By Lukman Otunuga Research Analyst, ForexTime

We’ve had a plethora of Fed members on the wires already this week and although they have been known doves, it is clearly evident that the Fed is very much in “patient” mode. Of course, they are “talking about talking about tapering” as San Francisco Fed President Daly said yesterday, but inflation is still described as “transitory” and it’s not about doing anything now or in the short term. Much will depend on the data flow and the next few job reports with this Friday’s new inflation data no doubt grabbing some headlines, with forecasters expecting personal consumption prices to rise to the highest reading since June 1993.

US stock futures are pointing to a better day after a mixed close overnight. Growth stocks continue to outperform value as we once again edge towards the all-time highs in the S&P500. European stocks are pretty much on that mark now and will look to push higher with the risk mood stays bright amid easing inflation concerns.

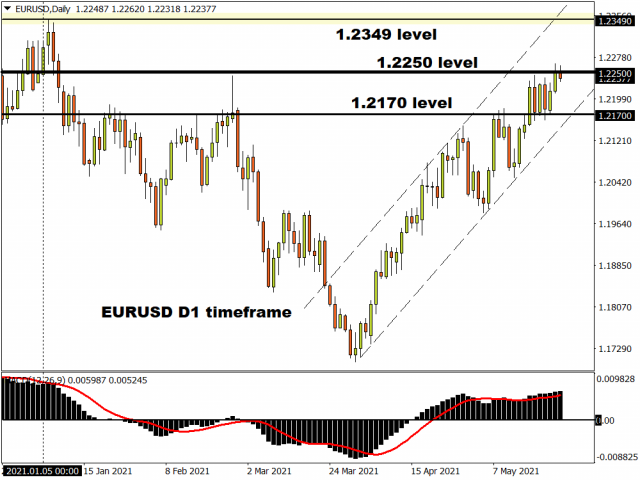

Dollar downtrend firmly intact

With this backdrop, the dollar is struggling to find many buyers as low yields and signs of a more synchronised global recovery begin to offer better alternatives to the greenback. The downtrend channel from the April highs in the dollar index is ongoing and bears are now targeting the year-to-date lows. EUR/USD moved above the 1.2250 zone yesterday and this opens up a push to the cycle high at 1.2349 from early January as long as we hold above the breakout level.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

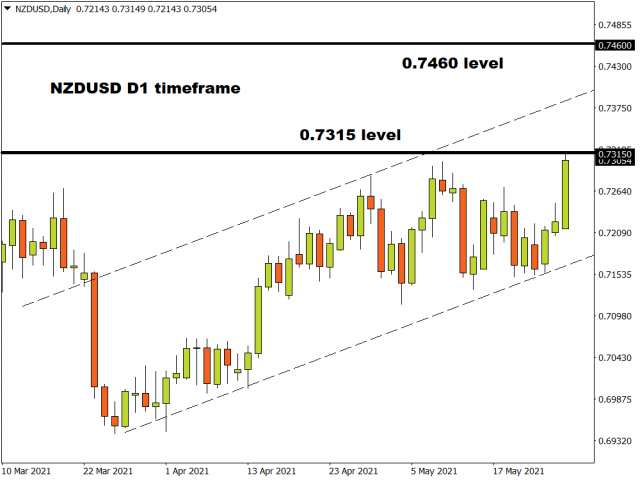

RBNZ joins the hawkish central bank club

Although it left its policy settings unchanged, the RBNZ took a step towards normalisation at its meeting overnight when it signalled a rate hike in the second half of next year in its latest projections, amid a notable improvement in the economic situation. This hawkish surprise has propelled NZD/USD higher over 1.1% towards the top of its recent range. The early January high at 0.7315 is close by before the year-to date highs around 0.7460. The kiwi finds itself in a similar situation to the loonie (CAD) with a standout hawkish central bank and this should provide strong support to its currency going forward.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026