By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday May 31st and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

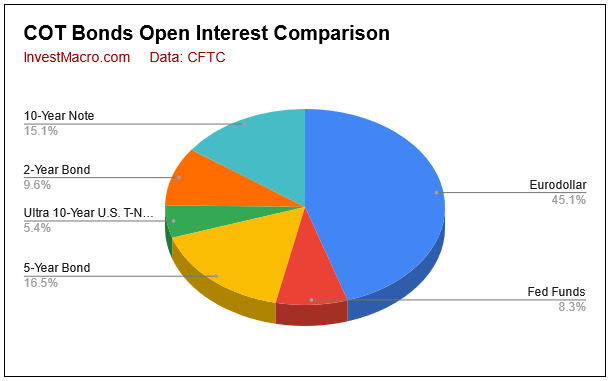

COT bonds market speculator bets were lower this week as all eight bond markets we cover had lower positioning this week. Leading the declines in speculator bets this week were the 5-Year Bond (-97,261 contracts) and the 2-Year Bond (-92,825 contracts) with the Eurodollar (-22,436 contracts), Fed Funds (-17,284 contracts), 10-Year Bond (-13,783 contracts), Long US Bond (-8,741 contracts), Ultra 10-Year (-6,442 contracts) and the Ultra US Bond (-1,383 contracts) also coming in with lower bets on the week.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

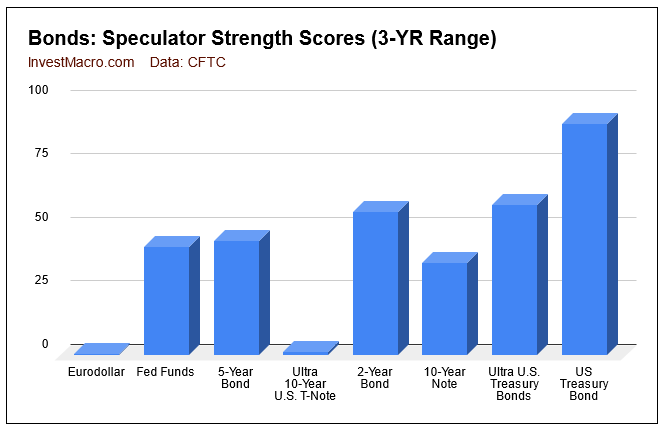

Strength scores (3-Year range of Speculator positions, from 0 to 100 where above 80 is extreme bullish and below 20 is extreme bearish) show that most of the bond markets are below their midpoints (50 percent) for the past 3 years. The US Treasury Bond, 2-Year and the Ultra US Bond have all gone above the midpoint and the US Treasury Bond has now entered extreme bullish levels as compared to its range over the past 3 years.

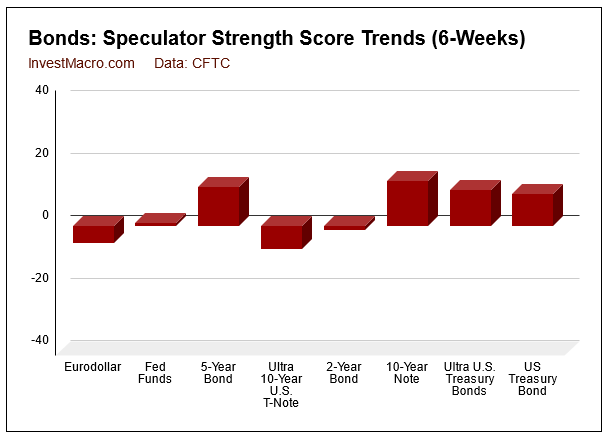

Strength score trends (or move index, that show 6-week changes in strength scores) shows a mixed picture with half the bond markets rising over the past six weeks and half not.

Strength score trends (or move index, that show 6-week changes in strength scores) shows a mixed picture with half the bond markets rising over the past six weeks and half not.

May-31-2022 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| Eurodollar | 10,374,105 | 31 | -2,855,216 | 0 | 3,260,722 | 99 | -405,506 | 15 |

| 5-Year | 3,804,715 | 40 | -217,788 | 45 | 367,355 | 58 | -149,567 | 40 |

| 10-Year | 3,470,808 | 28 | -238,907 | 36 | 411,183 | 71 | -172,276 | 39 |

| 2-Year | 2,219,497 | 19 | -128,118 | 56 | 193,103 | 62 | -64,985 | 21 |

| FedFunds | 1,907,235 | 69 | 25,207 | 43 | -17,303 | 58 | -7,904 | 40 |

| Long T-Bond | 1,212,023 | 51 | 19,761 | 91 | 1,627 | 21 | -21,388 | 36 |

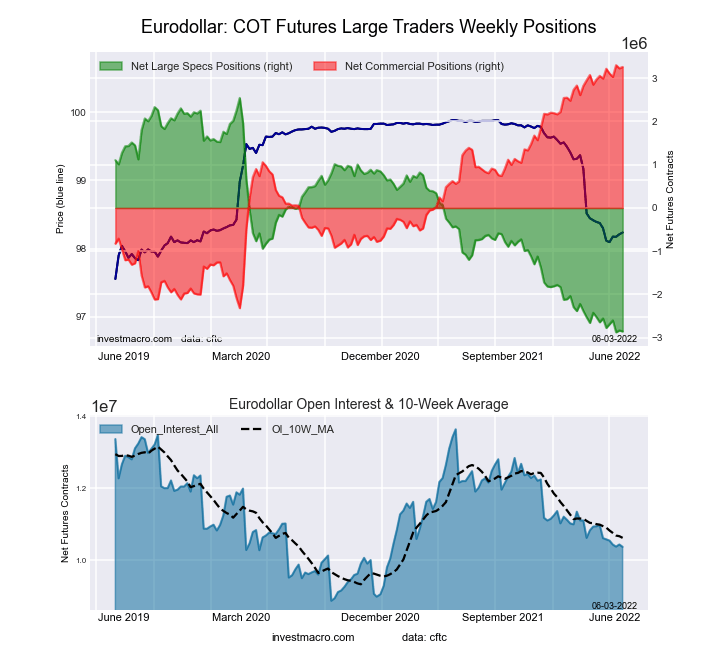

3-Month Eurodollars Futures:

The 3-Month Eurodollars large speculator standing this week was a net position of -2,855,216 contracts in the data reported through Tuesday. This was a weekly lowering of -22,436 contracts from the previous week which had a total of -2,832,780 net contracts.

The 3-Month Eurodollars large speculator standing this week was a net position of -2,855,216 contracts in the data reported through Tuesday. This was a weekly lowering of -22,436 contracts from the previous week which had a total of -2,832,780 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 0.4 percent. The commercials are Bullish-Extreme with a score of 99.3 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 15.2 percent.

| 3-Month Eurodollars Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 3.2 | 75.4 | 3.6 |

| – Percent of Open Interest Shorts: | 30.7 | 44.0 | 7.5 |

| – Net Position: | -2,855,216 | 3,260,722 | -405,506 |

| – Gross Longs: | 332,811 | 7,825,376 | 371,699 |

| – Gross Shorts: | 3,188,027 | 4,564,654 | 777,205 |

| – Long to Short Ratio: | 0.1 to 1 | 1.7 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 0.4 | 99.3 | 15.2 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.5 | 4.8 | 6.9 |

30-Day Federal Funds Futures:

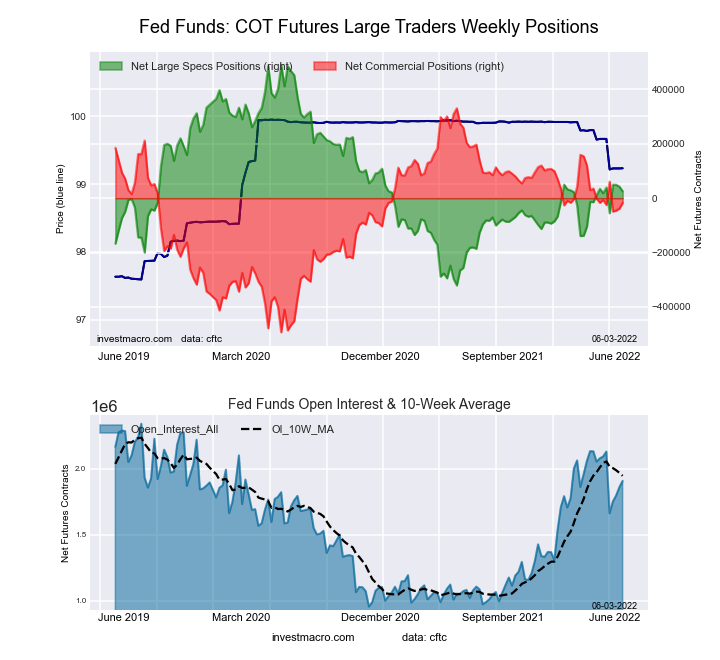

The 30-Day Federal Funds large speculator standing this week was a net position of 25,207 contracts in the data reported through Tuesday. This was a weekly reduction of -17,284 contracts from the previous week which had a total of 42,491 net contracts.

The 30-Day Federal Funds large speculator standing this week was a net position of 25,207 contracts in the data reported through Tuesday. This was a weekly reduction of -17,284 contracts from the previous week which had a total of 42,491 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 42.7 percent. The commercials are Bullish with a score of 57.8 percent and the small traders (not shown in chart) are Bearish with a score of 39.6 percent.

| 30-Day Federal Funds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 6.2 | 75.9 | 1.9 |

| – Percent of Open Interest Shorts: | 4.8 | 76.8 | 2.4 |

| – Net Position: | 25,207 | -17,303 | -7,904 |

| – Gross Longs: | 117,407 | 1,448,066 | 37,077 |

| – Gross Shorts: | 92,200 | 1,465,369 | 44,981 |

| – Long to Short Ratio: | 1.3 to 1 | 1.0 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 42.7 | 57.8 | 39.6 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.8 | -1.4 | 11.0 |

2-Year Treasury Note Futures:

The 2-Year Treasury Note large speculator standing this week was a net position of -128,118 contracts in the data reported through Tuesday. This was a weekly reduction of -92,825 contracts from the previous week which had a total of -35,293 net contracts.

The 2-Year Treasury Note large speculator standing this week was a net position of -128,118 contracts in the data reported through Tuesday. This was a weekly reduction of -92,825 contracts from the previous week which had a total of -35,293 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 56.4 percent. The commercials are Bullish with a score of 62.1 percent and the small traders (not shown in chart) are Bearish with a score of 21.5 percent.

| 2-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 11.9 | 77.2 | 6.5 |

| – Percent of Open Interest Shorts: | 17.6 | 68.5 | 9.4 |

| – Net Position: | -128,118 | 193,103 | -64,985 |

| – Gross Longs: | 263,530 | 1,714,483 | 143,470 |

| – Gross Shorts: | 391,648 | 1,521,380 | 208,455 |

| – Long to Short Ratio: | 0.7 to 1 | 1.1 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 56.4 | 62.1 | 21.5 |

| – Strength Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -1.2 | -5.1 | 12.2 |

5-Year Treasury Note Futures:

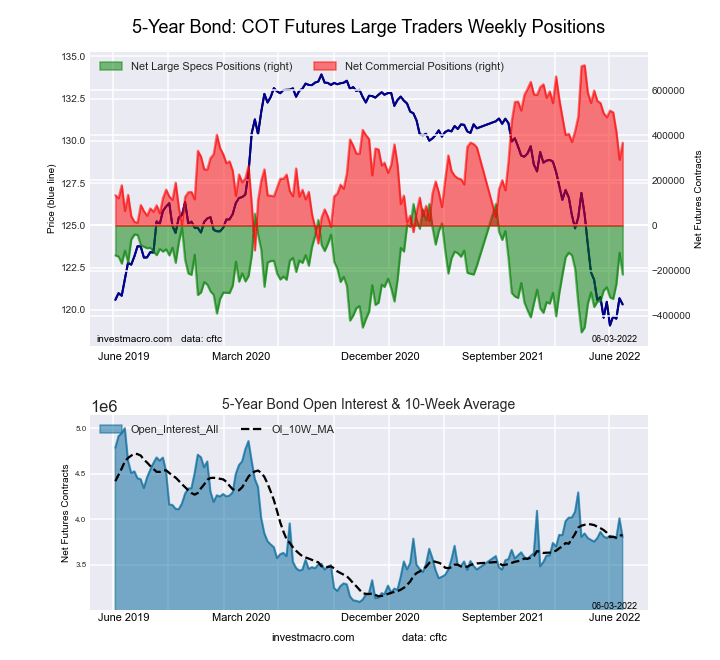

The 5-Year Treasury Note large speculator standing this week was a net position of -217,788 contracts in the data reported through Tuesday. This was a weekly decline of -97,261 contracts from the previous week which had a total of -120,527 net contracts.

The 5-Year Treasury Note large speculator standing this week was a net position of -217,788 contracts in the data reported through Tuesday. This was a weekly decline of -97,261 contracts from the previous week which had a total of -120,527 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 45.0 percent. The commercials are Bullish with a score of 58.1 percent and the small traders (not shown in chart) are Bearish with a score of 39.9 percent.

| 5-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.1 | 81.4 | 7.5 |

| – Percent of Open Interest Shorts: | 14.9 | 71.7 | 11.4 |

| – Net Position: | -217,788 | 367,355 | -149,567 |

| – Gross Longs: | 348,119 | 3,096,723 | 285,676 |

| – Gross Shorts: | 565,907 | 2,729,368 | 435,243 |

| – Long to Short Ratio: | 0.6 to 1 | 1.1 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 45.0 | 58.1 | 39.9 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 12.5 | -15.9 | 16.3 |

10-Year Treasury Note Futures:

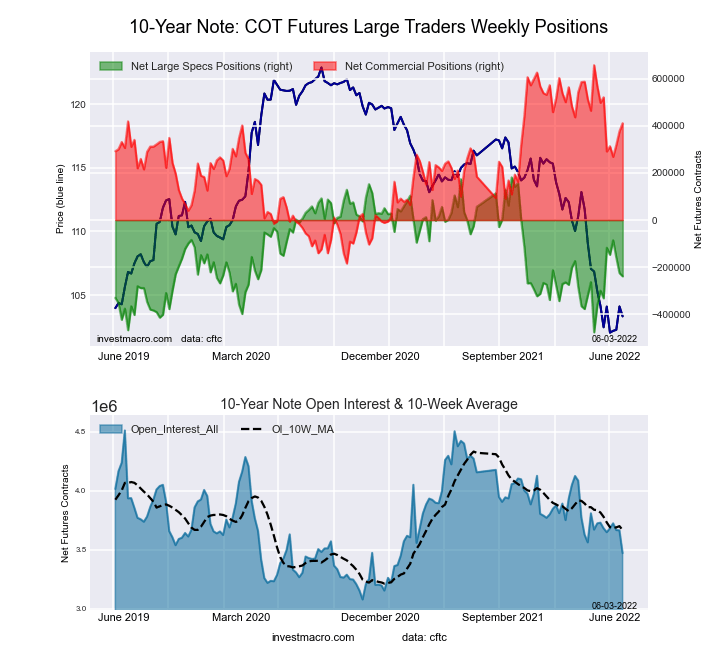

The 10-Year Treasury Note large speculator standing this week was a net position of -238,907 contracts in the data reported through Tuesday. This was a weekly decrease of -13,783 contracts from the previous week which had a total of -225,124 net contracts.

The 10-Year Treasury Note large speculator standing this week was a net position of -238,907 contracts in the data reported through Tuesday. This was a weekly decrease of -13,783 contracts from the previous week which had a total of -225,124 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 36.1 percent. The commercials are Bullish with a score of 70.7 percent and the small traders (not shown in chart) are Bearish with a score of 38.9 percent.

| 10-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 7.1 | 79.6 | 9.0 |

| – Percent of Open Interest Shorts: | 14.0 | 67.8 | 14.0 |

| – Net Position: | -238,907 | 411,183 | -172,276 |

| – Gross Longs: | 245,557 | 2,764,399 | 313,090 |

| – Gross Shorts: | 484,464 | 2,353,216 | 485,366 |

| – Long to Short Ratio: | 0.5 to 1 | 1.2 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 36.1 | 70.7 | 38.9 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.2 | -13.1 | 3.9 |

Ultra 10-Year Notes Futures:

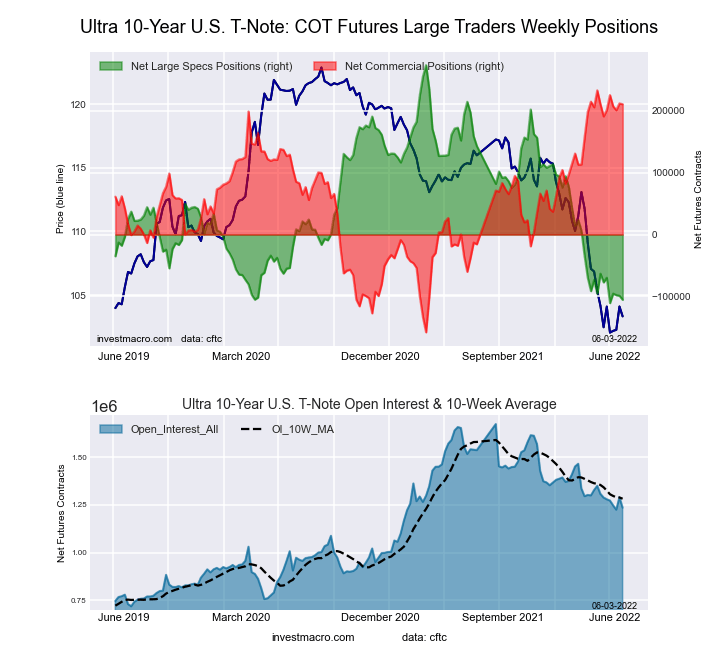

The Ultra 10-Year Notes large speculator standing this week was a net position of -105,367 contracts in the data reported through Tuesday. This was a weekly fall of -6,442 contracts from the previous week which had a total of -98,925 net contracts.

The Ultra 10-Year Notes large speculator standing this week was a net position of -105,367 contracts in the data reported through Tuesday. This was a weekly fall of -6,442 contracts from the previous week which had a total of -98,925 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 1.4 percent. The commercials are Bullish-Extreme with a score of 94.3 percent and the small traders (not shown in chart) are Bullish with a score of 52.6 percent.

| Ultra 10-Year Notes Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 4.8 | 81.8 | 11.9 |

| – Percent of Open Interest Shorts: | 13.4 | 64.7 | 20.4 |

| – Net Position: | -105,367 | 210,588 | -105,221 |

| – Gross Longs: | 59,643 | 1,010,524 | 147,144 |

| – Gross Shorts: | 165,010 | 799,936 | 252,365 |

| – Long to Short Ratio: | 0.4 to 1 | 1.3 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 1.4 | 94.3 | 52.6 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -7.3 | 5.0 | 5.2 |

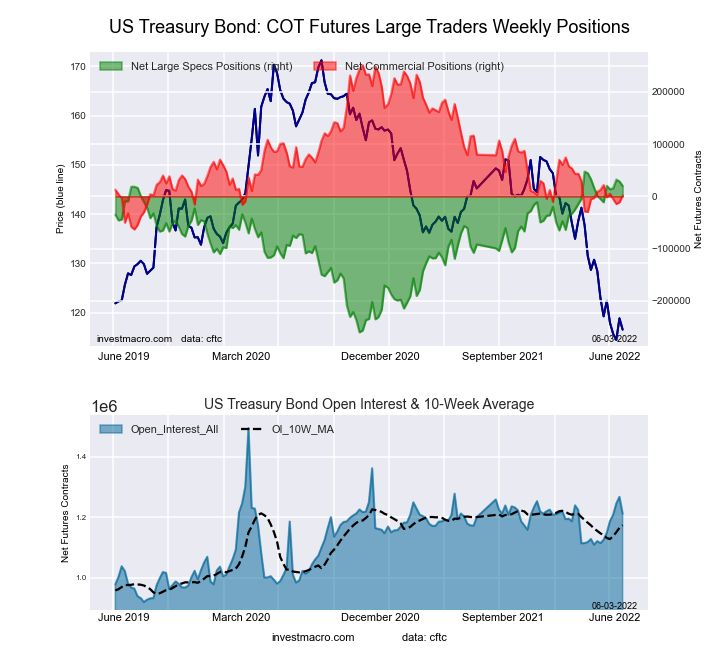

US Treasury Bonds Futures:

The US Treasury Bonds large speculator standing this week was a net position of 19,761 contracts in the data reported through Tuesday. This was a weekly reduction of -8,741 contracts from the previous week which had a total of 28,502 net contracts.

The US Treasury Bonds large speculator standing this week was a net position of 19,761 contracts in the data reported through Tuesday. This was a weekly reduction of -8,741 contracts from the previous week which had a total of 28,502 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 91.0 percent. The commercials are Bearish with a score of 20.6 percent and the small traders (not shown in chart) are Bearish with a score of 35.6 percent.

| US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.9 | 75.9 | 13.0 |

| – Percent of Open Interest Shorts: | 8.3 | 75.8 | 14.7 |

| – Net Position: | 19,761 | 1,627 | -21,388 |

| – Gross Longs: | 120,014 | 920,309 | 157,340 |

| – Gross Shorts: | 100,253 | 918,682 | 178,728 |

| – Long to Short Ratio: | 1.2 to 1 | 1.0 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 91.0 | 20.6 | 35.6 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 10.1 | -6.3 | -8.8 |

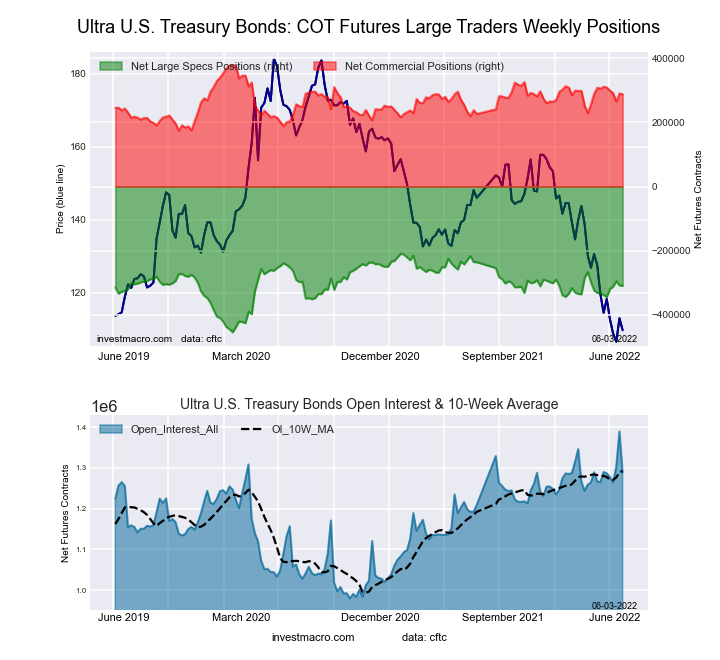

Ultra US Treasury Bonds Futures:

The Ultra US Treasury Bonds large speculator standing this week was a net position of -309,278 contracts in the data reported through Tuesday. This was a weekly fall of -1,383 contracts from the previous week which had a total of -307,895 net contracts.

The Ultra US Treasury Bonds large speculator standing this week was a net position of -309,278 contracts in the data reported through Tuesday. This was a weekly fall of -1,383 contracts from the previous week which had a total of -307,895 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 59.0 percent. The commercials are Bullish with a score of 55.7 percent and the small traders (not shown in chart) are Bearish with a score of 43.8 percent.

| Ultra US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 3.2 | 83.4 | 11.5 |

| – Percent of Open Interest Shorts: | 27.2 | 61.1 | 9.9 |

| – Net Position: | -309,278 | 287,591 | 21,687 |

| – Gross Longs: | 41,190 | 1,074,846 | 148,794 |

| – Gross Shorts: | 350,468 | 787,255 | 127,107 |

| – Long to Short Ratio: | 0.1 to 1 | 1.4 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 59.0 | 55.7 | 43.8 |

| – Strength Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 11.5 | -11.4 | -3.5 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

- China data beat expectations. Inflationary pressures in Canada continue to ease Apr 16, 2025

- Japanese Yen Surges as Weak US Dollar Fuels Momentum Apr 16, 2025

- Investors welcome tariff reliefs. Demand for safe assets is decreasing Apr 15, 2025

- CN50 waits on key China data Apr 15, 2025

- Gold Prices Remain Elevated Amid Concerns Over Trump’s Tariffs Apr 15, 2025

- Trump announces exemption of key tech goods from imposed tariffs Apr 14, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Platinum & Silver Apr 13, 2025

- COT Bonds Charts: Speculator Bets led by SOFR-3M, Fed Funds & Ultra Treasury Bonds Apr 13, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil & Wheat Apr 13, 2025

- COT Stock Market Charts: Speculator Bets led higher by Nasdaq, Russell & DowJones Apr 13, 2025