By Lukman Otunuga Research Analyst, ForexTime

It was a week defined by speeches from numerous Federal Reserve officials and Jerome Powell’s testimony before Congress.

Monday kicked off on a positive note as markets took a big breath and regathered their thoughts after the Fed’s hawkish surprise last week. King Dollar entered the week on a shaky note, dipping back below 92.00 while gold attempted to nurse its deep wounds.

Things started getting interesting on Monday evening as the first batch of Fed speakers entered the spotlight. Dallas Fed President Robert Kaplan favoured tapering “sooner rather than later” while St. Louis Fed President James Bullard said the Fed needs to be prepared to face upside risks to inflation. However, New York Fed President John Williams said he expected inflation to drop back towards the Fed’s longer-run goal.

Equity markets pushed higher on Tuesday thanks to dovish commentary from Fed officials including Chairman Jerome Powell. In written remarks prepared for his testimony before Congress, he reiterated that the recent jump in inflation would prove transitory.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

In other news, the Eurozone consumer confidence flash survey rose by 1.8 points from a month earlier to -3.3 in June – its highest level since January 2018.

Our trade of the week was the British Pound. We questioned whether the Bank of England would deliver a hawkish surprise after the Fed’s surprise pivot last week. After being beaten black and blue last week, the GBPUSD staged a sharp rebound on Monday with prices trading around the 100-day Simple Moving Average before the BoE decision.

On Tuesday evening, Chair Jerome Powell struck a more cautious tone during his testimony before the House Select Subcommittee on the Coronavirus Crises. Powell reiterated the view that higher inflation would be transitory and how the Fed was nowhere near hiking interest rates. Equity bulls rejoiced on this dovish rhetoric with the Nasdaq rallying to fresh record highs.

Mid-week more Fed speakers were under the spotlight. Atlanta Fed President Raphael Bostic and Fed Governor Michelle Bowman both said that they believed the current price pressure could be temporary. However, they added it could remain higher for longer than expected. Federal Reserve Bank of Boston President Eric Rosengren expected inflation to come down and return close to the Fed’s 2% target going into next year.

In the commodities arena, Brent futures surpassed $76.00 this week – reaching their highest levels since October 2018. Oil bulls remain in a position of power as demand continues to outstrip supply. The reopening of economies has fuelled expectations over rising fuel demand while stalled nuclear talks between the US and Iran continue to soothe concerns over Iranian supplies returning to the markets. WTI Crude has gained over 52% since the start of 2021 while Brent is trailing behind appreciating roughly 47%.

All eyes were on the Bank of England on Thursday. Investors who were expecting more hawks to join the policy discussion were left-empty handed. As widely expected, the central bank left interest rates unchanged while a majority voted to maintain asset purchases at the current level of $895 billion. The British Pound depreciated after the BoE decision with prices trading below 1.3900 as of writing. Sterling has weakened against most G10 currencies this week excluding the dollar and Japanese Yen.

Global stocks mostly rose on Friday, boosted by a rally on Wallstreet overnight after US President Joe Biden announced a bipartisan infrastructure deal. Equity bulls derived further strength from the weaker than expected inflation data which eased worries about monetary policy tightening in the near term.

The May core personal consumption expenditures (PCE) price index rose 3.4% from a year ago. Although this was the biggest increase since 1992, it was in line with market expectations. The PCE index rose 3.9% year-over-year – also in line with market forecasts. For the month, the core index rose 0.5% which was below the 0.6% estimate while the one including volatile food and energy prices rose 0.4% for the month – below the 0.5% estimate.

The S&P 500 hit a fresh record high on Friday and is on route to concluding the week roughly 2.8% higher.

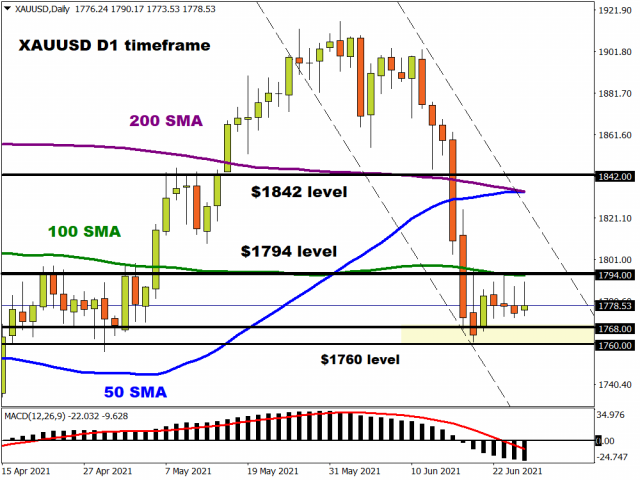

Let’s not forget about gold. The precious metal has struggled to nurse the deep wounds inflicted from last week’s brutal selloff. Gold remains trapped within a range with support around $1760-$1768 and resistance at $1794 which is where the 100-day Simple Average resides. A breakout could be on the horizon.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator bets led by Gold & Steel May 4, 2024

- COT Bonds Charts: Speculator bets led lower by SOFR 3M & 10-Year Bonds May 4, 2024

- COT Soft Commodities Charts: Speculator bets led by Wheat, Soybean Meal & Corn May 4, 2024

- COT Stock Market Charts: Speculator bets led lower by S&P500 & MSCI EAFE May 4, 2024

- The British index has updated the historical maximum. Oil lost 5% over the week May 3, 2024

- US Fed tilts towards a rate cut despite the postponement. HKMA left the rate unchanged at 5.75% May 2, 2024

- Brent crude oil hits seven-week low May 2, 2024

- Target Thursdays: USDJPY, Copper & EURCAD May 2, 2024

- WTI oil declines on rising inventories and negotiations between Israel and Hamas. Rising unemployment in New Zealand may force RBNZ to start cutting rates earlier May 1, 2024

- Bitcoin stumbles below $60k ahead of Fed May 1, 2024