By CountingPips.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday June 22 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

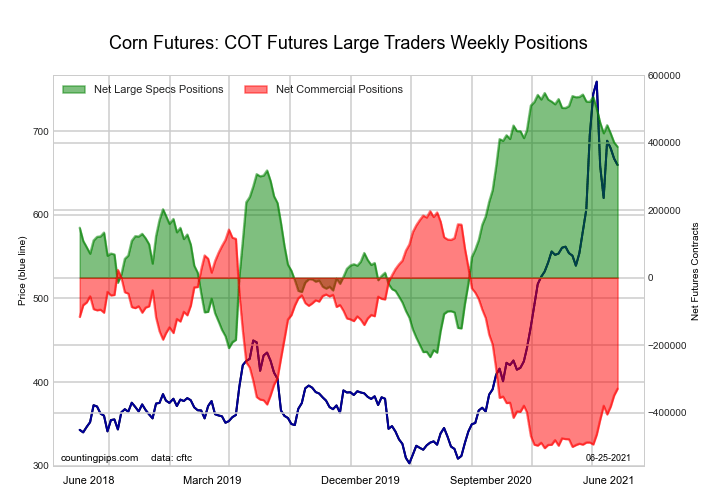

CORN Futures:

The CORN large speculator standing this week totaled a net position of 388,411 contracts in the data reported through Tuesday. This was a weekly fall of -12,965 contracts from the previous week which had a total of 401,376 net contracts.

The CORN large speculator standing this week totaled a net position of 388,411 contracts in the data reported through Tuesday. This was a weekly fall of -12,965 contracts from the previous week which had a total of 401,376 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 79.7 percent. The commercials are Bearish with a score of 25.1 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 2.0 percent.

| CORN Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 29.3 | 48.5 | 8.2 |

| – Percent of Open Interest Shorts: | 5.5 | 68.7 | 11.9 |

| – Net Position: | 388,411 | -328,959 | -59,452 |

| – Gross Longs: | 478,631 | 791,994 | 134,086 |

| – Gross Shorts: | 90,220 | 1,120,953 | 193,538 |

| – Long to Short Ratio: | 5.3 to 1 | 0.7 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 79.7 | 25.1 | 2.0 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -14.4 | 19.3 | -14.4 |

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

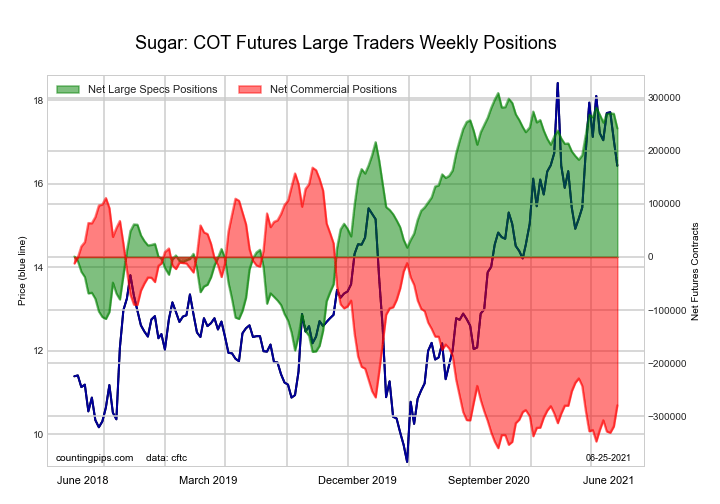

SUGAR Futures:

The SUGAR large speculator standing this week totaled a net position of 241,991 contracts in the data reported through Tuesday. This was a weekly decrease of -27,670 contracts from the previous week which had a total of 269,661 net contracts.

The SUGAR large speculator standing this week totaled a net position of 241,991 contracts in the data reported through Tuesday. This was a weekly decrease of -27,670 contracts from the previous week which had a total of 269,661 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 86.3 percent. The commercials are Bearish-Extreme with a score of 15.3 percent and the small traders (not shown in chart) are Bullish with a score of 53.7 percent.

| SUGAR Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 30.5 | 45.9 | 9.0 |

| – Percent of Open Interest Shorts: | 4.3 | 76.1 | 5.0 |

| – Net Position: | 241,991 | -279,035 | 37,044 |

| – Gross Longs: | 282,164 | 425,054 | 83,620 |

| – Gross Shorts: | 40,173 | 704,089 | 46,576 |

| – Long to Short Ratio: | 7.0 to 1 | 0.6 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 86.3 | 15.3 | 53.7 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -8.1 | 12.9 | -35.6 |

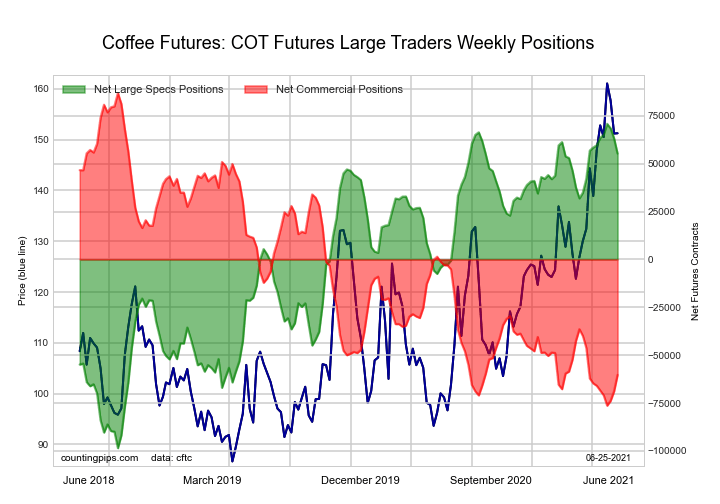

COFFEE Futures:

The COFFEE large speculator standing this week totaled a net position of 55,220 contracts in the data reported through Tuesday. This was a weekly fall of -7,932 contracts from the previous week which had a total of 63,152 net contracts.

The COFFEE large speculator standing this week totaled a net position of 55,220 contracts in the data reported through Tuesday. This was a weekly fall of -7,932 contracts from the previous week which had a total of 63,152 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 90.8 percent. The commercials are Bearish-Extreme with a score of 9.8 percent and the small traders (not shown in chart) are Bearish with a score of 23.4 percent.

| COFFEE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 30.9 | 46.9 | 4.5 |

| – Percent of Open Interest Shorts: | 10.2 | 69.5 | 2.6 |

| – Net Position: | 55,220 | -60,290 | 5,070 |

| – Gross Longs: | 82,447 | 125,020 | 12,103 |

| – Gross Shorts: | 27,227 | 185,310 | 7,033 |

| – Long to Short Ratio: | 3.0 to 1 | 0.7 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 90.8 | 9.8 | 23.4 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -2.6 | 3.5 | -8.9 |

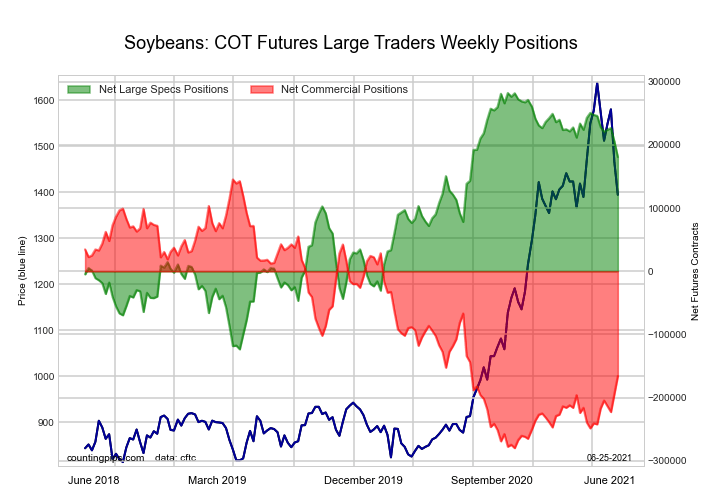

SOYBEANS Futures:

The SOYBEANS large speculator standing this week totaled a net position of 180,948 contracts in the data reported through Tuesday. This was a weekly fall of -24,445 contracts from the previous week which had a total of 205,393 net contracts.

The SOYBEANS large speculator standing this week totaled a net position of 180,948 contracts in the data reported through Tuesday. This was a weekly fall of -24,445 contracts from the previous week which had a total of 205,393 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 75.1 percent. The commercials are Bearish with a score of 26.8 percent and the small traders (not shown in chart) are Bearish with a score of 46.9 percent.

| SOYBEANS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.5 | 48.4 | 6.8 |

| – Percent of Open Interest Shorts: | 7.7 | 70.3 | 8.8 |

| – Net Position: | 180,948 | -165,947 | -15,001 |

| – Gross Longs: | 238,976 | 366,569 | 51,734 |

| – Gross Shorts: | 58,028 | 532,516 | 66,735 |

| – Long to Short Ratio: | 4.1 to 1 | 0.7 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 75.1 | 26.8 | 46.9 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -16.0 | 17.9 | -18.6 |

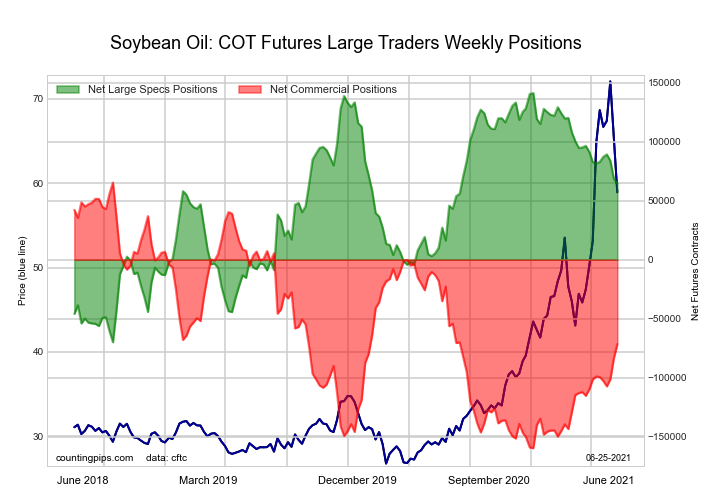

SOYBEAN OIL Futures:

The SOYBEAN OIL large speculator standing this week totaled a net position of 64,908 contracts in the data reported through Tuesday. This was a weekly reduction of -3,683 contracts from the previous week which had a total of 68,591 net contracts.

The SOYBEAN OIL large speculator standing this week totaled a net position of 64,908 contracts in the data reported through Tuesday. This was a weekly reduction of -3,683 contracts from the previous week which had a total of 68,591 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 63.9 percent. The commercials are Bearish with a score of 39.2 percent and the small traders (not shown in chart) are Bearish with a score of 37.8 percent.

| SOYBEAN OIL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 19.9 | 50.8 | 7.0 |

| – Percent of Open Interest Shorts: | 7.1 | 64.8 | 5.7 |

| – Net Position: | 64,908 | -71,439 | 6,531 |

| – Gross Longs: | 101,398 | 259,448 | 35,732 |

| – Gross Shorts: | 36,490 | 330,887 | 29,201 |

| – Long to Short Ratio: | 2.8 to 1 | 0.8 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 63.9 | 39.2 | 37.8 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -8.0 | 12.2 | -39.6 |

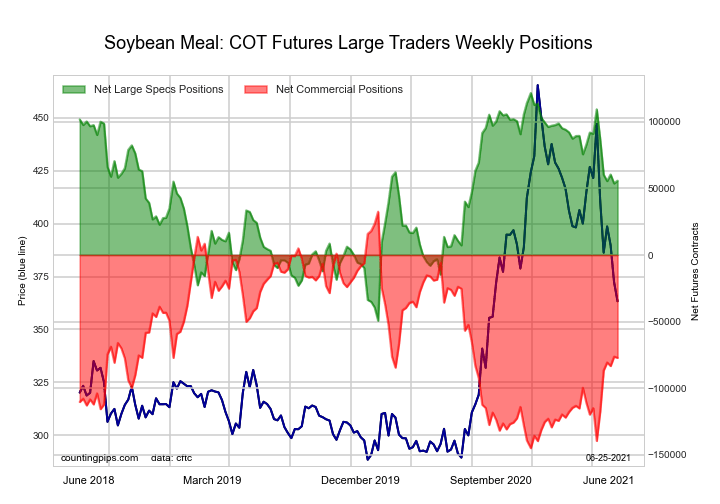

SOYBEAN MEAL Futures:

The SOYBEAN MEAL large speculator standing this week totaled a net position of 55,794 contracts in the data reported through Tuesday. This was a weekly advance of 2,023 contracts from the previous week which had a total of 53,771 net contracts.

The SOYBEAN MEAL large speculator standing this week totaled a net position of 55,794 contracts in the data reported through Tuesday. This was a weekly advance of 2,023 contracts from the previous week which had a total of 53,771 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 61.5 percent. The commercials are Bearish with a score of 38.2 percent and the small traders (not shown in chart) are Bullish with a score of 56.5 percent.

| SOYBEAN MEAL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 22.6 | 52.5 | 12.0 |

| – Percent of Open Interest Shorts: | 8.6 | 71.9 | 6.6 |

| – Net Position: | 55,794 | -77,209 | 21,415 |

| – Gross Longs: | 89,916 | 209,524 | 47,835 |

| – Gross Shorts: | 34,122 | 286,733 | 26,420 |

| – Long to Short Ratio: | 2.6 to 1 | 0.7 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 61.5 | 38.2 | 56.5 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -31.4 | 35.1 | -35.3 |

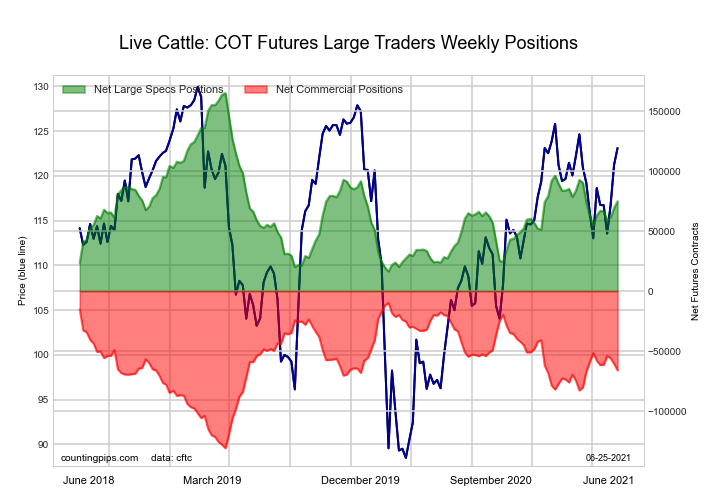

LIVE CATTLE Futures:

The LIVE CATTLE large speculator standing this week totaled a net position of 74,914 contracts in the data reported through Tuesday. This was a weekly gain of 5,593 contracts from the previous week which had a total of 69,321 net contracts.

The LIVE CATTLE large speculator standing this week totaled a net position of 74,914 contracts in the data reported through Tuesday. This was a weekly gain of 5,593 contracts from the previous week which had a total of 69,321 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 39.3 percent. The commercials are Bullish with a score of 53.6 percent and the small traders (not shown in chart) are Bullish with a score of 65.4 percent.

| LIVE CATTLE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 39.4 | 38.0 | 9.1 |

| – Percent of Open Interest Shorts: | 14.4 | 60.0 | 12.0 |

| – Net Position: | 74,914 | -65,988 | -8,926 |

| – Gross Longs: | 118,184 | 113,906 | 27,178 |

| – Gross Shorts: | 43,270 | 179,894 | 36,104 |

| – Long to Short Ratio: | 2.7 to 1 | 0.6 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 39.3 | 53.6 | 65.4 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 7.9 | -6.7 | -8.8 |

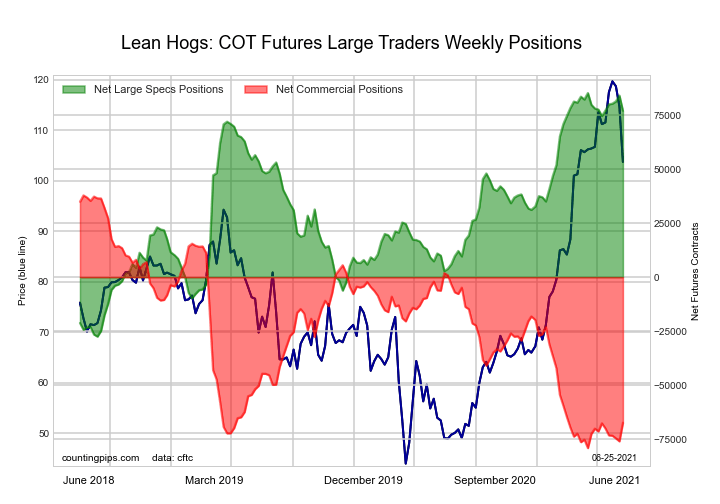

LEAN HOGS Futures:

The LEAN HOGS large speculator standing this week totaled a net position of 76,976 contracts in the data reported through Tuesday. This was a weekly decrease of -7,077 contracts from the previous week which had a total of 84,053 net contracts.

The LEAN HOGS large speculator standing this week totaled a net position of 76,976 contracts in the data reported through Tuesday. This was a weekly decrease of -7,077 contracts from the previous week which had a total of 84,053 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 92.7 percent. The commercials are Bearish-Extreme with a score of 10.0 percent and the small traders (not shown in chart) are Bearish with a score of 32.2 percent.

| LEAN HOGS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 40.6 | 30.2 | 7.9 |

| – Percent of Open Interest Shorts: | 13.6 | 53.8 | 11.2 |

| – Net Position: | 76,976 | -67,377 | -9,599 |

| – Gross Longs: | 115,935 | 86,344 | 22,515 |

| – Gross Shorts: | 38,959 | 153,721 | 32,114 |

| – Long to Short Ratio: | 3.0 to 1 | 0.6 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 92.7 | 10.0 | 32.2 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 2.1 | 0.2 | -12.5 |

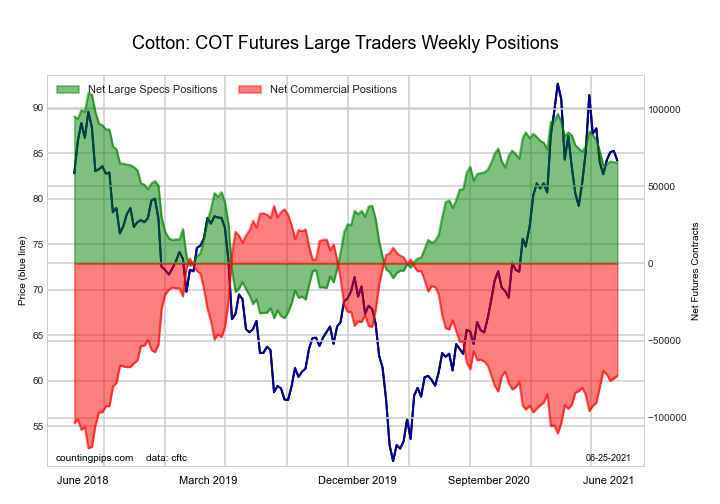

COTTON Futures:

The COTTON large speculator standing this week totaled a net position of 65,170 contracts in the data reported through Tuesday. This was a weekly fall of -534 contracts from the previous week which had a total of 65,704 net contracts.

The COTTON large speculator standing this week totaled a net position of 65,170 contracts in the data reported through Tuesday. This was a weekly fall of -534 contracts from the previous week which had a total of 65,704 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 69.0 percent. The commercials are Bearish with a score of 29.8 percent and the small traders (not shown in chart) are Bullish with a score of 62.1 percent.

| COTTON Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 36.5 | 44.8 | 7.1 |

| – Percent of Open Interest Shorts: | 5.2 | 79.8 | 3.4 |

| – Net Position: | 65,170 | -72,814 | 7,644 |

| – Gross Longs: | 75,914 | 93,021 | 14,702 |

| – Gross Shorts: | 10,744 | 165,835 | 7,058 |

| – Long to Short Ratio: | 7.1 to 1 | 0.6 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 69.0 | 29.8 | 62.1 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -10.3 | 11.1 | -15.4 |

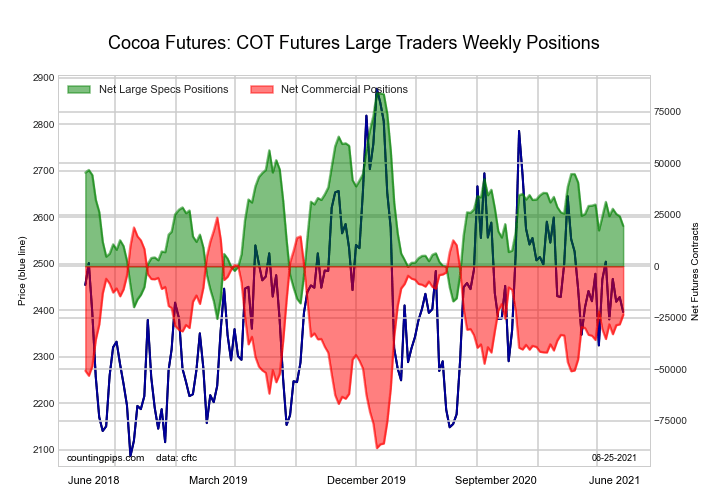

COCOA Futures:

The COCOA large speculator standing this week totaled a net position of 19,604 contracts in the data reported through Tuesday. This was a weekly decrease of -4,673 contracts from the previous week which had a total of 24,277 net contracts.

The COCOA large speculator standing this week totaled a net position of 19,604 contracts in the data reported through Tuesday. This was a weekly decrease of -4,673 contracts from the previous week which had a total of 24,277 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 41.2 percent. The commercials are Bullish with a score of 57.8 percent and the small traders (not shown in chart) are Bullish with a score of 53.7 percent.

| COCOA Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 28.3 | 46.7 | 5.4 |

| – Percent of Open Interest Shorts: | 19.5 | 57.2 | 3.7 |

| – Net Position: | 19,604 | -23,581 | 3,977 |

| – Gross Longs: | 63,381 | 104,656 | 12,213 |

| – Gross Shorts: | 43,777 | 128,237 | 8,236 |

| – Long to Short Ratio: | 1.4 to 1 | 0.8 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 41.2 | 57.8 | 53.7 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.2 | 6.3 | -28.2 |

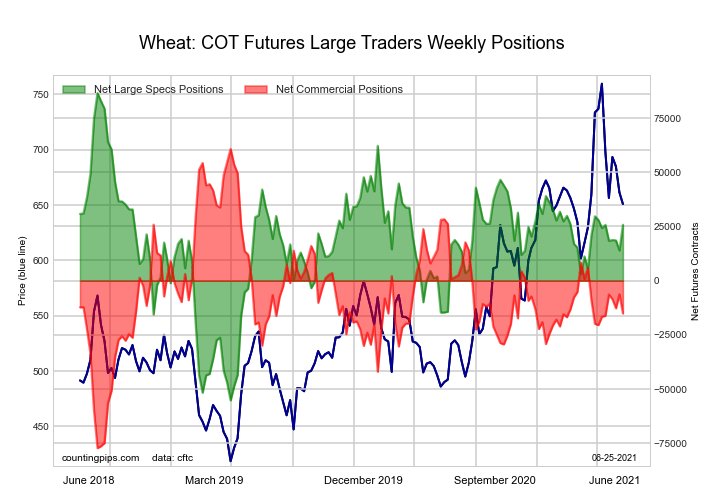

WHEAT Futures:

The WHEAT large speculator standing this week totaled a net position of 25,806 contracts in the data reported through Tuesday. This was a weekly gain of 11,858 contracts from the previous week which had a total of 13,948 net contracts.

The WHEAT large speculator standing this week totaled a net position of 25,806 contracts in the data reported through Tuesday. This was a weekly gain of 11,858 contracts from the previous week which had a total of 13,948 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 57.1 percent. The commercials are Bearish with a score of 45.0 percent and the small traders (not shown in chart) are Bullish with a score of 50.5 percent.

| WHEAT Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 29.0 | 37.2 | 7.2 |

| – Percent of Open Interest Shorts: | 22.3 | 41.1 | 10.0 |

| – Net Position: | 25,806 | -15,106 | -10,700 |

| – Gross Longs: | 112,624 | 144,499 | 28,005 |

| – Gross Shorts: | 86,818 | 159,605 | 38,705 |

| – Long to Short Ratio: | 1.3 to 1 | 0.9 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 57.1 | 45.0 | 50.5 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.0 | 1.1 | -14.4 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

- COT Metals Charts: Speculator bets led by Gold & Steel May 4, 2024

- COT Bonds Charts: Speculator bets led lower by SOFR 3M & 10-Year Bonds May 4, 2024

- COT Soft Commodities Charts: Speculator bets led by Wheat, Soybean Meal & Corn May 4, 2024

- COT Stock Market Charts: Speculator bets led lower by S&P500 & MSCI EAFE May 4, 2024

- The British index has updated the historical maximum. Oil lost 5% over the week May 3, 2024

- US Fed tilts towards a rate cut despite the postponement. HKMA left the rate unchanged at 5.75% May 2, 2024

- Brent crude oil hits seven-week low May 2, 2024

- Target Thursdays: USDJPY, Copper & EURCAD May 2, 2024

- WTI oil declines on rising inventories and negotiations between Israel and Hamas. Rising unemployment in New Zealand may force RBNZ to start cutting rates earlier May 1, 2024

- Bitcoin stumbles below $60k ahead of Fed May 1, 2024