By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

The latest update for the weekly Commitment of Traders (COT) report was released by the Commodity Futures Trading Commission (CFTC) on Friday for data ending on November 16th 2021.

This weekly Extreme Positions report highlights the Top 5 Most Bullish and Top 5 Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.

To signify an extreme position, we use the Strength Index (also known as the COT Index) of each instrument, a common method of measuring COT data. The Strength Index is simply a comparison of current trader positions against the range of positions over the previous 3 years. We use over 80 percent as extremely bullish and under 20 percent as extremely bearish. (Compare Strength Index scores across all markets in the data table or cot leaders table)

Speculators or Non-Commercials Notes:

Speculators, classified as non-commercial traders by the CFTC, are made up of large commodity funds, hedge funds and other significant for-profit participants. The Specs are generally regarded as trend-followers in their behavior towards price action – net speculator bets and prices tend to go in the same directions. These traders often look to buy when prices are rising and sell when prices are falling. To illustrate this point, many times speculator contracts can be found at their most extremes (bullish or bearish) when prices are also close to their highest or lowest levels.

These extreme levels can be dangerous for the large speculators as the trade is most crowded, there is less trading ammunition still sitting on the sidelines to push the trend further and prices have moved a significant distance. When the trend becomes exhausted, some speculators take profits while others look to also exit positions when prices fail to continue in the same direction. This process usually plays out over many months to years and can ultimately create a reverse effect where prices start to fall and speculators start a process of selling when prices are falling.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Here Are This Week’s Most Bullish Speculator Positions:

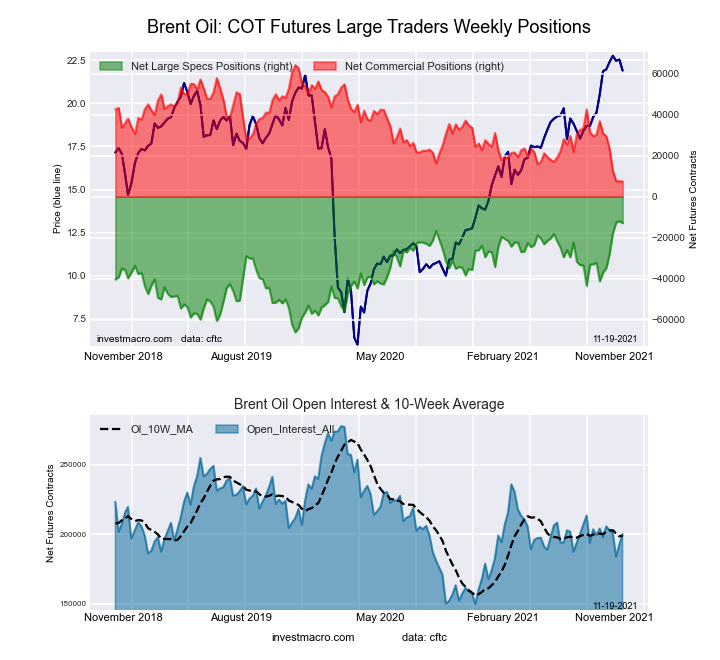

Brent Oil

The Brent Oil speculator trader’s futures position comes in as the most bullish extreme standing this week. The Brent speculator level is currently at a 98 percent score of its 3-year range.

The speculator position totaled -12,900 net contracts this week which was a change by -1,049 contracts from last week. The speculator long position was a total of 45,201 contracts compared to the total spec short position of 58,101 contracts.

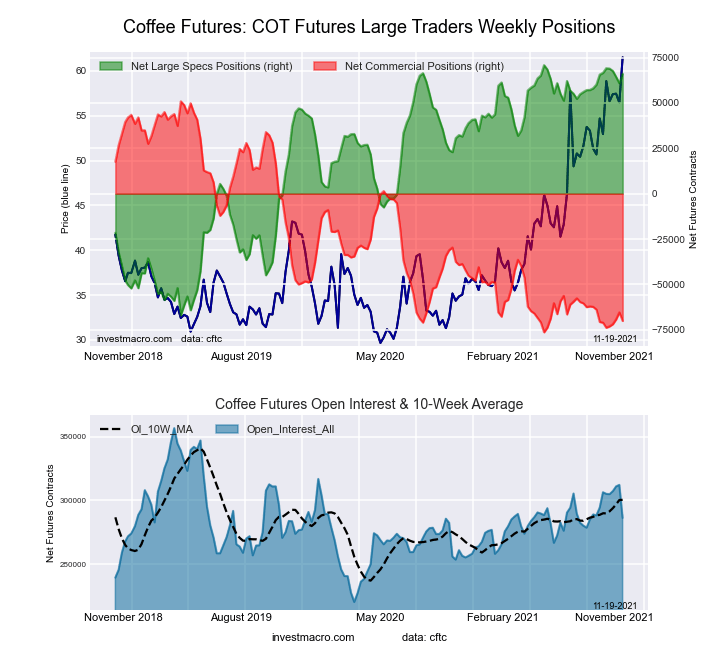

Coffee Futures

The Coffee Futures speculator trader’s futures position comes next in the extreme standings this week. The Coffee speculator level is now at a 97 percent score of its 3-year range.

The speculator position was 66,081 net contracts this week, a change by 5,261 contracts from last week. The speculator long position was a total of 79,550 contracts versus the total speculator short position of 13,469 contracts.

New Zealand Dollar

The New Zealand Dollar speculator trader’s futures position comes in third this week in the extreme standings. The NZD speculator level resides at a 95 percent score of its 3-year range.

The speculator position was 13,965 net contracts this week which marked a change by 1,083 contracts from last week. The speculator long position was a total of 26,388 contracts versus the total speculator short position of 12,423 contracts.

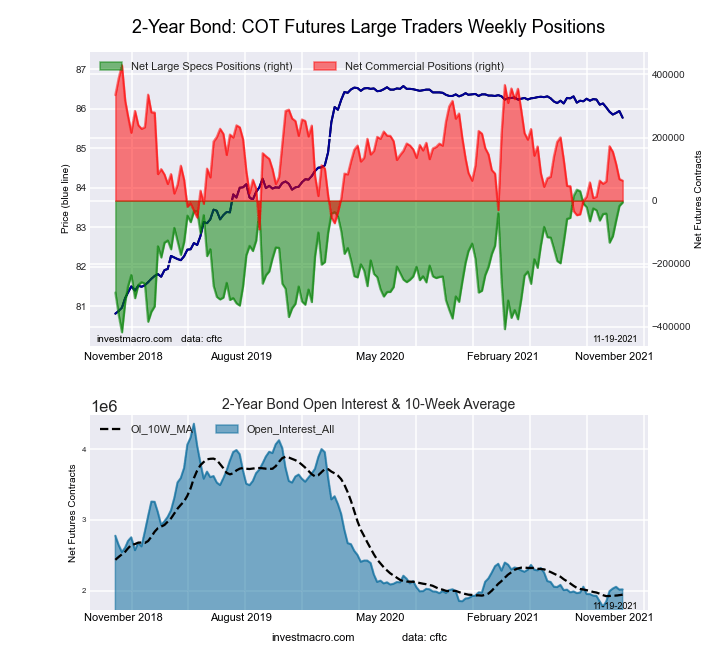

2-Year Bond

The 2-Year Bond speculator trader’s futures position comes up number four in the extreme standings this week. The 2-Year speculator level is at a 91 percent score of its 3-year range.

The speculator position was -5,445 net contracts this week and changed by 11,292 contracts from last week. The speculator long position was a total of 345,245 contracts against the total spec short position of 350,690 contracts.

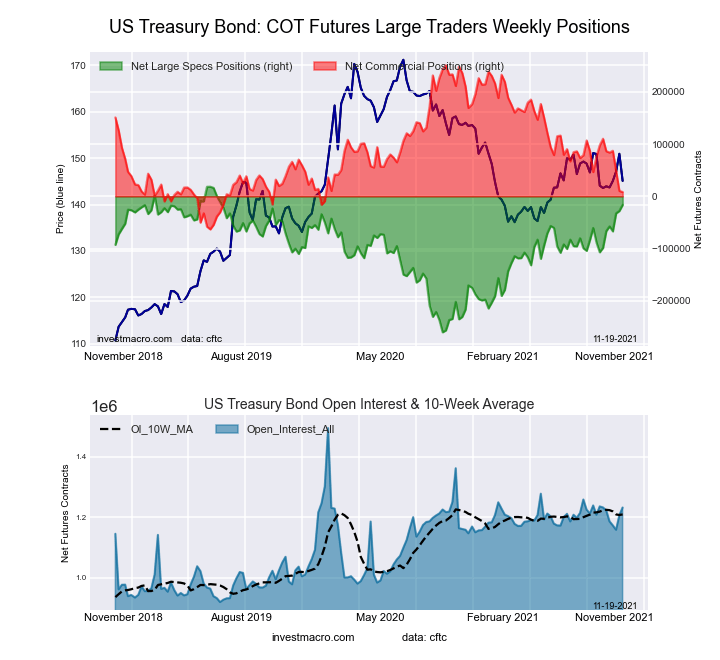

US Treasury Bond

The US Treasury Bond speculator trader’s futures position rounds out the top five in this week’s bullish extreme standings. The Long T-Bond speculator level sits at a 88 percent score of its 3-year range.

The speculator position was -16,368 net contracts this week which was a move of 11,704 contracts from last week. The speculator long position was a total of 144,973 contracts in comparison to the total speculator short position of 161,341 contracts.

This Week’s Most Bearish Speculator Positions:

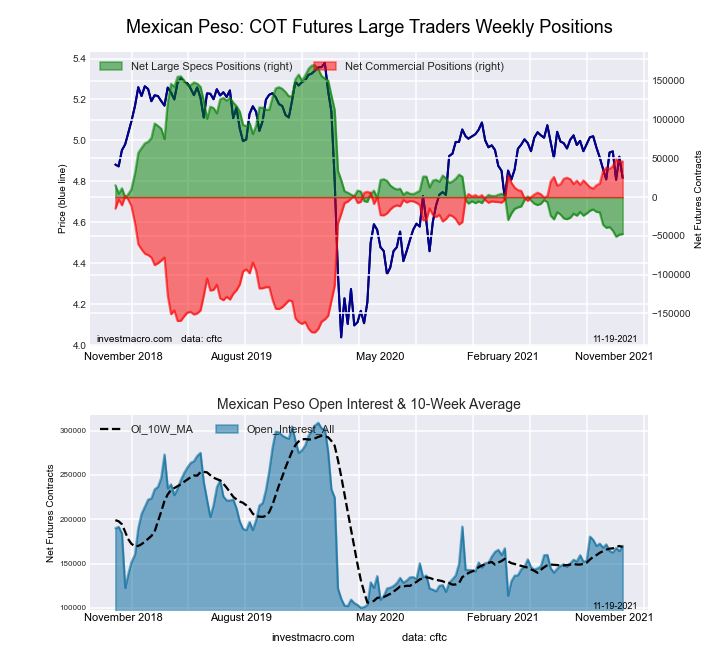

Mexican Peso

The Mexican Peso speculator trader’s futures position comes in as the most bearish extreme standing this week. The MXN speculator level is at a 2 percent score of its 3-year range.

The speculator position was -47,655 net contracts this week, a weekly change of 752 contracts from last week. The speculator long position was a total of 69,984 contracts versus the total spec short position of 117,639 contracts.

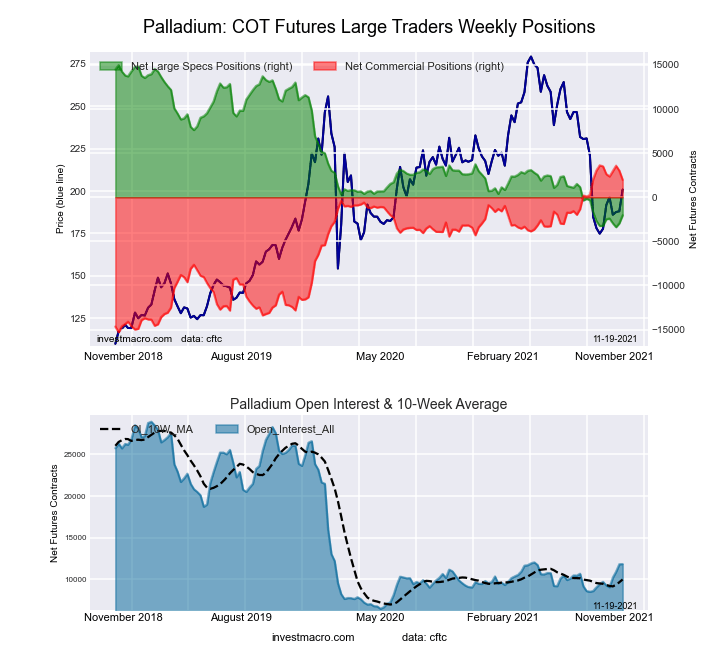

Palladium

The Palladium speculator trader’s futures position comes in next for the most bearish extreme standing on the week. The Palladium speculator level is at a 7 percent score of its 3-year range.

The speculator position was -2,038 net contracts this week which was a change by 916 contracts from last week. The speculator long position was a total of 3,108 contracts compared to the total speculator short position of 5,146 contracts.

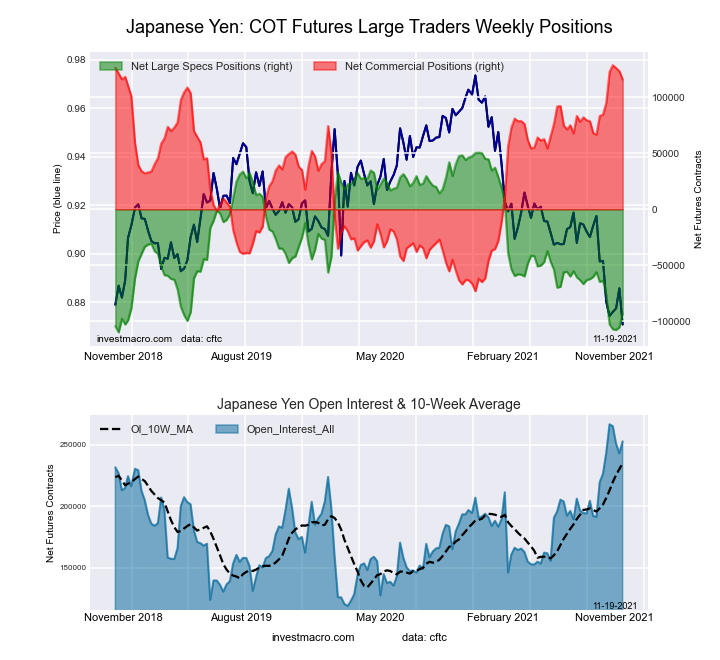

Japanese Yen

The Japanese Yen speculator trader’s futures position comes in as third most bearish extreme standing of the week. The JPY speculator level resides at a 10 percent score of its 3-year range.

The speculator position was -93,126 net contracts this week saw movement by 12,225 contracts from last week. The speculator long position was a total of 24,635 contracts against the total spec short position of 117,761 contracts.

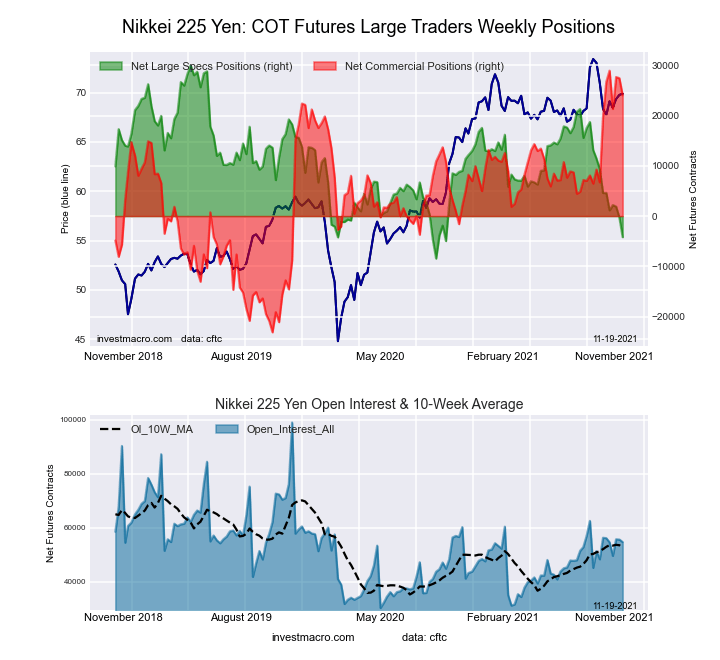

Nikkei 225 Yen

The Nikkei 225 Yen (Japanese stock market) speculator trader’s futures position comes in as this week’s fourth most bearish extreme standing. The Nikkei 225 Yen speculator level is at a 11 percent score of its 3-year range.

The speculator position was -4,195 net contracts this week which was a change by -3,892 contracts on the week. The speculator long position was a total of 9,075 contracts versus the total speculator short position of 13,270 contracts.

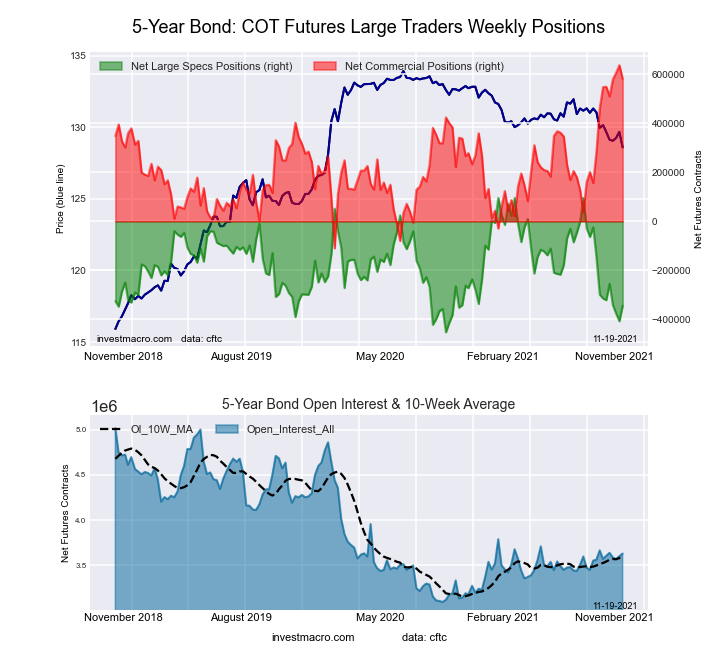

5-Year Bond

Finally, the 5-Year Bond speculator trader’s futures position comes in as the fifth most bearish extreme standing for this week. The 5-Year speculator level is at a 20 percent score of its 3-year range.

The speculator position was -344,595 net contracts this week and changed by 62,890 contracts from last week. The speculator long position was a total of 300,750 contracts compared to the total spec short position of 645,345 contracts.

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026