Markets are waking up to inflation numbers the like of which many of us have never seen before. US stock indices sold off with the Tech sector getting hit, especially after Elon Musk sold $5bn worth of Tesla stock.

The broader S&P500 experienced its worst day in more than a month. It also marked the first back-to-back decline in a month, after the index closed at a record high to start the week. Asian markets are mixed with the Nikkei is supported by the yen’s weakness. European markets are lower while US futures are modestly in the green.

Team Transitory licking its wounds

Is the battle between policymakers and many market watchers finally over?

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

We all know the argument by now – the former believe price pressures are temporary due to supply bottlenecks and lingering pandemic issues that will ease in time.

The “inflationistas” are finally enjoying their moment in the sun after multi-decade high US CPI numbers.

There are a multitude of statistics flying about. We like the one the Atlanta Fed produces on flexible and “sticky” inflation. Prices of some goods adjust quickly. Others which take months are hard to reverse and what central bankers certainly want to avoid. Last month saw the sharpest rise in “sticky” prices since January 1991.

Dollar breakout in full effect

It’s Veterans Day holiday in the US which suggest liquidity will be lower than normal. But a narrative of inflation staying high and potentially heading higher (7% anyone?!), along with further employment gains and a Fed exiting loose policy more quickly should keep the dollar bid.

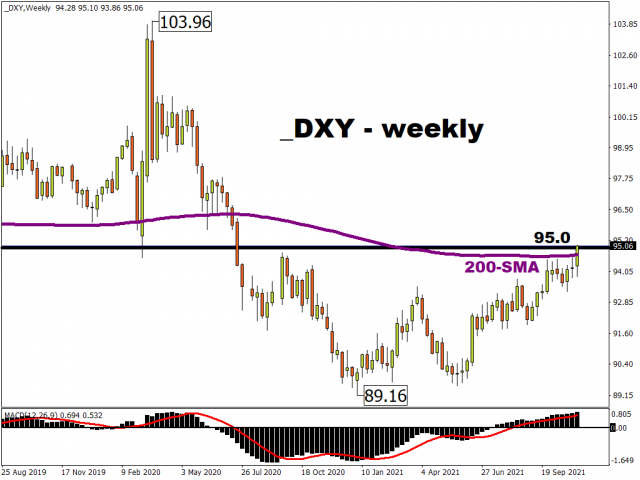

Trade weighted measures of the greenback have pushed to new highs for the year. The DXY has breached 95 having crossed the 200-week moving average.

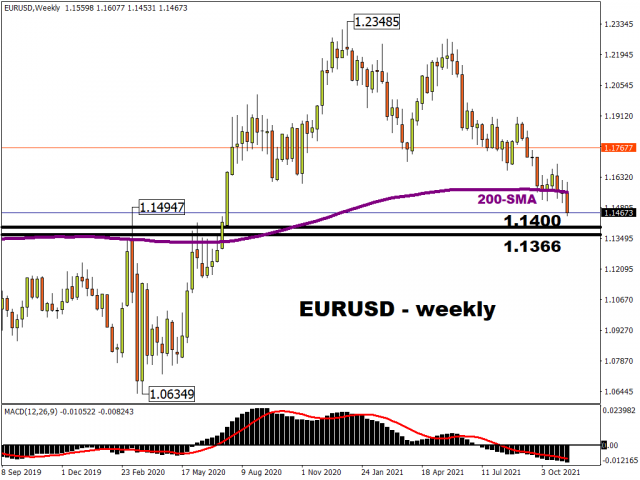

The five-month downtrend in EUR/USD has finally broken down through the 1.15 support zone. The failure below 1.16 had warned of further weakness. That support zone extends just below 1.15, with the March 2020 spike high at 1.14947.

Long-term levels below which sellers have their eyes on include 1.14 and then 1.1366. The weekly close will be key for an extended move like this to kick on.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Trump signals de-escalation in the Middle East; China’s trade surplus hits a new record Mar 10, 2026

- EUR/USD in Turbulence: Market Questions When Conflict Over Iran Will End Mar 10, 2026

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026