COT | Data | Leaders | What is COT? | Excel | COT Dashboard

Here are the latest links to our coverage of the Commitment of Traders data changes. Data updated through January 30th.

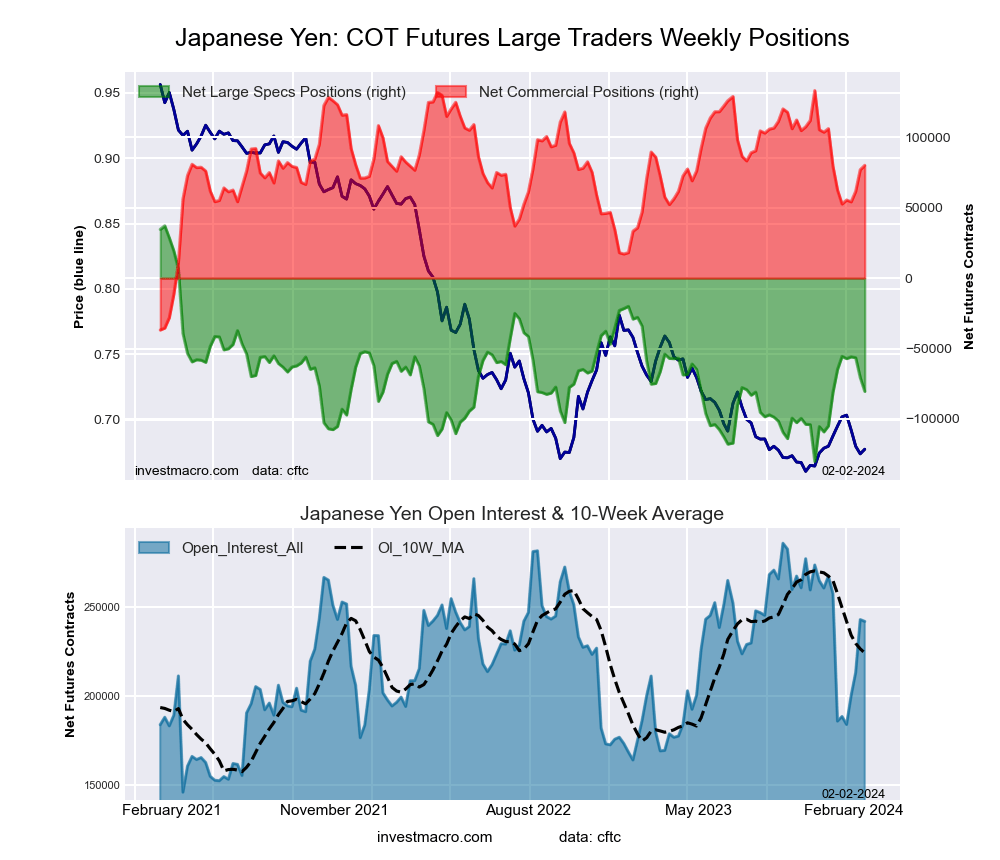

Japanese Yen Speculators add to their bearish bets as yen falls

The COT currency market speculator bets were higher this week as six out of the eleven currency markets we cover had higher positioning.

Leading the gains for the currency markets was the Canadian Dollar (6,063 contracts) with the Mexican Peso (5,294 contracts), British Pound (2,716 contracts), the Swiss Franc (1,267 contracts), the New Zealand Dollar (703 contracts) and the EuroFX (447 contracts) also showing positive weeks.

The currencies seeing declines in speculator bets on the week were the Japanese Yen (-9,810 contracts) the Brazilian Real (-5,452 contracts), the Australian Dollar (-4,175 contracts), the US Dollar Index (-1,275 contracts) and Bitcoin (-137 contracts) also recording lower bets on the week.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Weekly Market Price Changes

Ultra U.S. Treasury Bonds, Cocoa Futures & Coffee lead weekly price gains

| Name | PctChg_5_Days |

|---|---|

| Ultra U.S. Treasury Bonds | 7.68 |

| Cocoa Futures | 7.16 |

| Coffee | 3.88 |

| VIX | 3.20 |

| US Treasury Bond | 2.55 |

| Lean Hogs | 2.02 |

| Bitcoin | 1.98 |

| Nikkei 225 | 1.53 |

| S&P500 Mini | 1.26 |

| Live Cattle | 1.14 |

Steel, Gasoline & WTI Crude Oil lead the price declines

| Name | PctChg_5_Days |

|---|---|

| Steel | -9.94 |

| Gasoline | -7.97 |

| WTI Crude Oil | -7.55 |

| Brent Oil | -6.86 |

| Natural Gas | -3.68 |

| Heating Oil | -2.95 |

| Platinum | -2.45 |

| Bloomberg Commodity Index | -2.38 |

| Soybean Oil | -2.00 |

| Wheat | -1.76 |

See Weekly Price Changes for major markets and their performance.

COT Speculator Extremes

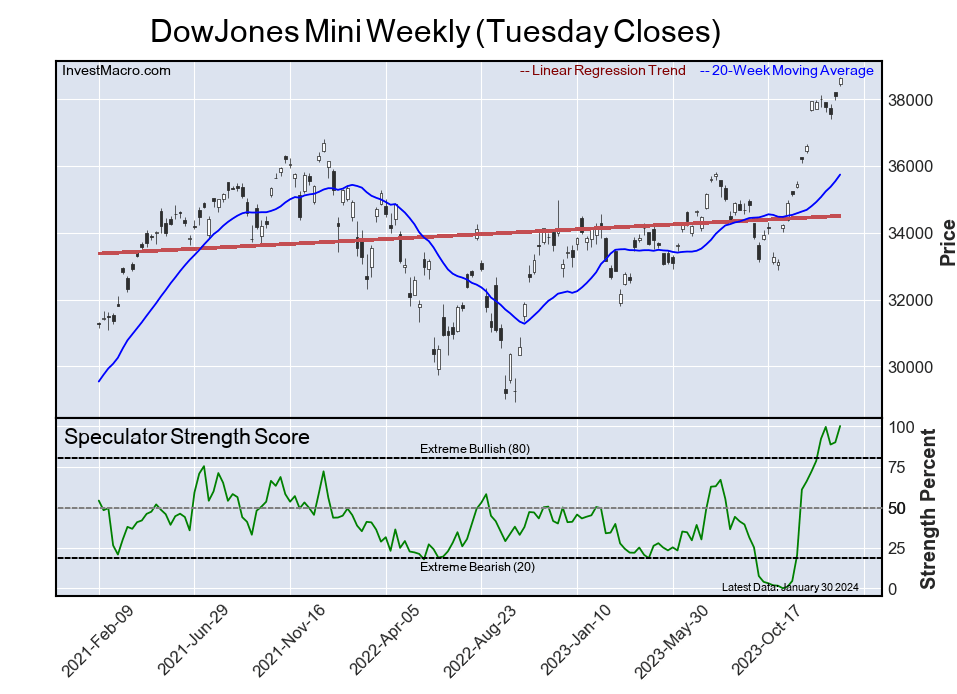

Speculator Extremes: DowJones, Nasdaq, Soybeans & Corn lead Bullish & Bearish Positions

This weekly Extreme Positions report highlights the Most Bullish and Most Bearish Positions for the speculator category. See full article…

COT Bonds

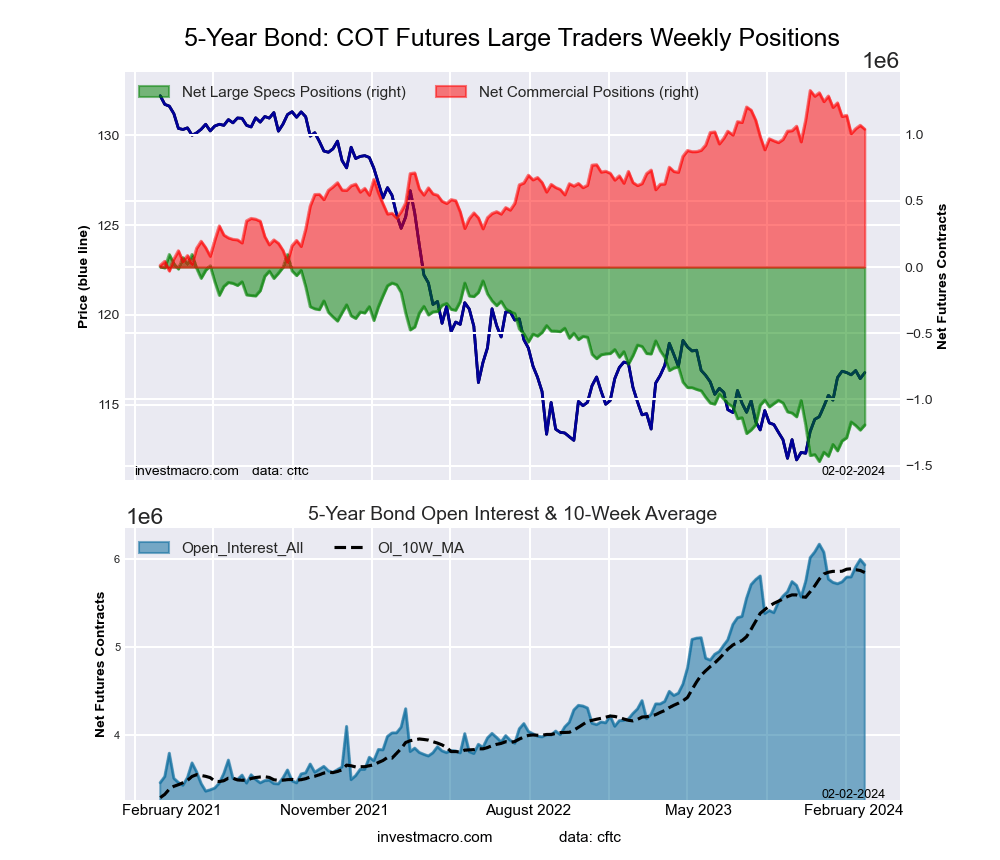

COT Bonds Charts: Speculator bets led by 5-Year Bonds

The COT bond market speculator bets were lower this week as just two out of the eight bond markets we cover had higher positioning. See full article…

COT Metals

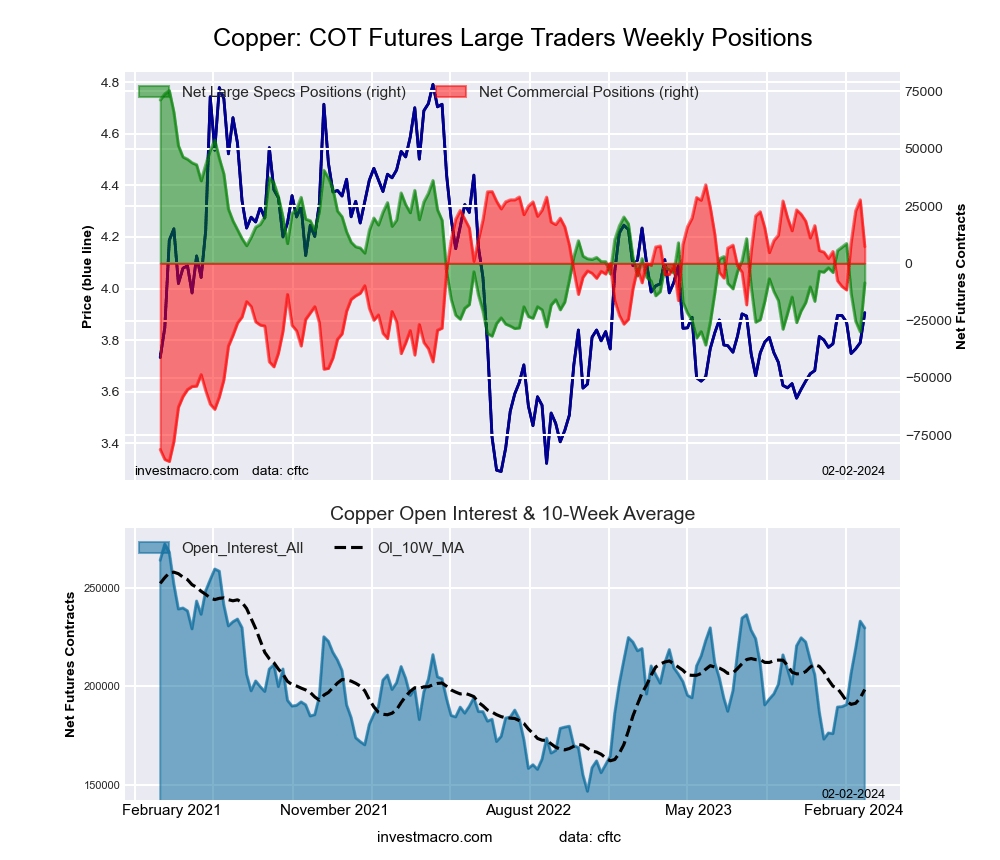

COT Metals Charts: Speculator bets led by Copper & Silver

The COT metals markets speculator bets were higher this week as four out of the six metals markets we cover had higher speculator contracts. See full article…

COT Soft Commodities

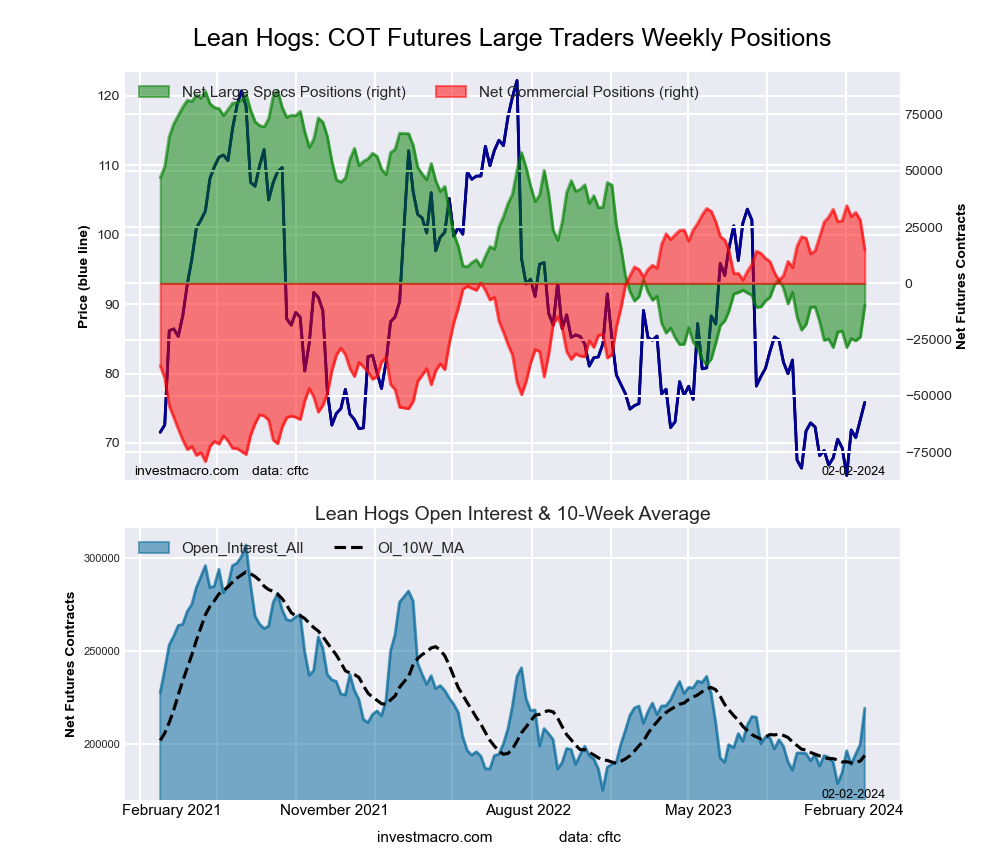

COT Soft Commodities Charts: Speculator bets led by Lean Hogs & Live Cattle

The COT soft commodities speculator bets were lower this week as four out of the eleven softs markets we cover had higher positioning. See full article…

COT Stock Markets

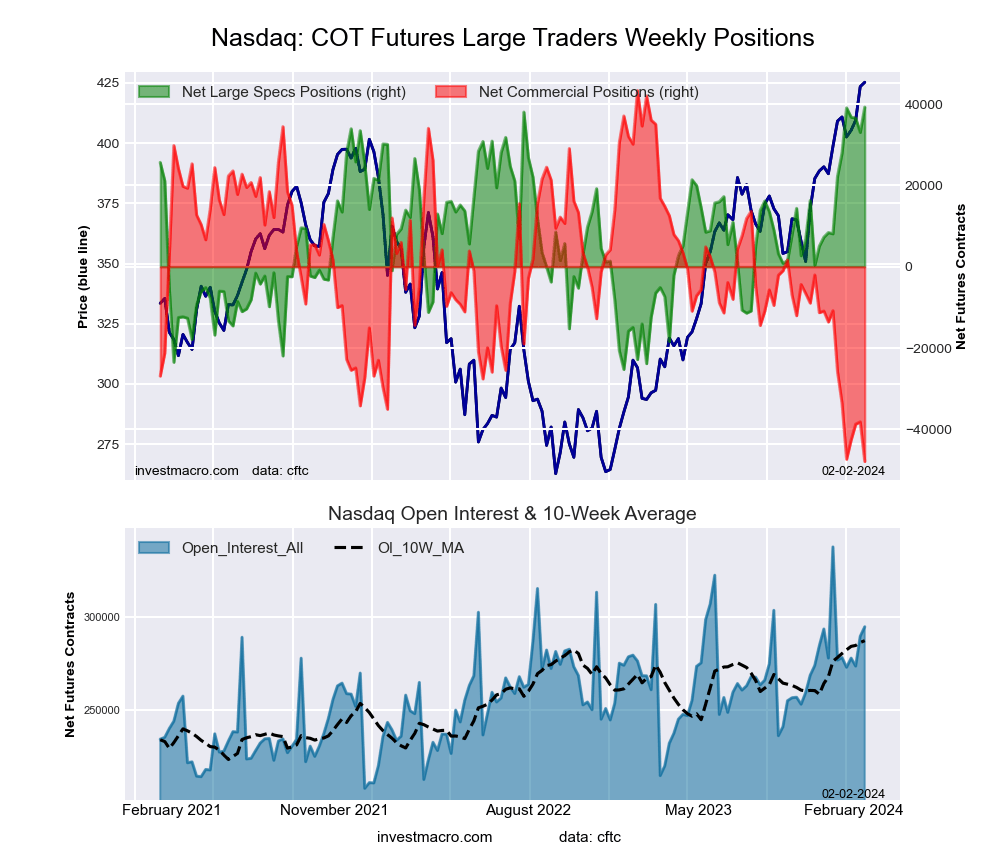

COT Stock Market Charts: Speculator bets led by Nasdaq & DowJones

The COT stock markets speculator bets were lower this week as just two out of the seven stock markets we cover had higher positioning. See full article…

Have a Wonderful Trading Week

By InvestMacro.com

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators, non-commercials (for-profit traders), commercial traders and small traders were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).