By InvestMacro

The fourth quarter of 2021 is approximately halfway over and we wanted to highlight some of the top companies that have been analyzed by our QuantStock system so far. The QuantStock system is an algorithm that examines each company’s fundamental metrics, earnings trends and overall strength trends to pinpoint quality companies. We use it as a stock market ideas generator and to update our stock watchlist every quarter. However, be aware the QuantStock system does not take into consideration the stock price so one must compare each idea with their current stock prices. Many studies are consistently showing overvalued markets and that has to be taken into consideration with any stock market idea. As with all investment ideas, past performance does not guarantee future results.

Here we go with 5 of our Top Stocks halfway through Quarter 4 of 2021:

Gilead Sciences Inc.

Health Care, Large Cap, 4.29% Dividend, Our Grade = A

Gilead Sciences Inc. (NASDAQ: GILD) is first up and is a company engaged in developing innovative therapies for life-threatening diseases. Its medicine portfolio includes treatment for conditions ranging from HIV and hepatitis to coronavirus and cardiovascular disorders. If we talk about its financial performance, the bio-pharmaceutical company recently crushed expectations for the third quarter. It posted adjusted earnings of $2.65 per share on revenue of $7.42 billion for the quarter ended September 30. The results easily beat the consensus forecast of $1.76 per share for earnings and $6.29 billion for revenue. If we look at its key financial metrics, Gilead stock is currently trading around $67.48 against its 52-week range of $56.56 – $73.34. Moreover, its P/E value is 11.55, while the company’s total market value is just over $84 billion.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

US Steel

Materials, Small Cap, 0.77% Dividend, Our Grade = A-

United States Steel Corporation (NYSE: X), founded in 1901, is one of the leading steel producers in the U.S. The strong demand for steel helped the company post better-than-expected financial results for the third quarter. United States Steel reported adjusted earnings of $5.36 per share for the three months ended September 30, beating expectations of $4.85 per share. Quarterly revenue of $5.96 billion also surpassed the consensus forecast of $5.79 billion. If we look at the recent price movement, United States Steel stock has gained more than 50 percent value so far in 2021. The 52-week range of the stock is $10.72 – $30.57, while the total market value of the company is approx. $7 billion.

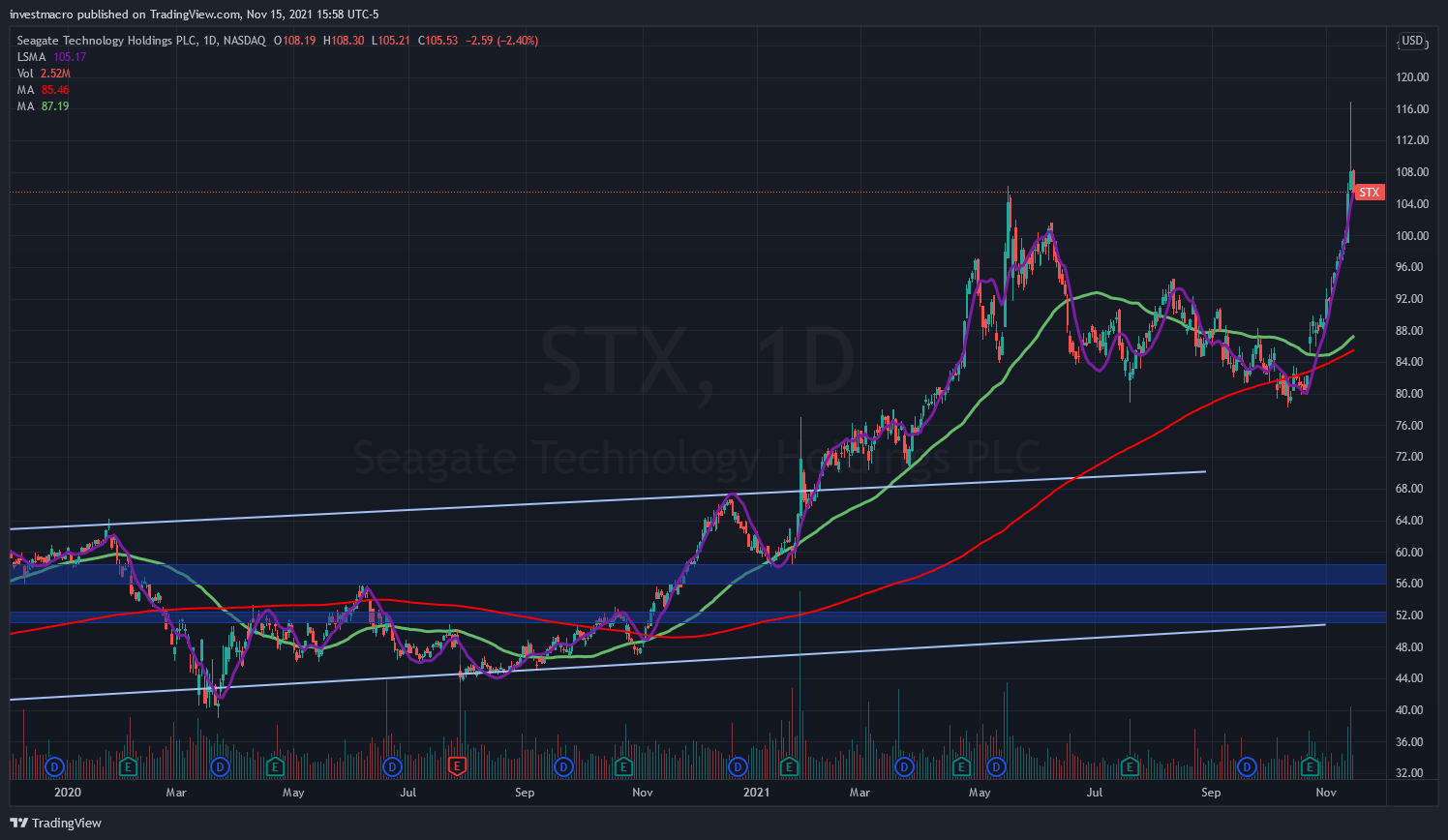

Seagate Technology

Information Technology, Medium Cap, 3.18% Dividend, Our Grade = A-

Seagate Technology Holdings plc (NASDAQ: STX) is one of the world’s biggest hard disk drives (HDDs) makers. It still generates a large portion of its revenue by selling traditional HDDs. The company last month announced better-than-expected financial results for its fiscal first quarter, driven by solid demand from cloud data center clients. Seagate reported adjusted earnings of $2.35 per share on revenue of $3.12 billion for the three months ended October 1, while analysts were looking for earnings of $2.21 per share on revenue of $3.11 billion. The impressive financial performance drove Seagate stock higher in recent weeks. Seagate stock is now up nearly 80 percent on a year-to-date basis.

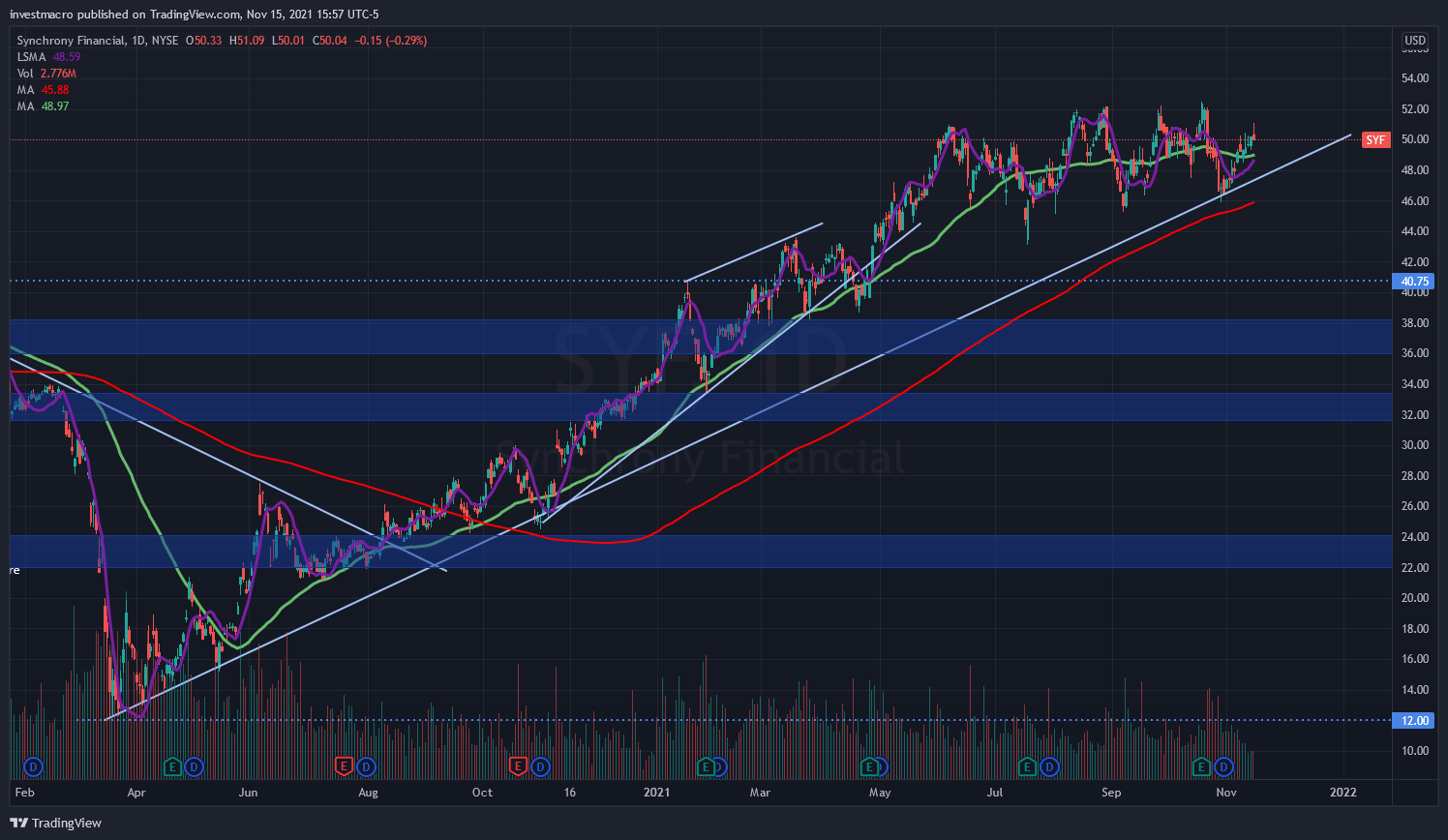

Synchrony Financial

Financials, Medium Cap, 1.68% Dividend, Our Grade = A-

Synchrony Financial (NYSE: SYF) has vast experience in the financial sector. It is one of the biggest credit card issuers in the U.S., working with hundreds of retailers to support their credit card plans. The company last month announced a solid profit for the third quarter. Synchrony reported earnings of $2 per share, significantly higher than 52 cents per share in the comparable period of 2020 and better than the consensus forecast of $1.52 per share. If we see its recent price trend, Synchrony has grown its value at a decent pace so far in 2021. The company’s share price has increased about 47 percent on a year-to-date basis. The 52-week range of the stock is $29.32 – $52.49, while its P/E ratio stands at 7.10.

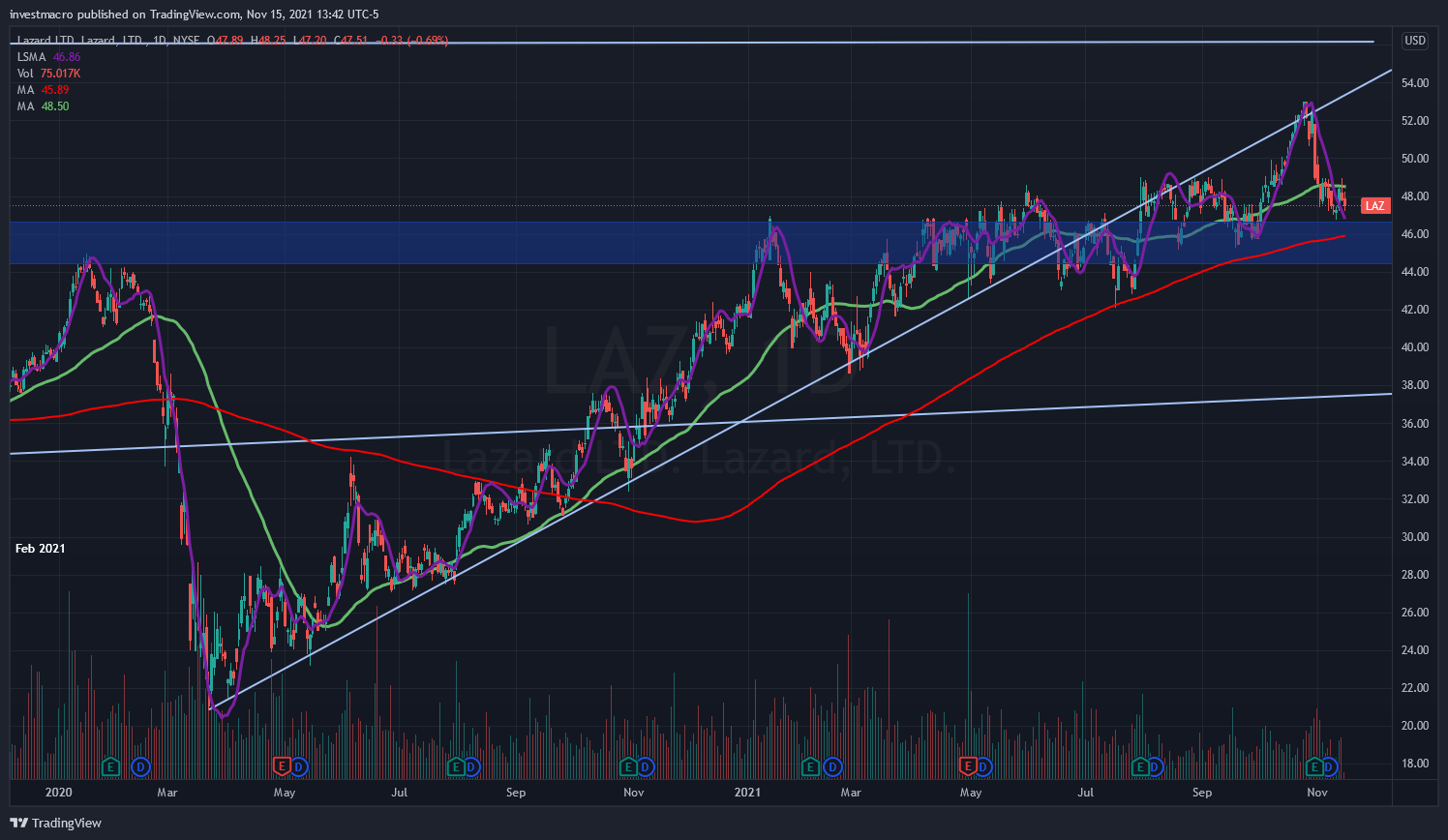

Lazard Ltd

Financials, Small Cap, 3.98% Dividend, Our Grade = A-

Lazard Ltd (NYSE: LAZ) specializes in financial advisory and asset management services. It mainly advises clients on mergers and acquisitions (M&A), capital structure, and restructuring plans. It has advised on some of the biggest and most complicated M&A deals of the last century. If we look at its financial performance, Lazard posted mixed results for the third quarter. Its earnings of 98 cents per share exceeded the expectations of 95 cents per share. However, the quarterly revenue of $702 million missed analysts’ average estimate of $715 million. Lazard stock traded mostly lower following the results. Nevertheless, the company’s share price is still up nearly 15 percent on a year-to-date basis.

By InvestMacro – Be sure to join our stock market newsletter to get our updates and to see more top companies we add to our stock watch list.

All information, stock ideas and opinions on this website are for general informational purposes only and do not constitute investment advice.

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026

- Oil prices have seen their largest surge in 4 years amid the military conflict in the Persian Gulf. Mar 2, 2026

- EUR/USD Reacts to Geopolitics and Data: Week Opens Nervously Mar 2, 2026