Source: Clive Maund (10/31/22)

With the possibility of a Fed pivot looming, expert Clive Maund touches on his views of the precious metals sector and why he believes you should invest in it sooner rather than later.

On the 1-year chart for gold shown below, we can see precisely why it has been in a quite severe downtrend from its peak last March. It is because the dollar and interest rates, shown at the top and bottom of the chart, have been in strong uptrends during this period.

A very important point to note is that while gold has dropped about $400 from its March peak, in real terms, this decline is much more serious because of the robust inflation during this period.

So if the Fed does pivot soon, that is to say, it stops raising rates and starts lowering them, or other Central Banks start raising rates, thus reducing the dollar’s appeal.

It will mean a reversal to the downside in the dollar and to the upside in gold and commodities and risk-on assets generally, and as we saw on Friday 21st, even talk of a pivot is enough to generate a recovery.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Gold

A very important point to note is that while gold has dropped about $400 from its March peak, in real terms, this decline is much more serious because of the robust inflation during this period.

So when you talk about $1600 gold now, it means that in, say, 2019 prices, it’s probably about $1200. This gives us more of an idea about how undervalued gold and especially silver are now. Before leaving this chart, observe that gold may be making a Double Bottom here with its September lows.

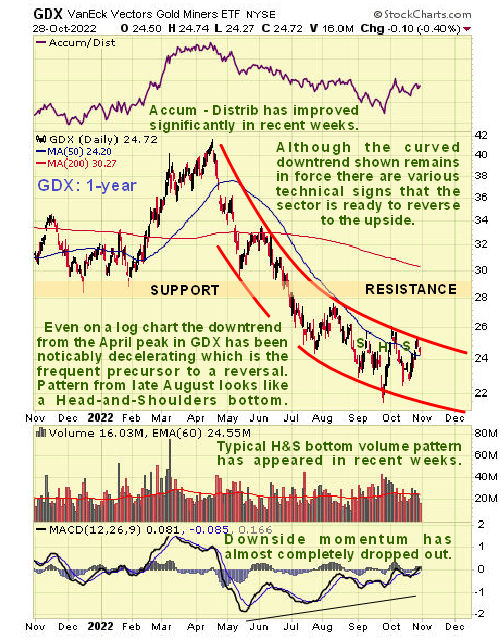

The next chart, the 1-year chart for PM sector proxy GDX, is most interesting as it makes plain that, even on a log chart as this is, the downtrend in the sector from its April highs has been decelerating steadily to the point that the MACD indicator has recovered back almost to the zero line.

If this interpretation is correct, then we are at a point of huge opportunity to buy the sector before it breaks out.

This is the sort of behavior that usually precedes a reversal to the upside, so it is not surprising to see that a small Head-and-Shoulders appears to be completed within the downtrend channel, whose validity is endorsed by the bullish volume pattern that has accompanied it, with strong volume on the rise to form the right side of the Head of the pattern and again on the rise late last week as it completes what is believed to be the Right Shoulder of the pattern.

If this interpretation is correct, then we are at a point of huge opportunity to buy the sector before it breaks out.

In the context of the foregoing, it’s useful for us to consider the extent to which the PM sector has markedly underperformed even the frail stock market in recent months.

Silver is regarded as probably the most undervalued asset in the world.

On the 1-year chart for GDX over the S&P500 index, we can see that it has seriously underperformed due, of course, to the strong rise in the dollar and interest rates.

This is important because it means that the PM sector is even better value here compared to the broad market.

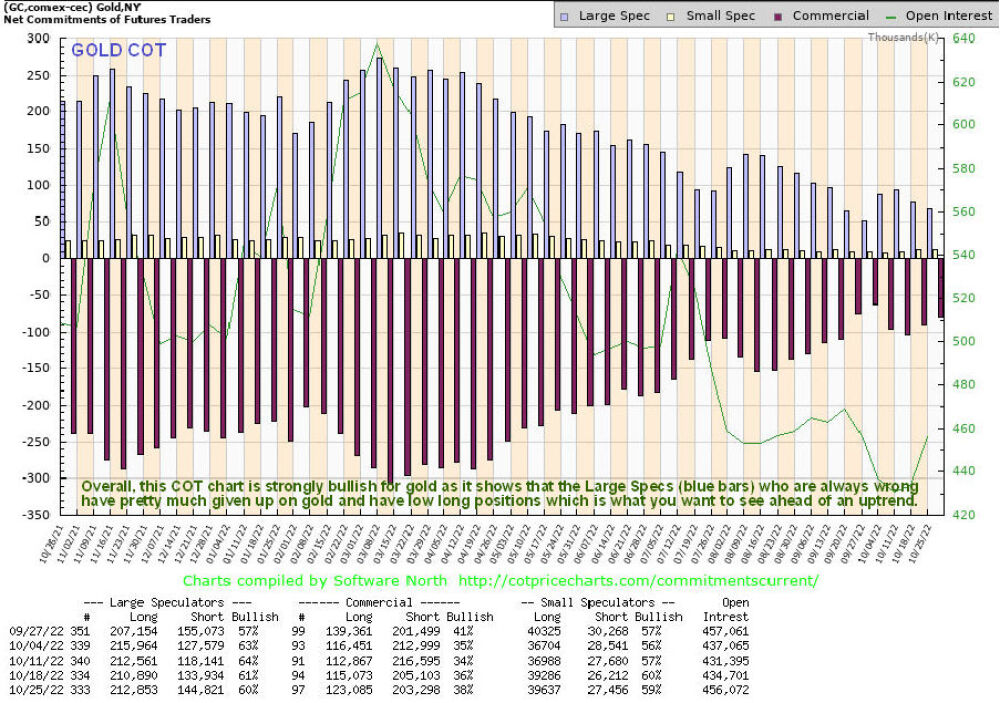

Alright, so if we are at or close to a bottom in gold and the PM sector, then we would expect to see the normally wrong Large Specs having Little interest in gold, and that is exactly what we see on the latest COT chart for gold, which shows that they have pretty much given up on it.

This COT chart alone augurs well for a new bull market phase in gold . . .

Silver

What about silver?

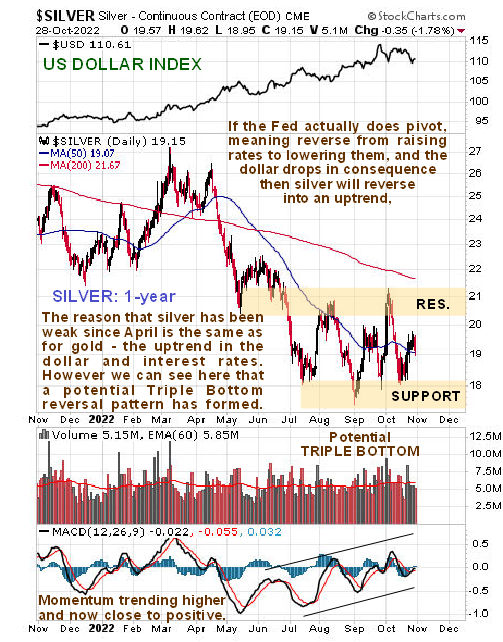

On its 1-year chart, we can see that it has dropped back from its March highs for the same reasons that gold has, the strong uptrends in the dollar, and interest rates.

This is looking like a great place to load up on the better gold and silver stocks.

However, since July, a potential base pattern has been building out that is now starting to look like a completing Triple Bottom, and with the steadily uptrending momentum (MACD) now about to swing positive, the outlook is brightening and the strong volume on the rally out of the low in the middle of the month, better seen on a 6-month chart, looks like the beginnings of a rally up towards the resistance at the upper boundary of the pattern.

Silver is regarded as probably the most undervalued asset in the world, and in the dark times that we are headed towards, physical silver is probably the best asset to have in your possession, along with some firearms to make sure that it stays in your possession.

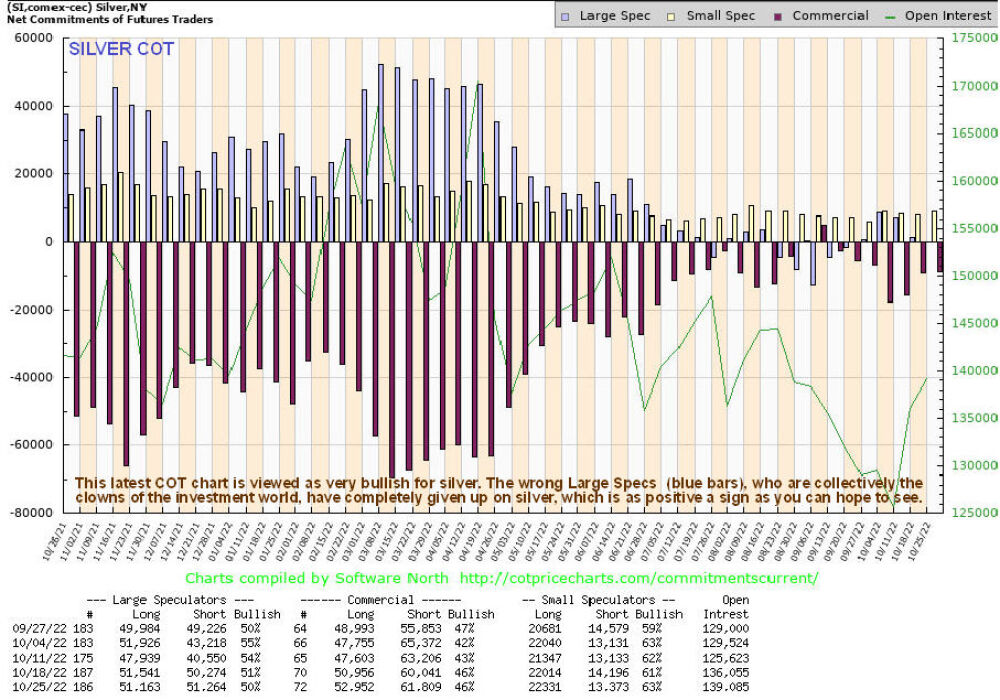

If silver is close to an optimum point to buy, then we would expect to see the dumb Large Specs having no interest in it all, and that is exactly what we see on silver’s latest COT chart, which shows the Large Specs net long positions to be virtually non-existent . . .

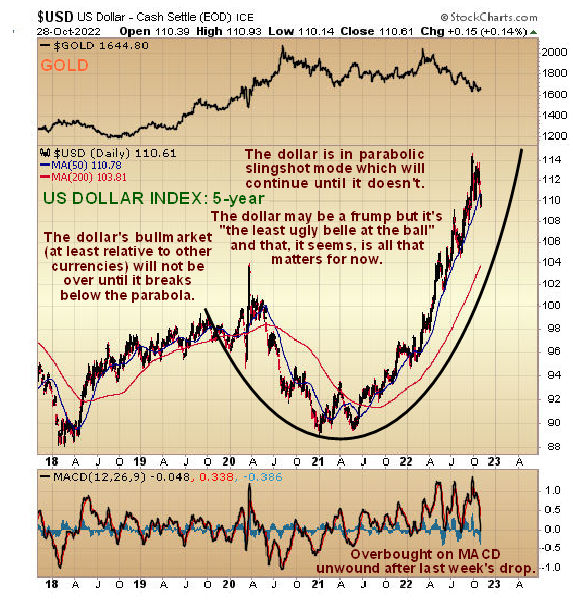

It’s useful here to take a quick look at the 5-year chart for the dollar index because, on this chart, we see that it has gone parabolic in recent months, and it’s possible that it just topped out.

Two possible reasons for it to turn and break down that have already been mentioned are a “Fed pivot” and other countries or trading blocs, such as the European Union, following the Fed’s lead and raising rates too.

The U.S. Dollar and British Pound

Just for laughs, let’s take a quick look at the 5-year chart for the British Pound.

It shows that it has been terribly weak, dropping an incredible 40% in less than 18 months . . .

For U.S. readers who’ve always wanted to see the sights in Britain, and have the time and money, now is a good time to vacation there while the exchange rate is good before the Winter.

If you want ideas on what to visit, I can give you a list as long as your arm.

The Risk of a Market Crash

Finally, what about the ongoing risk of an all-out market crash? Would that not drag gold and silver, and PM stocks down even further?

Well, it could, although it may not because, this time, there will be no hiding place for investors in the Treasury market, which is already on the rocks.

So with this option closed off, funk money will probably flee into gold and silver instead. This time round is very different in that the powers that be fully intend to destroy the world economy kill off most of the population, and turn the survivors into cyborg-like slaves, and have made their intentions very clear to anyone with more than a few functioning brain cells.

This would best be achieved by a state of hyperinflation, Venezuela style, that would render the population destitute and totally at the mercy of the State (except for some preppers, who will probably be identified and rounded up anyway).

Following this logic, they will continue to create money to defer the debt market collapse for as long as possible, and the hyperinflation that will result, which we are already close to, must mean an exponential rise in the price of hard assets like gold and silver, with physical being very highly prized and hard to obtain.

The charts that we have reviewed in this update strongly suggest that, whatever the broad market does from here, the PM sector has bottomed out and is going to rally soon. An important article posted by Adam Hamilton a couple of days ago, Gold Stocks’ Winter Rally 7, strongly supports this contention.

Although long, this common sense article presents reasoned arguments based on his many years of experience with this sector and should thus be taken seriously.

Conclusion — This is looking like a great place to load up on the better gold and silver stocks.

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024

- US dollar exhibits remarkable strength amid global tensions Apr 15, 2024

- COT Metals Charts: Speculator bets led higher by Copper & Platinum Apr 13, 2024

- COT Bonds Charts: Speculator Bets led by 10-Year & 5-Year Bonds Apr 13, 2024

- COT Soft Commodities Charts: Speculator Bets led by Soybean Meal & Lean Hogs Apr 13, 2024

- COT Stock Market Charts: Weekly Speculator Bets led by VIX & S&P500-Mini Apr 13, 2024

- Singapore’s central bank (MAS) maintained its monetary policy settings. The ECB hinted at a rate cut soon Apr 12, 2024