By Lukman Otunuga, Research Analyst, ForexTime

Have you seen the recent movements in gold prices?

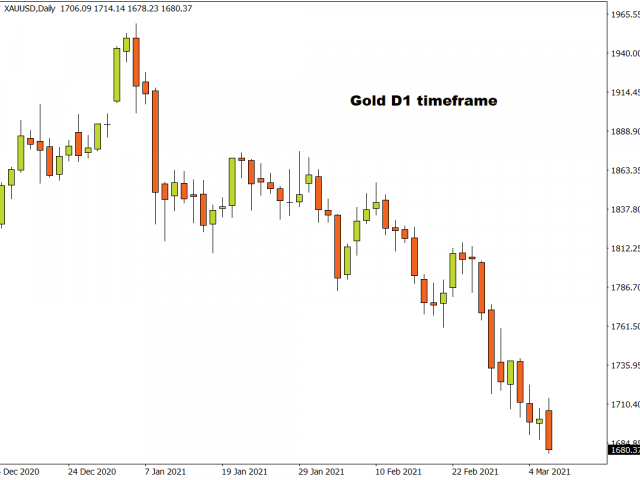

Over the past few weeks, the precious metal has cut through multiple levels of support like a hot knife through butter. One would have expected gold to draw ample strength from the great reflation trade, yet prices are down over 10% since the start of 2021.

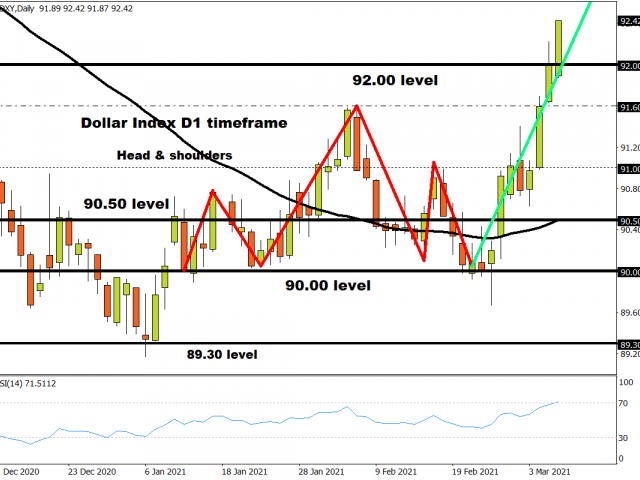

It is becoming clear that gold remains under the mercy of an appreciating dollar and rising bond yields.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The low-down…

Back in 2020, when the Covid menace created extraordinary levels of uncertainty and chaos, central banks were embarking on aggressive interest rate cuts. Unprecedented measures were enforced with stimulus injected into the financial system to prevent markets from flat-lining. This all sent bond prices through the roof, dragging yields to rock-bottom levels.

Fast forward to the present day, bond prices are falling thanks to growth optimism and inflation expectations. Given how inflation remains the arch-enemy of bond markets as it shaves away the real value of the fixed-interest payments, bonds may become depressed and somewhat unloved moving forward.

Why does this even matter?

Well, gold is seen as a hedge against inflation but is also a zero-yielding asset.

The precious metal is not only trapped in a fierce battle against rising bond yields but prospects of higher interest rates in the face of accelerating inflation!

Fundamentally, the pendulum swings in favour of bears especially when factoring in how global sentiment is improving on vaccine rollouts and Covid-19 cases are falling globally.

How about the great reflation trade?

The good news is that Senate passed President Biden’s $1.9 trillion stimulus package over the weekend…but the bad news is that could fuel expectations over faster inflation. Such will most likely spell more trouble for Gold despite its status as an inflation hedge as markets focus on rising yields.

Will Gold find a friend in Oil?

So far so good, oil is proving to be an unreliable friend.

One would have expected the recent jump in Brent crude oil to benefit gold (the inflation hedge), given how rising oil may lead to higher transport costs and prices for many goods. However, the precious metal has extended losses as inflation expectations hit bond markets.

Time to talk technicals

Prices are heavily oversold on the daily charts as the RSI is below the 30.00 level. This could provide an opportunity for bulls to make a counterattack with $1730 acting as a pivotal level.

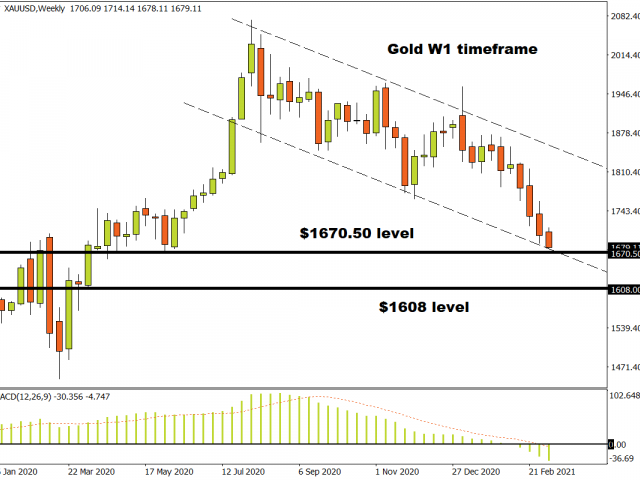

But the weekly and monthly timeframe suggest further downside with $1670.50 and $1608 acting as key levels of interest.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026