By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) reports data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday September 20th and shows a quick view of how large market participants (for-profit speculators and commercial traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

This data is through Tuesday and one day before the US Federal Reserve lifted the benchmark interest rate by 75 basis points to a range of 3 to 3.25 percent.

Euro & British pound lead Weekly Speculator Changes

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

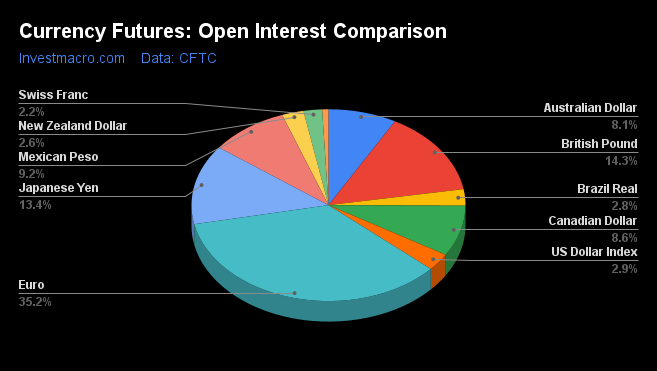

The COT currency market speculator bets were slightly lower this week as five out of the eleven currency markets we cover had higher positioning while the other six markets had lower speculator contracts.

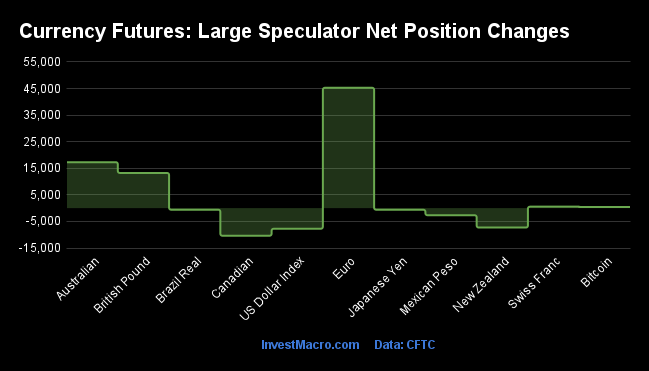

Leading the gains for the currency markets was the Euro (45,286 contracts) with the Australian dollar (17,294 contracts), the British pound sterling (13,243 contracts), the Swiss franc (565 contracts) and Bitcoin (451 contracts) also showing a positive week.

The currencies leading the declines in speculator bets this week were the Canadian dollar (-10,369 contracts) with the US Dollar Index (-7,738 contracts), the New Zealand dollar (-7,288 contracts), the Mexican peso (-2,652 contracts), the Japanese yen (-588 contracts) and the Brazilian real (-584 contracts) also registering lower bets on the week.

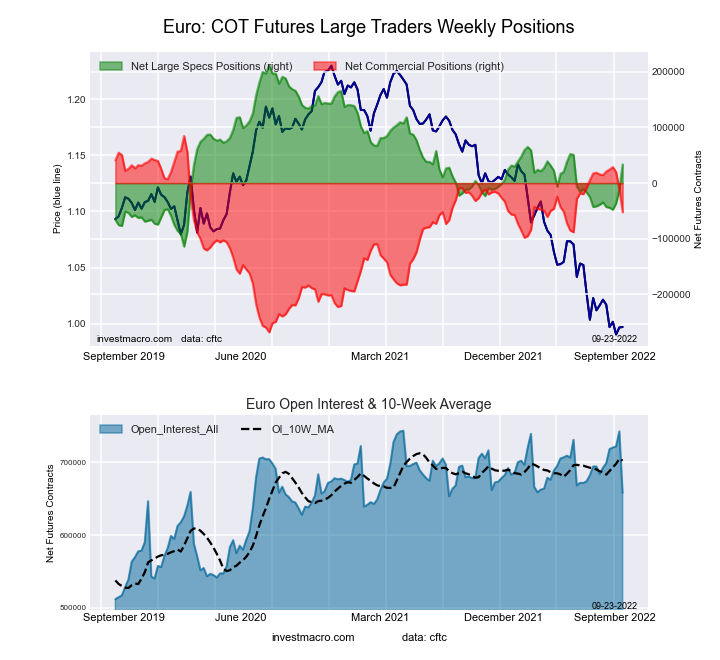

Highlighting the COT Forex data this week was the sharp change in speculator positioning for the Euro again this week. The speculative positioning for the Euro jumped by a total of +45,286 contracts this week following last week’s gain of +24,512 contracts and a rise of +11,327 contracts in the week before that.

Overall, Euro speculator positions have risen by +81,125 contracts in just the past three weeks and have now taken the speculator standing out of bearish territory for the first time in fifteen weeks (current net position of +33,449 contracts). This is a surprising turnabout for this market because speculators (especially in currencies) have tended to be trend-followers historically. They buy when prices are rising and sell when prices are falling.

The Euro has been on a historic decline with prices hitting levels below parity that have not been touched for approximately twenty years. However, the Euro futures speculators have been going the opposite way and increasing their bullish positioning as the currency falls. Will this positioning hold up? Are the speculators buying at the right time (betting on catching the low)? These interesting questions will resolve themselves in the future but it is an example of a current situation that shows that markets and traders can change their tune or flip usual behavior on its head, at least in the short-term.

The Euro price, meanwhile, followed through lower to close out the week. The EURUSD currency pair fell by more than 3 percent and ended the week at the 0.9692 exchange rate – the lowest level since October of 2002.

Sep-20-2022 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| EUR | 657,952 | 63 | 33,449 | 45 | -52,310 | 61 | 18,861 | 6 |

| GBP | 266,295 | 77 | -54,843 | 22 | 73,488 | 84 | -18,645 | 8 |

| JPY | 250,892 | 81 | -81,280 | 19 | 97,513 | 83 | -16,233 | 20 |

| MXN | 172,650 | 36 | -28,033 | 15 | 23,741 | 83 | 4,292 | 61 |

| CAD | 160,314 | 37 | 2,056 | 42 | 892 | 69 | -2,948 | 24 |

| AUD | 150,544 | 45 | -40,556 | 47 | 52,128 | 58 | -11,572 | 24 |

| USD Index | 54,292 | 76 | 27,931 | 72 | -30,775 | 27 | 2,844 | 48 |

| BRL | 51,500 | 42 | 32,369 | 82 | -34,071 | 18 | 1,702 | 85 |

| NZD | 47,884 | 39 | -12,589 | 50 | 16,791 | 56 | -4,202 | 3 |

| CHF | 40,937 | 23 | -6,740 | 39 | 12,986 | 64 | -6,246 | 36 |

| RUB | 20,930 | 4 | 7,543 | 31 | -7,150 | 69 | -393 | 24 |

| Bitcoin | 13,880 | 80 | 577 | 87 | -812 | 0 | 235 | 18 |

Bitcoin and Brazilian Real lead Strength Scores

Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is extreme bullish and below 20 is extreme bearish) show that Bitcoin (87.0 percent) and the Brazilian Real (82.2 percent) lead the currency markets this week near the top of their respective ranges and are both in bullish extreme positions (above 80 percent). The US Dollar Index (71.5 percent) comes in as the next highest in the currency markets in strength scores.

On the downside, the Mexican Peso (15.4 percent) and the Japanese Yen (18.8 percent) come in at the lowest strength level currently and are both in extreme bearish positions.

Strength Statistics:

US Dollar Index (71.5 percent) vs US Dollar Index previous week (84.4 percent)

EuroFX (45.3 percent) vs EuroFX previous week (31.4 percent)

British Pound Sterling (21.9 percent) vs British Pound Sterling previous week (10.6 percent)

Japanese Yen (18.8 percent) vs Japanese Yen previous week (19.2 percent)

Swiss Franc (39.4 percent) vs Swiss Franc previous week (38.0 percent)

Canadian Dollar (41.7 percent) vs Canadian Dollar previous week (53.3 percent)

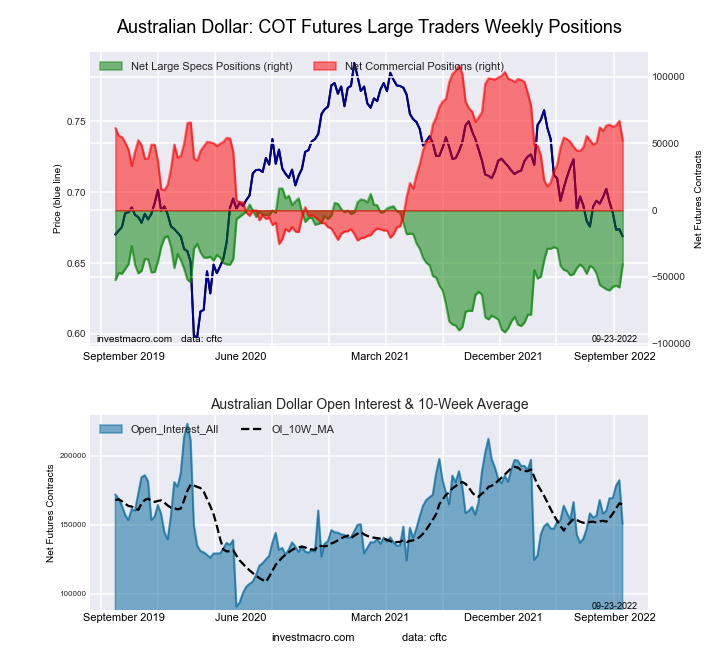

Australian Dollar (47.2 percent) vs Australian Dollar previous week (31.2 percent)

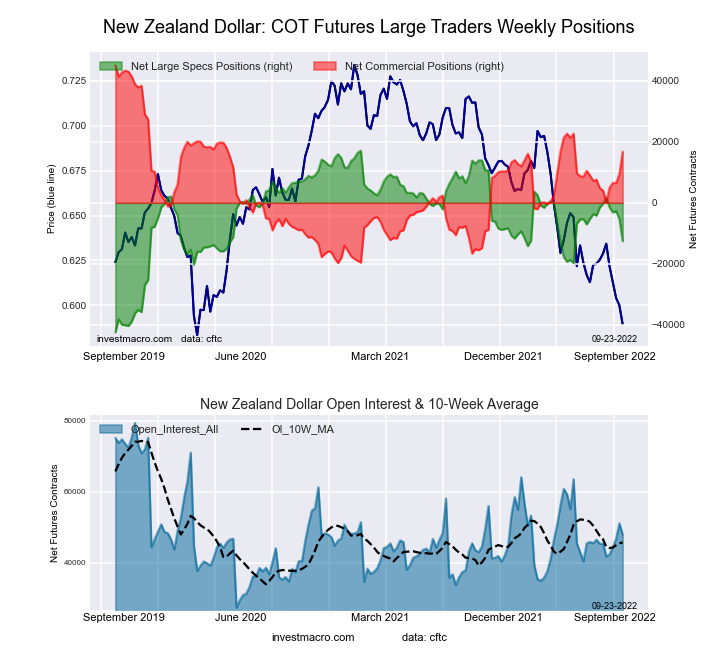

New Zealand Dollar (50.1 percent) vs New Zealand Dollar previous week (62.4 percent)

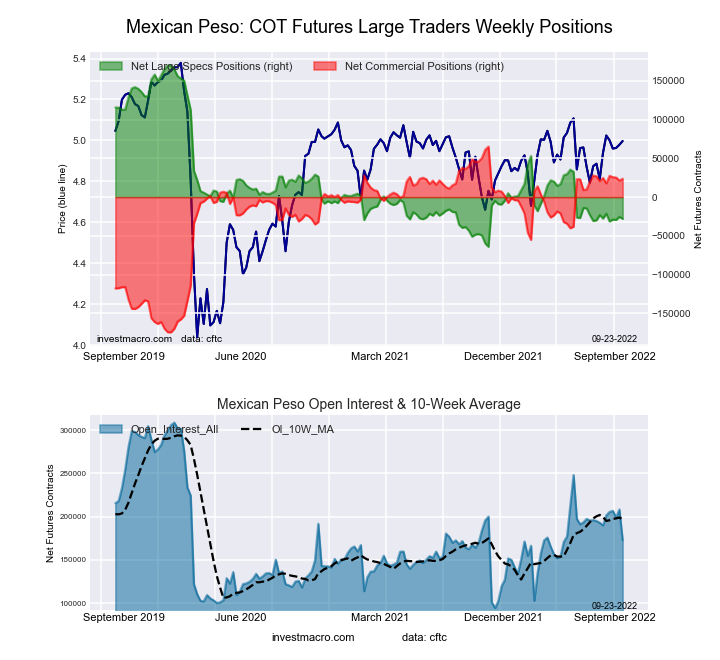

Mexican Peso (15.4 percent) vs Mexican Peso previous week (16.5 percent)

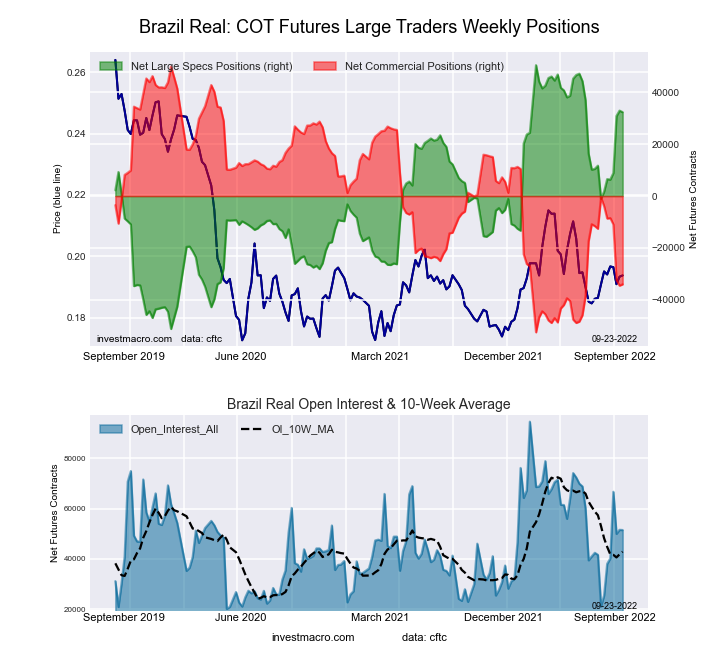

Brazilian Real (82.2 percent) vs Brazilian Real previous week (82.8 percent)

Bitcoin (87.0 percent) vs Bitcoin previous week (79.1 percent)

Brazilian Real, Euro and Aussie lead the Strength Trends

Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that the Brazilian Real (30.1 percent) leads the past six weeks trends for the currency markets this week. The EuroFX (20.9 percent), the Australian Dollar (15.8 percent), Bitcoin (14.1 percent) and the Swiss Franc (7.7 percent) fill out the rest of the positive movers in the latest trends data.

The Japanese Yen (-34.6 percent), Canadian Dollar (-21.5 percent), New Zealand Dollar (-20.7 percent) and the US Dollar Index (-17.9 percent) were the leaders in the downside trend scores this week.

Strength Trend Statistics:

US Dollar Index (-17.9 percent) vs US Dollar Index previous week (-6.1 percent)

EuroFX (20.9 percent) vs EuroFX previous week (8.3 percent)

British Pound Sterling (-17.5 percent) vs British Pound Sterling previous week (-10.0 percent)

Japanese Yen (-34.6 percent) vs Japanese Yen previous week (-23.4 percent)

Swiss Franc (7.7 percent) vs Swiss Franc previous week (15.2 percent)

Canadian Dollar (-21.5 percent) vs Canadian Dollar previous week (-8.8 percent)

Australian Dollar (15.8 percent) vs Australian Dollar previous week (-1.8 percent)

New Zealand Dollar (-20.7 percent) vs New Zealand Dollar previous week (-6.3 percent)

Mexican Peso (-0.2 percent) vs Mexican Peso previous week (-1.0 percent)

Brazilian Real (30.1 percent) vs Brazilian Real previous week (33.5 percent)

Bitcoin (14.1 percent) vs Bitcoin previous week (12.3 percent)

Individual COT Forex Markets:

US Dollar Index Futures:

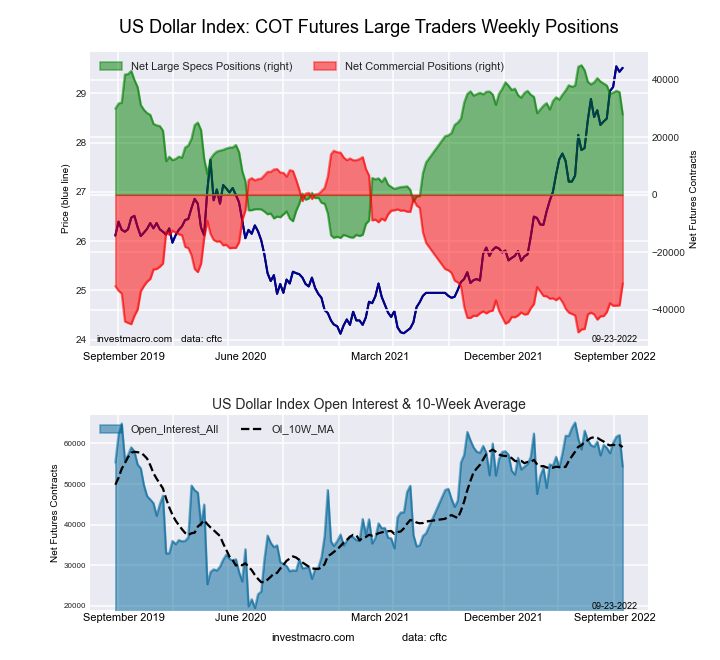

The US Dollar Index large speculator standing this week reached a net position of 27,931 contracts in the data reported through Tuesday. This was a weekly decline of -7,738 contracts from the previous week which had a total of 35,669 net contracts.

The US Dollar Index large speculator standing this week reached a net position of 27,931 contracts in the data reported through Tuesday. This was a weekly decline of -7,738 contracts from the previous week which had a total of 35,669 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 71.5 percent. The commercials are Bearish with a score of 26.9 percent and the small traders (not shown in chart) are Bearish with a score of 47.6 percent.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 84.2 | 4.1 | 10.1 |

| – Percent of Open Interest Shorts: | 32.7 | 60.8 | 4.9 |

| – Net Position: | 27,931 | -30,775 | 2,844 |

| – Gross Longs: | 45,704 | 2,226 | 5,479 |

| – Gross Shorts: | 17,773 | 33,001 | 2,635 |

| – Long to Short Ratio: | 2.6 to 1 | 0.1 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 71.5 | 26.9 | 47.6 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -17.9 | 18.0 | -6.8 |

Euro Currency Futures:

The Euro Currency large speculator standing this week reached a net position of 33,449 contracts in the data reported through Tuesday. This was a weekly advance of 45,286 contracts from the previous week which had a total of -11,837 net contracts.

The Euro Currency large speculator standing this week reached a net position of 33,449 contracts in the data reported through Tuesday. This was a weekly advance of 45,286 contracts from the previous week which had a total of -11,837 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 45.3 percent. The commercials are Bullish with a score of 61.2 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 5.7 percent.

| EURO Currency Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.4 | 53.9 | 11.5 |

| – Percent of Open Interest Shorts: | 26.3 | 61.9 | 8.6 |

| – Net Position: | 33,449 | -52,310 | 18,861 |

| – Gross Longs: | 206,564 | 354,891 | 75,546 |

| – Gross Shorts: | 173,115 | 407,201 | 56,685 |

| – Long to Short Ratio: | 1.2 to 1 | 0.9 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 45.3 | 61.2 | 5.7 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 20.9 | -18.9 | -2.1 |

British Pound Sterling Futures:

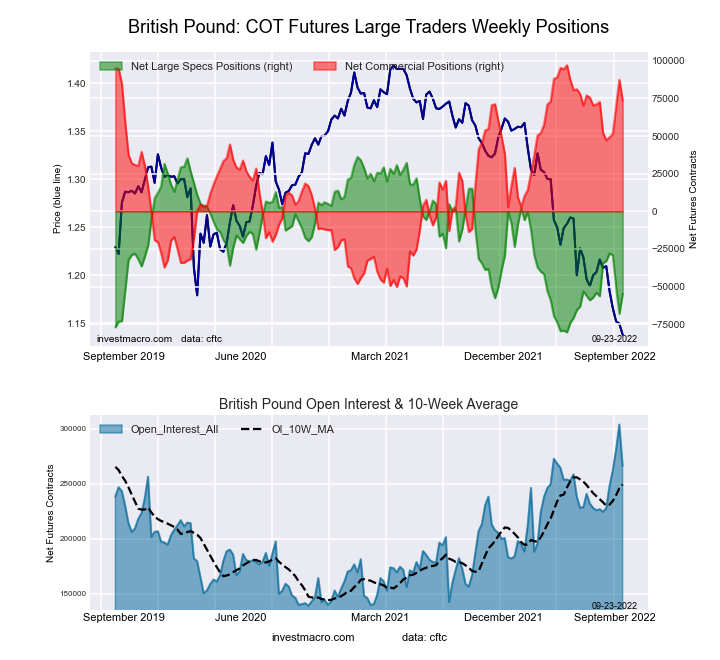

The British Pound Sterling large speculator standing this week reached a net position of -54,843 contracts in the data reported through Tuesday. This was a weekly rise of 13,243 contracts from the previous week which had a total of -68,086 net contracts.

The British Pound Sterling large speculator standing this week reached a net position of -54,843 contracts in the data reported through Tuesday. This was a weekly rise of 13,243 contracts from the previous week which had a total of -68,086 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 21.9 percent. The commercials are Bullish-Extreme with a score of 84.0 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 8.4 percent.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 15.5 | 74.1 | 8.2 |

| – Percent of Open Interest Shorts: | 36.1 | 46.5 | 15.2 |

| – Net Position: | -54,843 | 73,488 | -18,645 |

| – Gross Longs: | 41,289 | 197,346 | 21,738 |

| – Gross Shorts: | 96,132 | 123,858 | 40,383 |

| – Long to Short Ratio: | 0.4 to 1 | 1.6 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 21.9 | 84.0 | 8.4 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -17.5 | 14.6 | -2.4 |

Japanese Yen Futures:

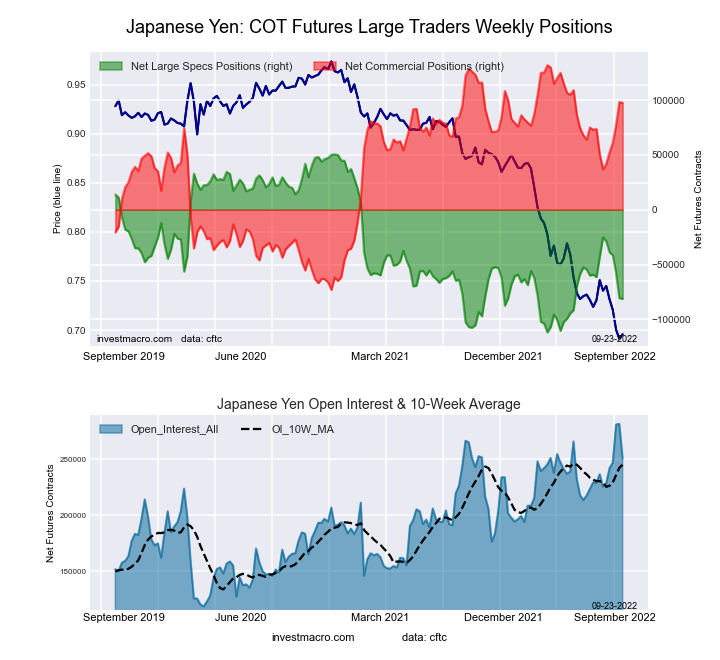

The Japanese Yen large speculator standing this week reached a net position of -81,280 contracts in the data reported through Tuesday. This was a weekly fall of -588 contracts from the previous week which had a total of -80,692 net contracts.

The Japanese Yen large speculator standing this week reached a net position of -81,280 contracts in the data reported through Tuesday. This was a weekly fall of -588 contracts from the previous week which had a total of -80,692 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 18.8 percent. The commercials are Bullish-Extreme with a score of 83.2 percent and the small traders (not shown in chart) are Bearish with a score of 20.5 percent.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 13.9 | 75.8 | 8.9 |

| – Percent of Open Interest Shorts: | 46.3 | 37.0 | 15.4 |

| – Net Position: | -81,280 | 97,513 | -16,233 |

| – Gross Longs: | 34,767 | 190,267 | 22,337 |

| – Gross Shorts: | 116,047 | 92,754 | 38,570 |

| – Long to Short Ratio: | 0.3 to 1 | 2.1 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 18.8 | 83.2 | 20.5 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -34.6 | 29.5 | -8.7 |

Swiss Franc Futures:

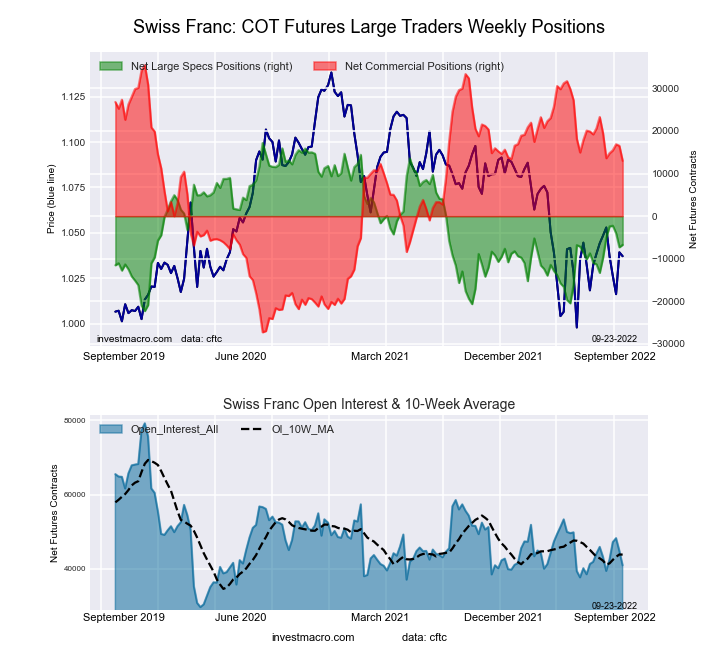

The Swiss Franc large speculator standing this week reached a net position of -6,740 contracts in the data reported through Tuesday. This was a weekly lift of 565 contracts from the previous week which had a total of -7,305 net contracts.

The Swiss Franc large speculator standing this week reached a net position of -6,740 contracts in the data reported through Tuesday. This was a weekly lift of 565 contracts from the previous week which had a total of -7,305 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 39.4 percent. The commercials are Bullish with a score of 64.2 percent and the small traders (not shown in chart) are Bearish with a score of 36.4 percent.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 20.0 | 54.5 | 25.5 |

| – Percent of Open Interest Shorts: | 36.4 | 22.8 | 40.7 |

| – Net Position: | -6,740 | 12,986 | -6,246 |

| – Gross Longs: | 8,167 | 22,309 | 10,421 |

| – Gross Shorts: | 14,907 | 9,323 | 16,667 |

| – Long to Short Ratio: | 0.5 to 1 | 2.4 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 39.4 | 64.2 | 36.4 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 7.7 | -10.3 | 11.6 |

Canadian Dollar Futures:

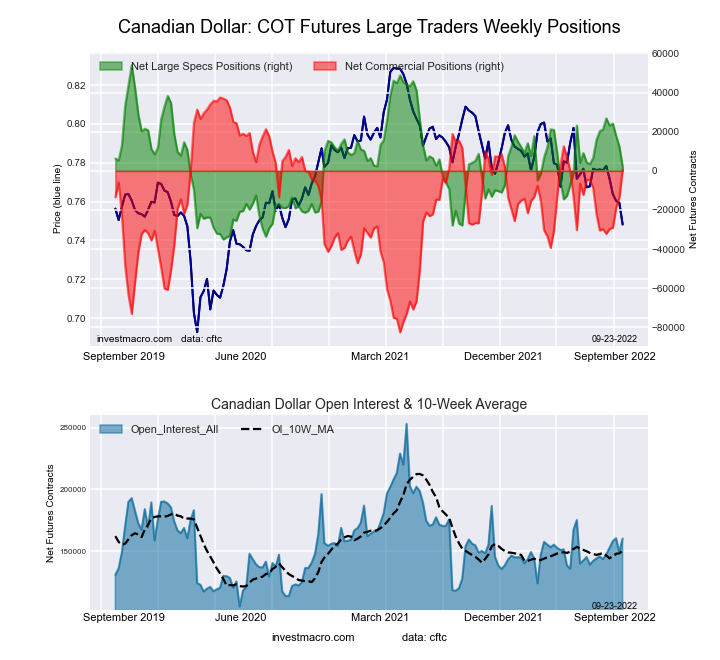

The Canadian Dollar large speculator standing this week reached a net position of 2,056 contracts in the data reported through Tuesday. This was a weekly decrease of -10,369 contracts from the previous week which had a total of 12,425 net contracts.

The Canadian Dollar large speculator standing this week reached a net position of 2,056 contracts in the data reported through Tuesday. This was a weekly decrease of -10,369 contracts from the previous week which had a total of 12,425 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 41.7 percent. The commercials are Bullish with a score of 69.5 percent and the small traders (not shown in chart) are Bearish with a score of 24.2 percent.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 29.9 | 45.7 | 21.2 |

| – Percent of Open Interest Shorts: | 28.6 | 45.2 | 23.0 |

| – Net Position: | 2,056 | 892 | -2,948 |

| – Gross Longs: | 47,913 | 73,298 | 33,975 |

| – Gross Shorts: | 45,857 | 72,406 | 36,923 |

| – Long to Short Ratio: | 1.0 to 1 | 1.0 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 41.7 | 69.5 | 24.2 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -21.5 | 25.5 | -23.1 |

Australian Dollar Futures:

The Australian Dollar large speculator standing this week reached a net position of -40,556 contracts in the data reported through Tuesday. This was a weekly lift of 17,294 contracts from the previous week which had a total of -57,850 net contracts.

The Australian Dollar large speculator standing this week reached a net position of -40,556 contracts in the data reported through Tuesday. This was a weekly lift of 17,294 contracts from the previous week which had a total of -57,850 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 47.2 percent. The commercials are Bullish with a score of 57.8 percent and the small traders (not shown in chart) are Bearish with a score of 24.2 percent.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 25.8 | 61.7 | 10.3 |

| – Percent of Open Interest Shorts: | 52.7 | 27.1 | 17.9 |

| – Net Position: | -40,556 | 52,128 | -11,572 |

| – Gross Longs: | 38,797 | 92,900 | 15,434 |

| – Gross Shorts: | 79,353 | 40,772 | 27,006 |

| – Long to Short Ratio: | 0.5 to 1 | 2.3 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 47.2 | 57.8 | 24.2 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 15.8 | -5.5 | -23.7 |

New Zealand Dollar Futures:

The New Zealand Dollar large speculator standing this week reached a net position of -12,589 contracts in the data reported through Tuesday. This was a weekly lowering of -7,288 contracts from the previous week which had a total of -5,301 net contracts.

The New Zealand Dollar large speculator standing this week reached a net position of -12,589 contracts in the data reported through Tuesday. This was a weekly lowering of -7,288 contracts from the previous week which had a total of -5,301 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 50.1 percent. The commercials are Bullish with a score of 56.3 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 3.3 percent.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.3 | 69.8 | 5.3 |

| – Percent of Open Interest Shorts: | 50.6 | 34.7 | 14.1 |

| – Net Position: | -12,589 | 16,791 | -4,202 |

| – Gross Longs: | 11,646 | 33,408 | 2,544 |

| – Gross Shorts: | 24,235 | 16,617 | 6,746 |

| – Long to Short Ratio: | 0.5 to 1 | 2.0 to 1 | 0.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 50.1 | 56.3 | 3.3 |

| – Strength Index Reading (3 Year Range): | Bullish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -20.7 | 19.6 | -5.0 |

Mexican Peso Futures:

The Mexican Peso large speculator standing this week reached a net position of -28,033 contracts in the data reported through Tuesday. This was a weekly fall of -2,652 contracts from the previous week which had a total of -25,381 net contracts.

The Mexican Peso large speculator standing this week reached a net position of -28,033 contracts in the data reported through Tuesday. This was a weekly fall of -2,652 contracts from the previous week which had a total of -25,381 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 15.4 percent. The commercials are Bullish-Extreme with a score of 82.7 percent and the small traders (not shown in chart) are Bullish with a score of 61.2 percent.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 56.0 | 38.9 | 4.3 |

| – Percent of Open Interest Shorts: | 72.2 | 25.2 | 1.8 |

| – Net Position: | -28,033 | 23,741 | 4,292 |

| – Gross Longs: | 96,671 | 67,201 | 7,445 |

| – Gross Shorts: | 124,704 | 43,460 | 3,153 |

| – Long to Short Ratio: | 0.8 to 1 | 1.5 to 1 | 2.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 15.4 | 82.7 | 61.2 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -0.2 | -0.4 | 5.9 |

Brazilian Real Futures:

The Brazilian Real large speculator standing this week reached a net position of 32,369 contracts in the data reported through Tuesday. This was a weekly lowering of -584 contracts from the previous week which had a total of 32,953 net contracts.

The Brazilian Real large speculator standing this week reached a net position of 32,369 contracts in the data reported through Tuesday. This was a weekly lowering of -584 contracts from the previous week which had a total of 32,953 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 82.2 percent. The commercials are Bearish-Extreme with a score of 18.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 84.7 percent.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 81.5 | 12.4 | 6.0 |

| – Percent of Open Interest Shorts: | 18.7 | 78.6 | 2.7 |

| – Net Position: | 32,369 | -34,071 | 1,702 |

| – Gross Longs: | 41,979 | 6,410 | 3,109 |

| – Gross Shorts: | 9,610 | 40,481 | 1,407 |

| – Long to Short Ratio: | 4.4 to 1 | 0.2 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 82.2 | 18.0 | 84.7 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 30.1 | -29.4 | -5.3 |

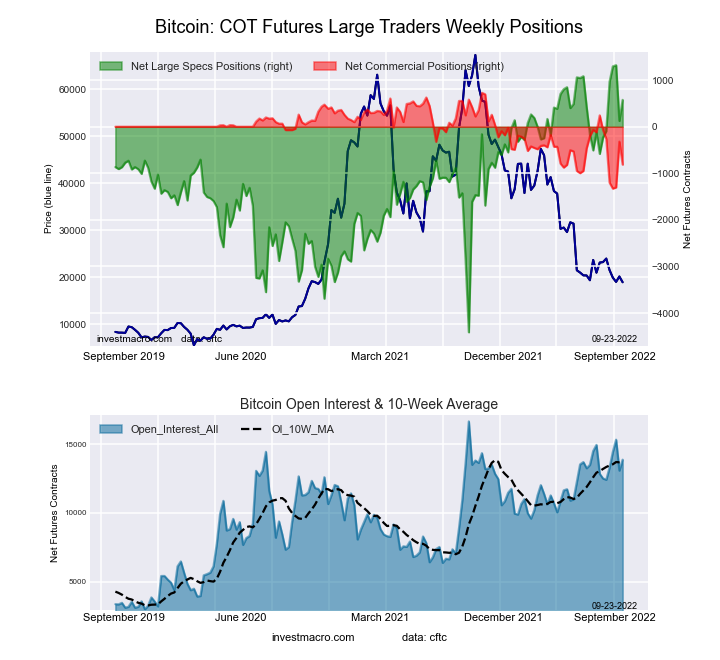

Bitcoin Futures:

The Bitcoin large speculator standing this week reached a net position of 577 contracts in the data reported through Tuesday. This was a weekly advance of 451 contracts from the previous week which had a total of 126 net contracts.

The Bitcoin large speculator standing this week reached a net position of 577 contracts in the data reported through Tuesday. This was a weekly advance of 451 contracts from the previous week which had a total of 126 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 87.0 percent. The commercials are Bearish with a score of 25.0 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 18.3 percent.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 80.4 | 1.8 | 8.0 |

| – Percent of Open Interest Shorts: | 76.2 | 7.6 | 6.3 |

| – Net Position: | 577 | -812 | 235 |

| – Gross Longs: | 11,157 | 245 | 1,107 |

| – Gross Shorts: | 10,580 | 1,057 | 872 |

| – Long to Short Ratio: | 1.1 to 1 | 0.2 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 87.0 | 25.0 | 18.3 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.1 | -36.0 | -1.5 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- Most of the tariffs imposed by the Trump administration take effect today Apr 2, 2025

- EUR/USD Declines as Markets Await Signals of a Renewed Trade War Apr 2, 2025

- “Liberation Day”: How markets might react to Trump’s April 2nd tariff announcement? Apr 2, 2025

- The RBA expectedly kept interest rates unchanged. Oil rose to a one-month high Apr 1, 2025

- World stock indices sell off under the weight of new tariffs Mar 31, 2025

- COT Metals Charts: Speculator Bets led by Copper & Palladium Mar 30, 2025

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds, Fed Funds & 2-Year Bonds Mar 30, 2025

- COT Soft Commodities Charts: Speculator Bets led by Sugar & Live Cattle Mar 30, 2025

- COT Stock Market Charts: Weekly Speculator Bets led this week by Nikkei 225 Mar 30, 2025

- It Looks Like Its a Good Time To Buy This Gold Stock Mar 28, 2025