By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

In March, Gold updated its high at $2,078.80 and then started a correction. Early in a new week March week, the precious metal is trading at $1,977.

Gold is an excellent tool for investors to protect them from the consequences of increasing inflation, which is expected to continue rising for a while longer. It means that the fundamental support factor for Gold will remain in effect. The US inflation is at its 40-year high and there are barely any reasons for the indicator to go down.

The current decline in Gold is probably the result of profit-taking. Gold enthusiasts do not consider the strong USD factor, as they are supported by stable demand for the precious metal.

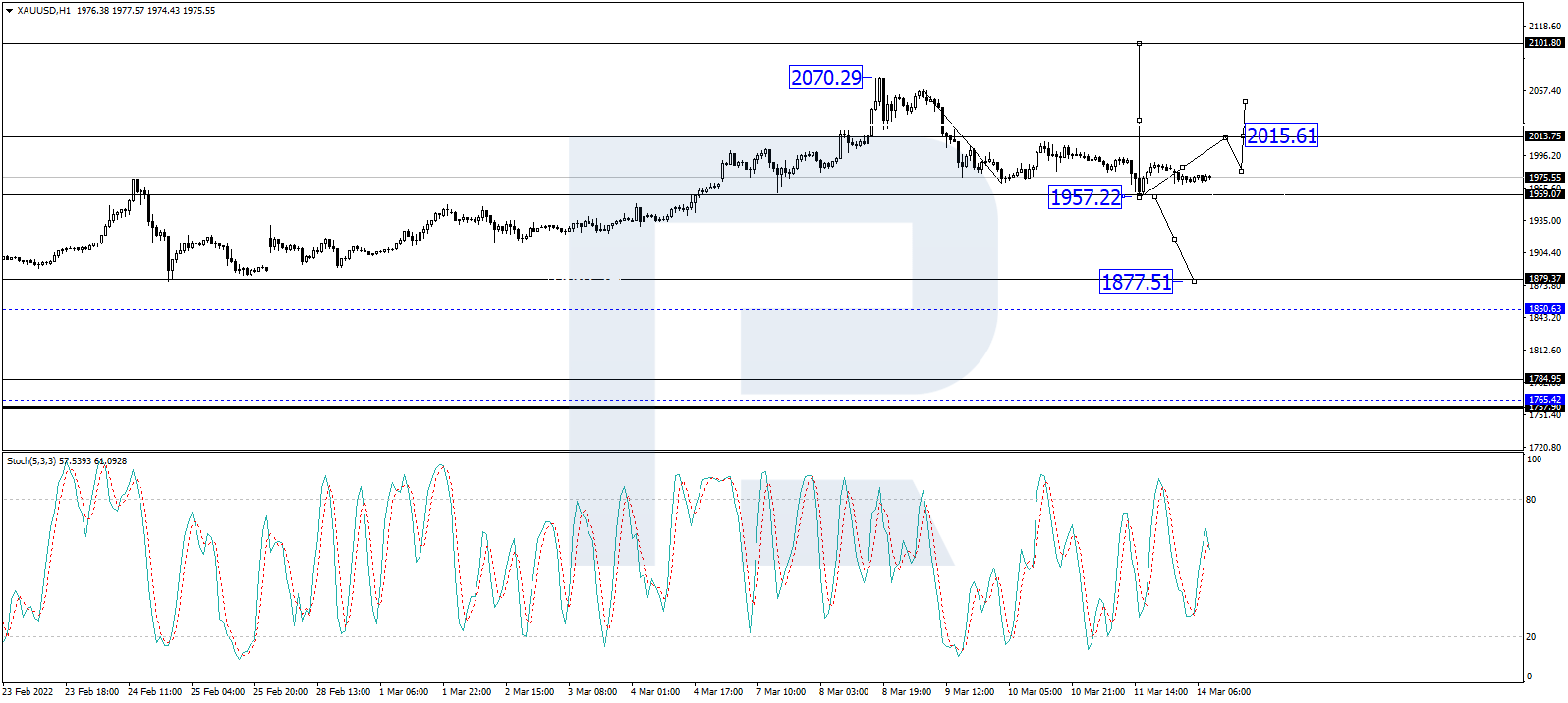

As we can see in the H4 chart, after completing the descending wave at 1958.50 along with the ascending impulse towards 1987.90, XAU/USD is forming a new consolidation range between these two levels. Possibly, the metal may break the range to the upside and grow with the first target at 2015.60. Later, the market may start a new decline to reach 1980.00. On the other hand, if the price breaks the above-mentioned range to the downside, the asset may resume trading downwards towards 1877.50. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after breaking 50 to the upside, its signal line is expected to grow towards 80. Otherwise, the indicator may resume falling to reach 20.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

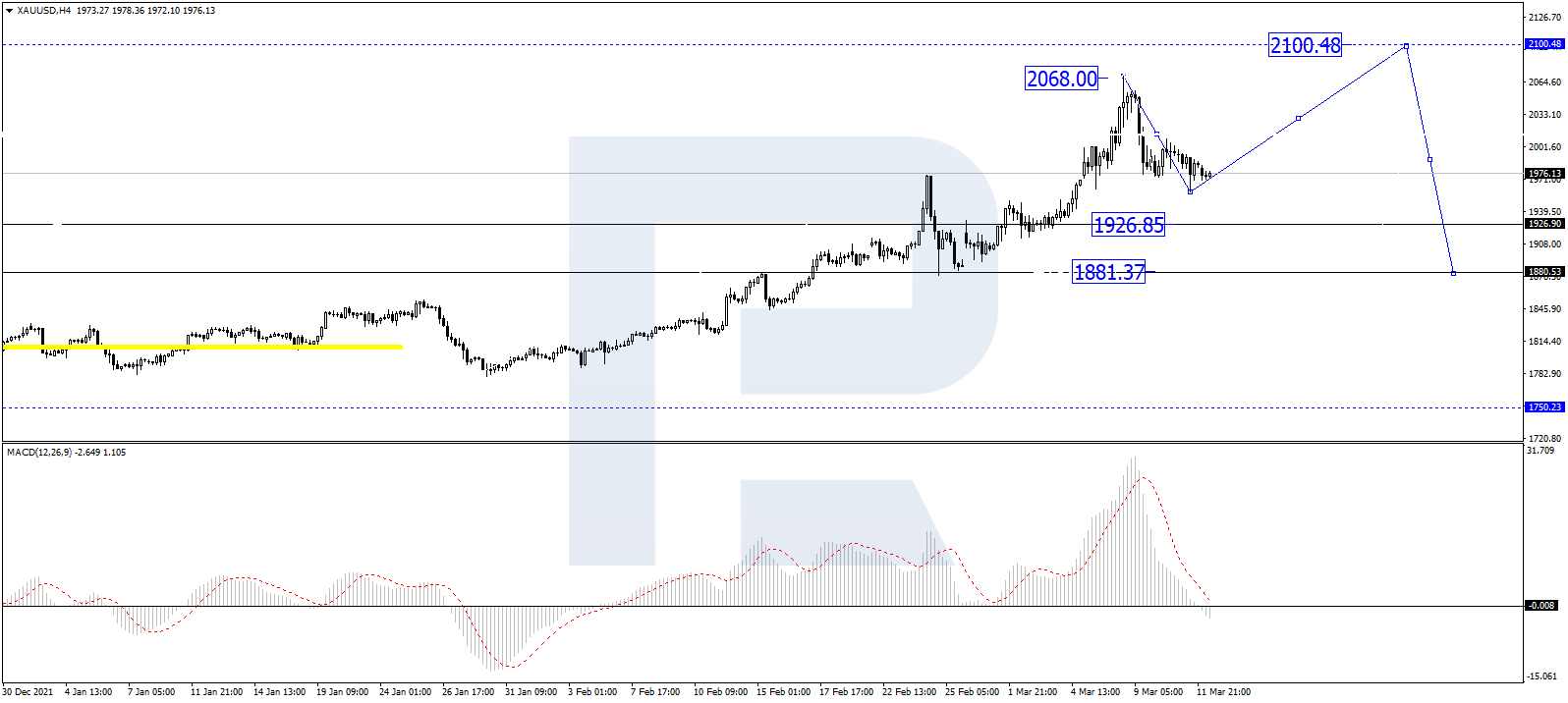

In the H1 chart, Gold has finished the correctional wave at 1958.50; right now, it is consolidating near the lows. Possibly, the metal may form one more ascending wave towards 2015.00 and then start another correction to reach 1982.00, thus forming a new consolidation range between these two levels. If the price breaks this range to the upside, the market may resume growing towards 2100.00 or even reach 2200.00; if to the downside – correct down to 1850.00. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal is falling to break 0 and may later continue moving downwards to reach new lows. However, if the line rebound from 0, it may grow towards new highs.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024