Have you ever been sprayed by a shaken soda can or seen the cork pop from a champagne bottle?

Now imagine a similar situation on the GBPUSD…

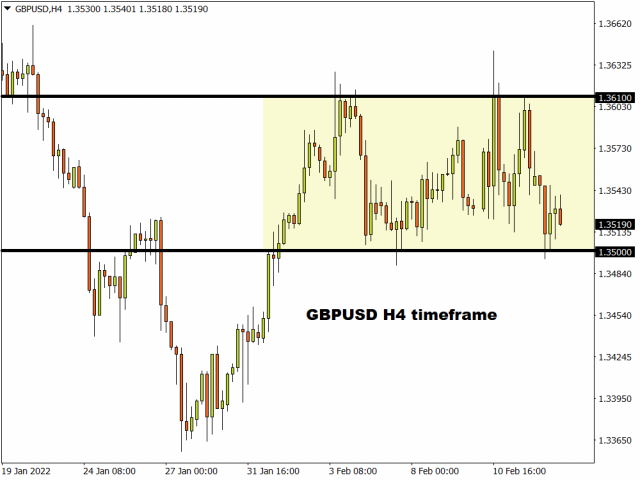

The currency pair remains trapped within a range as bulls and bears fight for control. Pressure is certainly building up as time passes with a fresh directional catalyst needed to trigger a breakout or breakdown.

Before we take a deep dive into what factors could influence the GBPUSD this week, it is worth keeping in mind that sterling has appreciated against almost every single G10 currency year-to-date.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

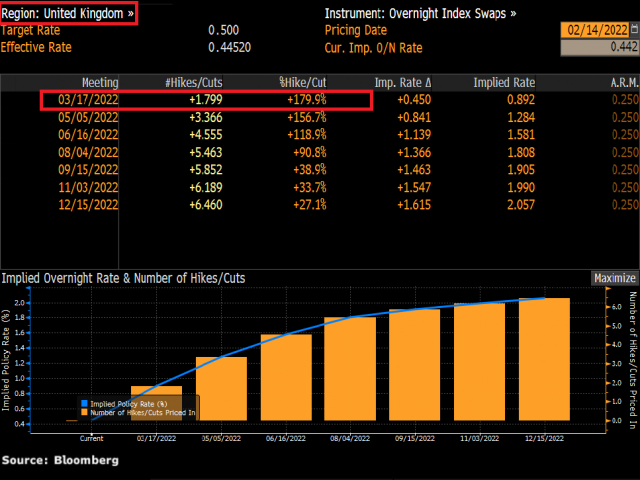

Pound bulls continue to draw strength from improving economic data and BoE rate hike expectations. A rate hike for March has already been priced in with traders expecting the central bank to raise interest rates 6 times in 2022.

While political uncertainty and renewed Brexit concerns could create some bumps down the road, the fundamentals remain stacked in favour of bulls and this continues to be reflected in price action.

Data heavy week for Pound

On Tuesday all eyes will be on the UK December unemployment figures and January jobless claims. Job growth is expected to have cooled in the three months to December, while the unemployment rate is expected to remain unchanged at 4.1%.

The inflation report will steal the spotlight on Wednesday with the headline consumer price index projected to remain unchanged at 5.4% in January. Core CPI is forecast to hit 4.3%, higher than the 4.2% in December. If the headline inflation meets or prints below expectations, this could fuel speculation over inflation plateauing. However, given how energy providers are set to charge drastically higher prices from April any slowdown in inflation will be seen as temporary.

Retail sales will be in focus on Friday with markets expecting sales to rebound in January following the 3.7% decline seen in the final month of 2021. Given how consumption remains an engine of growth, a strong figure is likely to boost sentiment towards the UK economy. According to Bloomberg estimates, retail sales are forecast to rise 1.1% MoM in January and 9.3% YoY.

Let’s not forget about the Fed minutes!

Now, this is where things get really interesting.

The Fed minutes will be released a couple of hours after the UK inflation report on Wednesday.

Earlier we stated that the GBPUSD needed a fresh directional catalyst to breakout or breakdown. Well, this could be triggered by the CPI and Fed minutes as investors ponder which central bank is more hawkish.

Investors will closely scrutinize the minutes for any new insight on rate hikes, the inflation outlook, and any discussions on its balance sheet. Should the minutes strike a hawkish tone or signal that the Fed could be considering raising interest rates larger-than-expected in March, this could boost the dollar. Such a development has the potential to spark volatility on the GBPUSD with prices potentially dipping below 1.3500 as a result.

Other than the Fed minutes, there will be a chorus of Fed officials under the spotlight which could also influence the dollar.

GBPUSD breakout/breakdown on the horizon

The GBPUSD remains stuck within a 100-pip range on the daily timeframe with support at 1.3500 and resistance at 1.3600. Prices are trading above the 50-day and 100-day Simple Moving Average while the MACD trades above zero. A solid daily close below 1.3500 may trigger a selloff towards 1.3420 and 1.3350. Alternatively, a strong move above 1.3600 could open the doors towards 1.3670 which is just below the 200-day Simple Moving Average. Above this point, the next big resistance can be found at 1.3750.

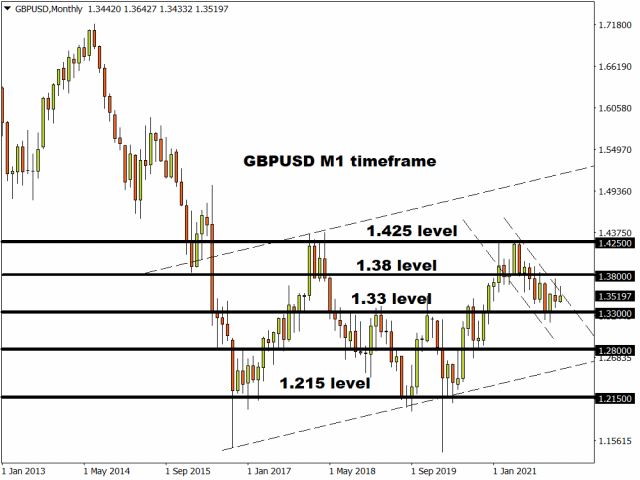

Zooming out on the monthly, it is the same old story. Although prices look to be trending lower, major support can be found at 1.3300 and resistance at 1.3800. If bears can drag prices below 1.3300, the next significant level of interest can be found at 1.2800. Alternatively, a move back above 1.3800 could signal bulls are back in the game with the next major resistance at 1.4250.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026