Article By RoboForex.com

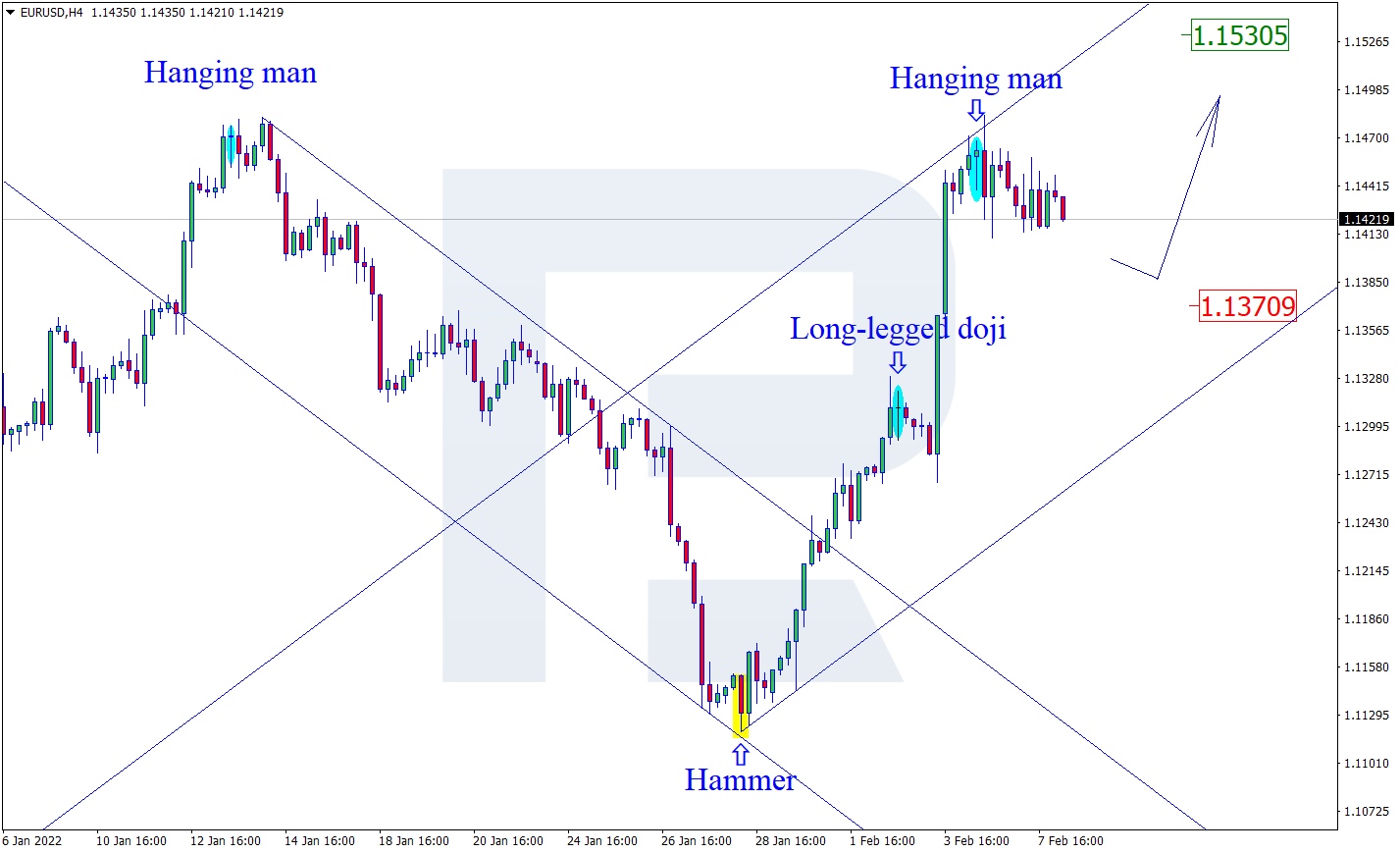

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, the asset has formed a Hanging Man reversal pattern close to the resistance level. At the moment, EURUSD is reversing and may form a new correctional impulse. In this case, the downside target may be at 1.1370. However, an alternative scenario implies that the price may continue growing to reach 1.1530 without forming any corrections towards the support area.

USDJPY, “US Dollar vs Japanese Yen”

As we can see in the H4 chart, USDJPY has formed a Hammer reversal pattern during the pullback. At the moment, USDJPY is reversing and may start a new rising wave towards the resistance level. In this case, the upside target may be at 116.00. At the same time, an opposite scenario implies that the price may correct to reach 115.00 before resuming its uptrend.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

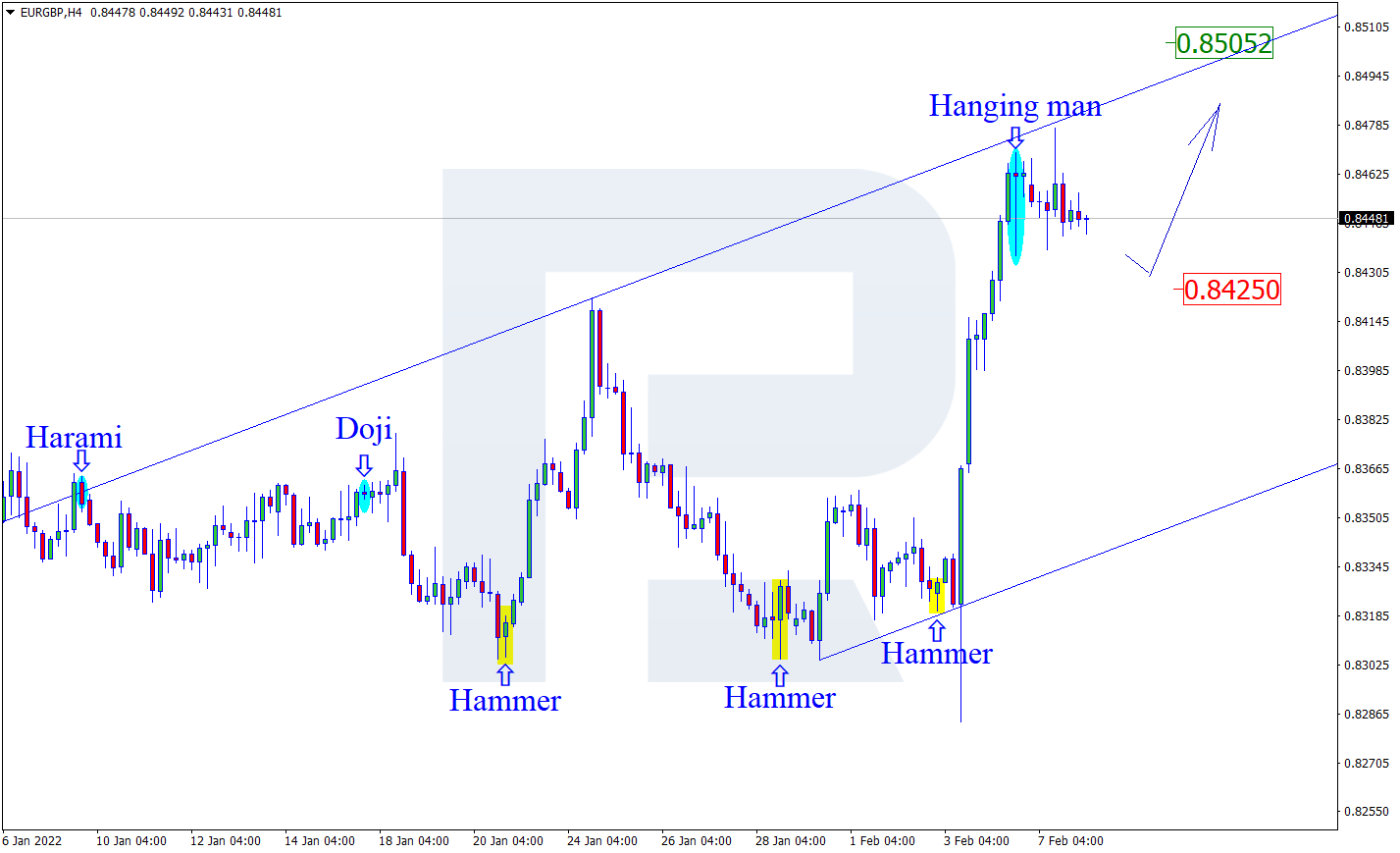

EURGBP, “Euro vs Great Britain Pound”

As we can see in the H4 chart, after forming several reversal patterns, for example, Hanging Man, near the resistance level, EURGBP is reversing and may start another decline towards the support area. In this case, the downside target may be at 0.8425. Later, the market may test the area, rebound from it, and resume the ascending tendency. Still, there might be an alternative scenario, according to which the asset may grow to reach 0.8505 without testing the support area.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026