By Lukman Otunuga Research Analyst, ForexTime

It’s been a fairly quiet start to the week in many markets with FX ranges narrow and directionless trading in the dollar after the signature US payrolls data last week failed to embolden either the bulls or the bears. Asian markets are mixed and European bourses have opened up in similar fashion. That said, global equity indices are still sitting near to record / cycle highs as the Fed’s patient message continues to mean the stimulus punchbowl are still being passed around.

We had another reminder this morning about rising price pressures with China’s producer prices increasing at their fastest pace in 13 years. Soaring commodity prices as well as a low base effect after being in negative territory for most of last year has seen the index jump in recent months. This will add to global inflationary pressures and perhaps more action from the Chinese government economic planning agency who last month warned of “excessive speculation” in commodity markets and a crack down on monopolies.

Majors rangebound

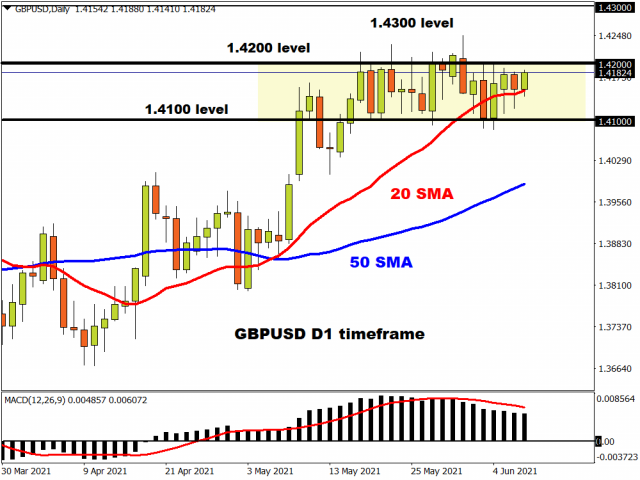

Expect more quiet trade in dollar crosses today ahead of the US CPI data and ECB meeting tomorrow. Sterling is trapped in a 1.41-1.42 range with the reopening delay not unduly worrying markets that much. June 21 has been in the minds of many in the UK, but a postponement of a couple of weeks is being signalled by the government.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

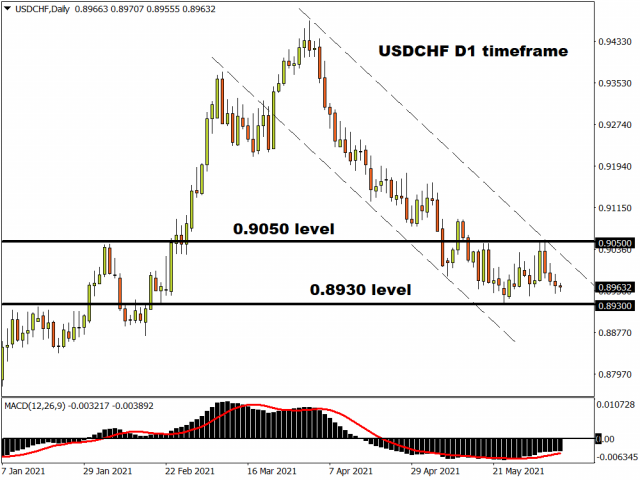

The swissie has been attracting buyers this week ahead of the ECB meeting tomorrow with USD/CHF back into its descending channel after venturing north last week above 0.9050. Bear will target the cycle low at 0.8930 unless the US inflation data prints to the topside of estimates.

Bank of Canada to stand pat

After shifting to a hawkish bias at its last meeting in April with the signalling of a rate rise in late 2022 and a second taper of its QE program, the leading hawkish central bank of the moment is set to wait for more post-lockdown data before continuing on its merry way to policy normalisation. A positive tone is expected from the Bank of Canada with an impressive vaccine rollout and strong CPI figures offset by two months of disappointing jobs data.

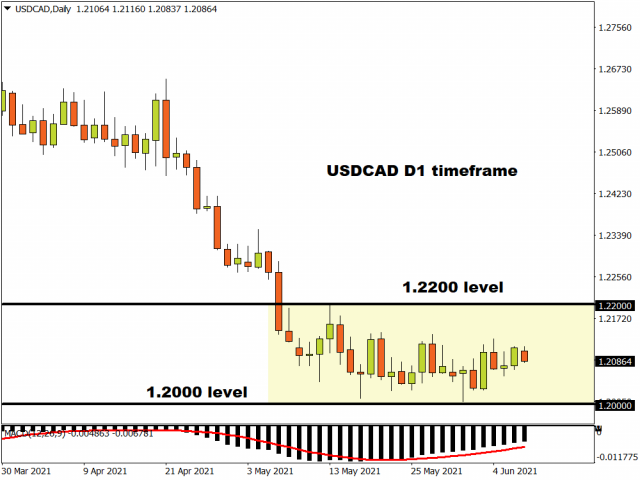

USD/CAD continues to consolidate above long-term support around 1.20. Any rebounds have been lacking in momentum with prices only moving above 1.22 on one occasion since mid-May. A downside break needs to develop sooner rather than later though as otherwise a deeper retracement may come into play.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026