The festive stock market rally appears to be playing out nicely with US equities continuing to drive higher in thin, holiday liquidity. The S&P 500 marked its fourth straight day of gains with another record high close, as the index climbed 1.38%. The tech sector led the way with the Nasdaq advancing 1.39% while the Dow pushed north with gains just shy of 1%.

An ecommerce boom in retail sales underscored the evident underlying strength in the economy and eased worries from Omicron-driven flight cancellations which hit travel stocks.

Festive spirits remain high despite rising infection rates

The UK and France are seemingly looking through their record and rising cases of Covid-19 as both governments declined to ramp up more severe social restrictions as we head into the new year. With other positive Omicron news out of South Africa, markets are getting into the spirit of the Santa rally in the last few trading days of 2021.

Of course, trading volumes are traditionally very much suppressed at this time of the year, so it is probably wise not to go chasing price action too much.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

That said, the traditional Santa rally does traditionally kick off in the last few days of the year and the first couple of the new year. Interestingly, going back to the mid-1990s, there have been only six times Santa has failed to show in December and January was lower in five of those six times.

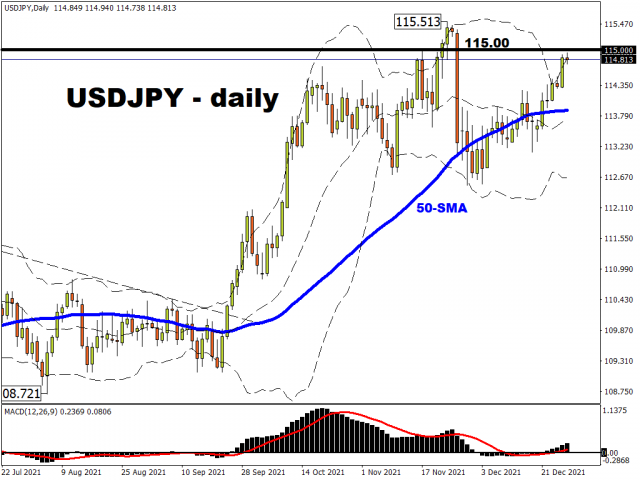

Yen lags in thin conditions

JPY has been the notable laggard in trading amid low volumes, as risk sentiment remains mildly positive.

USD/JPY hit a one-month high yesterday as bulls eye up the recent cycle top in late November at 115.513. Previous long-term resistance also sits near here, with next levels nearer 118. A move through the mid-115s will need the US 10-year Treasury yield to push convincingly through and above 1.5%.

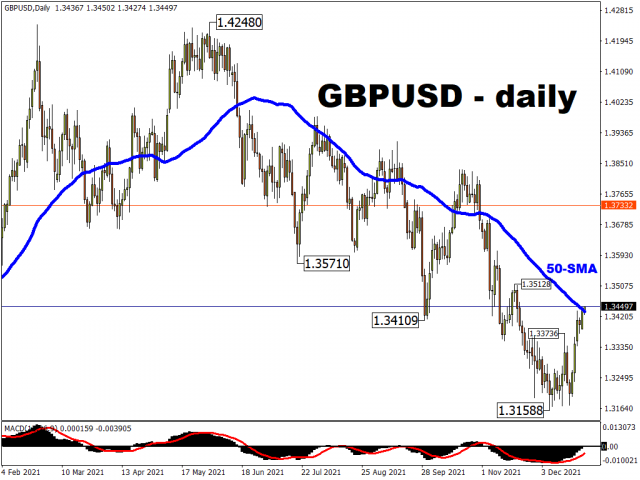

Meanwhile sterling continues to build on its pre-Christmas gains. Bets on the Bank of England hiking rates four times next year has boosted GBP with traders expecting a slight overshoot to rein in inflation.

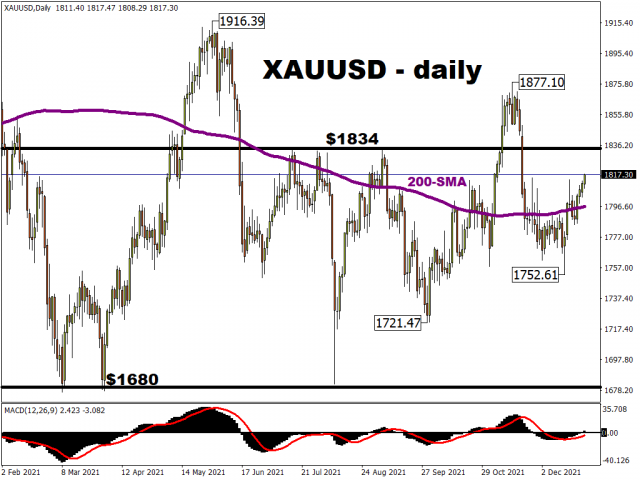

Gold inching higher

Amid the quiet trade, gold is creeping north with four straight days of gains. Prices had been trading around the 200-day simple moving average around $1800 but the recent move has pushed up making one-month highs. Strong resistance again sits at $1834 ahead of recent cycle highs above $1870.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026