By InvestMacro | COT | Data Tables | COT Leaders | Downloads | COT Newsletter

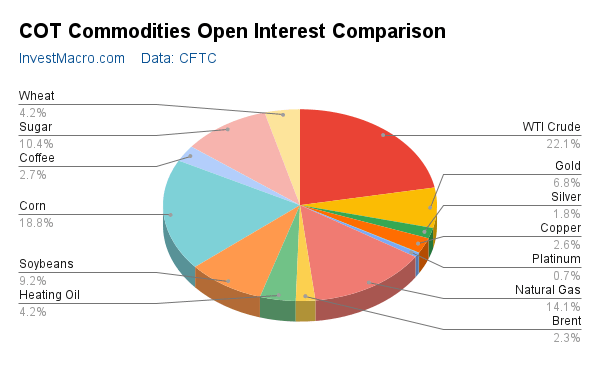

Each Commodity Share Percent of All Commodities Open Interest

Each Commodity Share Percent of All Commodities Open Interest

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday April 5th and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

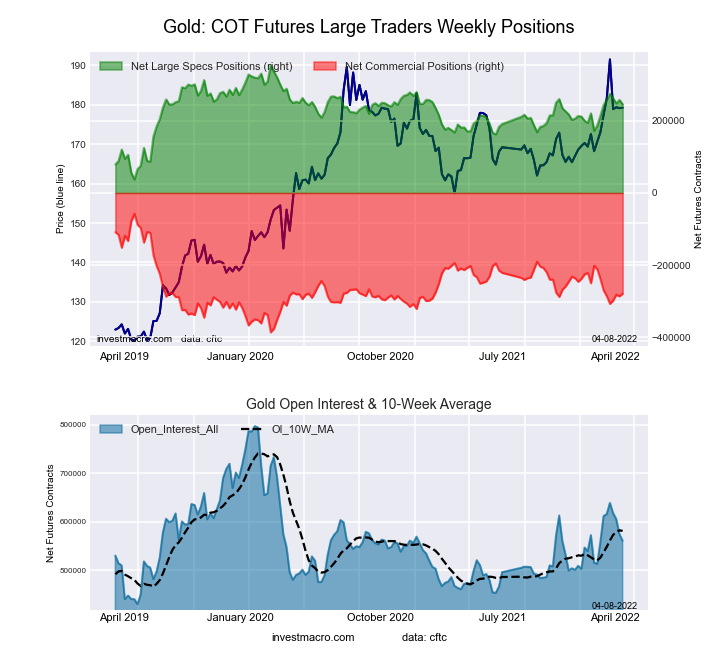

Highlighting the COT metals data is the recent decline in the Gold futures bets. The speculative net position in the Gold futures dropped this week for the third time in the past four weeks and by a total of -28,847 contracts over that time-frame. Gold spec positions had previously been on a strong run of rising weekly bullish bets and had increased for five straight weeks from February 8th to March 8th with a total gain of +102,246 contracts over that period. That speculator sentiment strength brought positions to a sixty-one week high with a net position of +274,388 contracts and coincided with the Gold price surging above the $2,050 level. Since then, bullish bets have cooled off while the Gold price has also taken a breather and fallen back into a trading range between approximately $1,920 and $1,960 where it currently resides.

Overall, the metals market that rose this week was just Copper (5,561 contracts) while Gold (-12,055 contracts), Platinum (-2,711 contracts), Palladium (-30 contracts) and Silver (-3,206 contracts) all had lower bets on the week.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

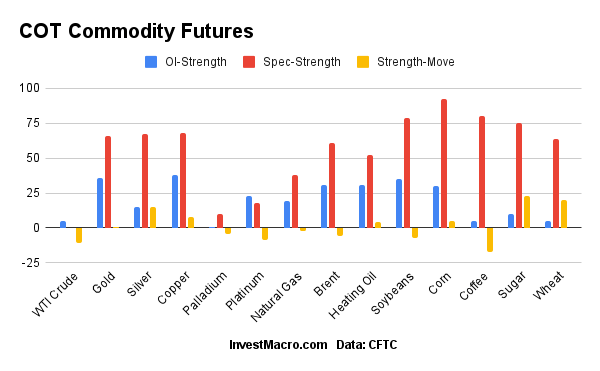

Speculator strength standings for each Commodity where strength index is current net position compared to past three years, above 80 is bullish extreme, below 20 is bearish extreme

Speculator strength standings for each Commodity where strength index is current net position compared to past three years, above 80 is bullish extreme, below 20 is bearish extreme

OI Strength = Current Open Interest level compared to last 3 years range

Spec Strength = Current Net Speculator level compared to last 3 years range

Strength Move = Six week change of Spec Strength

Apr-05-2022 | OI | OI-Index | Spec-Net | Spec-Index | Com-Net | COM-Index | Smalls-Net | Smalls-Index |

|---|---|---|---|---|---|---|---|---|

| WTI Crude | 1,823,366 | 5 | 308,594 | 0 | -355,435 | 100 | 46,841 | 81 |

| Corn | 1,556,206 | 30 | 487,073 | 92 | -424,154 | 12 | -62,919 | 7 |

| Natural Gas | 1,169,620 | 19 | -136,611 | 38 | 92,647 | 60 | 43,964 | 90 |

| Sugar | 859,871 | 10 | 188,547 | 75 | -240,107 | 23 | 51,560 | 72 |

| Soybeans | 756,785 | 35 | 198,924 | 79 | -170,882 | 26 | -28,042 | 24 |

| Gold | 560,666 | 36 | 245,541 | 66 | -278,758 | 33 | 33,217 | 58 |

| Heating Oil | 349,618 | 31 | 6,455 | 52 | -32,434 | 37 | 25,979 | 88 |

| Wheat | 344,615 | 5 | 19,951 | 64 | -15,332 | 26 | -4,619 | 89 |

| Coffee | 226,730 | 5 | 43,811 | 80 | -48,758 | 22 | 4,947 | 23 |

| Copper | 216,157 | 38 | 36,142 | 68 | -43,039 | 30 | 6,897 | 65 |

| Brent | 189,394 | 31 | -29,712 | 61 | 26,537 | 37 | 3,175 | 52 |

| Silver | 148,526 | 15 | 45,034 | 67 | -60,036 | 40 | 15,002 | 30 |

| Platinum | 60,983 | 23 | 11,290 | 18 | -17,905 | 83 | 6,615 | 54 |

| Palladium | 6,642 | 1 | -2,041 | 10 | 1,443 | 85 | 598 | 78 |

Gold Comex Futures:

The Gold Comex Futures large speculator standing this week resulted in a net position of 245,541 contracts in the data reported through Tuesday. This was a weekly decline of -12,055 contracts from the previous week which had a total of 257,596 net contracts.

The Gold Comex Futures large speculator standing this week resulted in a net position of 245,541 contracts in the data reported through Tuesday. This was a weekly decline of -12,055 contracts from the previous week which had a total of 257,596 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 65.8 percent. The commercials are Bearish with a score of 32.6 percent and the small traders (not shown in chart) are Bullish with a score of 58.5 percent.

| Gold Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 57.9 | 22.2 | 9.2 |

| – Percent of Open Interest Shorts: | 14.1 | 71.9 | 3.3 |

| – Net Position: | 245,541 | -278,758 | 33,217 |

| – Gross Longs: | 324,570 | 124,506 | 51,778 |

| – Gross Shorts: | 79,029 | 403,264 | 18,561 |

| – Long to Short Ratio: | 4.1 to 1 | 0.3 to 1 | 2.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 65.8 | 32.6 | 58.5 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.8 | -2.8 | 18.9 |

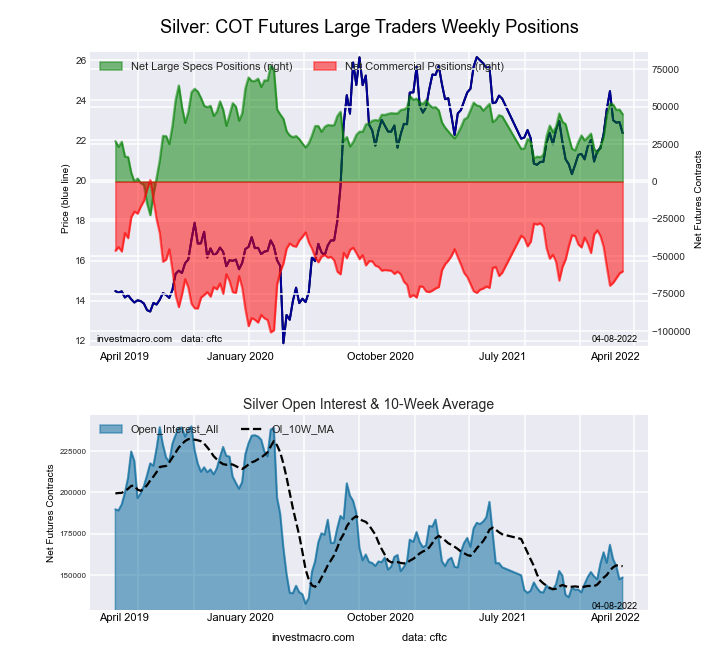

Silver Comex Futures:

The Silver Comex Futures large speculator standing this week resulted in a net position of 45,034 contracts in the data reported through Tuesday. This was a weekly lowering of -3,206 contracts from the previous week which had a total of 48,240 net contracts.

The Silver Comex Futures large speculator standing this week resulted in a net position of 45,034 contracts in the data reported through Tuesday. This was a weekly lowering of -3,206 contracts from the previous week which had a total of 48,240 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 67.3 percent. The commercials are Bearish with a score of 40.0 percent and the small traders (not shown in chart) are Bearish with a score of 30.2 percent.

| Silver Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 43.7 | 30.9 | 17.7 |

| – Percent of Open Interest Shorts: | 13.4 | 71.3 | 7.6 |

| – Net Position: | 45,034 | -60,036 | 15,002 |

| – Gross Longs: | 64,936 | 45,922 | 26,307 |

| – Gross Shorts: | 19,902 | 105,958 | 11,305 |

| – Long to Short Ratio: | 3.3 to 1 | 0.4 to 1 | 2.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 67.3 | 40.0 | 30.2 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.7 | -16.0 | 9.2 |

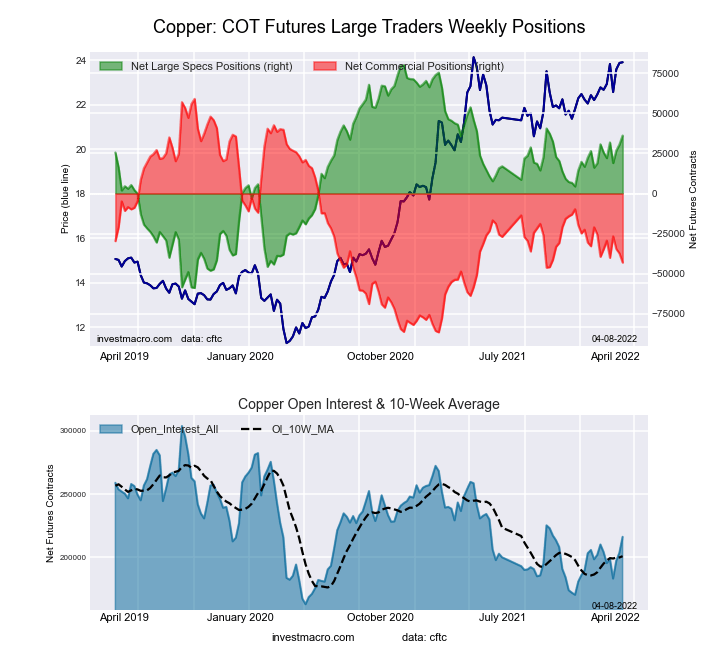

Copper Grade #1 Futures:

The Copper Grade #1 Futures large speculator standing this week resulted in a net position of 36,142 contracts in the data reported through Tuesday. This was a weekly boost of 5,561 contracts from the previous week which had a total of 30,581 net contracts.

The Copper Grade #1 Futures large speculator standing this week resulted in a net position of 36,142 contracts in the data reported through Tuesday. This was a weekly boost of 5,561 contracts from the previous week which had a total of 30,581 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 68.4 percent. The commercials are Bearish with a score of 29.9 percent and the small traders (not shown in chart) are Bullish with a score of 65.2 percent.

| Copper Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 42.0 | 38.0 | 8.6 |

| – Percent of Open Interest Shorts: | 25.3 | 57.9 | 5.4 |

| – Net Position: | 36,142 | -43,039 | 6,897 |

| – Gross Longs: | 90,779 | 82,054 | 18,675 |

| – Gross Shorts: | 54,637 | 125,093 | 11,778 |

| – Long to Short Ratio: | 1.7 to 1 | 0.7 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 68.4 | 29.9 | 65.2 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 7.6 | -5.7 | -13.2 |

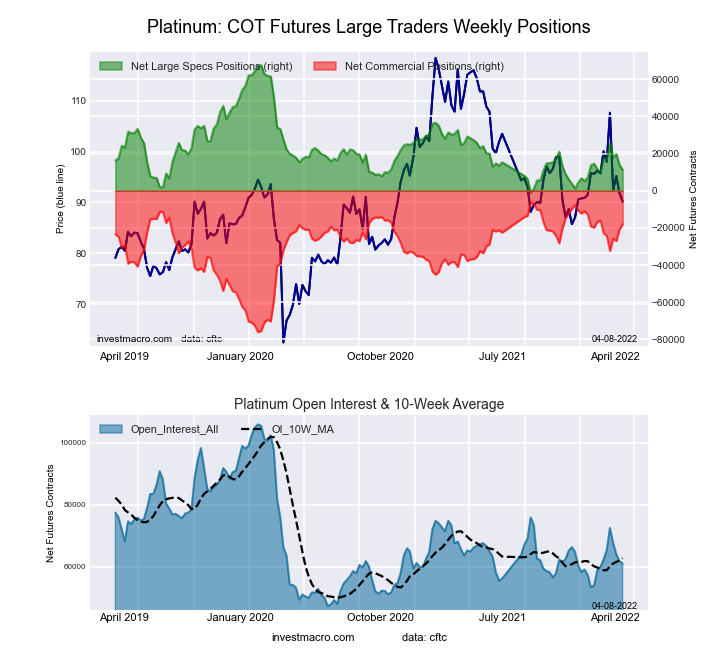

Platinum Futures:

The Platinum Futures large speculator standing this week resulted in a net position of 11,290 contracts in the data reported through Tuesday. This was a weekly fall of -2,711 contracts from the previous week which had a total of 14,001 net contracts.

The Platinum Futures large speculator standing this week resulted in a net position of 11,290 contracts in the data reported through Tuesday. This was a weekly fall of -2,711 contracts from the previous week which had a total of 14,001 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 18.0 percent. The commercials are Bullish-Extreme with a score of 83.4 percent and the small traders (not shown in chart) are Bullish with a score of 54.3 percent.

| Platinum Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 47.3 | 32.6 | 16.5 |

| – Percent of Open Interest Shorts: | 28.8 | 62.0 | 5.6 |

| – Net Position: | 11,290 | -17,905 | 6,615 |

| – Gross Longs: | 28,827 | 19,894 | 10,054 |

| – Gross Shorts: | 17,537 | 37,799 | 3,439 |

| – Long to Short Ratio: | 1.6 to 1 | 0.5 to 1 | 2.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 18.0 | 83.4 | 54.3 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.1 | 7.1 | 17.7 |

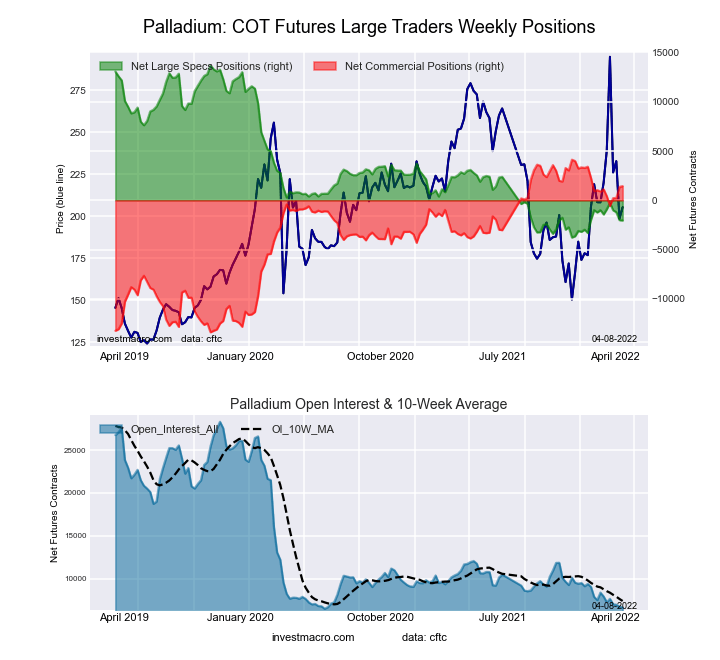

Palladium Futures:

The Palladium Futures large speculator standing this week resulted in a net position of -2,041 contracts in the data reported through Tuesday. This was a weekly decrease of -30 contracts from the previous week which had a total of -2,011 net contracts.

The Palladium Futures large speculator standing this week resulted in a net position of -2,041 contracts in the data reported through Tuesday. This was a weekly decrease of -30 contracts from the previous week which had a total of -2,011 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 9.9 percent. The commercials are Bullish-Extreme with a score of 84.7 percent and the small traders (not shown in chart) are Bullish with a score of 78.5 percent.

| Palladium Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 25.7 | 52.5 | 20.6 |

| – Percent of Open Interest Shorts: | 56.4 | 30.7 | 11.5 |

| – Net Position: | -2,041 | 1,443 | 598 |

| – Gross Longs: | 1,704 | 3,484 | 1,365 |

| – Gross Shorts: | 3,745 | 2,041 | 767 |

| – Long to Short Ratio: | 0.5 to 1 | 1.7 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 9.9 | 84.7 | 78.5 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -3.5 | 1.9 | 16.6 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

- It Looks Like Its a Good Time To Buy This Gold Stock Mar 28, 2025

- Copper Co. Should Be Up Way Higher Mar 28, 2025

- Banxico cut the rate by 0.5%. The global auto market is under pressure from the introduction of tariffs. Mar 28, 2025

- The Pound Stands Strong Amid Global Trade Tensions Mar 28, 2025

- Uncertainty over the scope and impact of tariffs increased market volatility Mar 27, 2025

- EUR/USD Faces Further Decline Amid Market Jitters and Trump’s Tariff Threat Mar 27, 2025

- Australia’s inflation rate is at a 3-month low. Oil prices are approaching $70 again Mar 26, 2025

- USD/JPY Rises Again: Yen Lacks Support as Bulls Take Control Mar 26, 2025

- Oil prices rise amid a new OPEC+ plan to cut production. Inflation in Singapore continues to weaken. Mar 24, 2025

- SNB cut the interest rate to 0.25%. Inflationary pressures are easing in Hong Kong and Malaysia Mar 21, 2025