By InvestMacro.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday October 19th 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

| Oct-19-2021 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| S&P500-Mini | 2,386,587 | 0 | 67,619 | 65 | -85,275 | 51 | 17,656 | 30 |

| Nikkei 225 | 16,977 | 8 | 1,212 | 62 | -3,790 | 39 | 2,578 | 60 |

| Nasdaq-Mini | 237,365 | 35 | -3,057 | 73 | 10,428 | 33 | -7,371 | 27 |

| DowJones-Mini | 106,040 | 78 | 3,631 | 40 | -8,168 | 52 | 4,537 | 63 |

| VIX | 361,391 | 45 | -86,768 | 50 | 93,607 | 51 | -6,839 | 30 |

| Nikkei 225 Yen | 54,615 | 35 | 1,144 | 25 | 28,926 | 100 | -30,070 | 21 |

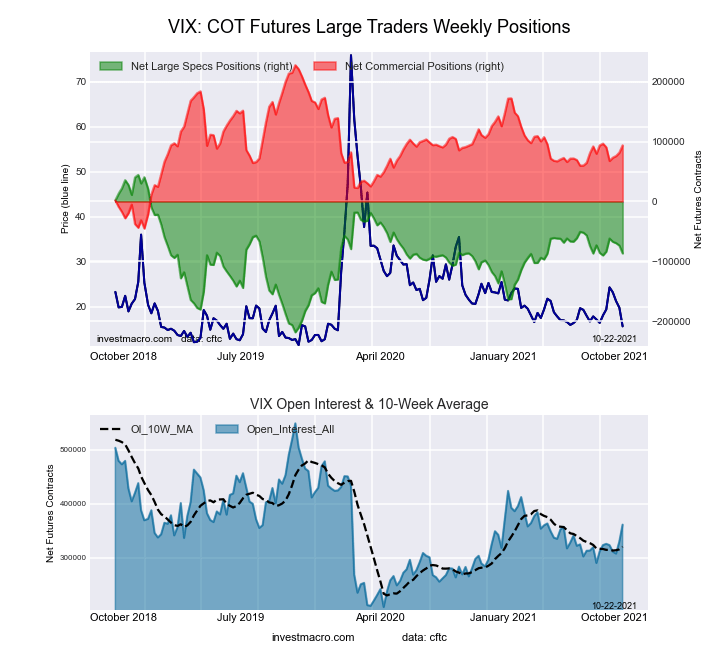

VIX Volatility Futures:

The VIX Volatility large speculator standing this week totaled a net position of -86,768 contracts in the data reported through Tuesday. This was a weekly reduction of -13,199 contracts from the previous week which had a total of -73,569 net contracts.

The VIX Volatility large speculator standing this week totaled a net position of -86,768 contracts in the data reported through Tuesday. This was a weekly reduction of -13,199 contracts from the previous week which had a total of -73,569 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 50.1 percent. The commercials are Bullish with a score of 50.9 percent and the small traders (not shown in chart) are Bearish with a score of 30.5 percent.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

| VIX Volatility Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 16.8 | 53.1 | 6.3 |

| – Percent of Open Interest Shorts: | 40.8 | 27.2 | 8.2 |

| – Net Position: | -86,768 | 93,607 | -6,839 |

| – Gross Longs: | 60,834 | 191,937 | 22,690 |

| – Gross Shorts: | 147,602 | 98,330 | 29,529 |

| – Long to Short Ratio: | 0.4 to 1 | 2.0 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 50.1 | 50.9 | 30.5 |

| – COT Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.3 | -1.0 | -1.7 |

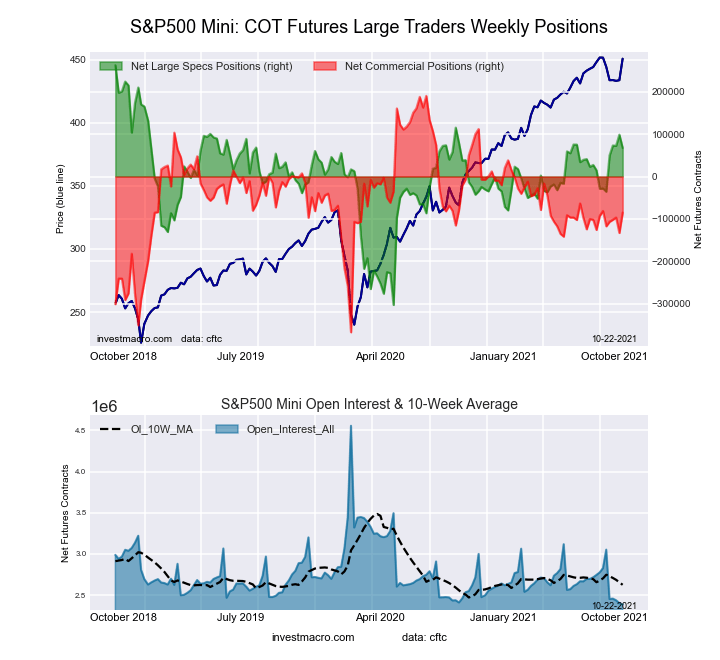

S&P500 Mini Futures:

The S&P500 Mini large speculator standing this week totaled a net position of 67,619 contracts in the data reported through Tuesday. This was a weekly lowering of -31,164 contracts from the previous week which had a total of 98,783 net contracts.

The S&P500 Mini large speculator standing this week totaled a net position of 67,619 contracts in the data reported through Tuesday. This was a weekly lowering of -31,164 contracts from the previous week which had a total of 98,783 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 65.5 percent. The commercials are Bullish with a score of 50.6 percent and the small traders (not shown in chart) are Bearish with a score of 30.1 percent.

| S&P500 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 14.7 | 72.0 | 10.8 |

| – Percent of Open Interest Shorts: | 11.8 | 75.6 | 10.1 |

| – Net Position: | 67,619 | -85,275 | 17,656 |

| – Gross Longs: | 350,155 | 1,718,651 | 258,179 |

| – Gross Shorts: | 282,536 | 1,803,926 | 240,523 |

| – Long to Short Ratio: | 1.2 to 1 | 1.0 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 65.5 | 50.6 | 30.1 |

| – COT Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 16.9 | -0.7 | -19.3 |

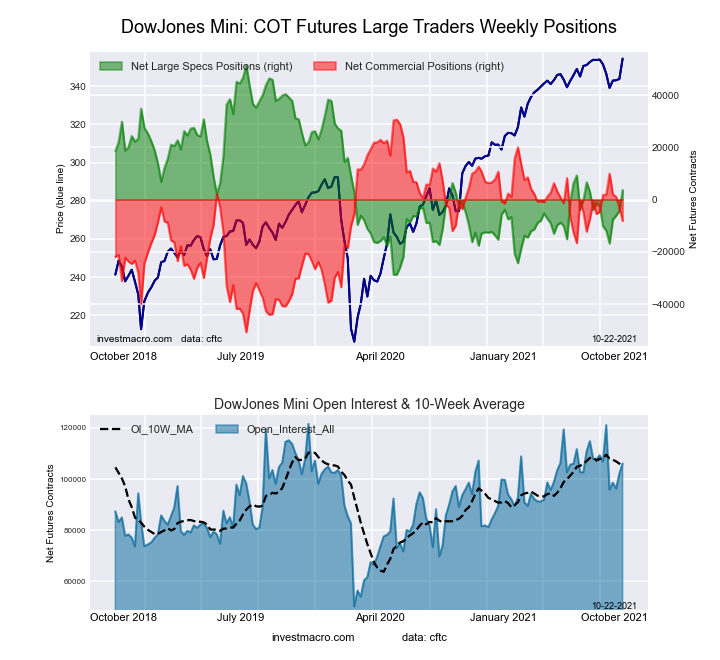

Dow Jones Mini Futures:

The Dow Jones Mini large speculator standing this week totaled a net position of 3,631 contracts in the data reported through Tuesday. This was a weekly rise of 7,914 contracts from the previous week which had a total of -4,283 net contracts.

The Dow Jones Mini large speculator standing this week totaled a net position of 3,631 contracts in the data reported through Tuesday. This was a weekly rise of 7,914 contracts from the previous week which had a total of -4,283 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 40.4 percent. The commercials are Bullish with a score of 52.4 percent and the small traders (not shown in chart) are Bullish with a score of 62.7 percent.

| Dow Jones Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 37.8 | 43.5 | 16.4 |

| – Percent of Open Interest Shorts: | 34.4 | 51.2 | 12.1 |

| – Net Position: | 3,631 | -8,168 | 4,537 |

| – Gross Longs: | 40,105 | 46,155 | 17,408 |

| – Gross Shorts: | 36,474 | 54,323 | 12,871 |

| – Long to Short Ratio: | 1.1 to 1 | 0.8 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 40.4 | 52.4 | 62.7 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 17.2 | -12.2 | -20.5 |

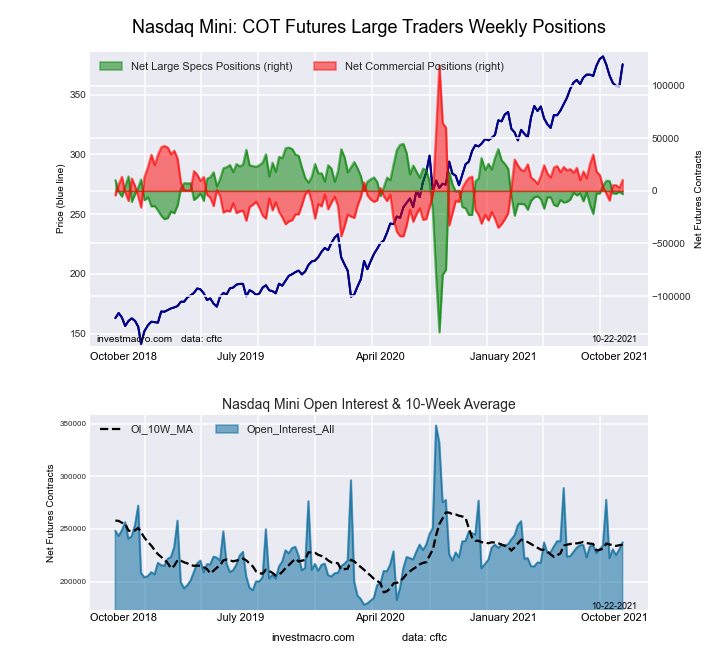

Nasdaq Mini Futures:

The Nasdaq Mini large speculator standing this week totaled a net position of -3,057 contracts in the data reported through Tuesday. This was a weekly decline of -2,239 contracts from the previous week which had a total of -818 net contracts.

The Nasdaq Mini large speculator standing this week totaled a net position of -3,057 contracts in the data reported through Tuesday. This was a weekly decline of -2,239 contracts from the previous week which had a total of -818 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 73.3 percent. The commercials are Bearish with a score of 32.9 percent and the small traders (not shown in chart) are Bearish with a score of 27.4 percent.

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 25.5 | 56.9 | 15.4 |

| – Percent of Open Interest Shorts: | 26.8 | 52.5 | 18.5 |

| – Net Position: | -3,057 | 10,428 | -7,371 |

| – Gross Longs: | 60,578 | 135,012 | 36,648 |

| – Gross Shorts: | 63,635 | 124,584 | 44,019 |

| – Long to Short Ratio: | 1.0 to 1 | 1.1 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 73.3 | 32.9 | 27.4 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.5 | 4.1 | 3.3 |

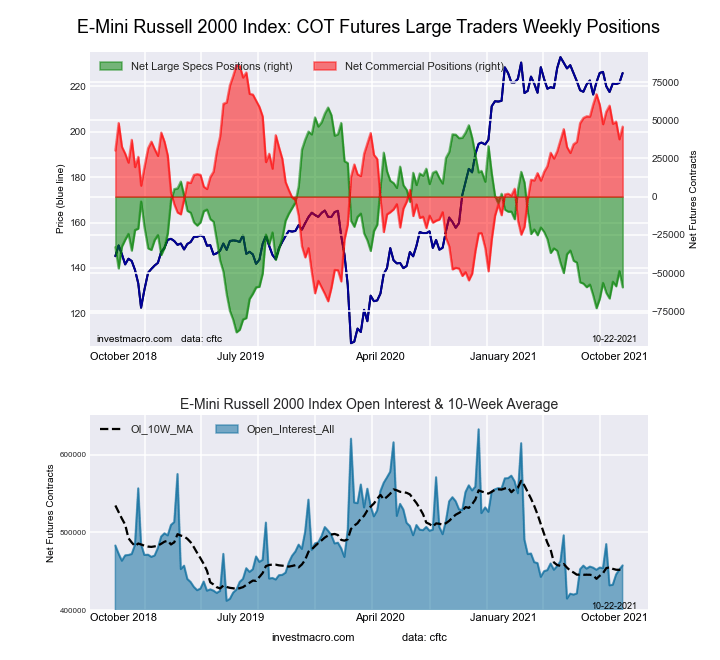

Russell 2000 Mini Futures:

The Russell 2000 Mini large speculator standing this week totaled a net position of -59,321 contracts in the data reported through Tuesday. This was a weekly decrease of -10,615 contracts from the previous week which had a total of -48,706 net contracts.

The Russell 2000 Mini large speculator standing this week totaled a net position of -59,321 contracts in the data reported through Tuesday. This was a weekly decrease of -10,615 contracts from the previous week which had a total of -48,706 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 20.0 percent. The commercials are Bullish with a score of 74.0 percent and the small traders (not shown in chart) are Bullish with a score of 71.1 percent.

| Russell 2000 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 12.4 | 79.7 | 7.0 |

| – Percent of Open Interest Shorts: | 25.4 | 69.7 | 4.1 |

| – Net Position: | -59,321 | 45,830 | 13,491 |

| – Gross Longs: | 56,745 | 364,548 | 32,132 |

| – Gross Shorts: | 116,066 | 318,718 | 18,641 |

| – Long to Short Ratio: | 0.5 to 1 | 1.1 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 20.0 | 74.0 | 71.1 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -2.0 | -1.0 | 12.6 |

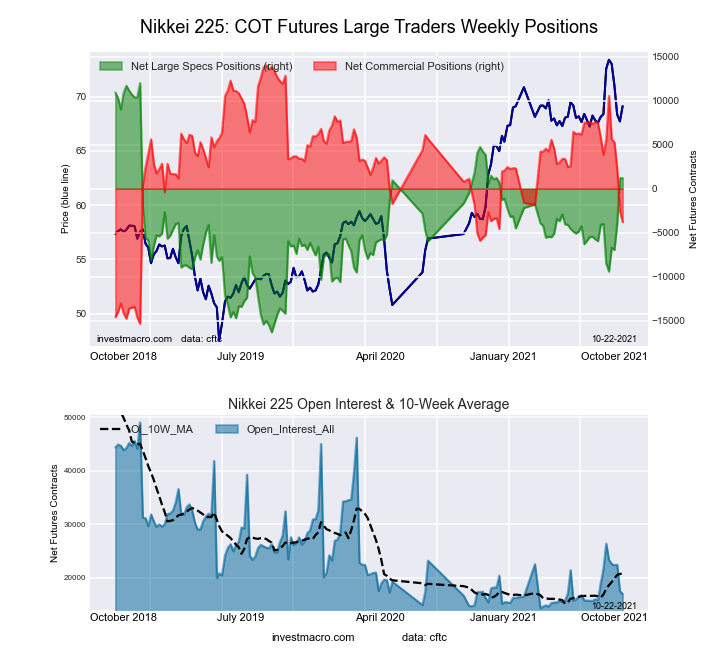

Nikkei Stock Average (USD) Futures:

The Nikkei Stock Average (USD) large speculator standing this week totaled a net position of 1,212 contracts in the data reported through Tuesday. This was a weekly gain of 18 contracts from the previous week which had a total of 1,194 net contracts.

The Nikkei Stock Average (USD) large speculator standing this week totaled a net position of 1,212 contracts in the data reported through Tuesday. This was a weekly gain of 18 contracts from the previous week which had a total of 1,194 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 61.9 percent. The commercials are Bearish with a score of 39.3 percent and the small traders (not shown in chart) are Bullish with a score of 59.9 percent.

| Nikkei Stock Average Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 14.0 | 56.2 | 29.6 |

| – Percent of Open Interest Shorts: | 6.8 | 78.6 | 14.5 |

| – Net Position: | 1,212 | -3,790 | 2,578 |

| – Gross Longs: | 2,371 | 9,546 | 5,033 |

| – Gross Shorts: | 1,159 | 13,336 | 2,455 |

| – Long to Short Ratio: | 2.0 to 1 | 0.7 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 61.9 | 39.3 | 59.9 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 34.3 | -31.7 | -5.1 |

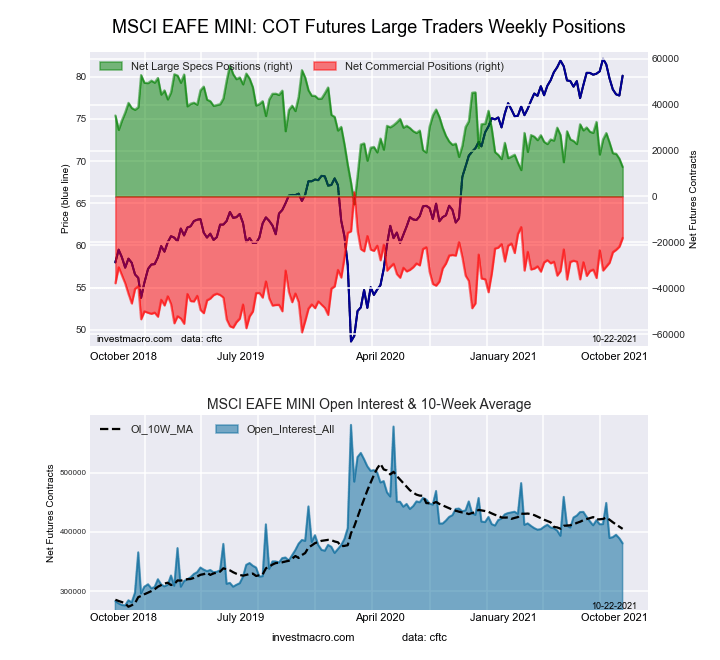

MSCI EAFE Mini Futures:

The MSCI EAFE Mini large speculator standing this week totaled a net position of 12,839 contracts in the data reported through Tuesday. This was a weekly decline of -3,615 contracts from the previous week which had a total of 16,454 net contracts.

The MSCI EAFE Mini large speculator standing this week totaled a net position of 12,839 contracts in the data reported through Tuesday. This was a weekly decline of -3,615 contracts from the previous week which had a total of 16,454 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 26.8 percent. The commercials are Bullish with a score of 67.3 percent and the small traders (not shown in chart) are Bullish with a score of 63.6 percent.

| MSCI EAFE Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 6.8 | 89.8 | 3.0 |

| – Percent of Open Interest Shorts: | 3.4 | 94.6 | 1.7 |

| – Net Position: | 12,839 | -18,092 | 5,253 |

| – Gross Longs: | 25,861 | 342,244 | 11,565 |

| – Gross Shorts: | 13,022 | 360,336 | 6,312 |

| – Long to Short Ratio: | 2.0 to 1 | 0.9 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 26.8 | 67.3 | 63.6 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -19.8 | 23.2 | -19.7 |

Article By InvestMacro.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026