Even as the drums of war continue reverberating across global financial markets, investors and traders remain gripped by the Fed’s next policy moves.

Look out for the FOMC minutes due mid-week, sandwiched between speeches by key Fed officials in the coming week:

Monday, April 4

- AUD: Australia March inflation gauge

- EUR: Germany February trade balance

- GBP: BOE Governor Andrew Bailey speech

Tuesday, April 5

- AUD: Reserve Bank of Australia rate decision

- EUR: Eurozone March services and composite PMIs (final)

- USD: Fed Governor Lael Brainard speech

Wednesday, April 6

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

- CNH: China March Caixin composite and services PMI

- EUR: February Eurozone producer prices and Germany factory orders

- USD: FOMC minutes and Philadelphia Fed President Patrick Harker speech

- US crude: EIA weekly US crude inventories

Thursday, April 7

- AUD: Australia February external trade

- EUR: ECB publishes account of March policy meeting, Eurozone February retail sales, Germany February industrial production

- GBP: BOE Chief Economist Huw Pill speech

- USD: US weekly jobless claims

- USD: Fed speak – St. Louis Fed President James Bullard, Atlanta Fed President Raphael Bostic, Chicago Fed President Charles Evans

Friday, April 8

The benchmark dollar index (DXY) added to its year-to-date gains by climbing another 1.66% in March.

Despite faltering in recent sessions, the DXY is attempting to climb back above its 21-day simple moving average, striving to retain the 99.0 handle once more.

The buck’s climb last month was fueled by:

- rising safe haven demand amid the ongoing invasion of the Ukraine which is darkening the outlooks for the EU and UK economies

- the widening yields between US and Japanese bonds, which sent the greenback surging against the Japanese Yen.

Note that the euro, British Pound, and the Japanese Yen all combine to make up 83.1% of the DXY.

The Canadian Dollar, Swedish Krona, and Swiss Franc account for the remaining 16.9%.

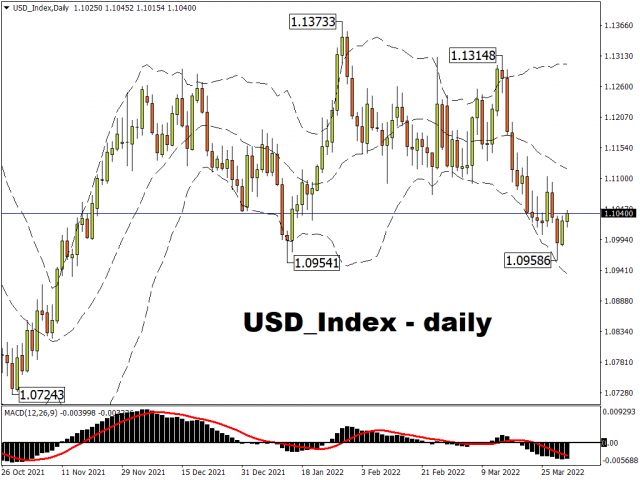

However, the equally-weighted dollar index tells a different story.

It faltered and hugged its lower Bollinger band in the second half of March, nearly matching its year-to-date low around 1.095.

This was despite the sustained safe haven bids, along with the rise in US Treasury yields due to signs that the Fed has to turn more aggressive in its battle against inflation.

Note that this index comprises the following pairs all in equal weights:

Considering that half of this dollar index comprises commodity-linked currencies, namely the Australian Dollar, New Zealand Dollar, and the Canadian Dollar, hence no surprise that the resurgence in oil prices in the second half of March in turn swept up those currencies, which in turn heaped downward pressure on this equally-weighted dollar index.

With all that in mind, US dollar bulls could do with a morale-booster.

Investors and traders worldwide will be keenly eyeing the incoming FOMC minutes as well as scheduled speeches by Fed officials.

Already, Fed Chair Jerome Powell had indicated that details on the central bank’s discussions surrounding its balance sheet reduction plans will be included in the minutes of the March FOMC meeting. The Fed believes that financial markets can start withdrawing its pandemic-era support for financial markets, with policymakers intending to start paring down the central bank’s balance sheet which now stands at US$8.94 trillion.

Those trillions being sucked out of financial markets at a sooner-than-expected start date or a faster-than-expected pace could upend markets, sending Treasury yields soaring even higher, potentially reinvigorating dollar bulls as well.

The greenback could also be cajoled into retracing its steps towards recent highs (back above 99 for DXY and above 1.11 for the equally-weighted dollar index), if more Fed officials next week ramp up expectations for a 50-basis point hike at the May FOMC meeting.

Overall, the US dollar still finds itself in a supportive environment, thanks to persistent fears over the global implications of the Russia-Ukraine war, as well as the Fed’s hawkish policy bias.

Still, dollar bulls could do with another shot in the arm, which could arrive via the FOMC minutes or Fed speak due in the first full trading week of April.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026