Article By RoboForex.com

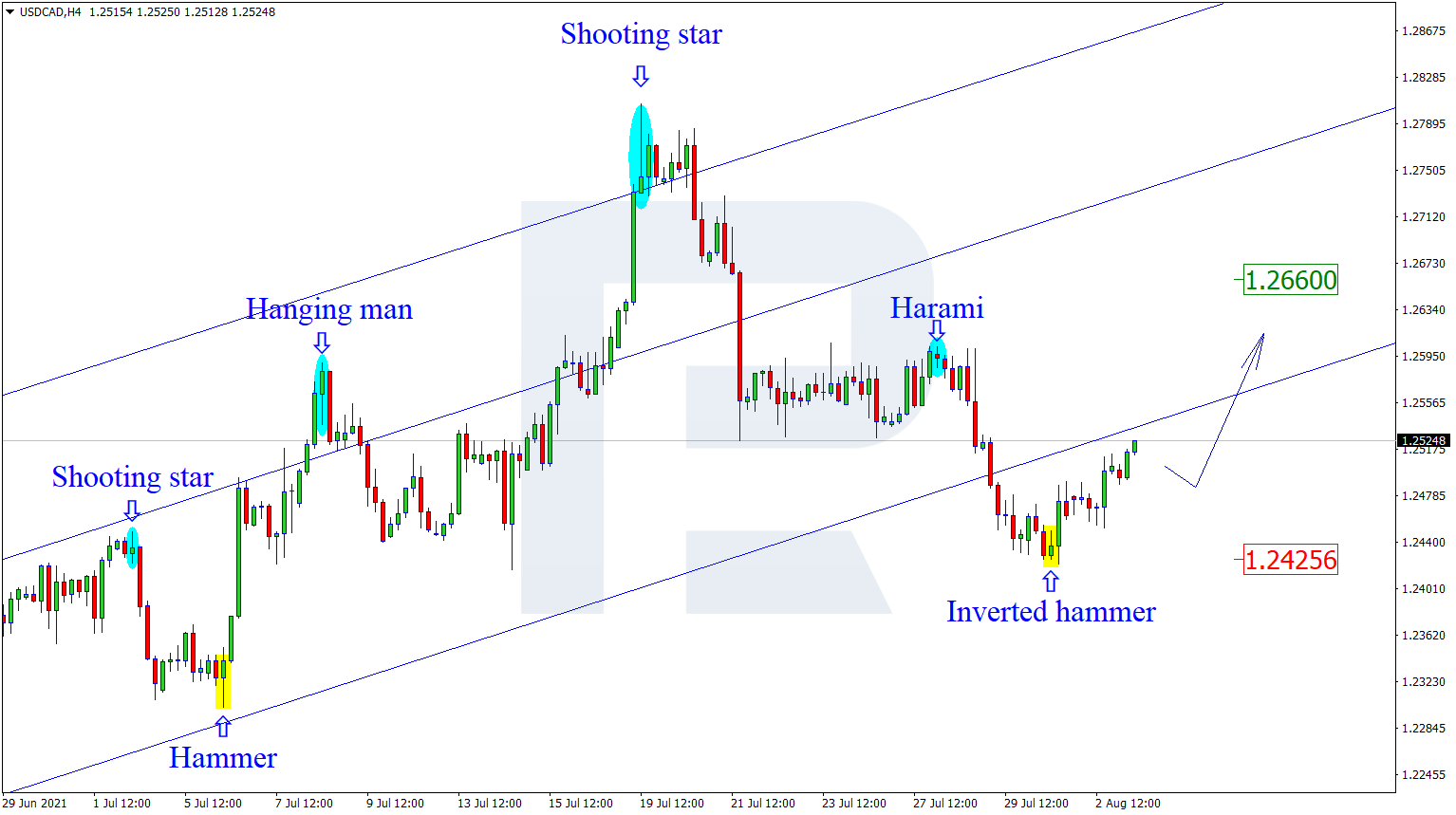

USDCAD, “US Dollar vs Canadian Dollar”

On H4, USDCAD quotations keep growing. Currently, at the support level, several reversal patterns, including a Hammer and an Inverted Hammer, have formed. Going by the reversal signal, the pair might continue the uotrend with the aim at the resistance level of 1.2660. However, the quotations might still pull back to 1.2425 before growing.

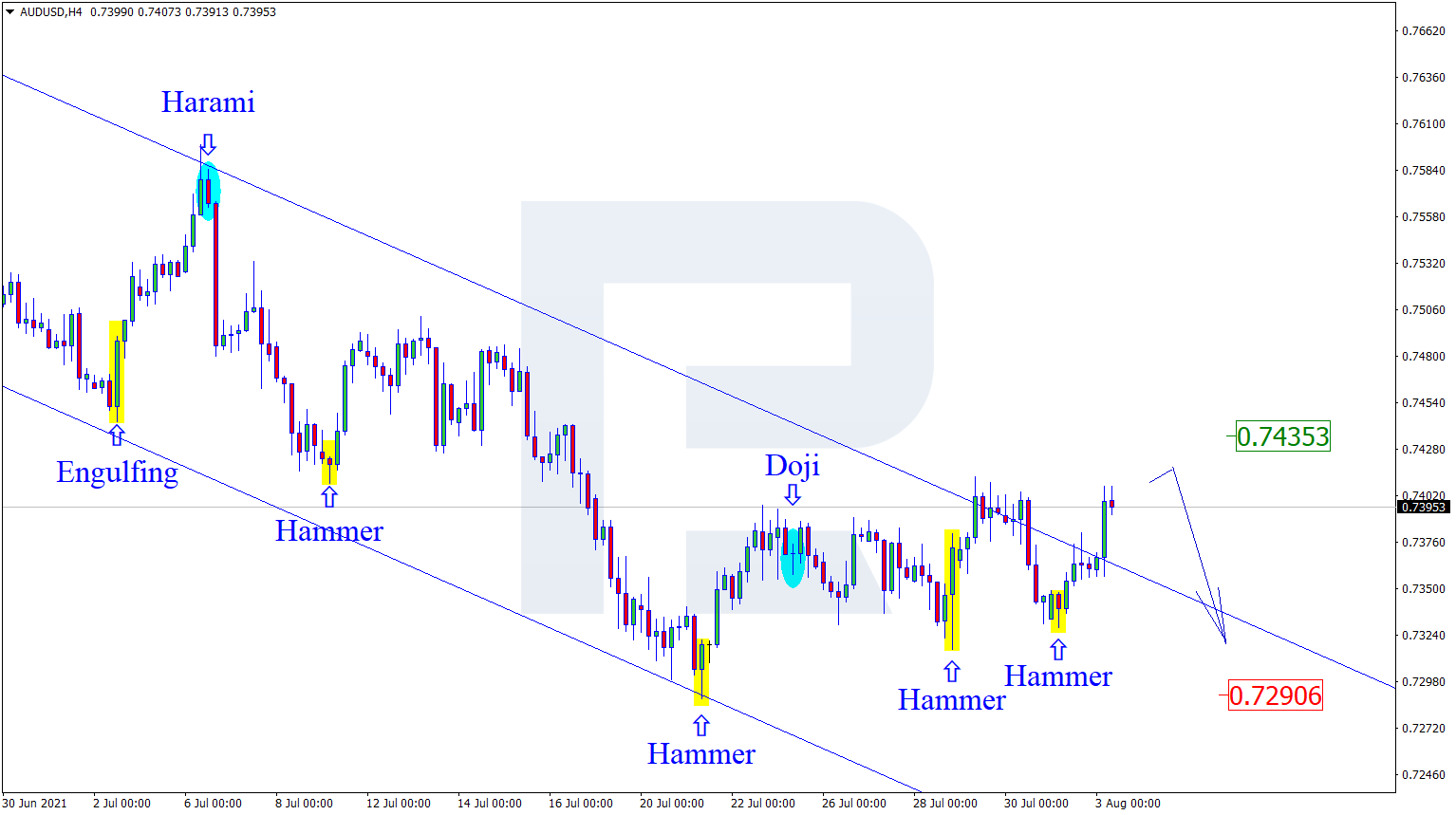

AUDUSD, “Australian Dollar vs US Dollar”

On H4, at the support level, the currency pair has formed several reversal patterns, including a Hammer. Currently, going by the reversal signal, the pair might pull back to the resistance level with the aim at 0.7435. However, the price might still decline to the support level of 0.7290 and continue the downtrend without testing the resistance level.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

USDCHF, “US Dollar vs Swiss Franc”

On H4, the pair keep correcting. Near the support level, the pair has formed several reversal patterns, including a Doji and a Hammer. Currently, going by the signal, the pair might end up at the resistance level. The aim of growth is 0.9110. However, the price might still fall to 0.9025 without testing the resistance level.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- US Fed tilts towards a rate cut despite the postponement. HKMA left the rate unchanged at 5.75% May 2, 2024

- Brent crude oil hits seven-week low May 2, 2024

- Target Thursdays: USDJPY, Copper & EURCAD May 2, 2024

- WTI oil declines on rising inventories and negotiations between Israel and Hamas. Rising unemployment in New Zealand may force RBNZ to start cutting rates earlier May 1, 2024

- Bitcoin stumbles below $60k ahead of Fed May 1, 2024

- Expert Says Now Looks Like a Good Time To Buy This Renewable Energy Stock Apr 30, 2024

- Optimism over corporate earnings is fueling stock indices. The Hong Kong index reached a 5-month high Apr 30, 2024

- FXTM’s Copper: Hits fresh two-year high! Apr 30, 2024

- European indices grow on the ECB’s “dovish” position. Quarterly reports of mega-companies support the broad market Apr 29, 2024

- Japanese yen shows volatility amid speculation of intervention Apr 29, 2024