By Han Tan Market Analyst, ForexTime

While we pause for breath in equity markets, bond markets continue to grab the attention of Wall Street with US 10-year yields pushing up above 1.30% which is almost pre-Covid.

The return in real yields is an important issue here as this means markets are getting more optimistic about economic growth expectations.

But the pace of the bond market sell-off too is worrying as we’ve gone from 1.1% to 1.3% in just three days, and if this continues, then risk markets will do an about-turn very sharply.

Focus is increasingly on the US Federal Reserve to provide some reassurance that it won’t seek to tighten its monetary polices and measures more aggressively than the market thinks, in the face of faster inflation. Overnight, a couple of Fed members struck a dovish tone (phew!) dismissing fears of policy tightening and emphasising how it would harm job creation.

Nothing new in the FOMC Minutes

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Talking of the Fed, we get to see the minutes of the January meeting later today.

Remember that while the bigger forecast upgrades were seen in the December meeting, last month’s rendez-vous delivered small statement changes that sounded a bit more optimistic. Expectations are for these minutes to repeat that it’s premature to talk about tapering just yet and that the Fed will be patient in assessing progress toward full employment and its overshoot of 2% inflation for “some time”. As is the way with such fast moving times regarding the pandemic, the minutes may be a bit stale with regard to both fiscal policy and vaccines amid more positive expectations since the meeting.

The pick of today’s economic data releases will be the US January retail sales.

Data has surprised to the upside everywhere on a regular basis in recent months and consumer spending numbers are expected to turn much higher too, following a very weak December. Headline sales should print north of 1% helped by firm auto sales, while the control group, used for GDP purposes and seen as a more reliable gauge of underlying consumer demand, is set for a strong rebound.

Along with today’s industrial production, the data should continue the recent trend of US outperformance among developed nations, with the momentum in forecasts remaining robust. This should mean a continuation in the reflation story, albeit potentially at slower pace in rising yields, as the bar for a hawkish surprise with the “stale” minutes especially, is set quite high.

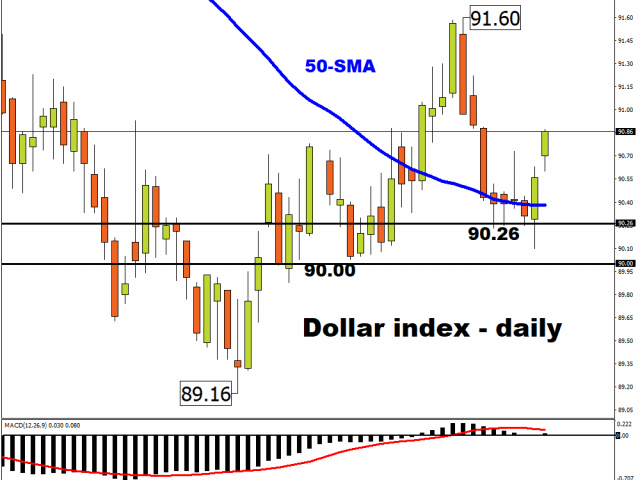

With the bond market fragile, the dollar may find some support, which shouldn’t interfere too much with buoyant stock markets.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Bitcoin has dropped below $70,000. The Bank of Mexico held its rate at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Risks Feb 6, 2026

- The British Index has hit a new all-time high. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Under Local Pressure: Focus on Bank of England Signals Feb 5, 2026

- Bitcoin has plummeted to a 14-month low. Silver jumped by more than 10% Feb 4, 2026

- Gold is Back in the Black: Geopolitics Dictates Conditions Again Feb 4, 2026

- US natural gas prices collapsed by 21%. The RBA raised its interest rate by 0.25% Feb 3, 2026

- What goes up must come down… Feb 2, 2026

- Donald Trump appoints a new successor for the Fed chair. Precious metals hit by sell-off Feb 2, 2026

- USDJPY Realises Correction: BOJ Policy Weighs on Yen Feb 2, 2026