By RoboForex Analytical Department

The crude oil sector fights with the news flow, trying to climb higher. A Brent barrel now costs 85.25 USD.

China has changed its forecast for economic growth in the country to 5.0% from 5.5% earlier. This made capital market really unhappy because it had really counted on the demand on energy carriers from China. Last year, the Chinese GDP grew by just 3%. Hence, the decrease in the target for 2023 might be an attempt to place more realistic goals and reach them efficiently. However, at the moment things look bad.

For now, the market has few fundamental reasons for optimism, yet local waves of purchases happen.

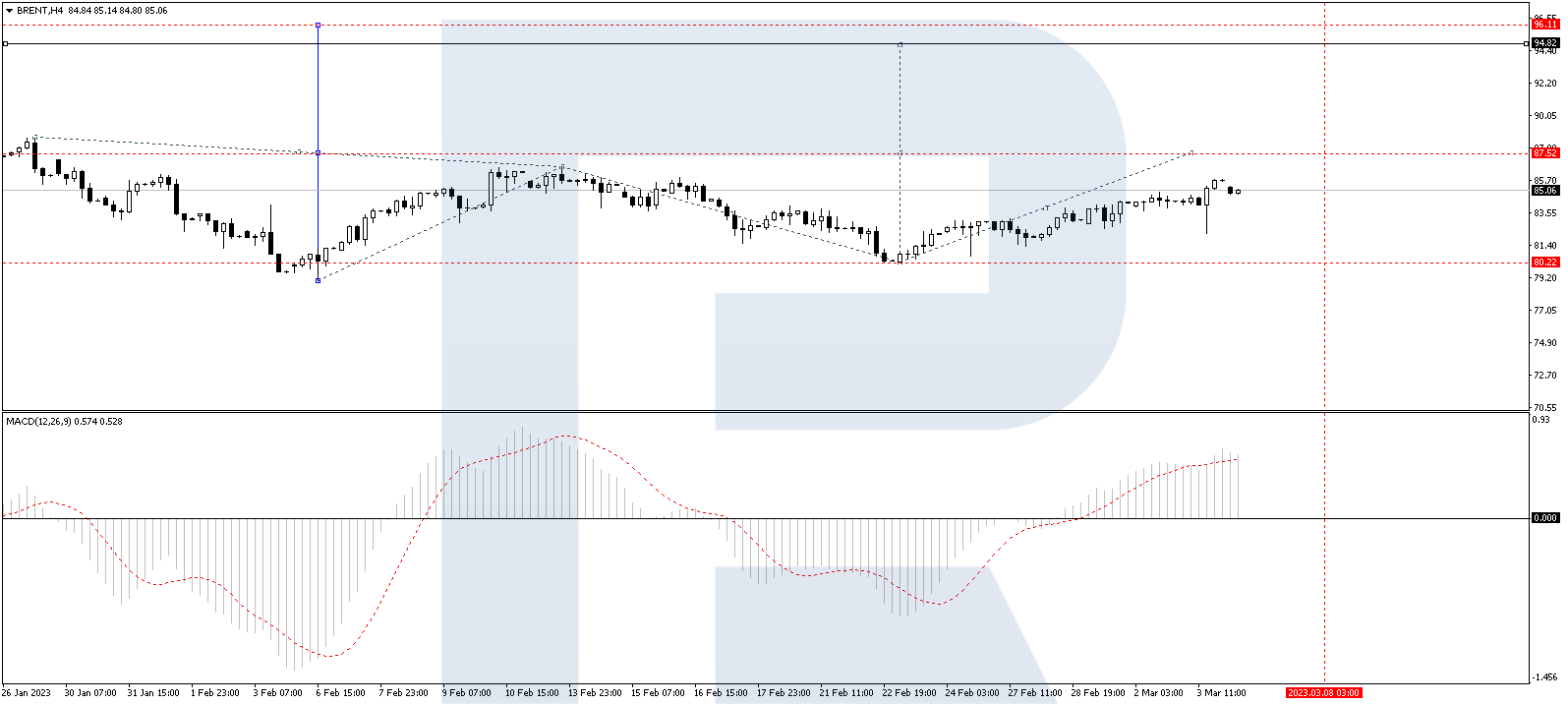

On H4, Brent has formed a consolidation range around 83.83. With an escape upwards, a pathway to 87.52 will practically open. After this level is reached, a link of correction to 83.83 might happen, followed by further growth to 87.52. And this is just a half of the wave. After the goal of growth is reached, a decline to 83.83 might follow, and then — growth to 94.80. Technically, this scenario is confirmed by the MACD: its signal line is above zero in the histogram area suggesting growth to new highs.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

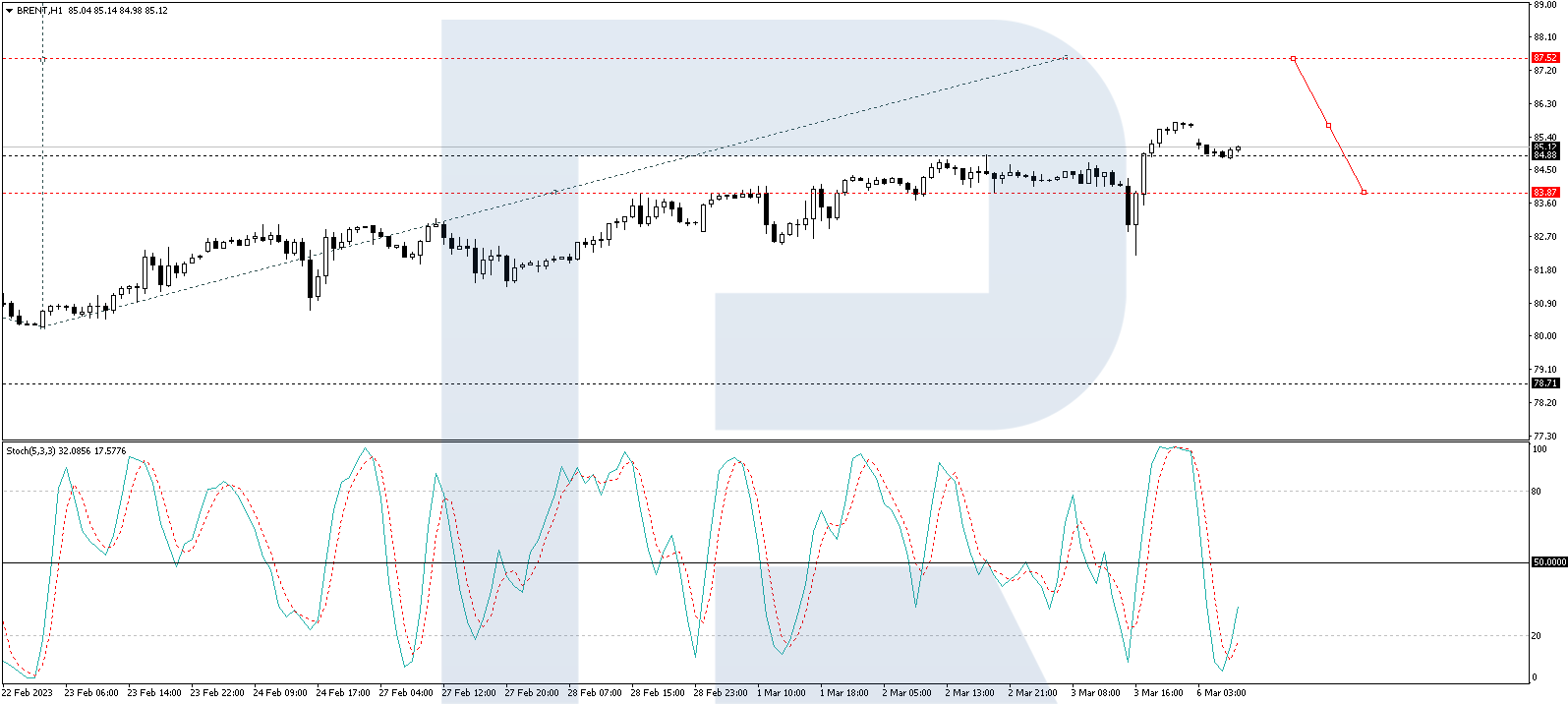

On H1, the structure of the fifth wave of growth to 85.80 has been completed. Today a consolidation range is forming below it. An escape downwards and a link of correction to 83.83 are not excluded. With an escape upwards, the wave might continue to 87.50. The target is local. After it is reached, a link of decline to 83.83 and growth to 90.00 might follow. Technically, this scenario is confirmed by Stochastic. Its signal line is above 20, aimed strictly upwards.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Bitcoin price is approaching 100,000. Natural gas prices rise due to declining inventories and cold weather Nov 22, 2024

- USD/JPY Awaits Potential Stimulus Impact Nov 22, 2024

- RBNZ may cut the rate by 0.75% next week. NVDA report did not meet investors’ expectations Nov 21, 2024

- NZD/USD Under Pressure Amidst USD Strength Nov 21, 2024

- USDJPY bulls venture into intervention zone Nov 20, 2024

- The PBoC kept interest rates. The escalating war between Ukraine and Russia is negatively affecting investor sentiment Nov 20, 2024

- AUD/USD Consolidates After Recent Gains Nov 20, 2024

- The RBA will maintain a restrictive monetary policy until the end of the year. Nov 19, 2024

- Safe-haven assets rally on nuclear concerns Nov 19, 2024

- Gold Rebounds Amid USD Weakness and Geopolitical Uncertainties Nov 19, 2024