By RoboForex Analytical Department

The USDJPY pair has surged to a 14-week peak, touching 153.83 as demand for the US dollar strengthens with the unfolding US presidential election. This rally aligns with increasing support for Donald Trump, whose lead in critical states has fuelled investor optimism.

This week, US political developments are poised to dominate market attention, with the outcome still pending in several swing states.

In Japan, the recent Bank of Japan (BoJ) meeting minutes indicate a consensus among board members to persist with interest rate hikes, aligning with their inflation and economic objectives. Despite this, there is no immediate expectation for a rate increase until at least January 2025, reflecting the prevailing global economic uncertainties and market volatility.

Currently, the Japanese yen is not favoured as a safe-haven asset, with the market focus sharply pivoting towards the US dollar.

Technical analysis of USDJPY

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

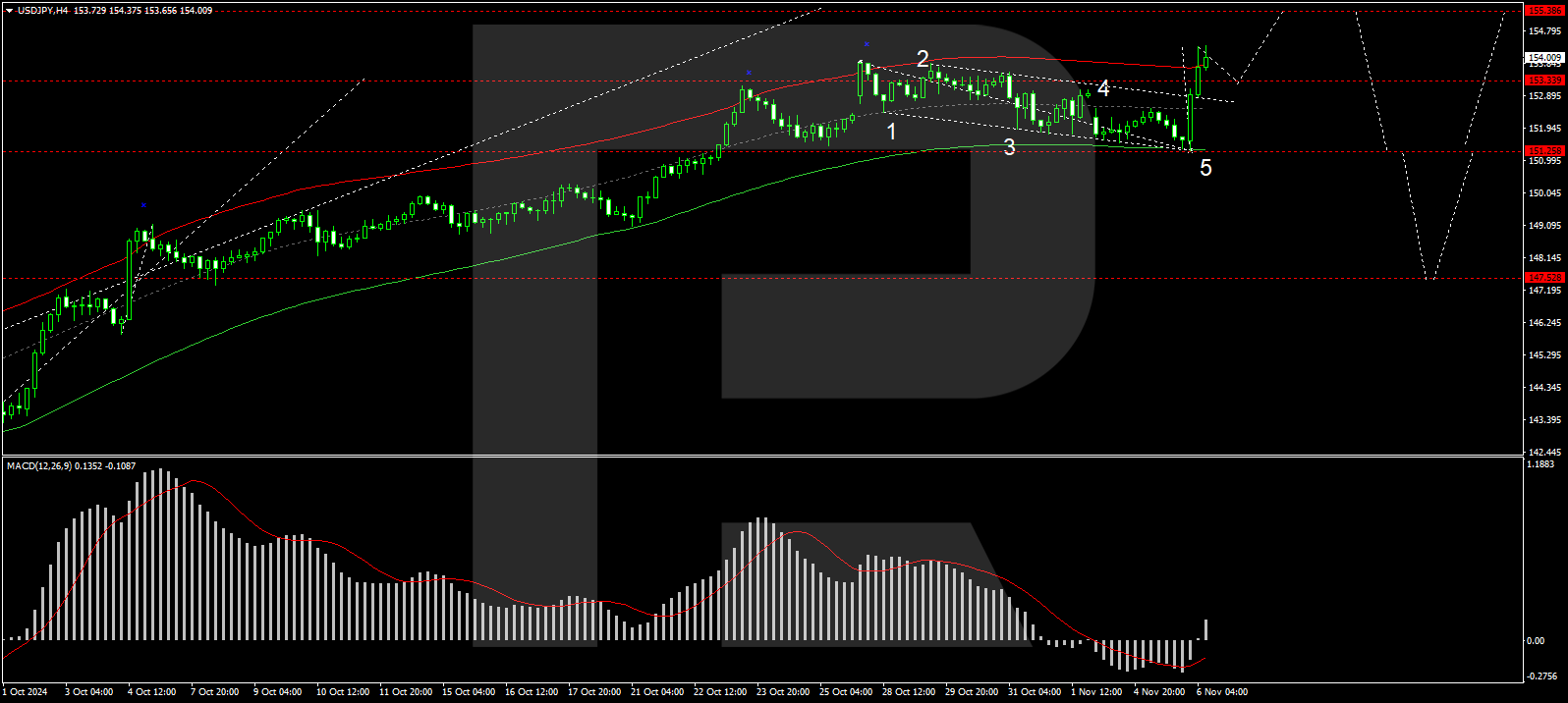

The USDJPY pair has completed a corrective phase to 151.28 and initiated the fifth wave of growth towards 155.38. A consolidation phase around 153.33 suggests the potential for an upward breakout, continuing the ascent towards 155.38. This bullish scenario is supported by the MACD indicator, which shows a solid upward momentum from below the zero level.

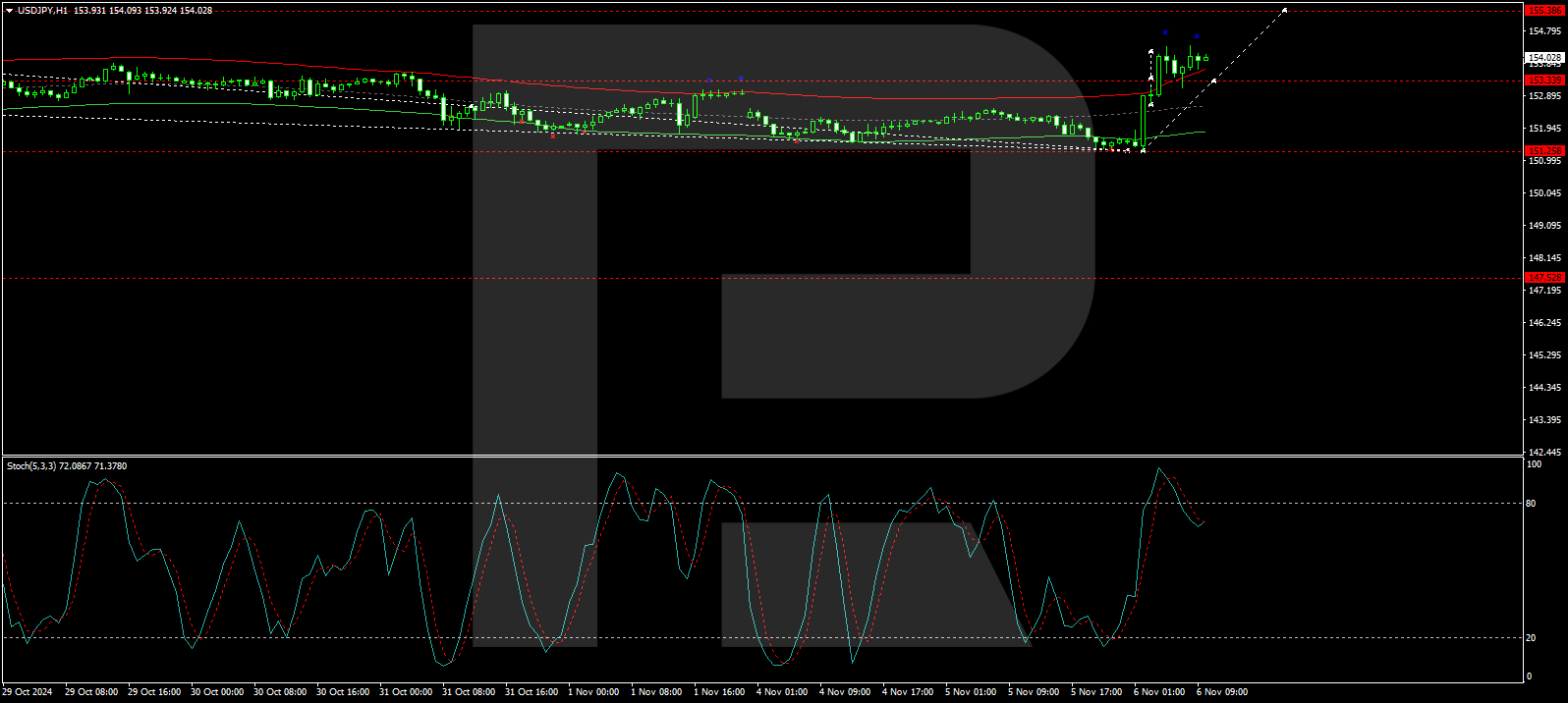

Following a full correction to 151.28, the pair found strong support and advanced to 153.33. The market is now consolidating at this level, and a continuation of the upward trend to 155.38 is anticipated. This view is corroborated by the Stochastic oscillator, positioned near 80, indicating sustained upward pressure.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026

- Oil prices have seen their largest surge in 4 years amid the military conflict in the Persian Gulf. Mar 2, 2026

- EUR/USD Reacts to Geopolitics and Data: Week Opens Nervously Mar 2, 2026