 66.5 | 31.5 | 77.7 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.2 | -6.5 | 46.0 |

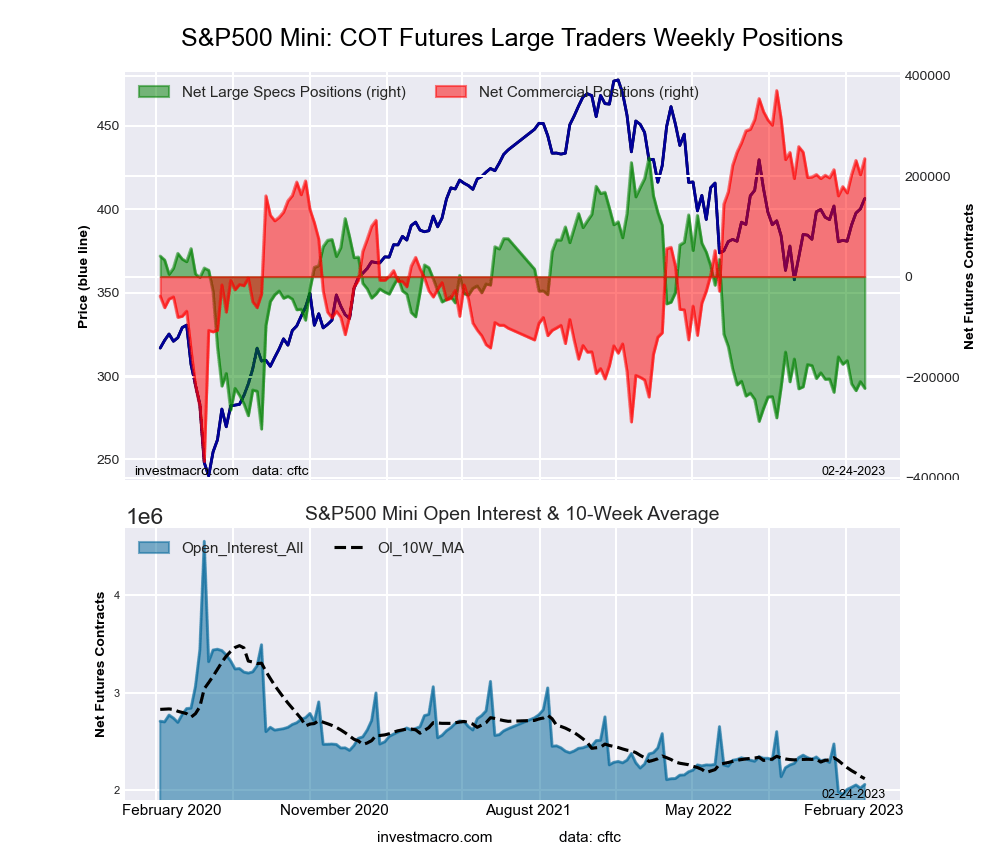

S&P500 Mini Futures:

The S&P500 Mini large speculator standing for the week totaled a net position of -222,257 contracts in the data reported through January 31st. This was a weekly fall of -13,266 contracts from the previous week which had a total of -208,991 net contracts.

The S&P500 Mini large speculator standing for the week totaled a net position of -222,257 contracts in the data reported through January 31st. This was a weekly fall of -13,266 contracts from the previous week which had a total of -208,991 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 15.0 percent. The commercials are Bullish-Extreme with a score of 81.6 percent and the small traders (not shown in chart) are Bearish with a score of 23.7 percent.

| S&P500 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 12.3 | 73.7 | 11.9 |

| – Percent of Open Interest Shorts: | 23.1 | 62.3 | 12.5 |

| – Net Position: | -222,257 | 234,786 | -12,529 |

| – Gross Longs: | 253,439 | 1,519,069 | 245,628 |

| – Gross Shorts: | 475,696 | 1,284,283 | 258,157 |

| – Long to Short Ratio: | 0.5 to 1 | 1.2 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 15.0 | 81.6 | 23.7 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.6 | 10.0 | -2.4 |

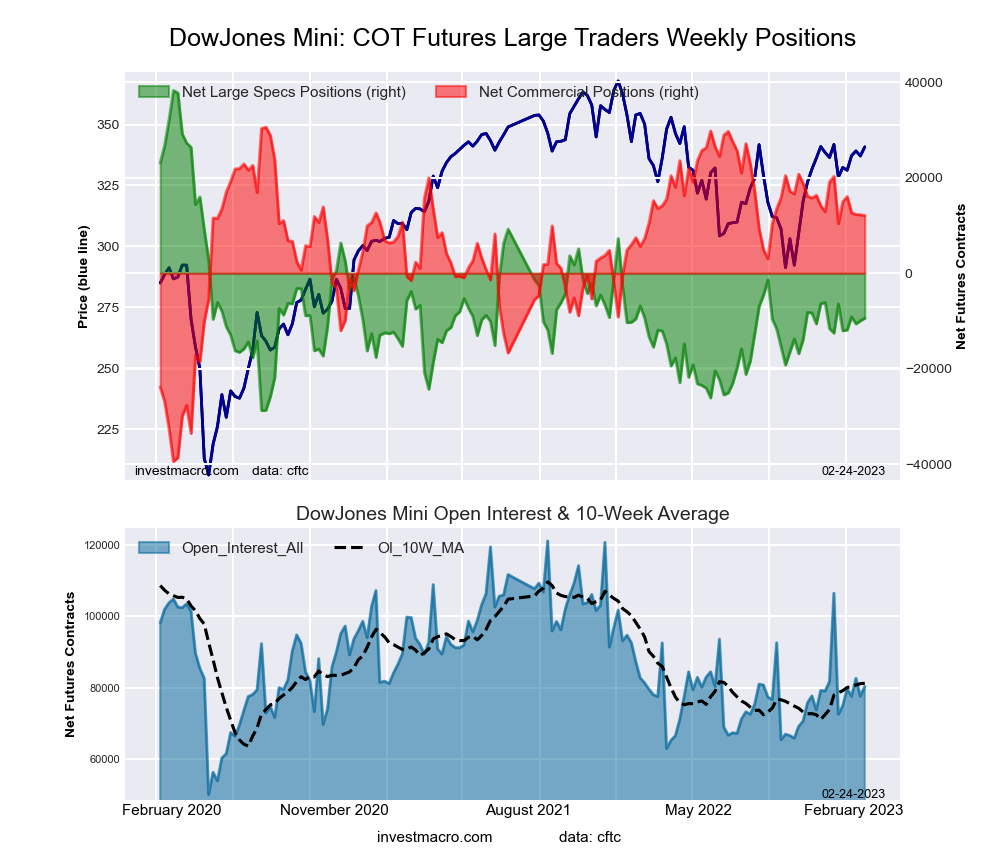

Dow Jones Mini Futures:

The Dow Jones Mini large speculator standing for the week totaled a net position of -9,428 contracts in the data reported through January 31st. This was a weekly advance of 538 contracts from the previous week which had a total of -9,966 net contracts.

The Dow Jones Mini large speculator standing for the week totaled a net position of -9,428 contracts in the data reported through January 31st. This was a weekly advance of 538 contracts from the previous week which had a total of -9,966 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 33.4 percent. The commercials are Bullish with a score of 71.1 percent and the small traders (not shown in chart) are Bearish with a score of 27.2 percent.

| Dow Jones Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.5 | 52.1 | 16.9 |

| – Percent of Open Interest Shorts: | 38.3 | 37.1 | 20.1 |

| – Net Position: | -9,428 | 12,077 | -2,649 |

| – Gross Longs: | 21,339 | 41,874 | 13,546 |

| – Gross Shorts: | 30,767 | 29,797 | 16,195 |

| – Long to Short Ratio: | 0.7 to 1 | 1.4 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 33.4 | 71.1 | 27.2 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.2 | 2.7 | 6.6 |

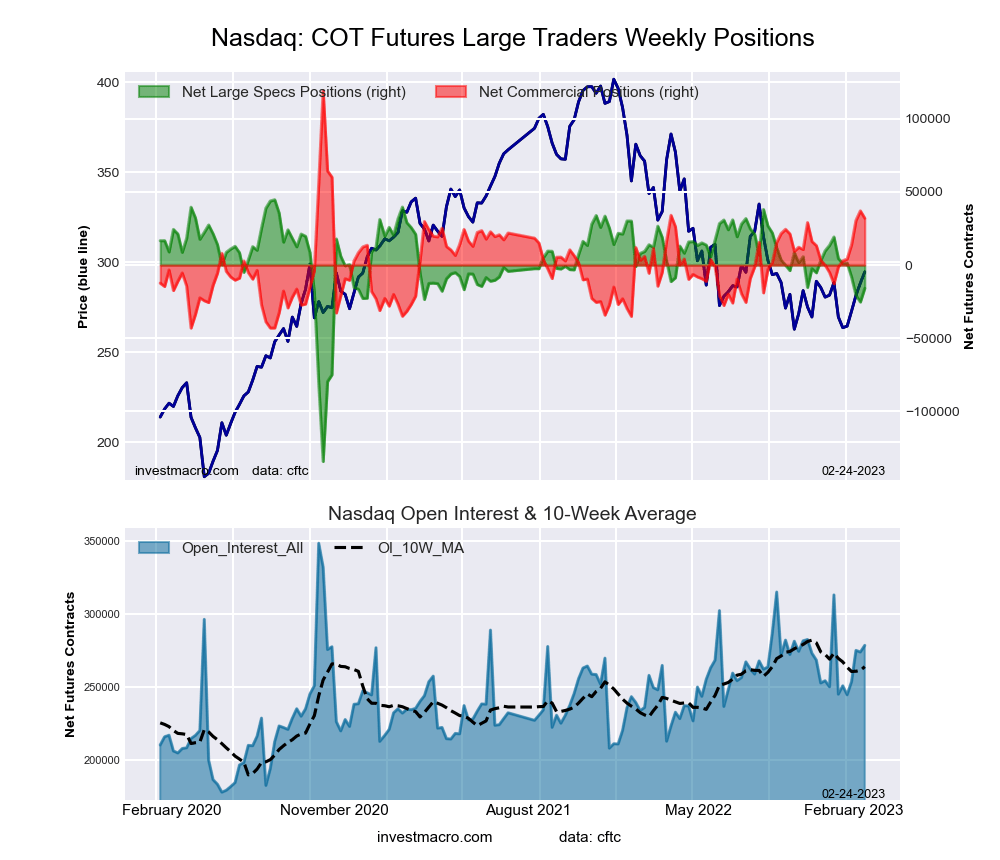

Nasdaq Mini Futures:

The Nasdaq Mini large speculator standing for the week totaled a net position of -15,858 contracts in the data reported through January 31st. This was a weekly boost of 9,403 contracts from the previous week which had a total of -25,261 net contracts.

The Nasdaq Mini large speculator standing for the week totaled a net position of -15,858 contracts in the data reported through January 31st. This was a weekly boost of 9,403 contracts from the previous week which had a total of -25,261 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 66.2 percent. The commercials are Bearish with a score of 46.2 percent and the small traders (not shown in chart) are Bearish with a score of 21.3 percent.

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 21.3 | 65.8 | 11.1 |

| – Percent of Open Interest Shorts: | 27.0 | 54.2 | 16.9 |

| – Net Position: | -15,858 | 32,053 | -16,195 |

| – Gross Longs: | 59,439 | 183,098 | 30,935 |

| – Gross Shorts: | 75,297 | 151,045 | 47,130 |

| – Long to Short Ratio: | 0.8 to 1 | 1.2 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 66.2 | 46.2 | 21.3 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.4 | 20.5 | -24.8 |

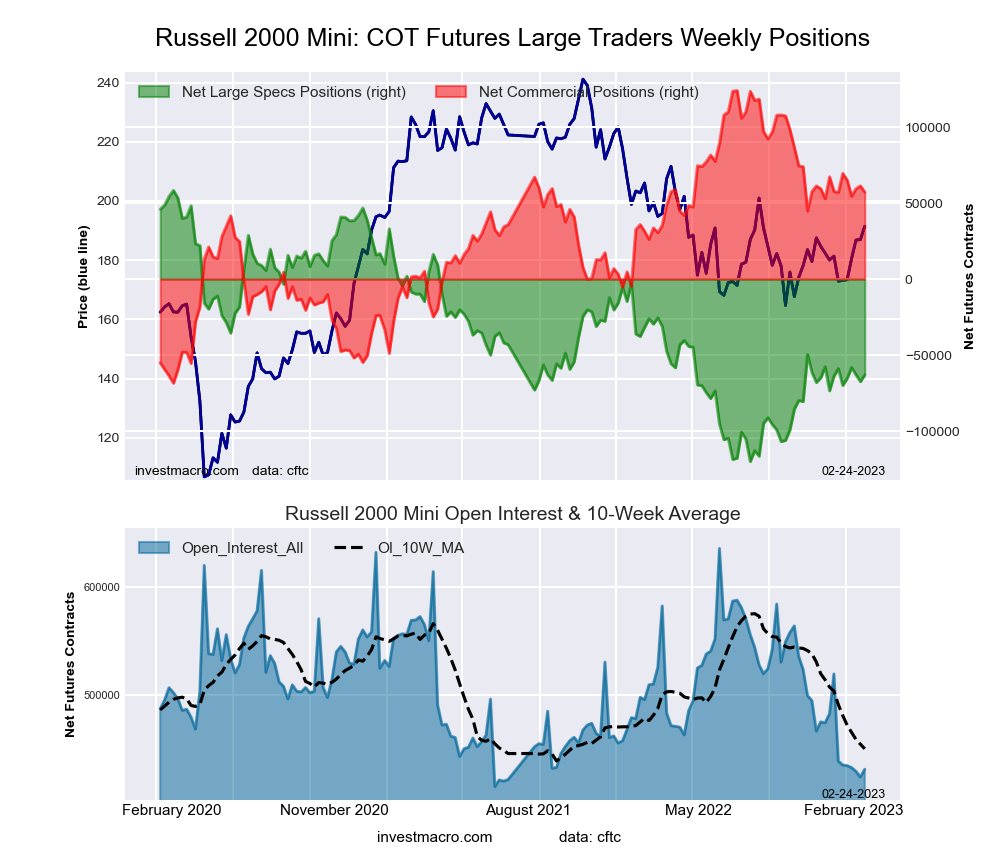

Russell 2000 Mini Futures:

The Russell 2000 Mini large speculator standing for the week totaled a net position of -63,024 contracts in the data reported through January 31st. This was a weekly gain of 4,377 contracts from the previous week which had a total of -67,401 net contracts.

The Russell 2000 Mini large speculator standing for the week totaled a net position of -63,024 contracts in the data reported through January 31st. This was a weekly gain of 4,377 contracts from the previous week which had a total of -67,401 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 33.9 percent. The commercials are Bullish with a score of 62.7 percent and the small traders (not shown in chart) are Bearish with a score of 44.8 percent.

| Russell 2000 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.9 | 82.7 | 5.9 |

| – Percent of Open Interest Shorts: | 24.5 | 69.4 | 4.6 |

| – Net Position: | -63,024 | 57,143 | 5,881 |

| – Gross Longs: | 42,702 | 356,143 | 25,493 |

| – Gross Shorts: | 105,726 | 299,000 | 19,612 |

| – Long to Short Ratio: | 0.4 to 1 | 1.2 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 33.9 | 62.7 | 44.8 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -2.4 | 0.1 | 12.4 |

Nikkei Stock Average (USD) Futures:

The Nikkei Stock Average (USD) large speculator standing for the week totaled a net position of -5,072 contracts in the data reported through January 31st. This was a weekly fall of -360 contracts from the previous week which had a total of -4,712 net contracts.

The Nikkei Stock Average (USD) large speculator standing for the week totaled a net position of -5,072 contracts in the data reported through January 31st. This was a weekly fall of -360 contracts from the previous week which had a total of -4,712 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 53.4 percent. The commercials are Bullish with a score of 57.0 percent and the small traders (not shown in chart) are Bearish with a score of 23.6 percent.

| Nikkei Stock Average Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 15.8 | 65.9 | 18.3 |

| – Percent of Open Interest Shorts: | 51.2 | 27.8 | 20.9 |

| – Net Position: | -5,072 | 5,452 | -380 |

| – Gross Longs: | 2,269 | 9,440 | 2,621 |

| – Gross Shorts: | 7,341 | 3,988 | 3,001 |

| – Long to Short Ratio: | 0.3 to 1 | 2.4 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 53.4 | 57.0 | 23.6 |

| – Strength Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -10.0 | 20.2 | -24.2 |

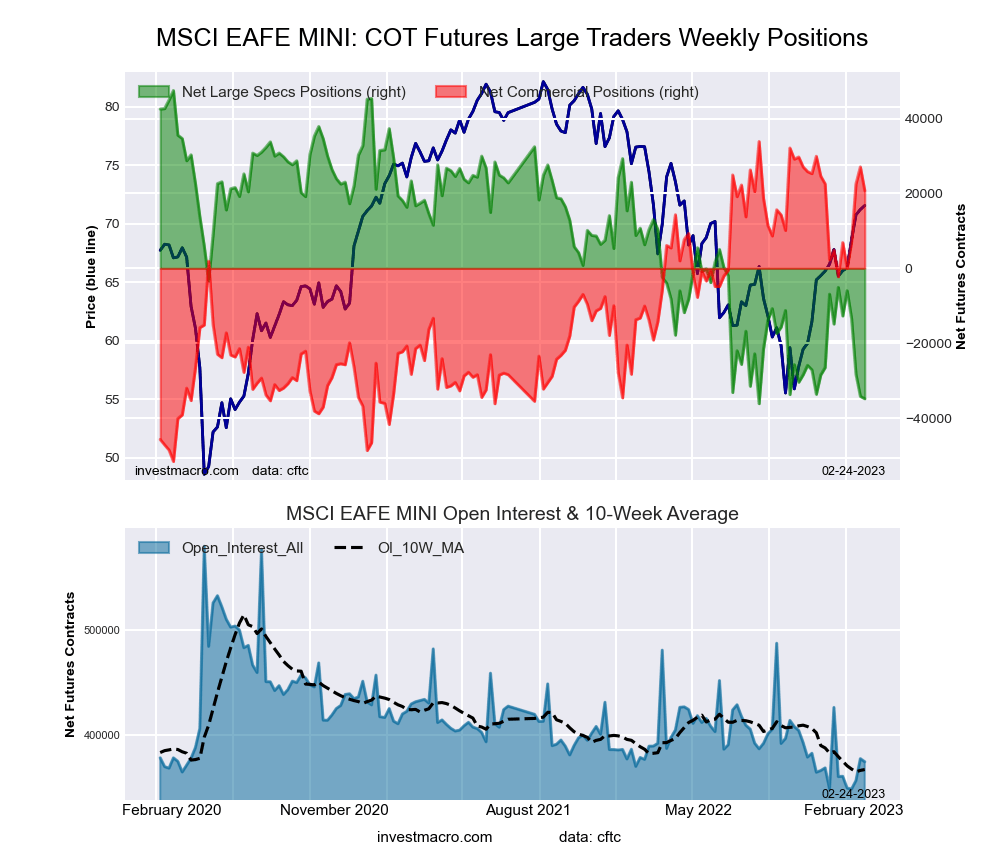

MSCI EAFE Mini Futures:

The MSCI EAFE Mini large speculator standing for the week totaled a net position of -34,840 contracts in the data reported. This was a weekly lowering of -638 contracts from the previous week which had a total of -34,202 net contracts.

The MSCI EAFE Mini large speculator standing for the week totaled a net position of -34,840 contracts in the data reported. This was a weekly lowering of -638 contracts from the previous week which had a total of -34,202 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 1.6 percent. The commercials are Bullish-Extreme with a score of 84.1 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

| MSCI EAFE Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 6.5 | 87.5 | 5.1 |

| – Percent of Open Interest Shorts: | 15.8 | 82.0 | 1.3 |

| – Net Position: | -34,840 | 20,734 | 14,106 |

| – Gross Longs: | 24,465 | 327,871 | 18,967 |

| – Gross Shorts: | 59,305 | 307,137 | 4,861 |

| – Long to Short Ratio: | 0.4 to 1 | 1.1 to 1 | 3.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 1.6 | 84.1 | 100.0 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -36.5 | 27.9 | 38.4 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- The sell-off in risk assets intensified as tariffs took effect Apr 7, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Silver Apr 5, 2025

- COT Bonds Charts: Speculator Bets led by SOFR 1-Month & US Treasury Bonds Apr 5, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil, Cotton & Soybeans Apr 5, 2025

- COT Stock Market Charts: Speculator Bets led by S&P500 & Nasdaq Apr 5, 2025

- Today, investors focus on the Non-Farm Payrolls labor market report Apr 4, 2025

- USD/JPY collapses to a 6-month low: safe-haven assets in demand Apr 4, 2025

- GBP/USD Hits 21-Week High: The Pound Outperforms Its Peers Apr 3, 2025

- Most of the tariffs imposed by the Trump administration take effect today Apr 2, 2025

- EUR/USD Declines as Markets Await Signals of a Renewed Trade War Apr 2, 2025