By Han Tan, Market Analyst, ForexTime

Risk appetite is continuing to look decidedly shaky as European stocks are dropping for a third day in a row and now sliding to five-month lows.

Mounting expectations of new government measures in France and Germany are seeing traders dump stocks and seek the safe havens of the Yen and the Dollar.

With rising infection rates and hospitalisations across the globe, US stock futures are also under pressure with S&P500 futures down around one percent. The upcoming US election was expected to be the key source of tumult over the next few weeks, but the VIX, commonly known as Wall street’s fear gauge, has traded above 36 this morning. This is well above its long-term average of 20 and the index is closing in on recent highs at the start of September.

Market expectations around the most risk-friendly scenario – a Blue Wave Biden victory – are being scaled back slightly and this is being seen in the rise in USD/JPY implied volatility over the election date.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

EUR suffering Covid bout

We also have another risk event in the form of tomorrow’s ECB meeting which is expected to send strong dovish signals from President Lagarde and plenty of hints about more policy stimulus at its December meeting. The spectre of further lockdowns looms large over the Governing Council and the Euro is at risk of further weakening.

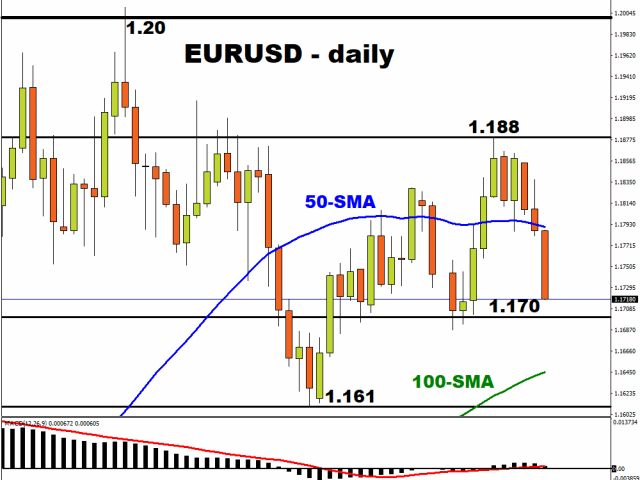

EUR/USD has finally waved the white flag to breaking above the 1.1880 resistance zone and has dropped through the 50-day Moving Average this morning. Support lies just below 1.17 ahead of the 100-day Moving Average at 1.1645.

FAANGs to release earnings

The latest equity sessions have seen a clear outperformance of growth over value with the rotation into tech clearly explaining the huge underperformance of Europe relative to the US. This tallies with the previous episode of a spike in Covid cases, which prompted buying in the megacap tech names.

Facebook, Apple, Amazon and Google all report shortly after the US cash market close Thursday in what could be a key catalyst for near-term direction for stock markets. These four names alone equate to around a third of the Nasdaq weighting and 15 percent on the S&P500. Notably, the average move on the day of earnings between these four tech titans is close to five percent, so expect some volatility!

Technically, the Nasdaq is trading around its 50-day Moving Average but losing support form Monday’s low may see the index drop further towards 11,000. Some Street estimates, for example for Amazon, see 70%+ rises in EPS so check your positioning into this major market ‘Super Thursday’.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Today, investors’ focus is on the PCE Price Index inflation report Apr 26, 2024

- Gold price recovers amid uncertain US economic outlook Apr 26, 2024

- This “Bullish Buzz” Reaches Highest Level in 53 Years Apr 26, 2024

- FastSpring and EBANX Forge Partnership to Expand Pix Payments for Digital Products in Brazil Apr 25, 2024

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024