By RoboForex Analytical Department

The Australian dollar against the US dollar is currently experiencing a pause in its recent upward trajectory, stabilising around 0.6525 on the H4 chart. After three sessions of gains, the currency pair is undergoing a period of consolidation, likely preparing for a return to a stable ascending trend.

The slight retreat in the US dollar, driven by profit-taking after its rally and anticipation of new developments in the US Treasury under President Donald Trump, has influenced the performance of the AUD.

The minutes from the Reserve Bank of Australia’s latest meeting highlight the bank’s commitment to maintaining a restrictive monetary policy until inflation consistently approaches the target range. The RBA remains open to adjusting its policy stance in response to changing economic conditions, with market expectations leaning towards a potential rate cut in the coming months, with a 37% probability in February and 58% in April.

Technical analysis of AUD/USD

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

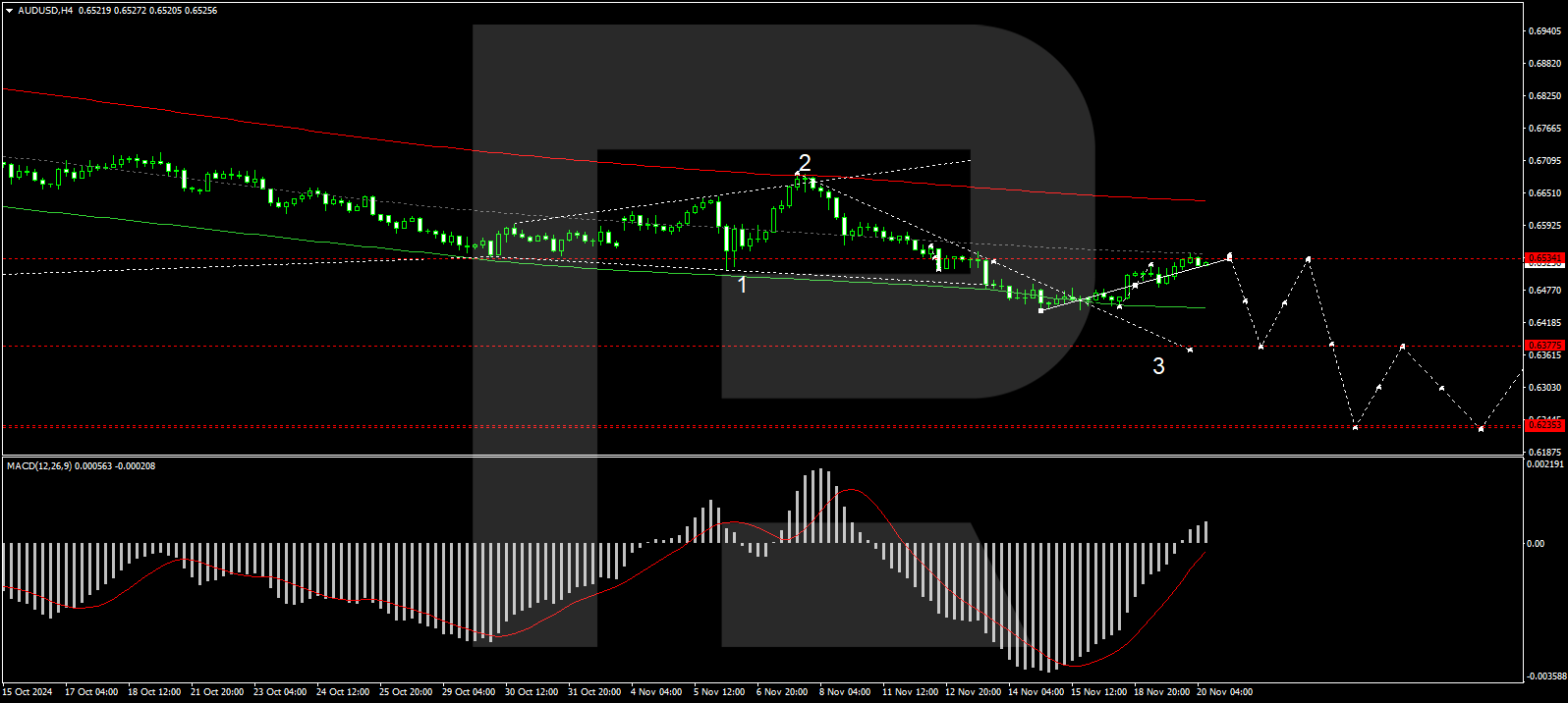

H4 chart: The AUD/USD pair is currently in a phase of correction following a downturn that saw the local decline target at 0.6440 reached. The market is forming a corrective wave towards 0.6543. If this correction is completed, a new downtrend towards 0.6380 is anticipated. The MACD indicator supports this bearish AUD/USD outlook, positioned below the zero line and poised to descend to new lows.

H1 chart: On the H1 chart, AUD/USD is approaching the correction target near 0.6543, forming a consolidation pattern just below this level. The breakout from this consolidation is expected to be downwards, initiating another phase of decline. The immediate target for this decline is set at 0.6464. The Stochastic oscillator reinforces this bearish forecast, with its signal line pointing downwards towards the 20 mark, indicating potential further declines.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026