By CountingPips.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday August 31 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

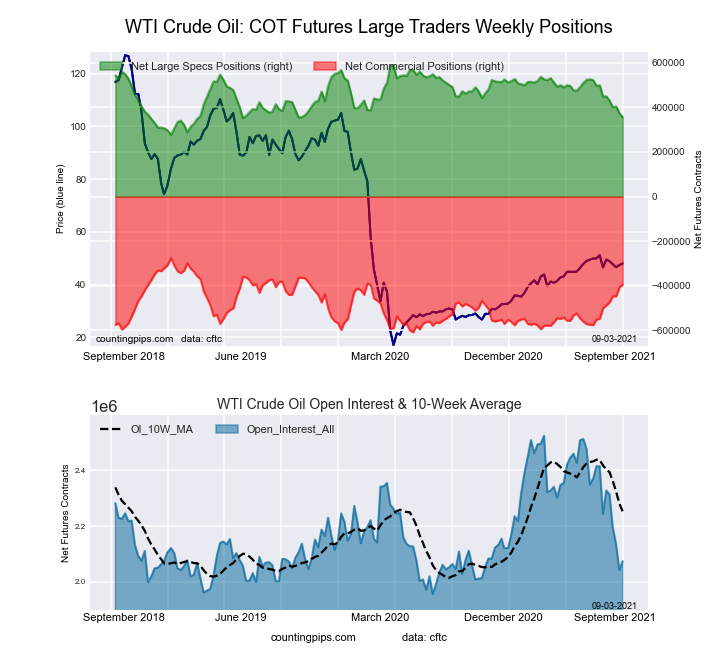

WTI Crude Oil Futures :

The WTI Crude Oil Futures large speculator standing this week came in at a net position of 356,528 contracts in the data reported through Tuesday. This was a weekly decline of -17,784 contracts from the previous week which had a total of 374,312 net contracts.

The WTI Crude Oil Futures large speculator standing this week came in at a net position of 356,528 contracts in the data reported through Tuesday. This was a weekly decline of -17,784 contracts from the previous week which had a total of 374,312 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 25.4 percent. The commercials are Bullish with a score of 64.3 percent and the small traders (not shown in chart) are Bullish with a score of 68.3 percent.

| WTI Crude Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.9 | 34.7 | 4.3 |

| – Percent of Open Interest Shorts: | 7.7 | 53.7 | 2.5 |

| – Net Position: | 356,528 | -394,313 | 37,785 |

| – Gross Longs: | 515,630 | 720,006 | 89,289 |

| – Gross Shorts: | 159,102 | 1,114,319 | 51,504 |

| – Long to Short Ratio: | 3.2 to 1 | 0.6 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 25.4 | 64.3 | 68.3 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -29.5 | 31.9 | -19.8 |

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

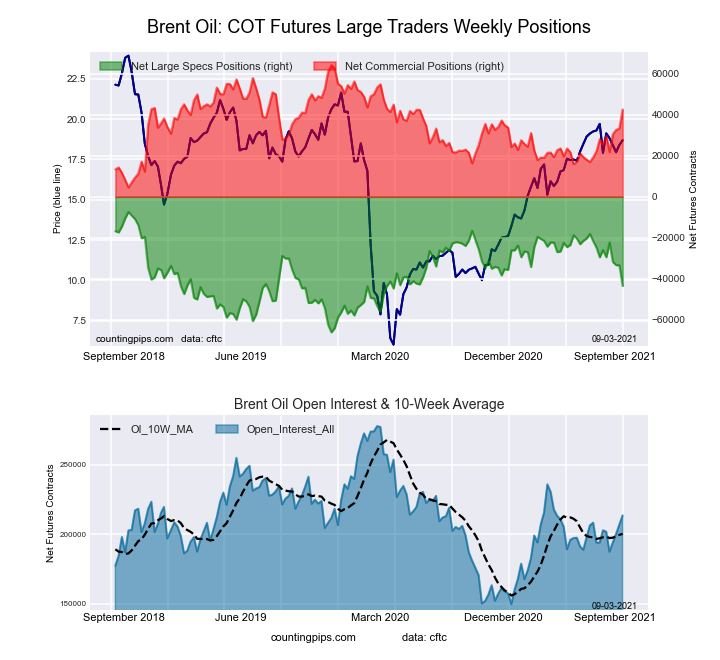

Brent Crude Oil Futures :

The Brent Crude Oil Futures large speculator standing this week came in at a net position of -43,561 contracts in the data reported through Tuesday. This was a weekly decline of -10,062 contracts from the previous week which had a total of -33,499 net contracts.

The Brent Crude Oil Futures large speculator standing this week came in at a net position of -43,561 contracts in the data reported through Tuesday. This was a weekly decline of -10,062 contracts from the previous week which had a total of -33,499 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 38.5 percent. The commercials are Bullish with a score of 63.8 percent and the small traders (not shown in chart) are Bearish with a score of 43.9 percent.

| Brent Crude Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 15.2 | 56.5 | 3.4 |

| – Percent of Open Interest Shorts: | 35.6 | 36.5 | 2.9 |

| – Net Position: | -43,561 | 42,594 | 967 |

| – Gross Longs: | 32,456 | 120,480 | 7,219 |

| – Gross Shorts: | 76,017 | 77,886 | 6,252 |

| – Long to Short Ratio: | 0.4 to 1 | 1.5 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 38.5 | 63.8 | 43.9 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -29.8 | 28.6 | 3.9 |

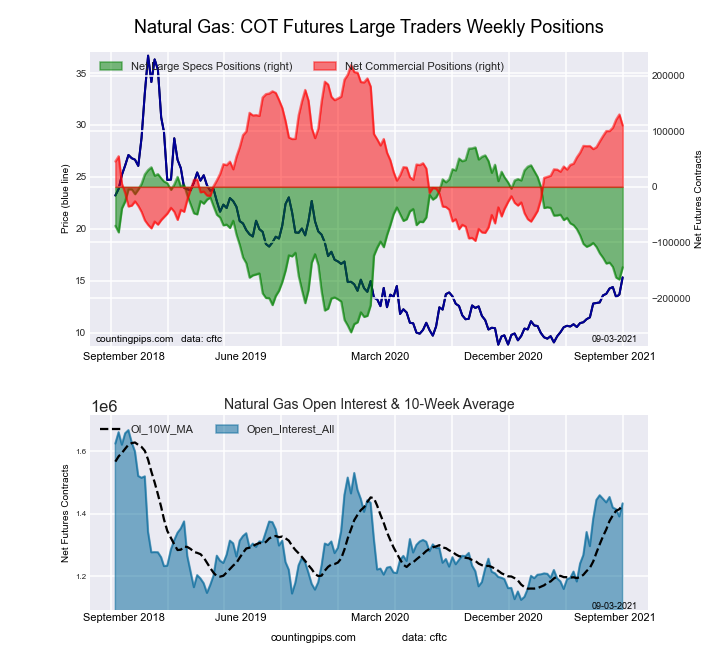

Natural Gas Futures :

The Natural Gas Futures large speculator standing this week came in at a net position of -144,695 contracts in the data reported through Tuesday. This was a weekly rise of 21,882 contracts from the previous week which had a total of -166,577 net contracts.

The Natural Gas Futures large speculator standing this week came in at a net position of -144,695 contracts in the data reported through Tuesday. This was a weekly rise of 21,882 contracts from the previous week which had a total of -166,577 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 35.1 percent. The commercials are Bullish with a score of 65.7 percent and the small traders (not shown in chart) are Bullish with a score of 57.3 percent.

| Natural Gas Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 23.9 | 44.1 | 4.3 |

| – Percent of Open Interest Shorts: | 34.0 | 36.4 | 1.9 |

| – Net Position: | -144,695 | 110,300 | 34,395 |

| – Gross Longs: | 342,111 | 632,044 | 61,935 |

| – Gross Shorts: | 486,806 | 521,744 | 27,540 |

| – Long to Short Ratio: | 0.7 to 1 | 1.2 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 35.1 | 65.7 | 57.3 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.2 | 6.0 | -5.4 |

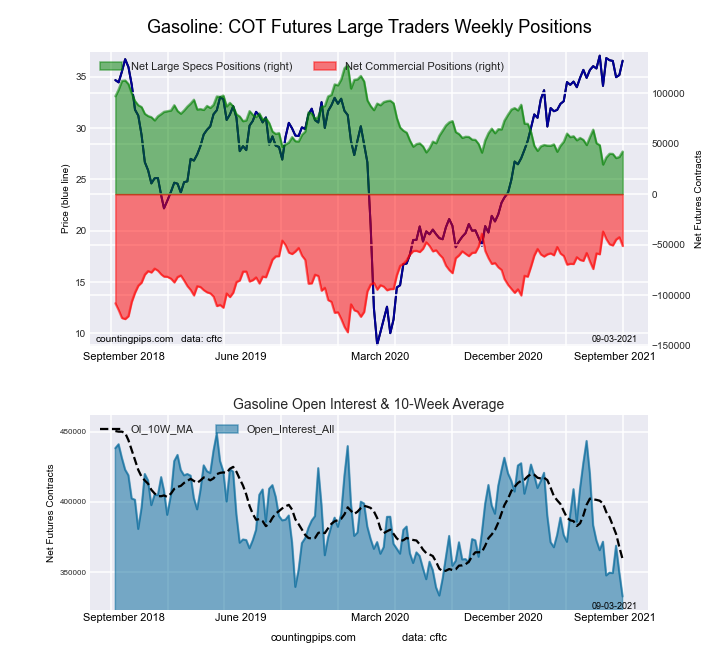

Gasoline Blendstock Futures :

The Gasoline Blendstock Futures large speculator standing this week came in at a net position of 42,221 contracts in the data reported through Tuesday. This was a weekly gain of 5,337 contracts from the previous week which had a total of 36,884 net contracts.

The Gasoline Blendstock Futures large speculator standing this week came in at a net position of 42,221 contracts in the data reported through Tuesday. This was a weekly gain of 5,337 contracts from the previous week which had a total of 36,884 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 13.1 percent. The commercials are Bullish-Extreme with a score of 85.6 percent and the small traders (not shown in chart) are Bullish with a score of 66.4 percent.

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 28.2 | 50.9 | 6.8 |

| – Percent of Open Interest Shorts: | 15.5 | 66.4 | 4.0 |

| – Net Position: | 42,221 | -51,407 | 9,186 |

| – Gross Longs: | 93,729 | 169,337 | 22,619 |

| – Gross Shorts: | 51,508 | 220,744 | 13,433 |

| – Long to Short Ratio: | 1.8 to 1 | 0.8 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 13.1 | 85.6 | 66.4 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 13.1 | -14.4 | 8.9 |

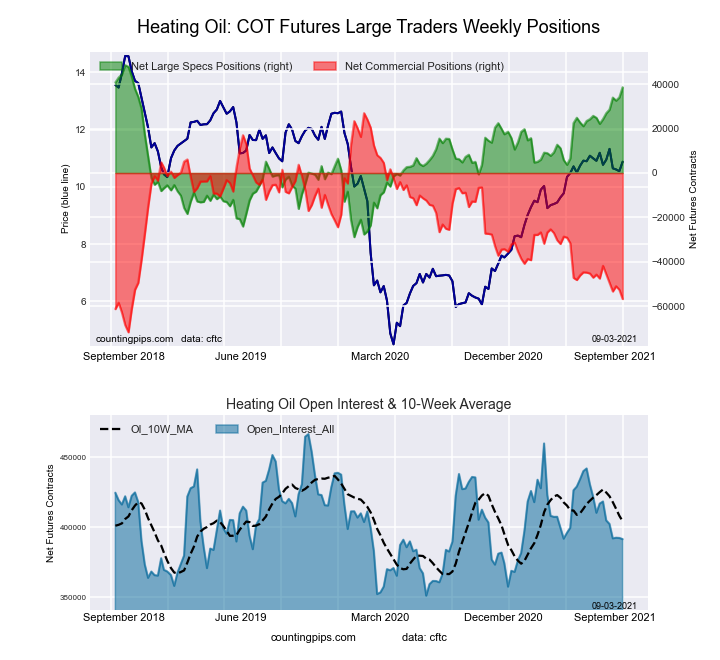

#2 Heating Oil NY-Harbor Futures :

The #2 Heating Oil NY-Harbor Futures large speculator standing this week came in at a net position of 38,583 contracts in the data reported through Tuesday. This was a weekly rise of 4,563 contracts from the previous week which had a total of 34,020 net contracts.

The #2 Heating Oil NY-Harbor Futures large speculator standing this week came in at a net position of 38,583 contracts in the data reported through Tuesday. This was a weekly rise of 4,563 contracts from the previous week which had a total of 34,020 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 87.2 percent. The commercials are Bearish-Extreme with a score of 15.2 percent and the small traders (not shown in chart) are Bullish with a score of 71.0 percent.

| Heating Oil Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.9 | 50.2 | 10.4 |

| – Percent of Open Interest Shorts: | 8.0 | 64.7 | 5.7 |

| – Net Position: | 38,583 | -56,707 | 18,124 |

| – Gross Longs: | 70,020 | 196,647 | 40,550 |

| – Gross Shorts: | 31,437 | 253,354 | 22,426 |

| – Long to Short Ratio: | 2.2 to 1 | 0.8 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 87.2 | 15.2 | 71.0 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 18.5 | -15.1 | 2.3 |

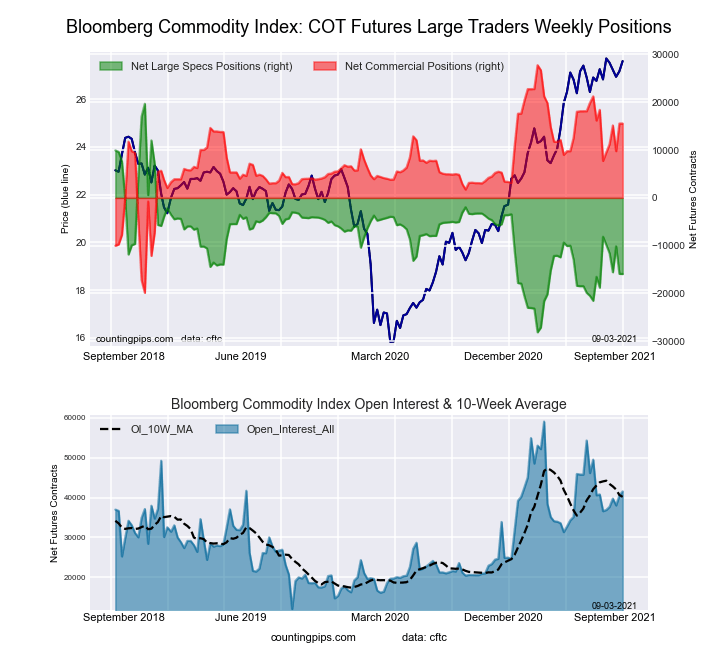

Bloomberg Commodity Index Futures :

The Bloomberg Commodity Index Futures large speculator standing this week came in at a net position of -15,912 contracts in the data reported through Tuesday. This was a weekly decline of -25 contracts from the previous week which had a total of -15,887 net contracts.

The Bloomberg Commodity Index Futures large speculator standing this week came in at a net position of -15,912 contracts in the data reported through Tuesday. This was a weekly decline of -25 contracts from the previous week which had a total of -15,887 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 25.5 percent. The commercials are Bullish with a score of 74.4 percent and the small traders (not shown in chart) are Bearish with a score of 40.2 percent.

| Bloomberg Index Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 52.2 | 45.6 | 1.1 |

| – Percent of Open Interest Shorts: | 90.5 | 8.2 | 0.2 |

| – Net Position: | -15,912 | 15,550 | 362 |

| – Gross Longs: | 21,702 | 18,950 | 450 |

| – Gross Shorts: | 37,614 | 3,400 | 88 |

| – Long to Short Ratio: | 0.6 to 1 | 5.6 to 1 | 5.1 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 25.5 | 74.4 | 40.2 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -16.3 | 16.4 | -1.3 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

- NZD/USD Hits Yearly Low Amid US Dollar Strength Nov 26, 2024

- Trump plans to raise tariffs by 10% on goods from China and 25% on goods from Mexico and Canada Nov 26, 2024

- Fast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers Nov 25, 2024

- “Trump trades” and geopolitics are the key factors driving market activity Nov 25, 2024

- EUR/USD Amid Slowing European Economy Nov 25, 2024

- COT Metals Charts: Weekly Speculator Changes led by Platinum Nov 23, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year & 10-Year Bonds Nov 23, 2024

- COT Soft Commodities Charts: Speculator Bets led lower by Soybean Oil, Soybean Meal & Cotton Nov 23, 2024

- COT Stock Market Charts: Speculator Changes led by S&P500 & Nasdaq Minis Nov 23, 2024

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024