By JustMarkets

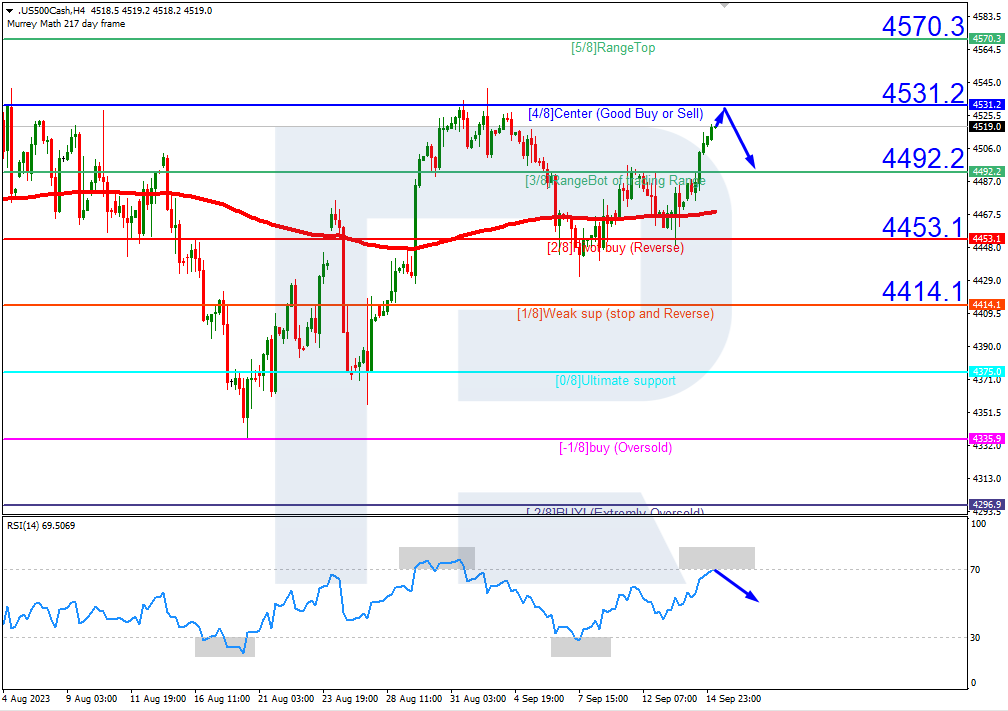

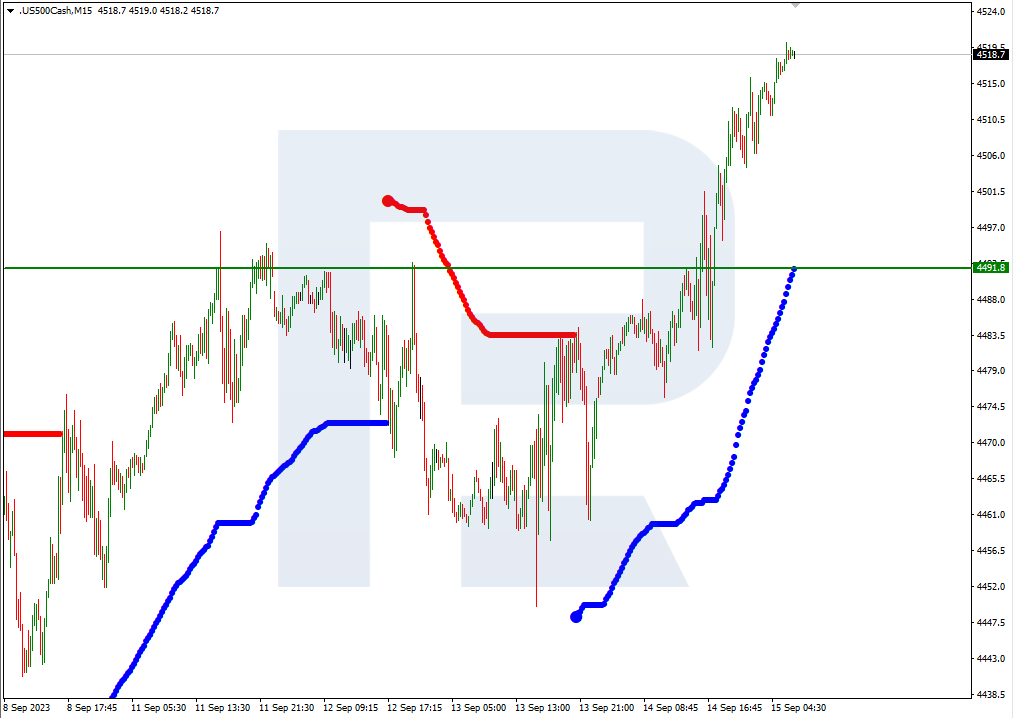

At the close of the stock exchange on Monday, the Dow Jones Index (US30) rose by 0.02%, and the S&P 500 Index (US500) increased by 0.07%. The NASDAQ Technology Index (US100) closed Monday at its opening price. Stock indices were down on Monday due to caution ahead of the two-day FOMC meeting on Tuesday and Wednesday. Markets fully expect the FOMC to leave the main rate target unchanged at 5.5% (99% probability) this week. However, the FOMC is expected to maintain a hawkish tone and remain open to one last rate hike, as inflation and the economy have not slowed enough yet.

Markets estimate the probability of the FOMC raising the rate by 25 bps at the November 1 meeting as 31%, and the probability of a 25 bps rate hike at the next meeting on December 13 is 14%. The markets then expect the FOMC to start cutting rates in 2024 in response to an expected slowdown in the US economy.

The NAHB US housing market index published on Monday fell by 5 points to a 5-month low of 45, which was much weaker than expected. The decline in confidence expressed by US homebuilders suggests that home-building activity may weaken in the coming months.

Apple (AAPL) shares jumped by 1.69% on Monday amid optimism about strong pre-orders for the latest iPhone 15 model. PayPal Holdings (PYPL) fell by 1.98% when MoffettNathanson downgraded the company to “downgrade” from “outperform” as analysts expect weak earnings growth due to increased competition.

Equity markets in Europe were mostly down yesterday. Germany’s DAX (DE40) fell by 1.05%, France’s CAC 40 (FR40) lost 1.39%, Spain’s IBEX 35 (ES35) decreased by 0.71%, and the UK’s FTSE 100 (UK100) closed negative 0.76%.

For the Eurozone, the main focus for the week ahead begins today with the inflation report, and another decline could have a negative impact on the euro but a positive impact on European indices. Eurozone and German business PMIs are expected to remain weak, although Friday’s announcement by Fitch that Germany remains under a AAA credit rating suggests a positive and stable outlook for the Eurozone’s largest economy. But overall, the US economy is much stronger right now than the Eurozone economy, and that’s evident in pricing and central bank guidance. This will likely keep the US dollar high against the euro until cracks in the US economy start to appear in the inflationary and labor environment.

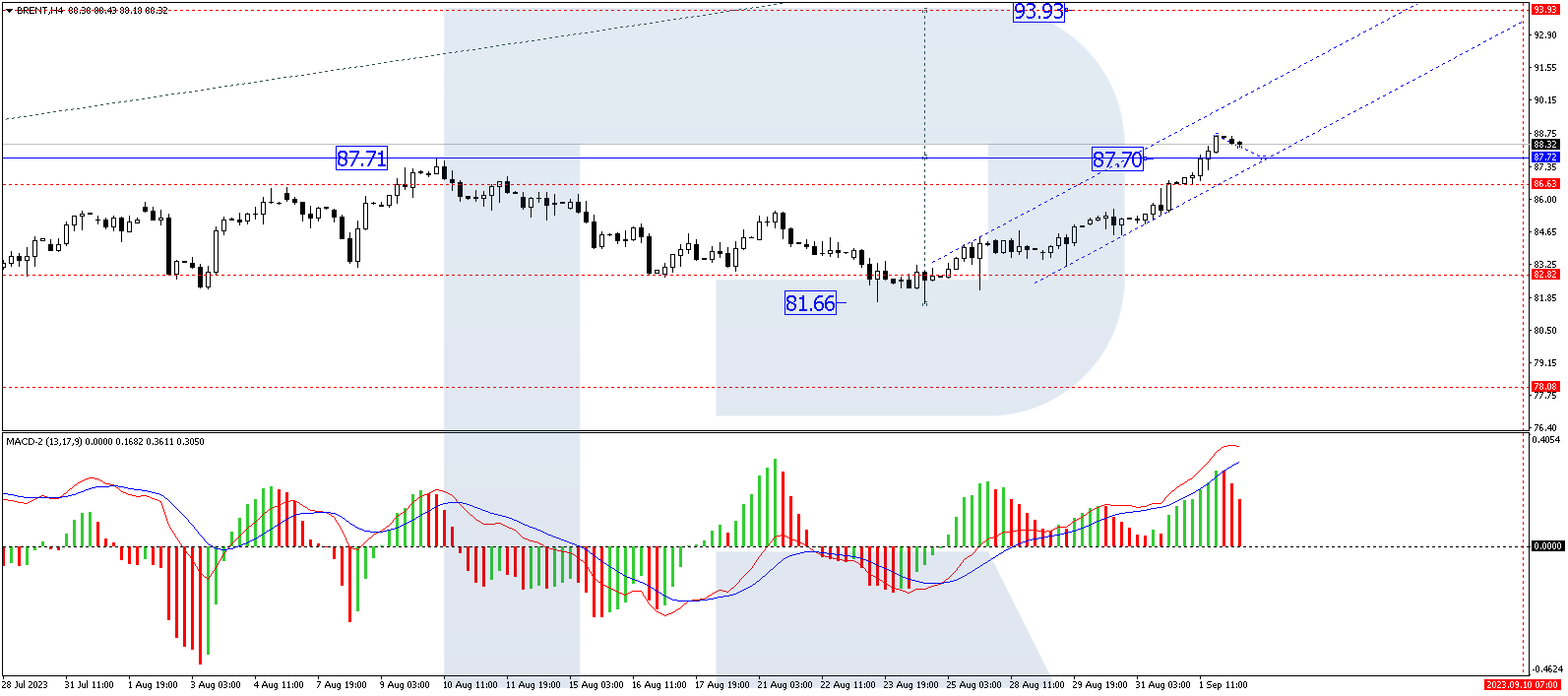

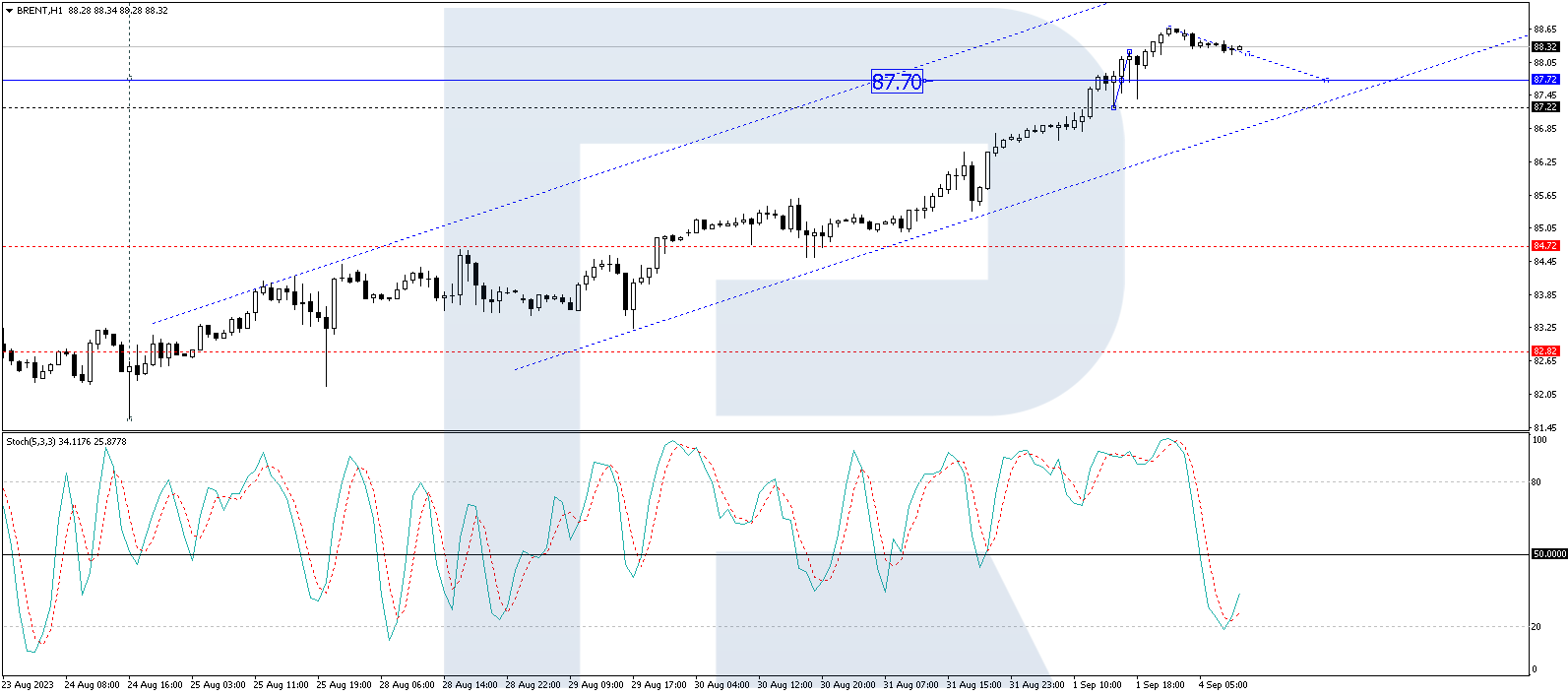

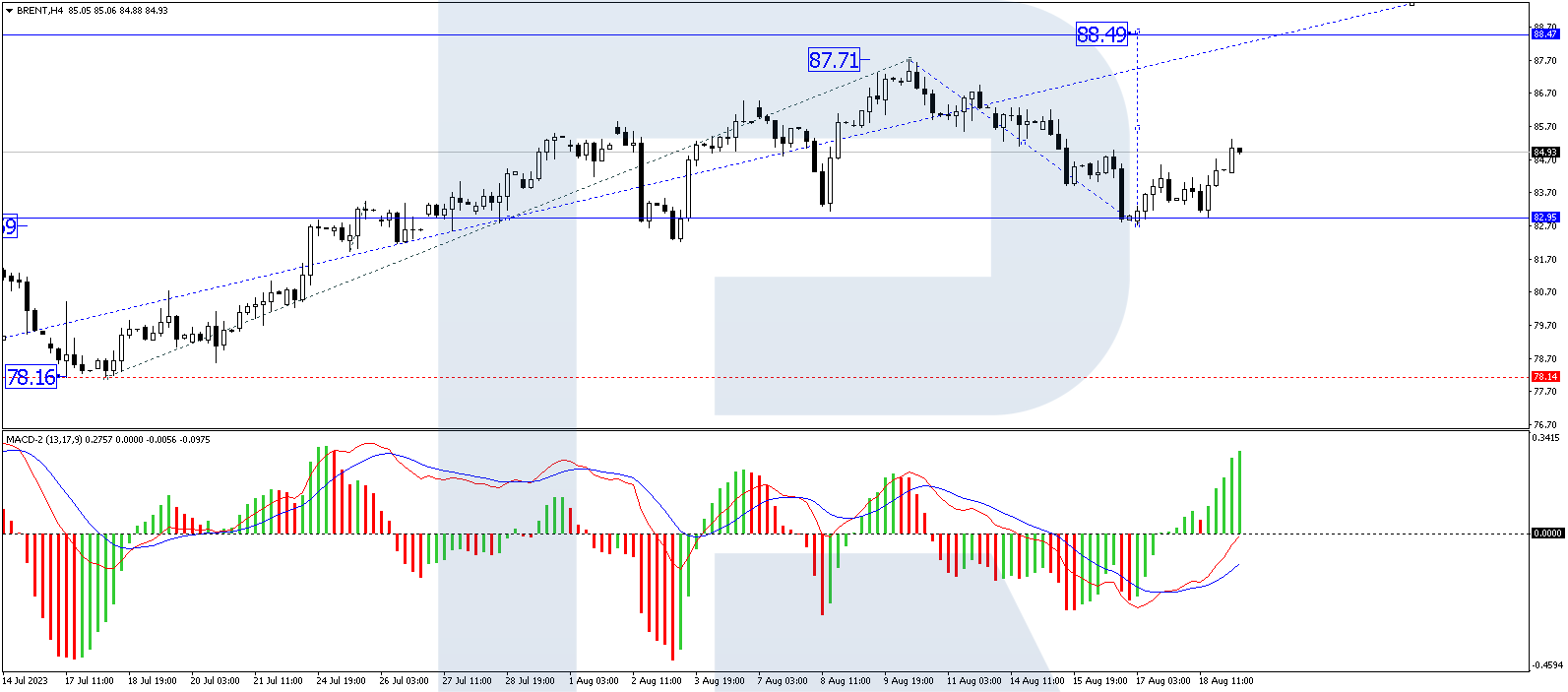

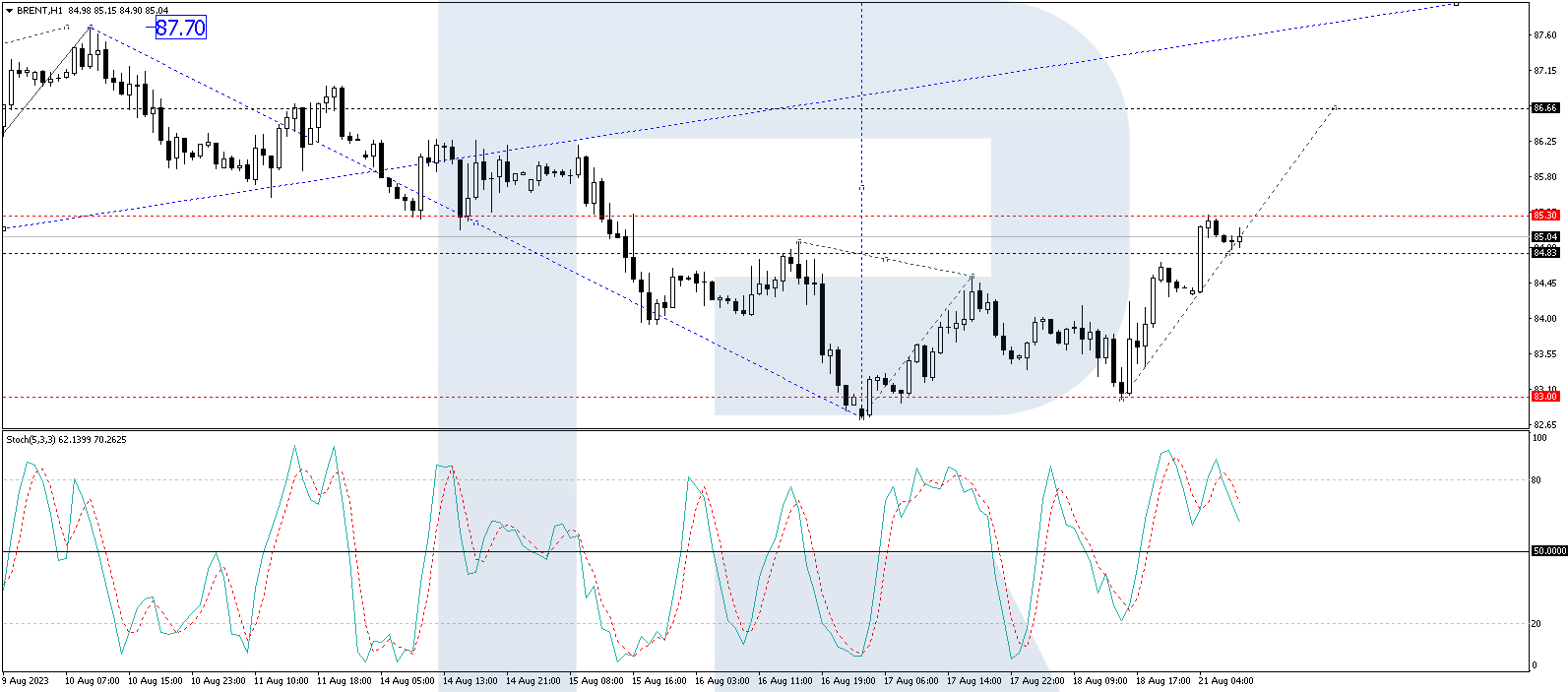

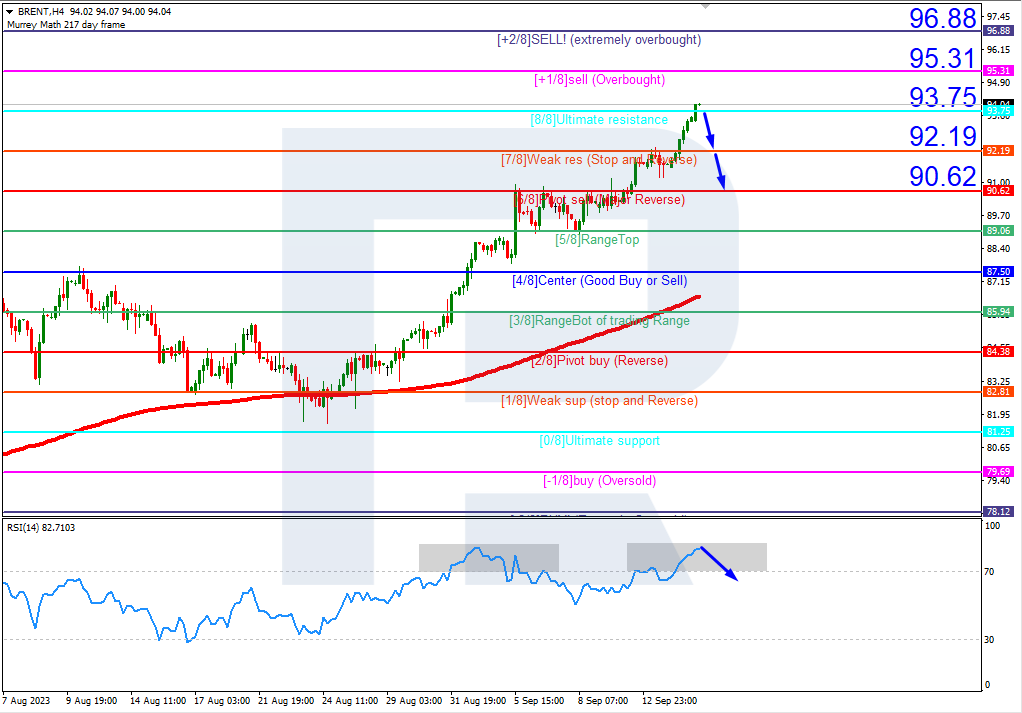

WTI crude oil prices rose to a new 11-month high on Monday, extending a rally seen over the past three months on expectations of a tight supply outlook for the rest of the year. Oil company Aramco forecasts record consumption of 103-104 million BPD in the second half of 2023. Oil prices received support from forecasts made last week by the International Energy Agency (IEA) and OPEC that the global oil market will be in deficit until the end of the year. And the bearish factors are not even enough to stop the rally yet.

Asian markets were mostly down. Japan’s Nikkei 225 was not trading yesterday, China’s FTSE China A50 (CHA50) added 0.91%, Hong Kong’s Hang Seng (HK50) decreased by 1.39% on the day, and Australia’s S&P/ASX 200 (AU200) was negative 0.67% on Monday.

The RBA’s Monetary Policy Minutes for August showed that Committee officials believe that inflation is still too high and is expected to remain so for an extended period of time. Committee representatives also noted that the previous month’s payroll data were broadly in line with the Bank’s forecasts: the labor market remains tight, but conditions are easing. The decision to maintain the interest rate at this meeting was due to the fact that interest rates have been raised significantly over a short period of time, and the effect of monetary tightening has not yet been fully realized.

S&P 500 (F)(US500) 4,453.53 +3.21 (+0.07%)

Dow Jones (US30) 34,624.30 +6.06 (+0.02%)

DAX (DE40) 15,727.12 −166.41 (−1.05%)

FTSE 100 (UK100) 7,652.94 −58.44 (−0.76%)

USD Index 105.09 −0.24 (−0.22%)

- – Australia RBA Meeting Minutes (m/m) at 04:30 (GMT+3);

- – Switzerland Trade Balance (m/m) at 09:00 (GMT+3);

- – Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3);

- – Canada Consumer Price Index (m/m) at 15:30 (GMT+3);

- – US Building Permits (m/m) at 15:30 (GMT+3).

By JustMarkets

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.

Article by

Article by