By RoboForex Analytical Department

The principal currency pair, EUR/USD, is experiencing a decline as the week commences, predominantly driven by heightened risk aversion in the market. As of Monday morning, the currency pair’s quotations are closely aligned with the 1.0552 mark.

A major contributor to the current sentiment is the escalating conflict between Arabian and Israeli forces. This geopolitical uncertainty has prompted investors to adopt a cautious stance, aiming to sidestep potential complications arising from the conflict.

Economic statistics unveiled in the US on Friday presented a mixed picture. The nation’s unemployment rate steadfastly remained at 3.8%. Contrarily, non-farm payrolls demonstrated a robust uptick, registering an increase of 336,000, substantially surpassing the anticipated 171,000. The average hourly earnings metric retained its prior growth trajectory, with a month-on-month rise of 0.2%.

The employment sector’s performance seemingly provides the US Federal Reserve with sufficient justification to proceed with interest rate hikes. However, consumer spending appears to be decelerating. Contrary to projections of an 11.7 billion USD increase, the US consumer lending volume dwindled by 15.6 billion USD.

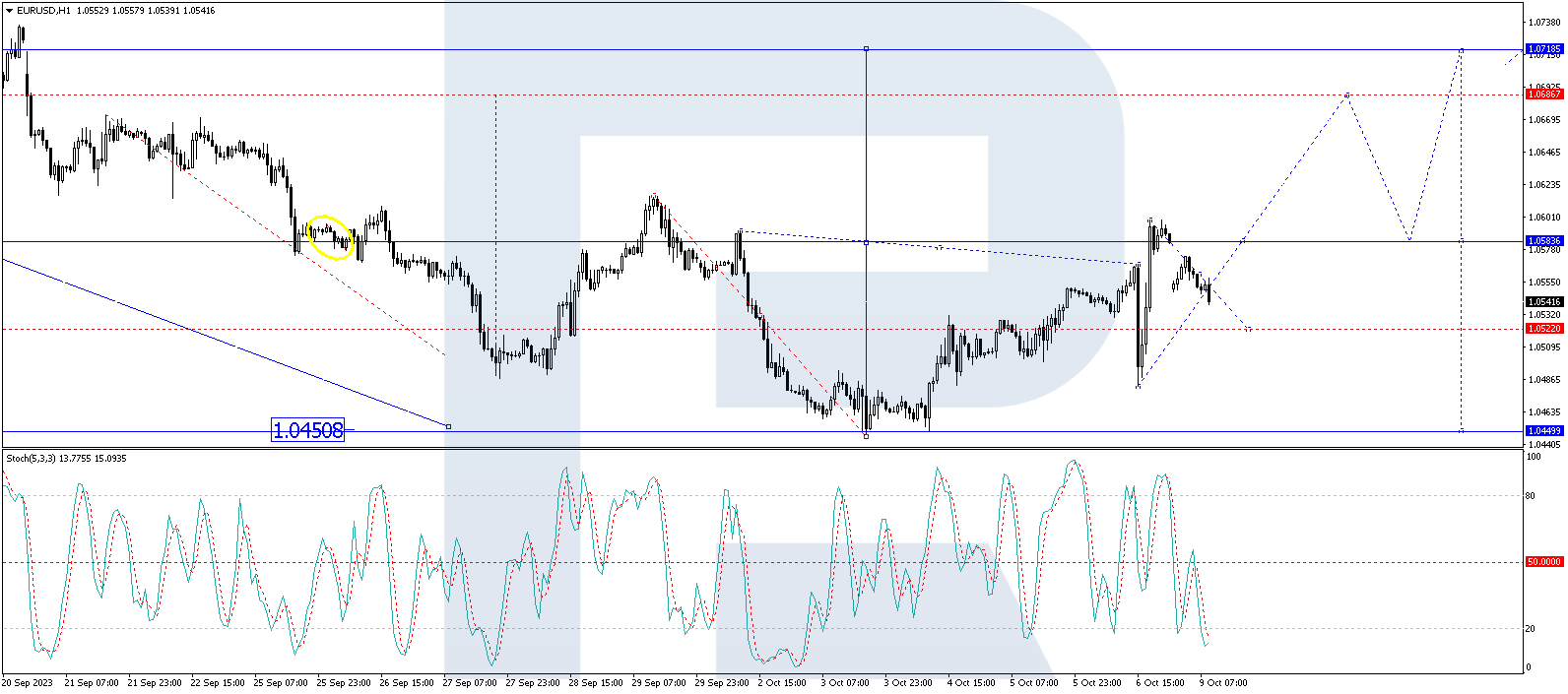

EUR/USD technical analysis

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

On the H4 timeframe of the EUR/USD currency pair, the market achieved the local target of the bearish wave at the 1.0450 juncture. As of the present moment, a corrective wave culminating at 1.0599 has been realized. The currency pair is now poised for a dip to the 1.0520 level, with indications suggesting the formation of a consolidation range around this point. A breach of this range to the upside could potentially propel the currency pair to the 1.0700 mark. Once this level is attained, a subsequent bearish wave targeting 1.0140 may ensue. The Moving Average Convergence Divergence (MACD) offers technical corroboration for this outlook, with its signal line entrenched below the zero mark, exhibiting a sharp upward trajectory, and poised for fresh peaks.

On the H1 timeframe for EUR/USD, an ascent towards 1.0599 has been charted. The market is currently undergoing a correctional phase targeting the 1.0520 mark. Upon completion of this correction, the potential for a bullish wave reaching 1.0700 emerges. This scenario gains validation from the Stochastic oscillator, which currently trades below the zero level but anticipates a climb to the 50-mark. A successful breach of this level could potentially drive the oscillator to the 80-mark.

Conclusion

Amid heightened geopolitical tensions, the EUR/USD pair exhibits bearish tendencies, albeit with potential recovery. While economic statistics from the US paint a varied picture, technical indicators suggest potential upside movements post corrections. Investors and traders should remain vigilant, weighing both the geopolitical landscape and economic indicators when formulating their strategies.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024

- USDJPY bulls venture into intervention zone Nov 20, 2024

- The PBoC kept interest rates. The escalating war between Ukraine and Russia is negatively affecting investor sentiment Nov 20, 2024

- AUD/USD Consolidates After Recent Gains Nov 20, 2024

- The RBA will maintain a restrictive monetary policy until the end of the year. Nov 19, 2024

- Safe-haven assets rally on nuclear concerns Nov 19, 2024

- Gold Rebounds Amid USD Weakness and Geopolitical Uncertainties Nov 19, 2024

- RoboForex Receives Best Introducing Broker Programme Award Nov 18, 2024

- The hawkish attitude of FOMC representatives puts pressure on stock indices. Oil is growing amid escalation in Eastern Europe Nov 18, 2024