Article By RoboForex.com

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, after finishing the pullback, GBPUSD is still forming another rising impulse to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1.3790 and 1.3980 respectively. However, a divergence on MACD implies a possible descending correction towards 23.6%, 38.2%, 50.0%, and 61.8% fibo at 1.3528, 1.3365, 1.3233, and 1.3100 respectively after the price reaches the area’s downside border.

In the H1 chart, after correcting by 23.6%, pair is trying to update its high again. If the price does break and fixes above it, the asset may continue growing towards the post-correctional extension area between 138.2% and 161.8% fibo at 1.3798 and 1.3830 respectively. The support is the local low at 1.3609.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

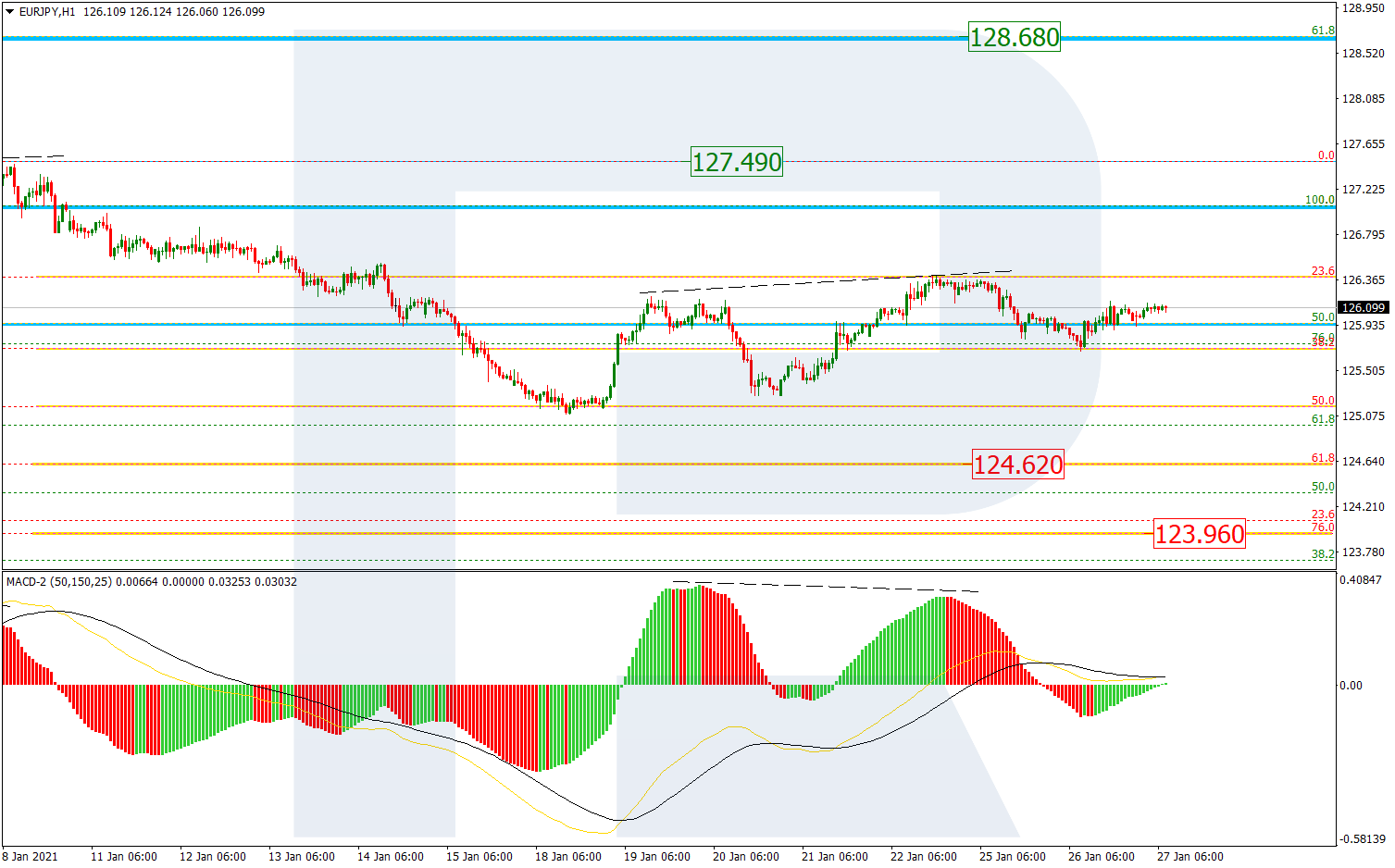

EURJPY, “Euro vs. Japanese Yen”

In the H4 chart, EURJPY has completed its correctional decline after another divergence on MACD; right now, it is moving upwards. The structure of the current movement may be considered as a correction after the previous descending wave and this implies a new decline within the correction. After completing the correction, the pair may resume growing to break the mid-term 61.8% fibo at 128.65 and then continue moving to reach the post-correctional extension area between 138.2% and 161.8% fibo at 129.16 and 130.43 respectively.

As we can see In the H1 chart, the pair is moving upwards to return to the local resistance at 23.6% fibo. At the same time, there is a divergence on MACD, which may hint at a new decline. The first descending wave has reached 50.0% fibo, while the next one may be heading towards 61.8% and 76.0% fibo at 124.62 and 123.96 respectively. The resistance is the high at 127.49.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024

- USDJPY bulls venture into intervention zone Nov 20, 2024

- The PBoC kept interest rates. The escalating war between Ukraine and Russia is negatively affecting investor sentiment Nov 20, 2024

- AUD/USD Consolidates After Recent Gains Nov 20, 2024

- The RBA will maintain a restrictive monetary policy until the end of the year. Nov 19, 2024

- Safe-haven assets rally on nuclear concerns Nov 19, 2024

- Gold Rebounds Amid USD Weakness and Geopolitical Uncertainties Nov 19, 2024